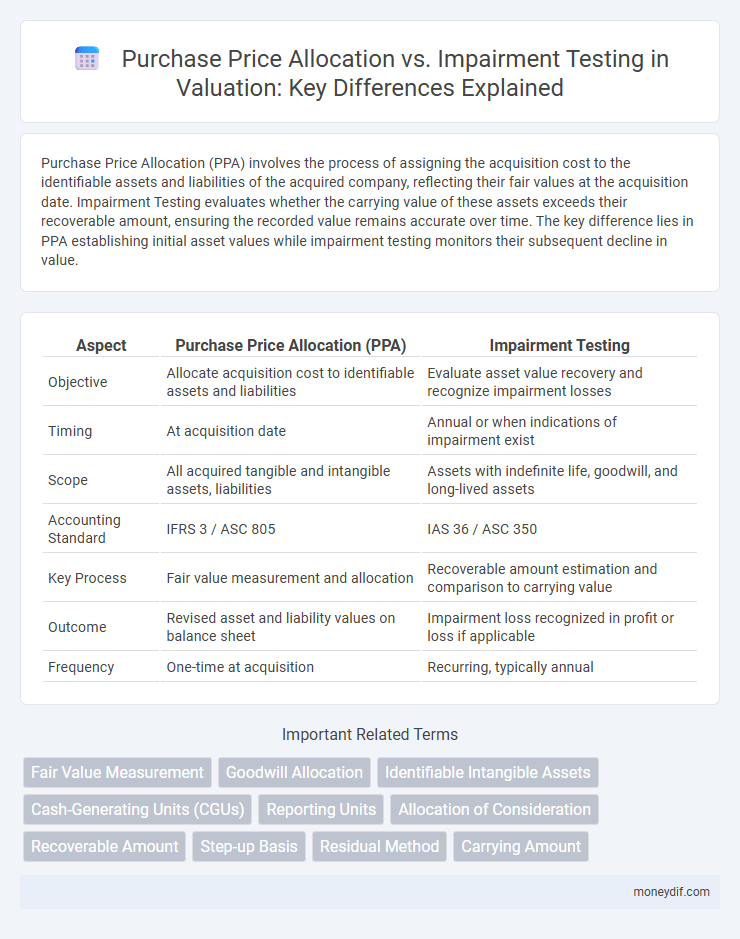

Purchase Price Allocation (PPA) involves the process of assigning the acquisition cost to the identifiable assets and liabilities of the acquired company, reflecting their fair values at the acquisition date. Impairment Testing evaluates whether the carrying value of these assets exceeds their recoverable amount, ensuring the recorded value remains accurate over time. The key difference lies in PPA establishing initial asset values while impairment testing monitors their subsequent decline in value.

Table of Comparison

| Aspect | Purchase Price Allocation (PPA) | Impairment Testing |

|---|---|---|

| Objective | Allocate acquisition cost to identifiable assets and liabilities | Evaluate asset value recovery and recognize impairment losses |

| Timing | At acquisition date | Annual or when indications of impairment exist |

| Scope | All acquired tangible and intangible assets, liabilities | Assets with indefinite life, goodwill, and long-lived assets |

| Accounting Standard | IFRS 3 / ASC 805 | IAS 36 / ASC 350 |

| Key Process | Fair value measurement and allocation | Recoverable amount estimation and comparison to carrying value |

| Outcome | Revised asset and liability values on balance sheet | Impairment loss recognized in profit or loss if applicable |

| Frequency | One-time at acquisition | Recurring, typically annual |

Introduction to Purchase Price Allocation and Impairment Testing

Purchase Price Allocation (PPA) involves assigning the acquisition cost of a business to its tangible and intangible assets and liabilities based on their fair values. Impairment Testing evaluates whether the carrying value of an asset exceeds its recoverable amount, triggering a write-down if necessary. Both processes are essential in financial reporting to ensure accurate asset valuation and compliance with accounting standards such as IFRS 3 for PPA and IAS 36 for impairment.

Key Definitions: PPA and Impairment Testing

Purchase Price Allocation (PPA) is the process of distributing the acquisition cost of a business over its identifiable assets and liabilities based on their fair values at the acquisition date. Impairment Testing evaluates whether the carrying amount of an asset or cash-generating unit exceeds its recoverable amount, indicating a need for a write-down. Both concepts are essential in valuation to ensure accurate financial reporting and compliance with accounting standards like IFRS and US GAAP.

Objective Comparison: PPA vs. Impairment Testing

Purchase Price Allocation (PPA) aims to allocate the acquisition cost to identifiable assets and liabilities at fair value, ensuring accurate financial representation post-acquisition. Impairment Testing evaluates whether the carrying amount of an asset exceeds its recoverable amount, focusing on asset value decline over time. PPA's objective is initial valuation accuracy, whereas Impairment Testing monitors ongoing asset value and identifies potential write-downs.

Regulatory Frameworks: IFRS vs. US GAAP

IFRS and US GAAP establish distinct regulatory frameworks for Purchase Price Allocation (PPA) and Impairment Testing, with IFRS emphasizing fair value measurement under IFRS 3 and IAS 36, whereas US GAAP follows ASC Topic 805 for PPA and ASC Topic 350 for impairment. IFRS requires detailed identification and valuation of acquired intangible assets during PPA and mandates annual impairment testing for goodwill without using a quantitative threshold. US GAAP mandates a two-step goodwill impairment test with optional qualitative assessment and rigid guidance on asset impairment recognition, reflecting fundamental differences in timing, thresholds, and measurement approaches between the two standards.

Recognition and Measurement of Intangible Assets

Purchase Price Allocation (PPA) requires recognizing identifiable intangible assets at fair value, assigning acquisition cost based on market participant assumptions. Impairment Testing involves measuring intangible assets' recoverable amount, comparing it to carrying value to identify and recognize any loss in value. Both processes emphasize accurate recognition and measurement but differ in timing and purpose within valuation frameworks.

Timing and Frequency of Analysis

Purchase Price Allocation is conducted immediately after an acquisition to allocate the purchase price to identifiable assets and liabilities, reflecting fair values at the acquisition date. Impairment Testing occurs subsequently, typically on an annual basis or when triggering events indicate a potential decline in asset value. The timing and frequency differentiation ensures initial valuation accuracy and ongoing asset value verification.

Impact on Financial Statements

Purchase Price Allocation (PPA) affects financial statements by allocating the acquisition cost to tangible and intangible assets, influencing future amortization and depreciation expenses, which impact net income and asset values on the balance sheet. Impairment testing identifies declines in asset value, requiring write-downs that reduce asset carrying amounts and directly decrease earnings through impairment losses, thereby affecting equity and profitability metrics. Both processes are critical for accurate asset valuation but differ in timing and impact, with PPA setting initial values post-acquisition and impairment testing addressing subsequent value declines.

Challenges in Valuation and Assumptions

Purchase Price Allocation (PPA) requires detailed identification and fair value measurement of acquired assets and liabilities, posing challenges due to limited market data and complex valuation assumptions. Impairment Testing involves estimating recoverable amounts based on future cash flow projections, often leading to subjective assumptions about growth rates, discount rates, and market conditions. Both processes demand robust methodologies and sensitivity analyses to address uncertainties and ensure accurate valuation outcomes.

Common Mistakes and How to Avoid Them

Common mistakes in Purchase Price Allocation include improper asset classification and inaccurate fair value measurements, leading to erroneous goodwill calculation. Impairment testing errors often arise from incorrect cash flow forecasting and discount rate application, which distort asset recoverable amounts. To avoid these pitfalls, ensure rigorous data validation and use consistent, market-based assumptions throughout both valuation processes.

Best Practices for PPA and Impairment Testing

Effective Purchase Price Allocation (PPA) requires thorough identification and fair valuation of tangible and intangible assets acquired, ensuring alignment with IFRS 3 and ASC 805 standards. Best practices for Impairment Testing emphasize regular monitoring of asset recoverable amounts against carrying values, employing consistent valuation techniques such as discounted cash flow analysis and market comparables. Maintaining detailed documentation and leveraging cross-functional expertise enhance accuracy and compliance in both PPA and Impairment Testing processes.

Important Terms

Fair Value Measurement

Fair Value Measurement ensures accurate Purchase Price Allocation by reflecting current market conditions while Impairment Testing uses this valuation to assess asset recoverability and recognize potential losses.

Goodwill Allocation

Goodwill allocation during Purchase Price Allocation involves assigning the acquired intangible value to specific cash-generating units, which is subsequently evaluated for impairment testing to ensure accurate asset valuation on financial statements.

Identifiable Intangible Assets

Identifiable intangible assets acquired through Purchase Price Allocation are initially recognized at fair value and subsequently subjected to Impairment Testing to assess whether their carrying amount exceeds recoverable value, ensuring accurate financial reporting.

Cash-Generating Units (CGUs)

Cash-Generating Units (CGUs) are critical in Purchase Price Allocation to identify and allocate acquired assets' fair values, while in Impairment Testing, CGUs serve to assess the recoverable amount and recognize potential asset impairments.

Reporting Units

Reporting units are critical in Purchase Price Allocation for identifying asset fair values and essential in Impairment Testing to assess potential goodwill or asset value declines.

Allocation of Consideration

Allocation of consideration in Purchase Price Allocation involves assigning fair values to acquired assets and liabilities, whereas Impairment Testing evaluates these assets for potential value reduction after acquisition.

Recoverable Amount

Recoverable amount is the higher of an asset's fair value less costs of disposal and its value in use, crucial for impairment testing but not directly used in purchase price allocation.

Step-up Basis

Step-up basis increases asset values in purchase price allocation to reflect fair market value, impacting impairment testing by raising the asset's carrying amount and potentially increasing future impairment charges.

Residual Method

The Residual Method in Purchase Price Allocation (PPA) calculates goodwill by subtracting the fair value of identifiable net assets from the total purchase price, while in Impairment Testing, it determines the recoverable amount by allocating the carrying value between tangible and intangible assets and residual goodwill. Accurate application of the Residual Method ensures proper financial reporting under IFRS and US GAAP by preventing overstatement of goodwill and identifying impairment losses promptly.

Carrying Amount

Carrying amount reflects the book value of an asset after Purchase Price Allocation (PPA) allocates the acquisition cost to identifiable assets and liabilities at fair value. Impairment testing then compares the carrying amount to recoverable value, recognizing a write-down if the carrying amount exceeds the asset's fair value or value in use.

Purchase Price Allocation vs Impairment Testing Infographic

moneydif.com

moneydif.com