Step-up basis resets the asset's tax basis to its fair market value at the time of inheritance, minimizing capital gains tax for beneficiaries. Carryover basis retains the original purchase price of the asset, passing the capital gains tax burden to the heir upon sale. Choosing between step-up and carryover basis impacts estate tax planning and long-term investment strategies.

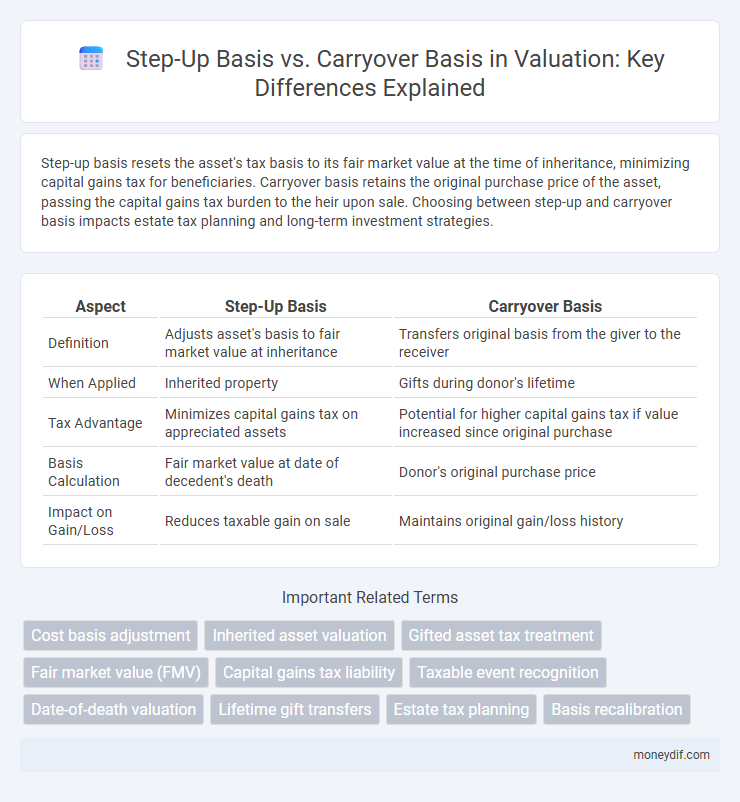

Table of Comparison

| Aspect | Step-Up Basis | Carryover Basis |

|---|---|---|

| Definition | Adjusts asset's basis to fair market value at inheritance | Transfers original basis from the giver to the receiver |

| When Applied | Inherited property | Gifts during donor's lifetime |

| Tax Advantage | Minimizes capital gains tax on appreciated assets | Potential for higher capital gains tax if value increased since original purchase |

| Basis Calculation | Fair market value at date of decedent's death | Donor's original purchase price |

| Impact on Gain/Loss | Reduces taxable gain on sale | Maintains original gain/loss history |

Understanding Step-Up Basis and Carryover Basis

Step-up basis adjusts the asset's value to its fair market value at the date of inheritance, minimizing capital gains tax for beneficiaries upon sale. Carryover basis retains the original purchase price of the asset, transferring the original cost basis from the grantor to the recipient, often used in gift transactions. Understanding these basis methods is crucial for accurate valuation and tax planning in estate and gift tax scenarios.

Key Differences Between Step-Up and Carryover Basis

Step-up basis adjusts the asset's value to its fair market value at the time of inheritance, minimizing capital gains tax upon sale. Carryover basis retains the original purchase price of the asset for tax purposes, potentially increasing capital gains liability. Understanding these key differences is crucial for estate planning and tax strategy optimization.

How Step-Up Basis Works in Inheritance

Step-up basis resets the value of inherited assets to their fair market value at the date of the decedent's death, minimizing capital gains taxes for heirs upon sale. Unlike a carryover basis, which transfers the original purchase price, the step-up basis effectively eliminates unrealized gains accrued during the decedent's holding period. This valuation method significantly impacts estate planning by potentially reducing tax liabilities and simplifying asset appraisal for inherited property.

Carryover Basis Explained for Gifting Assets

Carryover basis refers to the tax basis of an asset transferred through gifting, where the recipient inherits the original purchase price from the donor instead of a stepped-up basis. This means the recipient assumes the donor's original cost basis for calculating capital gains, which can result in higher taxes if the asset has appreciated significantly. Understanding carryover basis is crucial in valuation to accurately assess potential tax liabilities when gifting assets.

Tax Implications of Step-Up Basis

Step-up basis adjusts the value of an inherited asset to its fair market value at the date of the decedent's death, significantly reducing capital gains tax liability for beneficiaries. This revaluation eliminates the capital gains accrued during the decedent's lifetime, allowing heirs to potentially sell the asset with minimal tax burden. In contrast, carryover basis transfers the original cost basis to recipients, often resulting in higher capital gains taxes upon sale.

Tax Consequences of Carryover Basis

Carryover basis results in the recipient inheriting the original owner's tax basis in an asset, which can defer tax liabilities until a future sale occurs. This method often leads to lower immediate capital gains taxes compared to a step-up basis, where the asset is revalued at market price upon transfer. Understanding the tax consequences of carryover basis is essential for accurate valuation and strategic tax planning in asset transfers.

Impact on Capital Gains Calculation

Step-up basis resets the asset's cost basis to its fair market value at the time of inheritance, minimizing capital gains taxes by reducing the taxable appreciation. Carryover basis transfers the original purchase price to the heir, often resulting in higher capital gains taxes due to accumulated appreciation from the original acquisition date. Investors and heirs must carefully consider these basis methods, as they significantly influence the capital gains calculation and subsequent tax liability.

Estate Planning Strategies: Step-Up vs Carryover

Estate planning strategies often hinge on choosing between step-up basis and carryover basis for asset valuation. Step-up basis resets the asset's cost to its fair market value at the time of the owner's death, minimizing capital gains taxes for heirs. Carryover basis retains the original purchase price, potentially increasing tax liabilities but preserving the decedent's tax history for specific planning advantages.

Scenarios Favoring Step-Up or Carryover Basis

Step-up basis is advantageous in estates with appreciated assets because it resets the asset value to the market price at the decedent's death, minimizing capital gains tax for heirs. Carryover basis benefits situations involving gifts during the giver's lifetime, allowing the recipient to inherit the original cost basis and potentially defer taxes until asset disposition. Complex transactions like family business transfers or intergenerational wealth planning often favor carryover basis to preserve tax attributes and defer recognition of gains.

Legislative Updates Affecting Basis Rules

Recent legislative updates have introduced significant changes to the basis rules, particularly impacting step-up basis and carryover basis provisions. The Inflation Reduction Act of 2022, for example, limits step-up basis adjustments in certain high-value estates, altering estate tax planning strategies. These revisions emphasize the importance of updated valuation methods to accurately reflect basis changes and optimize tax outcomes.

Important Terms

Cost basis adjustment

Cost basis adjustment determines whether an inherited asset uses a step-up basis, resetting its value to the fair market value at the decedent's death, or a carryover basis, retaining the original owner's cost for tax purposes.

Inherited asset valuation

Inherited asset valuation uses the step-up basis to reset the asset's tax basis to its fair market value at the decedent's date of death, while the carryover basis retains the original cost basis from the decedent.

Gifted asset tax treatment

Gifted assets receive a carryover basis equal to the donor's original cost, while inherited assets benefit from a step-up basis to the fair market value at the date of death, impacting capital gains tax calculations.

Fair market value (FMV)

Fair market value (FMV) determines the step-up basis at inheritance, resetting the asset's tax basis to its FMV, unlike the carryover basis which maintains the original cost basis for tax purposes.

Capital gains tax liability

Capital gains tax liability is significantly impacted by whether an asset inherits a step-up basis or a carryover basis; a step-up basis resets the asset's value to its fair market value at the time of the owner's death, minimizing taxable gains when sold, whereas a carryover basis transfers the original purchase price, potentially increasing capital gains tax if the asset appreciates. Understanding the differences between these basis methods is crucial for estate planning and tax strategies to reduce capital gains exposure.

Taxable event recognition

Taxable event recognition occurs during property transfers, determining whether a step-up basis resets the asset's tax value to its fair market value or a carryover basis maintains the original cost basis for tax purposes.

Date-of-death valuation

Date-of-death valuation determines the fair market value of inherited assets, establishing a step-up basis that resets the asset's tax basis to its value at the decedent's death, minimizing capital gains tax upon sale. This contrasts with the carryover basis, where the inheritor assumes the original cost basis, potentially increasing capital gains tax liability.

Lifetime gift transfers

Lifetime gift transfers typically use a carryover basis, meaning the recipient inherits the donor's original cost basis, while assets inherited after death benefit from a step-up basis, resetting the cost basis to the fair market value at the date of death.

Estate tax planning

Estate tax planning strategically leverages the step-up basis to reset asset valuations at date of death, minimizing capital gains taxes for heirs compared to the carryover basis method which preserves the original cost basis.

Basis recalibration

Basis recalibration adjusts the asset's value for tax purposes by applying a step-up basis to reflect the fair market value at inheritance, contrasting with the carryover basis which retains the original cost basis from the previous owner.

Step-up basis vs carryover basis Infographic

moneydif.com

moneydif.com