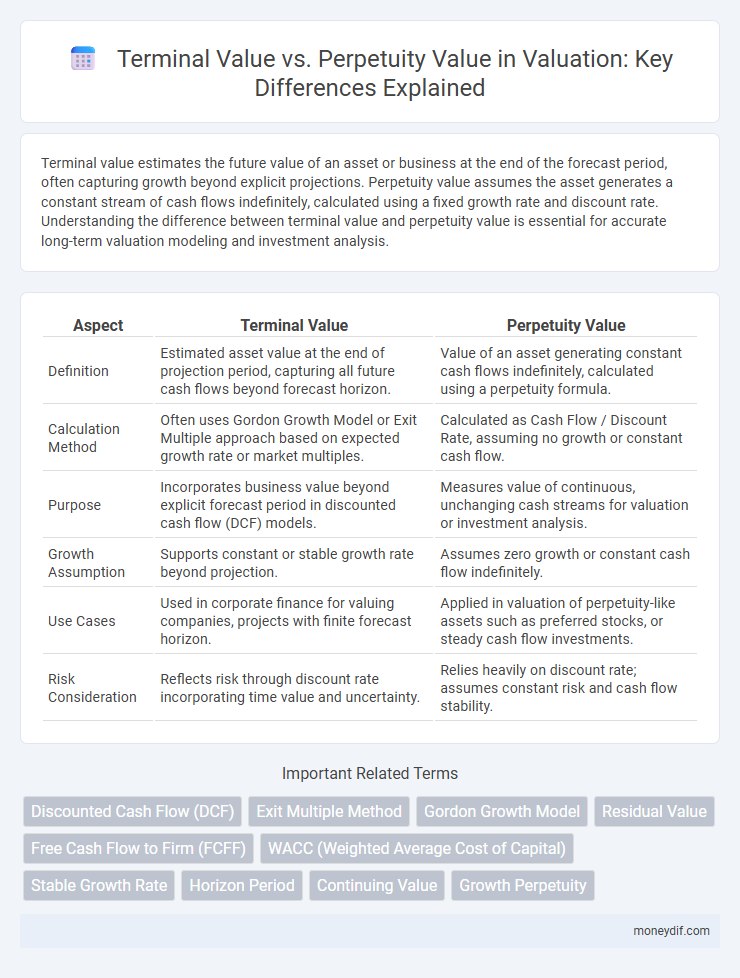

Terminal value estimates the future value of an asset or business at the end of the forecast period, often capturing growth beyond explicit projections. Perpetuity value assumes the asset generates a constant stream of cash flows indefinitely, calculated using a fixed growth rate and discount rate. Understanding the difference between terminal value and perpetuity value is essential for accurate long-term valuation modeling and investment analysis.

Table of Comparison

| Aspect | Terminal Value | Perpetuity Value |

|---|---|---|

| Definition | Estimated asset value at the end of projection period, capturing all future cash flows beyond forecast horizon. | Value of an asset generating constant cash flows indefinitely, calculated using a perpetuity formula. |

| Calculation Method | Often uses Gordon Growth Model or Exit Multiple approach based on expected growth rate or market multiples. | Calculated as Cash Flow / Discount Rate, assuming no growth or constant cash flow. |

| Purpose | Incorporates business value beyond explicit forecast period in discounted cash flow (DCF) models. | Measures value of continuous, unchanging cash streams for valuation or investment analysis. |

| Growth Assumption | Supports constant or stable growth rate beyond projection. | Assumes zero growth or constant cash flow indefinitely. |

| Use Cases | Used in corporate finance for valuing companies, projects with finite forecast horizon. | Applied in valuation of perpetuity-like assets such as preferred stocks, or steady cash flow investments. |

| Risk Consideration | Reflects risk through discount rate incorporating time value and uncertainty. | Relies heavily on discount rate; assumes constant risk and cash flow stability. |

Defining Terminal Value and Perpetuity Value

Terminal value represents the estimated value of a business or asset beyond the explicit forecast period, capturing future cash flows at the end of a projection horizon. Perpetuity value assumes cash flows continue indefinitely at a constant growth rate, often calculated using the Gordon Growth Model. Terminal value incorporates broader assumptions about growth and risk after the forecast period, while perpetuity value specifically focuses on a stable, ongoing cash flow into perpetuity.

Key Differences Between Terminal Value and Perpetuity Value

Terminal value estimates a company's future value at the end of a projection period, often using exit multiples or perpetuity growth models, capturing both growth potential and risk at that point. Perpetuity value assumes a constant cash flow or earnings stream indefinitely, calculated using the Gordon Growth Model, reflecting steady-state business conditions without growth or with constant growth. The key difference lies in terminal value's focus on a finite forecast horizon plus residual value, while perpetuity value represents the ongoing value beyond that horizon, making it a component of the terminal value calculation in discounted cash flow analysis.

Importance of Terminal Value in Valuation Models

Terminal value represents the present value of all future cash flows beyond the explicit forecast period and often accounts for a significant portion of a company's total valuation. It provides crucial insight into the long-term growth prospects and sustainability of a business, making it essential in discounted cash flow (DCF) models. Accurately estimating terminal value reduces valuation errors and enhances the reliability of investment decisions by capturing the continuing value of assets over time.

Role of Perpetuity Value in Discounted Cash Flow Analysis

Perpetuity value represents the value of all future cash flows beyond the forecast period, assuming a constant growth rate, making it a critical component in Discounted Cash Flow (DCF) analysis. Terminal value often incorporates perpetuity value, capturing the ongoing business's worth at the end of explicit projections. Accurately estimating perpetuity value significantly impacts the total valuation, as it typically constitutes the largest portion of the terminal value in DCF models.

Common Methods to Calculate Terminal Value

Terminal value is commonly calculated using the Perpetuity Growth Model, which estimates value by dividing the final year's free cash flow by the discount rate minus the perpetual growth rate. The Exit Multiple Method applies an industry-specific EBITDA or revenue multiple to the final projected year's financial metric, providing a market-based valuation. Both methods require careful consideration of growth assumptions and appropriate discount rates to ensure accurate terminal value estimation.

Perpetuity Growth Model Explained

The Perpetuity Growth Model calculates terminal value by assuming a constant growth rate in free cash flows indefinitely, reflecting the business's steady-state operations beyond the forecast period. This model is essential for valuing mature companies with stable growth prospects, where cash flows are expected to grow at a consistent rate. Terminal value derived from the perpetuity growth formula often dominates the total firm value in discounted cash flow (DCF) analysis, highlighting its critical role in investment decision-making.

Assumptions Behind Terminal and Perpetuity Values

Terminal value assumes a finite projection period followed by a steady-state growth phase, relying on assumptions of stable cash flows and a constant discount rate beyond the forecast horizon. Perpetuity value presumes indefinite cash flow generation at a fixed growth rate, requiring careful estimation of long-term growth assumptions that reflect economic fundamentals and industry conditions. Both values depend on realistic assumptions about growth sustainability, discount rates, and the business's lifecycle stage to accurately capture the residual worth in valuation models.

Limitations and Risks of Terminal and Perpetuity Calculations

Terminal value and perpetuity calculations often assume constant growth rates and discount rates, which may not reflect real-world market volatility, leading to over- or underestimation of firm value. These models are highly sensitive to small changes in assumptions, increasing the risk of significant valuation errors. Ignoring potential shifts in competitive dynamics and macroeconomic factors further limits the reliability of terminal and perpetuity value estimates.

Practical Examples: Terminal Value vs. Perpetuity Value

Terminal value captures a business's estimated worth at the end of a forecast period using a multiple-based or discount cash flow method, reflecting projected growth and exit scenarios. Perpetuity value calculates the present value of infinite cash flows assuming a constant growth rate, often applied in dividend discount models or stable mature companies. A practical example includes valuing a tech startup with high growth using terminal value at year five, while a utility company's stable dividends may be evaluated through perpetuity value.

Best Practices for Using Terminal and Perpetuity Values in Valuation

Terminal value estimation should align with stable growth assumptions beyond the explicit forecast period, ensuring consistency with long-term economic conditions and industry trends. Use perpetuity value formulas cautiously, applying conservative growth rates that do not exceed the economy's growth rate to avoid overvaluation. Regularly validate assumptions with market data and scenario analysis to enhance the reliability of terminal and perpetuity values in discounted cash flow models.

Important Terms

Discounted Cash Flow (DCF)

Terminal value in Discounted Cash Flow (DCF) analysis estimates the business's value beyond the forecast period by calculating the perpetuity value, which assumes a constant growth rate in free cash flows indefinitely.

Exit Multiple Method

Exit Multiple Method estimates terminal value by applying a market-based exit multiple to a financial metric, providing an alternative to the perpetuity growth model which calculates terminal value based on projected cash flows growing at a constant rate.

Gordon Growth Model

The Gordon Growth Model calculates terminal value by assuming a constant perpetual growth rate of free cash flows beyond the forecast period, effectively representing the perpetuity value of a company's cash flows. Terminal value derived from the Gordon Growth Model discounts future cash flows to present value, reflecting long-term sustainable growth, making it a critical component in discounted cash flow (DCF) analysis for valuation accuracy.

Residual Value

Residual value represents the estimated worth of an asset at the end of its useful life, often calculated as a terminal value in discounted cash flow models, whereas perpetuity value assumes constant cash flows extending indefinitely beyond the projection period.

Free Cash Flow to Firm (FCFF)

Free Cash Flow to Firm (FCFF) is used to calculate Terminal Value by applying the perpetuity growth model, which discounts expected perpetual cash flows beyond the forecast period.

WACC (Weighted Average Cost of Capital)

The Weighted Average Cost of Capital (WACC) serves as the discount rate in valuing both terminal value and perpetuity value, reflecting a firm's blended cost of equity and debt. Terminal value often uses a perpetuity growth model discounted by WACC to estimate the present value of all future cash flows beyond the projection period.

Stable Growth Rate

Stable Growth Rate directly influences Terminal Value calculation by assuming a constant perpetual growth, differentiating it from perpetuity value which assumes zero growth in cash flows.

Horizon Period

The Horizon Period marks the end of explicit forecast phases in valuation models, where Terminal Value estimates the business's value beyond this period using perpetuity growth assumptions. Terminal Value is often calculated through the perpetuity growth model, capturing cash flows extending indefinitely past the Horizon Period at a stable growth rate.

Continuing Value

Continuing value, often synonymous with terminal value, represents the present value of all future cash flows beyond a forecast period, calculated using perpetuity value formulas to estimate a business's ongoing worth.

Growth Perpetuity

Terminal value in discounted cash flow analysis represents the growth perpetuity value assuming a constant growth rate beyond the forecast period, calculated as the final year's cash flow multiplied by (1 + growth rate) divided by (discount rate minus growth rate).

Terminal value vs perpetuity value Infographic

moneydif.com

moneydif.com