Normalized earnings adjust reported earnings by excluding one-time events, non-recurring costs, and unusual gains or losses to present a more accurate reflection of a company's ongoing profitability. This adjustment helps investors and analysts assess the true operational performance and make better comparisons across periods or companies. Relying solely on reported earnings can mislead valuation decisions due to the impact of transient factors that do not reflect sustainable financial health.

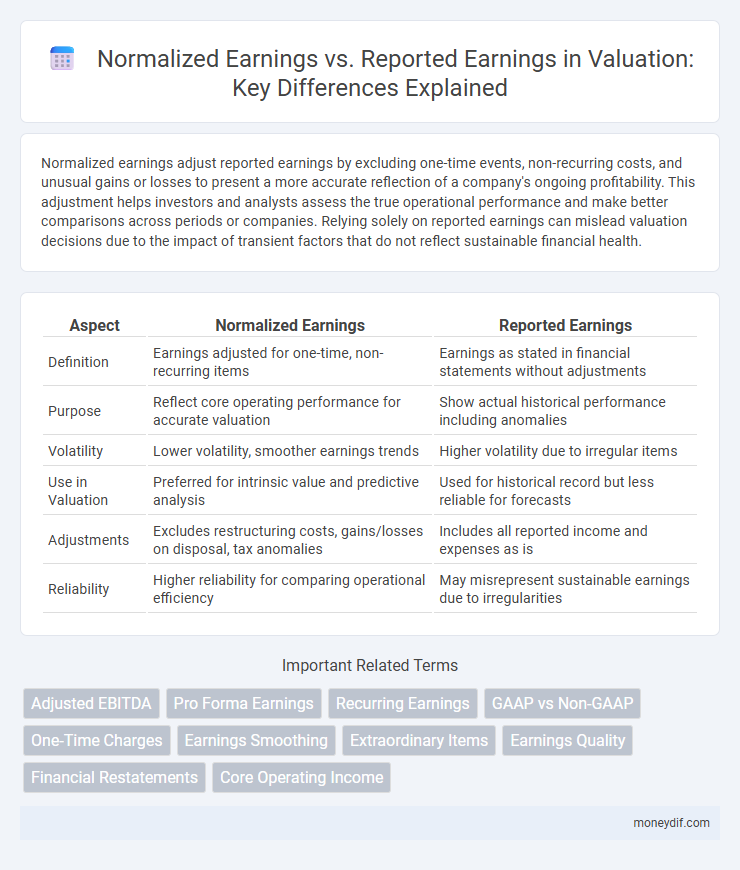

Table of Comparison

| Aspect | Normalized Earnings | Reported Earnings |

|---|---|---|

| Definition | Earnings adjusted for one-time, non-recurring items | Earnings as stated in financial statements without adjustments |

| Purpose | Reflect core operating performance for accurate valuation | Show actual historical performance including anomalies |

| Volatility | Lower volatility, smoother earnings trends | Higher volatility due to irregular items |

| Use in Valuation | Preferred for intrinsic value and predictive analysis | Used for historical record but less reliable for forecasts |

| Adjustments | Excludes restructuring costs, gains/losses on disposal, tax anomalies | Includes all reported income and expenses as is |

| Reliability | Higher reliability for comparing operational efficiency | May misrepresent sustainable earnings due to irregularities |

Understanding Normalized Earnings

Normalized earnings adjust reported earnings by removing one-time, non-recurring items and unusual expenses to reflect a company's sustainable operating performance. This adjustment enhances comparability across periods and companies, providing investors and analysts with a clearer picture of ongoing profitability. Understanding normalized earnings is essential for accurate valuation as it eliminates accounting distortions that can mislead financial analysis.

Defining Reported Earnings

Reported earnings represent the net income a company declares in its financial statements, reflecting all revenues, expenses, gains, and losses during a specific period according to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These earnings include non-recurring items, accounting adjustments, and extraordinary expenses, which can distort the company's core profitability. Understanding the components of reported earnings is essential for valuation, as analysts often adjust these figures to arrive at normalized earnings for a clearer assessment of ongoing operational performance.

Key Differences Between Normalized and Reported Earnings

Normalized earnings adjust reported earnings by removing non-recurring, extraordinary, or one-time items to present a clearer picture of a company's sustainable profitability. Reported earnings reflect the actual net income according to accounting standards, including irregular gains, losses, and seasonal fluctuations. Key differences lie in the treatment of non-operational transactions, where normalized earnings exclude these for comparability, while reported earnings incorporate all financial activities for the period.

Importance of Normalizing Earnings in Valuation

Normalized earnings provide a more accurate representation of a company's sustainable profitability by adjusting for one-time expenses, non-recurring gains, and accounting anomalies often found in reported earnings. This adjustment is crucial for valuation as it enables investors and analysts to assess the true earning power and future cash flow potential without distortions that can mislead financial analysis. Focusing on normalized earnings enhances comparability across periods and peers, supporting more reliable investment decisions and fair market value estimations.

Common Adjustments in Normalized Earnings

Common adjustments in normalized earnings include removing one-time expenses, such as restructuring costs or litigation settlements, and excluding non-recurring revenues like asset sales or tax credits. Normalized earnings also adjust for owner-related expenses not pertinent to ongoing operations and correct for aggressive revenue recognition or accounting anomalies. These adjustments provide a clearer, more consistent basis for valuation by reflecting the company's sustainable earning power.

Limitations of Reported Earnings in Financial Analysis

Reported earnings often include one-time items, non-recurring expenses, and accounting adjustments that can distort a company's true operating performance, making them less reliable for valuation purposes. These earnings may be influenced by inconsistent accounting policies, management discretion, and deliberate earnings management, leading to potential misinterpretation by investors. Normalized earnings address these limitations by adjusting for anomalies and providing a clearer, more comparable measure of sustainable profitability essential for accurate financial analysis.

Impact on Company Valuation Metrics

Normalized earnings provide a clearer picture of a company's sustainable profitability by adjusting for non-recurring items, which enhances the accuracy of valuation metrics like Price-to-Earnings (P/E) and Enterprise Value-to-EBITDA (EV/EBITDA) ratios. Reported earnings can be distorted by one-time charges or gains, leading to potential overvaluation or undervaluation when used in financial models. Investors and analysts rely on normalized earnings to better assess long-term cash flow generation and intrinsic company value, improving decision-making in equity valuation.

How Analysts Use Normalized vs Reported Earnings

Analysts use normalized earnings to exclude one-time, non-recurring, or extraordinary items, providing a clearer view of a company's sustainable profitability and enabling better comparison across periods and competitors. Reported earnings reflect the actual net income according to accounting standards, including all irregular and one-off events, which can sometimes distort underlying operational performance. By contrasting normalized earnings with reported earnings, analysts assess the quality and consistency of earnings to make more accurate valuation and investment decisions.

Case Study: Valuation Using Both Earnings Types

Valuation using normalized earnings adjusts for one-time expenses, non-recurring gains, and accounting anomalies to present a more stable and accurate measure of a company's sustainable profitability compared to reported earnings. Reported earnings often reflect short-term fluctuations and extraordinary items that can distort true financial performance, leading to potential misvaluation. Case studies demonstrate that incorporating normalized earnings in discounted cash flow (DCF) models and price-to-earnings (P/E) ratios yields more reliable valuations, especially for companies with volatile income statements or significant non-operating items.

Best Practices for Interpreting Earnings Figures

Normalized earnings adjust reported earnings by excluding one-time items, non-recurring expenses, and extraordinary gains to provide a clearer picture of a company's sustainable profitability. Best practices for interpreting earnings figures include analyzing normalized earnings alongside reported earnings to identify underlying operational performance and avoid misleading conclusions from volatility or accounting anomalies. Investors should prioritize normalized earnings in valuation models to achieve more accurate forecasts and comparability across periods and industry peers.

Important Terms

Adjusted EBITDA

Adjusted EBITDA excludes non-recurring expenses and income to better reflect normalized earnings, whereas reported earnings include all accounting entries impacting net profit.

Pro Forma Earnings

Pro forma earnings exclude one-time items and non-recurring expenses to present normalized earnings, offering a clearer comparison to the often more volatile reported earnings.

Recurring Earnings

Recurring earnings reflect normalized earnings by excluding one-time items and irregular gains or losses from reported earnings to provide a consistent measure of a company's sustainable profitability.

GAAP vs Non-GAAP

Normalized earnings adjust GAAP reported earnings by excluding one-time or non-recurring items to provide clearer insights into a company's core operational performance.

One-Time Charges

One-Time Charges significantly reduce Reported Earnings, whereas Normalized Earnings adjust for these charges to reflect the company's ongoing profitability more accurately.

Earnings Smoothing

Earnings smoothing involves adjusting reported earnings to produce normalized earnings that reflect the company's true financial performance by eliminating irregularities and one-time items.

Extraordinary Items

Extraordinary items are non-recurring financial events excluded from normalized earnings to provide a clearer comparison against reported earnings.

Earnings Quality

Normalized earnings provide a more accurate measure of earnings quality by adjusting reported earnings for non-recurring items and accounting anomalies to reflect the company's sustainable performance.

Financial Restatements

Financial restatements adjust reported earnings to more accurately reflect normalized earnings by correcting accounting errors, misstatements, or changes in accounting policies.

Core Operating Income

Core Operating Income reflects normalized earnings by excluding one-time items and non-recurring charges to provide a clearer comparison with reported earnings.

Normalized Earnings vs Reported Earnings Infographic

moneydif.com

moneydif.com