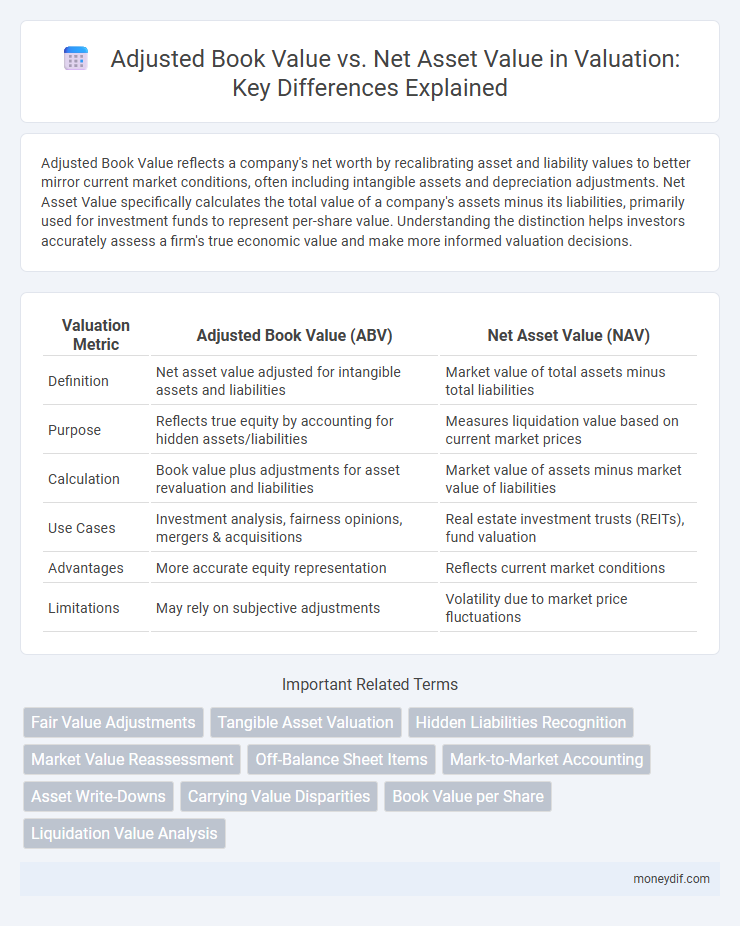

Adjusted Book Value reflects a company's net worth by recalibrating asset and liability values to better mirror current market conditions, often including intangible assets and depreciation adjustments. Net Asset Value specifically calculates the total value of a company's assets minus its liabilities, primarily used for investment funds to represent per-share value. Understanding the distinction helps investors accurately assess a firm's true economic value and make more informed valuation decisions.

Table of Comparison

| Valuation Metric | Adjusted Book Value (ABV) | Net Asset Value (NAV) |

|---|---|---|

| Definition | Net asset value adjusted for intangible assets and liabilities | Market value of total assets minus total liabilities |

| Purpose | Reflects true equity by accounting for hidden assets/liabilities | Measures liquidation value based on current market prices |

| Calculation | Book value plus adjustments for asset revaluation and liabilities | Market value of assets minus market value of liabilities |

| Use Cases | Investment analysis, fairness opinions, mergers & acquisitions | Real estate investment trusts (REITs), fund valuation |

| Advantages | More accurate equity representation | Reflects current market conditions |

| Limitations | May rely on subjective adjustments | Volatility due to market price fluctuations |

Introduction to Adjusted Book Value and Net Asset Value

Adjusted Book Value represents a refined measure of a company's net worth by recalibrating the book value of assets and liabilities to reflect current market conditions and intrinsic values. Net Asset Value (NAV) calculates the total value of an entity's assets minus its liabilities, commonly used in investment funds to determine per-share value. Both metrics serve critical roles in valuation by providing more accurate reflections of an entity's financial health than traditional book value alone.

Defining Adjusted Book Value

Adjusted Book Value represents a refined metric of a company's net worth by modifying the traditional book value to incorporate asset revaluations, depreciation adjustments, and intangible asset inclusion or exclusion. This valuation approach offers a more accurate reflection of a firm's current economic value, compared to standard Book Value, by considering market conditions and asset impairments. It serves as a critical tool for investors assessing true equity value beyond historical cost accounting.

Understanding Net Asset Value

Net Asset Value (NAV) represents the market value of a company's total assets minus its total liabilities, reflecting the current worth of equity available to shareholders. Unlike Adjusted Book Value, which revises book values based on accounting adjustments, NAV incorporates market fluctuations and asset revaluations to provide a more realistic valuation. Investors rely on NAV to assess a firm's true financial health and make informed decisions about its stock or investment fund value.

Key Differences Between Adjusted Book Value and Net Asset Value

Adjusted Book Value reflects the fair market value of a company's assets minus liabilities, incorporating asset revaluations to present a more accurate financial position. Net Asset Value (NAV) calculates the total value of a company's assets minus its liabilities, primarily used for investment funds, and is based on the current market value of assets. Key differences include Adjusted Book Value's focus on revalued tangible assets for corporate valuation versus NAV's emphasis on market value for investment portfolios.

Calculation Methods: Adjusted Book Value

Adjusted Book Value is calculated by modifying the book value of equity to reflect the current fair market value of assets and liabilities, rather than historical costs recorded on the balance sheet. This method involves revaluing tangible assets, adjusting for depreciation, and incorporating intangible assets or contingent liabilities to provide a more accurate representation of a company's intrinsic worth. The adjusted figure offers investors a refined valuation metric that accounts for market conditions and asset quality beyond traditional book value.

Calculation Methods: Net Asset Value

Net Asset Value (NAV) is calculated by subtracting total liabilities from total assets, reflecting the market value of a company's equity. This method incorporates current market valuations of assets and liabilities, offering a realistic snapshot of the company's worth. NAV is widely used in investment fund valuation due to its alignment with market-driven asset prices.

Advantages and Limitations of Adjusted Book Value

Adjusted Book Value offers a more accurate valuation by incorporating asset reappraisals and accounting for intangible assets, providing a clearer picture of a company's true worth than the traditional Book Value. This method is advantageous for firms with significant fixed assets or those undergoing restructuring, as it reflects current market conditions and asset values. However, its limitations include potential subjectivity in asset revaluation and difficulties in assessing intangible assets accurately, which can lead to valuation discrepancies.

Advantages and Limitations of Net Asset Value

Net Asset Value (NAV) offers a clear market-based assessment of a company's assets minus liabilities, reflecting real-time valuation that aligns with current market conditions. NAV advantages include ease of calculation using readily available market prices and its relevance for investment funds by providing an up-to-date snapshot of asset worth. Limitations of NAV arise from potential market volatility impacting asset prices and exclusion of intangible assets and future earnings potential, which can lead to undervaluation compared to Adjusted Book Value.

Practical Applications in Valuation Scenarios

Adjusted Book Value (ABV) refines traditional book value by incorporating asset revaluations and liabilities adjustments, providing a more accurate reflection of a company's worth in valuation scenarios. Net Asset Value (NAV) calculates the difference between total assets and liabilities, commonly used for investment funds and asset-heavy businesses to determine market value. Practical applications favor ABV when assessing private companies with non-current or intangible assets, while NAV suits portfolio valuations and real estate investments due to its clear asset-liability focus.

Choosing the Right Approach for Your Valuation Needs

Adjusted Book Value reflects an asset's fair market value by modifying book value for depreciation and market fluctuations, making it ideal for companies with significant tangible assets. Net Asset Value (NAV) calculates the total value of assets minus liabilities, commonly used in investment funds and real estate for a clearer picture of overall worth. Selecting between Adjusted Book Value and NAV depends on asset composition, valuation purpose, and industry standards to ensure accuracy and relevance in the financial analysis.

Important Terms

Fair Value Adjustments

Fair Value Adjustments refine Adjusted Book Value to more accurately reflect the market-based Net Asset Value by incorporating current asset and liability valuations.

Tangible Asset Valuation

Tangible asset valuation focuses on adjusted book value by excluding intangible assets to provide a clearer representation of net asset value for accurate financial analysis.

Hidden Liabilities Recognition

Hidden liabilities recognition critically impacts the accuracy of Adjusted Book Value, often causing it to diverge significantly from Net Asset Value by revealing unrecorded obligations that affect a company's true financial position.

Market Value Reassessment

Market Value Reassessment adjusts Asset Valuation by aligning Adjusted Book Value with Net Asset Value to reflect current market conditions accurately.

Off-Balance Sheet Items

Off-balance sheet items, such as leases and contingencies, impact the adjusted book value by reflecting economic obligations excluded from net asset value calculations.

Mark-to-Market Accounting

Mark-to-Market Accounting impacts Adjusted Book Value by reflecting current market prices of assets and liabilities, often resulting in values that differ significantly from Net Asset Value based on historical costs.

Asset Write-Downs

Asset write-downs directly reduce the adjusted book value by reflecting impaired asset values, while net asset value accounts for such impairments to provide a more accurate measure of a company's current equity worth.

Carrying Value Disparities

Carrying value disparities arise when the Adjusted Book Value, reflecting historical cost adjusted for depreciation and impairments, significantly differs from the Net Asset Value, which incorporates current market valuations of assets and liabilities.

Book Value per Share

Book Value per Share reflects a company's net asset value adjusted for liabilities and intangible assets, providing a clearer financial metric than traditional net asset value alone.

Liquidation Value Analysis

Liquidation Value Analysis compares Adjusted Book Value, which reflects asset depreciations and liabilities adjustments, to Net Asset Value, emphasizing current market valuations to estimate a company's tangible liquidation worth.

Adjusted Book Value vs Net Asset Value Infographic

moneydif.com

moneydif.com