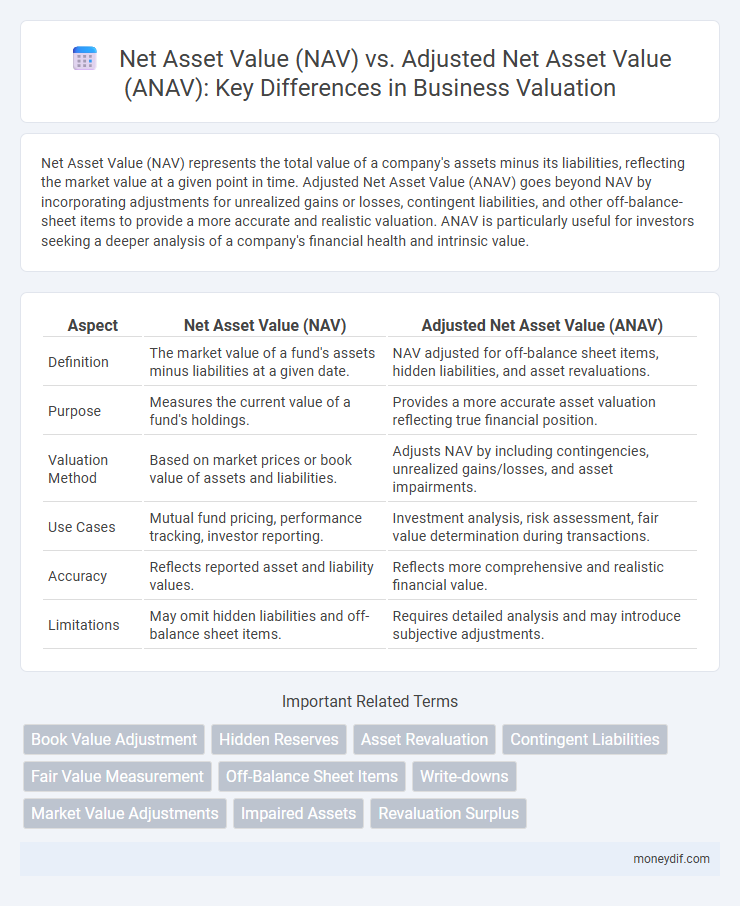

Net Asset Value (NAV) represents the total value of a company's assets minus its liabilities, reflecting the market value at a given point in time. Adjusted Net Asset Value (ANAV) goes beyond NAV by incorporating adjustments for unrealized gains or losses, contingent liabilities, and other off-balance-sheet items to provide a more accurate and realistic valuation. ANAV is particularly useful for investors seeking a deeper analysis of a company's financial health and intrinsic value.

Table of Comparison

| Aspect | Net Asset Value (NAV) | Adjusted Net Asset Value (ANAV) |

|---|---|---|

| Definition | The market value of a fund's assets minus liabilities at a given date. | NAV adjusted for off-balance sheet items, hidden liabilities, and asset revaluations. |

| Purpose | Measures the current value of a fund's holdings. | Provides a more accurate asset valuation reflecting true financial position. |

| Valuation Method | Based on market prices or book value of assets and liabilities. | Adjusts NAV by including contingencies, unrealized gains/losses, and asset impairments. |

| Use Cases | Mutual fund pricing, performance tracking, investor reporting. | Investment analysis, risk assessment, fair value determination during transactions. |

| Accuracy | Reflects reported asset and liability values. | Reflects more comprehensive and realistic financial value. |

| Limitations | May omit hidden liabilities and off-balance sheet items. | Requires detailed analysis and may introduce subjective adjustments. |

Introduction to NAV and ANAV

Net Asset Value (NAV) represents the market value of a fund's total assets minus its liabilities, providing a snapshot of its per-share value. Adjusted Net Asset Value (ANAV) refines this figure by incorporating adjustments for off-balance-sheet items, contingent liabilities, or market value discrepancies to reflect a more accurate valuation. Both NAV and ANAV are essential for investors to assess the true worth and investment potential of assets or funds.

Definition of Net Asset Value (NAV)

Net Asset Value (NAV) represents the total value of a fund's assets minus its liabilities, reflecting the intrinsic worth of a company's equity on a per-share basis. NAV is calculated by subtracting total liabilities from total assets, offering investors a clear snapshot of the firm's net worth at a specific point in time. This metric is crucial in fund valuation, asset management, and investment analysis, providing a baseline for comparing market prices and making informed financial decisions.

What is Adjusted Net Asset Value (ANAV)?

Adjusted Net Asset Value (ANAV) refines the traditional Net Asset Value (NAV) by incorporating adjustments for off-balance-sheet items, contingent liabilities, and revaluations of assets and liabilities to present a more accurate financial position of a company. ANAV includes market value adjustments, providing investors with a clearer picture of true asset worth and potential risks compared to the book-value approach of NAV. This metric is crucial in valuation for identifying hidden value or risks often overlooked in standard NAV calculations.

Key Differences Between NAV and ANAV

Net Asset Value (NAV) represents the market value of a fund's total assets minus its liabilities, reflecting the price at which shares can be bought or sold. Adjusted Net Asset Value (ANAV) incorporates additional adjustments such as unrealized gains, off-balance-sheet items, or revaluation of assets to provide a more accurate and comprehensive measure of a fund's true value. The key difference lies in ANAV's ability to capture hidden asset values and contingencies, making it more reflective of the underlying economic worth compared to the standard NAV.

Calculation Methodologies: NAV vs ANAV

Net Asset Value (NAV) calculation involves using the market value of a fund's total assets minus its total liabilities, providing a snapshot of the fund's per-share value based on current market prices. Adjusted Net Asset Value (ANAV) refines this valuation by incorporating adjustments such as unrealized gains or losses, off-balance sheet items, and potential liabilities, aiming for a more accurate reflection of the asset's intrinsic worth. NAV is typically computed using historical cost adjusted to market values, whereas ANAV integrates a broader range of financial factors and revaluations to enhance precision in asset valuation.

Importance of Asset Revaluation in ANAV

Asset revaluation plays a crucial role in Adjusted Net Asset Value (ANAV) by reflecting the current market value of assets rather than their historical cost, ensuring a more accurate and realistic assessment of a company's worth. This adjustment mitigates the distortion caused by asset depreciation or outdated book values in Net Asset Value (NAV), providing investors and stakeholders with enhanced transparency and improved decision-making metrics. Incorporating asset revaluation aligns ANAV closely with market conditions, making it a preferred metric in real estate, investment funds, and companies with significant fixed assets.

When to Use NAV vs ANAV in Valuation

Net Asset Value (NAV) is best used for straightforward asset-based valuation of investment funds where market prices for assets are readily available and reliable. Adjusted Net Asset Value (ANAV) should be applied when underlying asset values require correction for liabilities, off-balance-sheet items, or market distortions to reflect a more accurate economic value. Employing ANAV is crucial in complex transactions, distressed asset evaluations, or when dealing with illiquid investments to ensure a precise valuation estimate.

NAV and ANAV in Investment Analysis

Net Asset Value (NAV) represents the total value of a fund's assets minus its liabilities, providing a snapshot of the fund's market value per share at a specific time. Adjusted Net Asset Value (ANAV) refines this measure by incorporating adjustments for unrealized gains, off-balance-sheet items, or market fluctuations, offering a more accurate reflection of intrinsic value in investment analysis. Comparing NAV and ANAV allows investors to assess both the reported market value and the underlying asset quality, improving portfolio valuation and decision-making processes.

Limitations and Challenges of NAV and ANAV

Net Asset Value (NAV) often faces limitations such as ignoring off-balance-sheet items and intangible assets, leading to an incomplete valuation picture. Adjusted Net Asset Value (ANAV) attempts to address these by incorporating hidden liabilities and asset revaluations, yet it remains challenged by subjective adjustments and inconsistent application across firms. Both NAV and ANAV struggle with market distortions and varying accounting policies, impacting the comparability and accuracy of asset valuations.

Practical Examples: Comparing NAV and ANAV

Net Asset Value (NAV) represents the value of a fund's total assets minus its total liabilities, commonly used to determine the per-share value of mutual funds or ETFs. Adjusted Net Asset Value (ANAV) refines NAV by incorporating off-balance-sheet items, revaluation of assets, or adjustments for investment risk, providing a more precise valuation. For example, in real estate funds, NAV may reflect historical cost of properties, while ANAV accounts for current market appraisals, resulting in a more accurate reflection of the fund's intrinsic value.

Important Terms

Book Value Adjustment

Book Value Adjustment recalculates asset values to reflect true market conditions, aligning Net Asset Value (NAV) more accurately with Adjusted Net Asset Value (ANAV).

Hidden Reserves

Hidden reserves increase the Adjusted Net Asset Value (ANAV) compared to the reported Net Asset Value (NAV) by reflecting undervalued assets and providing a more accurate financial valuation.

Asset Revaluation

Asset revaluation impacts Net Asset Value (NAV) by reflecting current market values, whereas Adjusted Net Asset Value (ANAV) incorporates these revaluations along with other adjustments to provide a more accurate measure of an entity's true financial position.

Contingent Liabilities

Contingent liabilities reduce the reliability of Net Asset Value (NAV) by introducing potential future obligations not reflected in asset valuations, making Adjusted Net Asset Value (ANAV) a more accurate measure as it accounts for these off-balance-sheet risks.

Fair Value Measurement

Fair Value Measurement precisely aligns with Net Asset Value (NAV) by reflecting current market conditions, whereas Adjusted Net Asset Value (ANAV) incorporates additional asset revaluations and liability adjustments for more accurate investment appraisals.

Off-Balance Sheet Items

Off-balance sheet items can significantly impact the calculation of Net Asset Value (NAV) by excluding certain liabilities, making Adjusted Net Asset Value (ANAV) a more accurate measure that incorporates these hidden obligations.

Write-downs

Write-downs directly reduce Net Asset Value (NAV), while Adjusted Net Asset Value (ANAV) incorporates write-downs alongside other adjustments for a more accurate reflection of asset value.

Market Value Adjustments

Market Value Adjustments (MVAs) quantify discrepancies between Net Asset Value (NAV) and Adjusted Net Asset Value (ANAV) by reflecting market-driven revaluations of underlying assets.

Impaired Assets

Impaired assets reduce the Net Asset Value (NAV) and require adjustments to calculate Adjusted Net Asset Value (ANAV), reflecting more accurate asset valuations and potential losses.

Revaluation Surplus

Revaluation Surplus increases the asset values on the balance sheet, causing Adjusted Net Asset Value (ANAV) to reflect more accurate market-based valuations compared to Net Asset Value (NAV) calculated at historical cost.

Net Asset Value (NAV) vs Adjusted Net Asset Value (ANAV) Infographic

moneydif.com

moneydif.com