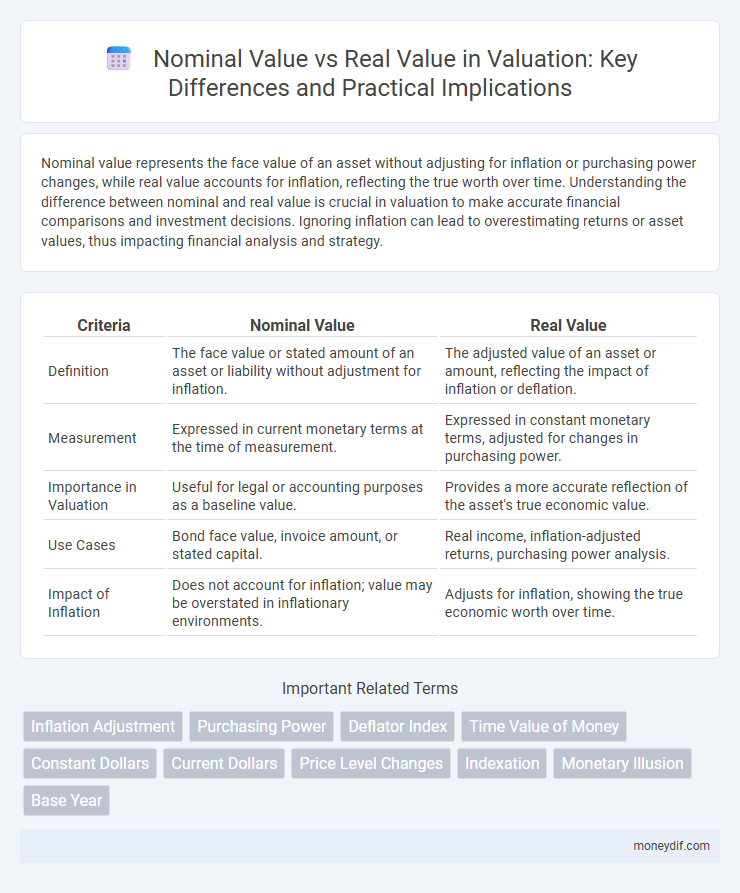

Nominal value represents the face value of an asset without adjusting for inflation or purchasing power changes, while real value accounts for inflation, reflecting the true worth over time. Understanding the difference between nominal and real value is crucial in valuation to make accurate financial comparisons and investment decisions. Ignoring inflation can lead to overestimating returns or asset values, thus impacting financial analysis and strategy.

Table of Comparison

| Criteria | Nominal Value | Real Value |

|---|---|---|

| Definition | The face value or stated amount of an asset or liability without adjustment for inflation. | The adjusted value of an asset or amount, reflecting the impact of inflation or deflation. |

| Measurement | Expressed in current monetary terms at the time of measurement. | Expressed in constant monetary terms, adjusted for changes in purchasing power. |

| Importance in Valuation | Useful for legal or accounting purposes as a baseline value. | Provides a more accurate reflection of the asset's true economic value. |

| Use Cases | Bond face value, invoice amount, or stated capital. | Real income, inflation-adjusted returns, purchasing power analysis. |

| Impact of Inflation | Does not account for inflation; value may be overstated in inflationary environments. | Adjusts for inflation, showing the true economic worth over time. |

Introduction to Nominal and Real Value

Nominal value represents the face value of an asset or currency without adjustment for inflation, reflecting the current price level. Real value accounts for changes in purchasing power by adjusting nominal value for inflation, providing a more accurate measure of true economic worth. Understanding the distinction between nominal and real values is essential for accurate financial analysis and investment decision-making.

Defining Nominal Value in Valuation

Nominal value in valuation refers to the face value of an asset or security, representing its stated worth without adjustments for inflation or market fluctuations. It is the original value assigned at issuance, often used for accounting and contractual purposes. Unlike real value, nominal value does not account for changes in purchasing power or economic conditions affecting asset valuation over time.

Understanding Real Value: An Overview

Real value represents the purchasing power of an asset or currency, adjusted for inflation to reflect its true economic worth over time. Unlike nominal value, which is expressed in current prices without accounting for changes in price levels, real value provides a more accurate measure for comparing financial data across different periods. Understanding real value is essential for precise valuation, investment analysis, and economic decision-making.

Key Differences Between Nominal and Real Value

Nominal value refers to the monetary value of an asset or income unadjusted for inflation, while real value accounts for changes in purchasing power by adjusting nominal figures using inflation rates. The key difference lies in real value providing a more accurate representation of economic worth over time, reflecting true growth or decline in value. Understanding these distinctions is essential for precise valuation, investment analysis, and economic comparison.

Importance of Adjusting for Inflation

Nominal value represents the face value of an asset or investment without accounting for inflation, while real value reflects the purchasing power after adjusting for inflation. Adjusting for inflation is crucial in valuation to provide a more accurate and realistic assessment of an asset's true worth over time. Ignoring inflation can lead to overestimating returns and misinforming investment decisions by failing to consider changes in the cost of living and price levels.

Impact of Time on Asset Valuation

Nominal value represents the face value of an asset without adjusting for inflation, while real value reflects the asset's purchasing power by accounting for changes in price levels over time. Inflation erodes nominal value, causing real value to be a more accurate measure of an asset's worth in different time periods. Time-driven factors like inflation and deflation critically impact asset valuation by altering real returns, influencing investment decisions and financial planning.

Calculating Real Value: Methods and Examples

Calculating real value involves adjusting the nominal value by an inflation index, typically the Consumer Price Index (CPI), to reflect true purchasing power over time. The formula used is Real Value = Nominal Value / (CPI in the current year / CPI in the base year), enabling accurate comparisons across different periods. For example, if a bond's nominal value is $1,000 and the CPI has doubled since issuance, its real value would be $500, accounting for inflation's impact.

Applications in Financial Analysis

Nominal value represents the face value of an asset or investment without adjusting for inflation, while real value accounts for changes in purchasing power by incorporating inflation adjustments. In financial analysis, using real value provides a more accurate measure of an asset's true profitability and performance over time by reflecting the impact of inflation on cash flows and returns. Applying real value adjustments in valuation models helps investors make informed decisions by comparing the inflation-adjusted worth of different assets and avoiding distorted comparisons driven by nominal figures.

Common Mistakes in Distinguishing Nominal and Real Value

Confusing nominal value with real value often leads to inaccurate financial analysis by ignoring inflation's impact on purchasing power. A common mistake is treating nominal figures as if they reflect true economic worth, which distorts investment appraisals and valuation models. Proper valuation requires adjusting nominal values using relevant price indices to obtain real value, ensuring accurate comparisons across time periods.

Best Practices for Accurate Valuation

Nominal value represents the face value of an asset without adjusting for inflation, while real value accounts for changes in purchasing power to reflect true economic worth. Best practices for accurate valuation include adjusting cash flows and asset prices for inflation using relevant price indices and consistently applying these adjustments across valuation periods. Incorporating real value measurements ensures more precise investment comparisons and better-informed financial decisions.

Important Terms

Inflation Adjustment

Inflation adjustment converts nominal values, which reflect money amounts at the time of measurement, into real values that account for changes in purchasing power over time. This process ensures that economic indicators like wages, GDP, and investment returns accurately represent true value by removing the distortions caused by inflation.

Purchasing Power

Purchasing power measures the real value of money by comparing nominal value to inflation-adjusted value over time.

Deflator Index

The Deflator Index measures the change in prices by comparing nominal value to real value, isolating inflation effects within an economy over time. It is calculated by dividing nominal GDP by real GDP and multiplying by 100, providing a comprehensive gauge of price level fluctuations.

Time Value of Money

The time value of money highlights that nominal value ignores inflation effects while real value adjusts for inflation, reflecting the true purchasing power over time.

Constant Dollars

Constant dollars measure real value by adjusting nominal value for inflation to reflect true purchasing power over time.

Current Dollars

Current dollars represent the nominal value of money without adjusting for inflation, while real value accounts for inflation to reflect the true purchasing power over time.

Price Level Changes

Price level changes impact nominal value by altering monetary amounts, while real value adjusts for inflation to reflect true purchasing power.

Indexation

Indexation adjusts the nominal value of assets or income to reflect real value by accounting for inflation and maintaining purchasing power over time.

Monetary Illusion

Monetary illusion occurs when individuals focus on nominal value changes without considering corresponding shifts in real value due to inflation.

Base Year

The base year serves as the reference point for calculating real values by adjusting nominal values for inflation or deflation, ensuring accurate comparison of economic indicators over time. Real value reflects purchasing power in the base year's prices, while nominal value is measured in current year prices without inflation adjustment.

Nominal Value vs Real Value Infographic

moneydif.com

moneydif.com