Contingent consideration in valuation refers to a payment obligation triggered by specific future events or performance metrics, often defined within acquisition agreements. An earnout is a type of contingent consideration where the seller receives additional compensation based on the business achieving predetermined financial goals post-transaction. Distinguishing between contingent consideration and earnouts is crucial for accurate valuation, as it impacts risk assessment and the allocation of purchase price.

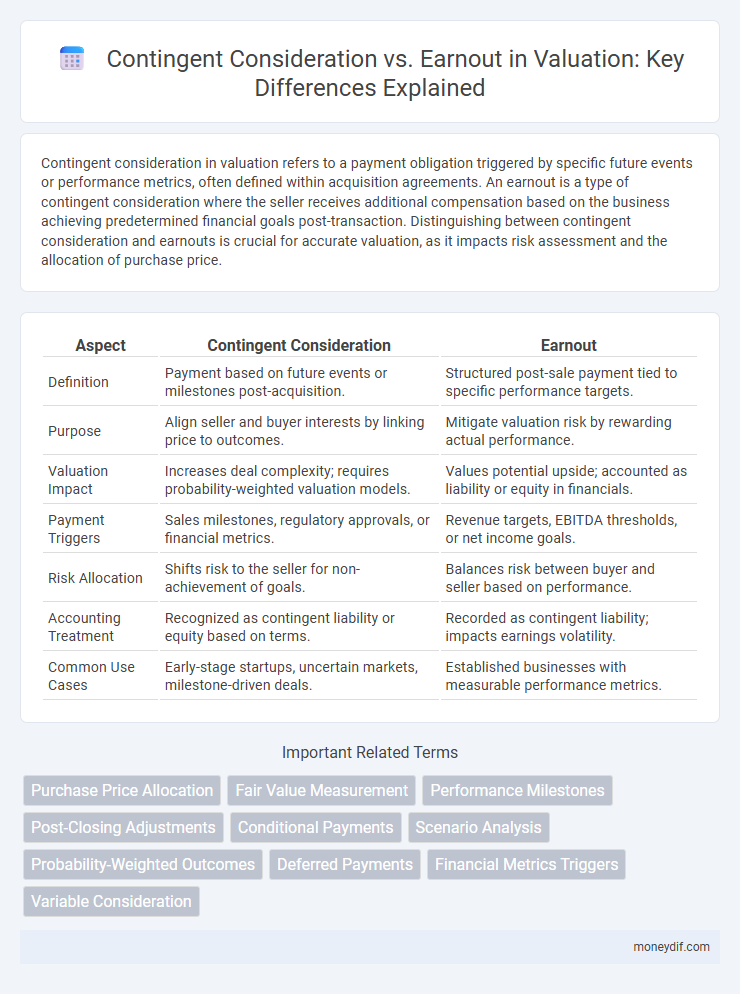

Table of Comparison

| Aspect | Contingent Consideration | Earnout |

|---|---|---|

| Definition | Payment based on future events or milestones post-acquisition. | Structured post-sale payment tied to specific performance targets. |

| Purpose | Align seller and buyer interests by linking price to outcomes. | Mitigate valuation risk by rewarding actual performance. |

| Valuation Impact | Increases deal complexity; requires probability-weighted valuation models. | Values potential upside; accounted as liability or equity in financials. |

| Payment Triggers | Sales milestones, regulatory approvals, or financial metrics. | Revenue targets, EBITDA thresholds, or net income goals. |

| Risk Allocation | Shifts risk to the seller for non-achievement of goals. | Balances risk between buyer and seller based on performance. |

| Accounting Treatment | Recognized as contingent liability or equity based on terms. | Recorded as contingent liability; impacts earnings volatility. |

| Common Use Cases | Early-stage startups, uncertain markets, milestone-driven deals. | Established businesses with measurable performance metrics. |

Introduction to Contingent Consideration and Earnouts

Contingent consideration and earnouts are common mechanisms in mergers and acquisitions to bridge valuation gaps between buyers and sellers by linking part of the purchase price to future performance or events. Contingent consideration typically involves a predetermined obligation based on specific milestones, financial targets, or operational criteria, providing risk-sharing between parties. Earnouts function similarly but often emphasize performance-dependent payouts over a defined period post-closing, ensuring alignment of incentives and reducing valuation uncertainty.

Defining Contingent Consideration in Valuation

Contingent consideration in valuation refers to a liability or asset whose value depends on the outcome of future events, often used in acquisition agreements to adjust the purchase price based on performance milestones. It differs from earnouts by being more broadly defined, including various types of future payments tied to uncertain conditions such as financial targets, regulatory approvals, or other specified criteria. Proper valuation of contingent consideration requires modeling possible outcomes and discounting expected payments to present value, reflecting the risk and timing of these future events.

What Is an Earnout in M&A Transactions?

An earnout in M&A transactions is a financial arrangement where the seller receives additional compensation based on the acquired business's future performance, aligning incentives between buyer and seller. This contingent consideration structure mitigates valuation risk by linking part of the purchase price to achieving specific financial targets or milestones post-closing. Earnouts are particularly useful when valuation disagreements exist, allowing buyers to pay a base amount upfront while sellers earn more if the business meets or exceeds projected goals.

Key Differences Between Contingent Consideration and Earnouts

Contingent consideration refers to future payments dependent on specific events or performance metrics, often found in merger and acquisition agreements to bridge valuation gaps. Earnouts are a subset of contingent consideration structured as post-closing payments tied directly to the target company's financial performance, such as revenue or EBITDA targets. Key differences include their scope--contingent consideration can cover various triggers beyond financial metrics, while earnouts focus narrowly on performance thresholds--and timing, with earnouts typically involving scheduled payments based on predefined milestones.

Valuation Methods for Contingent Consideration

Valuation methods for contingent consideration primarily include the income approach, which discounts expected future payments based on probability-weighted scenarios, and the market approach, which compares similar transactions with contingent terms. The income approach leverages discounted cash flow (DCF) analysis to estimate fair value under varying outcomes, reflecting risk and time value of money. Market data for contingent consideration remains limited, making scenario analysis and probability assessments critical in determining an accurate valuation.

How Earnouts Impact Deal Structure and Valuation

Earnouts significantly influence deal structure by aligning buyer and seller interests through performance-based payments contingent on future milestones. This mechanism mitigates valuation uncertainties by adjusting the purchase price according to actual business outcomes post-transaction. Incorporating earnouts can lead to more accurate valuations by reflecting realistic projections and reducing upfront risks for both parties.

Accounting Treatment: Contingent Consideration vs Earnout

Contingent consideration and earnouts both represent future payments tied to business performance, but their accounting treatments differ significantly under IFRS and US GAAP. Contingent consideration is initially measured at fair value and subsequently remeasured to fair value with changes recognized in profit or loss, impacting liabilities or equity depending on classification. Earnouts, classified as either liabilities or equity, often require careful judgment to determine fair value at acquisition and subsequent measurement, with emphasis on disclosure to reflect potential payment obligations accurately.

Risks and Challenges in Structuring Earnouts

Structuring earnouts involves significant risks such as potential disputes over performance targets and the accurate measurement of financial metrics, which can lead to prolonged conflicts between buyers and sellers. Earnouts may create misaligned incentives, resulting in management focusing on short-term goals rather than long-term value creation, thereby complicating post-transaction integration. Clear contractual terms and robust monitoring mechanisms are essential to mitigate challenges related to contingent consideration in earnout agreements.

Best Practices in Contingent Consideration Agreements

Contingent consideration agreements should clearly define measurable performance milestones and valuation metrics to align incentives between parties and reduce disputes. Incorporating transparent earnout structures with predefined financial or operational benchmarks enhances predictability and facilitates fair valuation adjustments. Regular monitoring and independent audits ensure adherence to terms and maintain the integrity of contingent payments in M&A transactions.

Conclusion: Selecting the Right Mechanism for Business Valuation

Contingent consideration and earnouts both bridge valuation gaps by linking payment to future performance, but contingent consideration is typically more flexible and negotiable, allowing precise adjustments based on defined milestones. Earnouts provide protection for buyers by tying part of the purchase price to actual business results, reducing risk in uncertain market conditions. Selecting the right mechanism depends on the nature of the transaction, risk tolerance, and clarity of performance metrics to ensure fair value realization.

Important Terms

Purchase Price Allocation

Purchase price allocation distinguishes contingent consideration as a liability or equity based on contractual terms, while earnouts are structured post-acquisition payments contingent on future performance metrics.

Fair Value Measurement

Fair value measurement of contingent consideration and earnouts involves estimating future payments based on performance targets using probability-weighted scenarios and discounting to present value.

Performance Milestones

Performance milestones directly influence contingent consideration by defining specific financial targets that trigger earnout payments in acquisition agreements.

Post-Closing Adjustments

Post-closing adjustments in mergers and acquisitions differentiate contingent consideration, which depends on future events, from earnouts that are structured payments tied to specific financial performance targets.

Conditional Payments

Conditional payments in mergers and acquisitions distinguish contingent consideration as performance-dependent payouts while earnouts specifically tie payments to future financial targets or milestones.

Scenario Analysis

Scenario analysis evaluates potential outcomes of contingent consideration versus earnout agreements by modeling financial impacts under various future performance conditions.

Probability-Weighted Outcomes

Probability-weighted outcomes improve valuation accuracy by assigning likelihoods to contingent consideration and earnout payments based on future performance metrics.

Deferred Payments

Deferred payments in mergers and acquisitions often involve contingent consideration or earnouts, which tie part of the purchase price to future performance metrics or milestones. Contingent consideration is typically based on specific financial targets or operational achievements, whereas earnouts usually depend on broader business results over a defined period, influencing the timing and risk allocation of the acquisition payout.

Financial Metrics Triggers

Financial metrics triggers in contingent consideration versus earnout agreements determine payment adjustments based on achieved performance benchmarks such as revenue, EBITDA, or net income targets.

Variable Consideration

Variable consideration in accounting distinguishes contingent consideration, which depends on future events for acquisition pricing, from earnouts that tie additional payments to the acquired company's performance milestones.

Contingent Consideration vs Earnout Infographic

moneydif.com

moneydif.com