Revenue multiples offer a straightforward valuation metric useful for comparing companies with varying cost structures, emphasizing top-line performance without accounting for profitability differences. EBITDA multiples provide a more comprehensive view by incorporating earnings before interest, taxes, depreciation, and amortization, thereby reflecting operational efficiency and cash flow potential. Selecting between revenue and EBITDA multiples depends on the industry context and the specific financial health indicators relevant to the valuation objective.

Table of Comparison

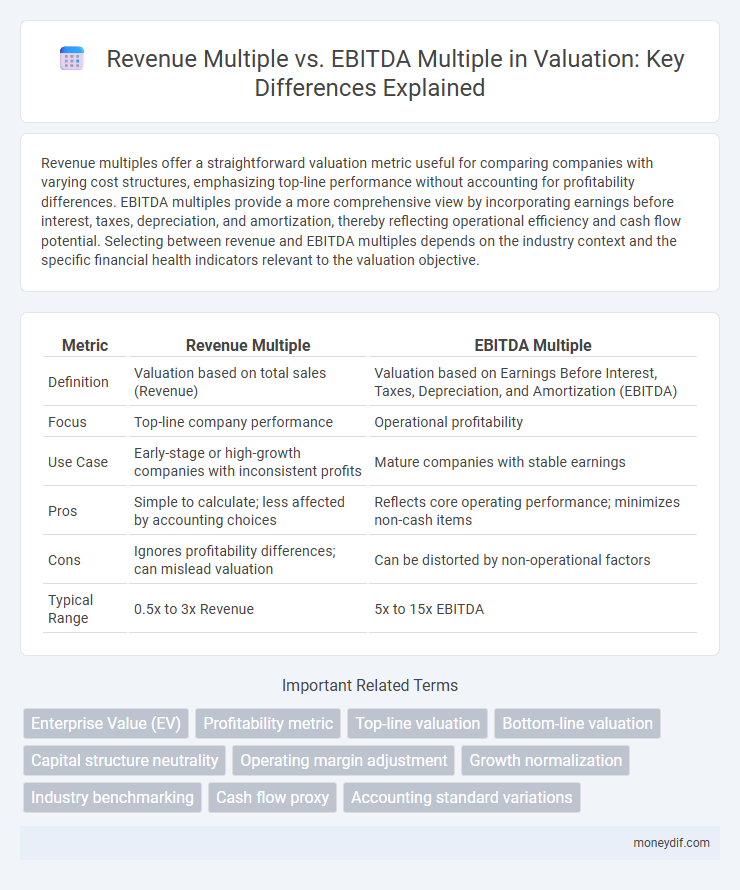

| Metric | Revenue Multiple | EBITDA Multiple |

|---|---|---|

| Definition | Valuation based on total sales (Revenue) | Valuation based on Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) |

| Focus | Top-line company performance | Operational profitability |

| Use Case | Early-stage or high-growth companies with inconsistent profits | Mature companies with stable earnings |

| Pros | Simple to calculate; less affected by accounting choices | Reflects core operating performance; minimizes non-cash items |

| Cons | Ignores profitability differences; can mislead valuation | Can be distorted by non-operational factors |

| Typical Range | 0.5x to 3x Revenue | 5x to 15x EBITDA |

Introduction to Valuation Multiples

Revenue multiples and EBITDA multiples are key valuation metrics used to assess a company's market value relative to its financial performance. Revenue multiples focus on total sales, providing a straightforward measure for comparing companies with varying profitability, while EBITDA multiples incorporate earnings before interest, taxes, depreciation, and amortization, offering a clearer picture of operational efficiency and cash flow potential. Understanding these multiples helps investors and analysts gauge valuation consistency across industries and stages of business development.

Understanding Revenue Multiples

Revenue multiples provide a straightforward valuation metric by comparing a company's enterprise value to its top-line sales, offering insights especially valuable for early-stage or high-growth companies with fluctuating profitability. Unlike EBITDA multiples, which factor in operating earnings and can be influenced by accounting adjustments, revenue multiples emphasize market perception of growth potential and scalability without relying on earnings stability. Investors often use revenue multiples when evaluating businesses in emerging industries or with negative EBITDA to benchmark value based on sales traction rather than profitability.

Exploring EBITDA Multiples

EBITDA multiples provide a clear indicator of a company's operating profitability by excluding non-operational expenses such as interest, taxes, depreciation, and amortization, making them more reliable for comparing firms across industries. Revenue multiples may overstate value in cases of companies with low profitability, while EBITDA multiples offer a more accurate reflection of cash flow generation and operational efficiency. Investors often prefer EBITDA multiples for valuation because they highlight earnings potential and operational performance without distortion from capital structure or tax environments.

Key Differences Between Revenue and EBITDA Multiples

Revenue multiple measures a company's valuation relative to its total sales, reflecting market perception without adjusting for operating costs or profitability. EBITDA multiple accounts for earnings before interest, taxes, depreciation, and amortization, providing insight into operational performance and cash flow generation. EBITDA multiples are commonly preferred for assessing profitability and operational efficiency, while revenue multiples offer a broader view useful in early-stage or high-growth companies with variable profitability.

Industry Preferences: When to Use Each Multiple

Industry preferences dictate the choice between revenue multiples and EBITDA multiples based on business models and profitability. High-growth tech companies often favor revenue multiples due to inconsistent earnings, while mature industries with stable cash flows prefer EBITDA multiples for a clearer profitability measure. Understanding sector-specific financial dynamics ensures accurate valuation and investment decisions.

Advantages of Revenue Multiples

Revenue multiples offer clear advantages in valuation, especially for early-stage companies or those with inconsistent profitability, as they provide a straightforward metric less affected by accounting variances and non-cash expenses. These multiples facilitate comparisons across industries where EBITDA may be less stable or meaningful, allowing investors to assess top-line growth potential without the distortions of cost structures. Moreover, revenue multiples enable quicker valuation assessments during rapid growth phases, supporting strategic decision-making when profits are not yet reflective of company value.

Advantages of EBITDA Multiples

EBITDA multiples provide a clearer picture of a company's operational profitability by excluding non-operational expenses such as interest, taxes, and depreciation, making comparisons across businesses more accurate. This metric allows investors to evaluate cash flow generating ability without the distortions caused by varying capital structures and tax rates. Using EBITDA multiples enhances valuation reliability, especially in asset-heavy industries where depreciation and amortization can significantly skew earnings.

Limitations and Pitfalls of Revenue vs EBITDA Multiples

Revenue multiples often inflate company value by ignoring profitability and cost structures, leading to misleading comparisons between businesses with different operational efficiencies. EBITDA multiples, while accounting for earnings before interest, taxes, depreciation, and amortization, can mask significant capital expenditures and working capital needs, skewing cash flow analysis. Both metrics may fail to capture sector-specific risks, growth potential, and non-operating income, necessitating cautious use and supplementary valuation methods for accurate investment decisions.

Practical Examples and Case Studies

Revenue multiple often applies to high-growth startups with minimal earnings, demonstrated by Uber's early valuation at over 10x revenue despite negative EBITDA. EBITDA multiple suits mature companies with stable profits, like Coca-Cola, typically valued around 15x EBITDA, reflecting cash flow reliability. Case studies reveal that tech firms prioritize revenue multiples for scalability, whereas industrials favor EBITDA multiples for consistent profitability assessment.

Choosing the Right Multiple for Your Valuation

Choosing the right multiple for valuation depends on the company's profitability and capital structure; revenue multiples are preferred for early-stage or high-growth companies with variable earnings, while EBITDA multiples suit mature businesses with stable cash flows. Revenue multiples offer simplicity and comparability across industries, but EBITDA multiples provide a clearer picture of operational efficiency by excluding non-operating expenses and depreciation. Accurate valuation requires aligning the multiple with the specific financial metrics that best reflect the company's performance and growth potential.

Important Terms

Enterprise Value (EV)

Enterprise Value (EV) to Revenue multiples assess company worth based on sales, while EV to EBITDA multiples evaluate profitability by comparing EV to earnings before interest, taxes, depreciation, and amortization.

Profitability metric

EBITDA multiple provides a clearer profitability metric than revenue multiple by factoring in operating earnings, offering a more accurate valuation of a company's financial performance.

Top-line valuation

Top-line valuation focuses on revenue multiples to assess company worth, while EBITDA multiples provide insight into operating profitability and cash flow efficiency.

Bottom-line valuation

Bottom-line valuation focuses on net income as a key metric, whereas revenue multiple valuation compares enterprise value to total sales, highlighting top-line performance. EBITDA multiple valuation evaluates company value based on earnings before interest, taxes, depreciation, and amortization, providing a clearer picture of operational profitability.

Capital structure neutrality

Capital structure neutrality ensures valuation consistency by adjusting revenue multiples and EBITDA multiples to reflect differences in debt and equity financing.

Operating margin adjustment

Operating margin adjustment is crucial when comparing revenue multiples to EBITDA multiples because it aligns profitability metrics with valuation benchmarks. Higher operating margins typically translate to a smaller gap between revenue and EBITDA multiples, reflecting improved earnings efficiency in valuation assessments.

Growth normalization

Growth normalization adjusts revenue multiples relative to EBITDA multiples to provide a more accurate valuation by accounting for differing growth rates.

Industry benchmarking

Industry benchmarking reveals that revenue multiples provide a broad valuation view by comparing company sales, while EBITDA multiples offer a focused profitability perspective essential for assessing operational efficiency. Comparing revenue multiples with EBITDA multiples enables investors to balance growth potential against earnings stability, optimizing investment decisions in sectors with varying capital structures and margin profiles.

Cash flow proxy

Cash flow proxy measures, such as EBITDA multiples, provide a more accurate valuation by reflecting operational cash generation compared to revenue multiples, which can overstate value in low-margin industries. Firms with strong EBITDA margins often command higher multiples, highlighting the importance of cash flow quality over mere top-line revenue in valuation models.

Accounting standard variations

Accounting standard variations significantly impact the comparability of Revenue multiples and EBITDA multiples by influencing the recognition of revenues and expenses, thereby affecting valuation metrics across different jurisdictions.

Revenue multiple vs EBITDA multiple Infographic

moneydif.com

moneydif.com