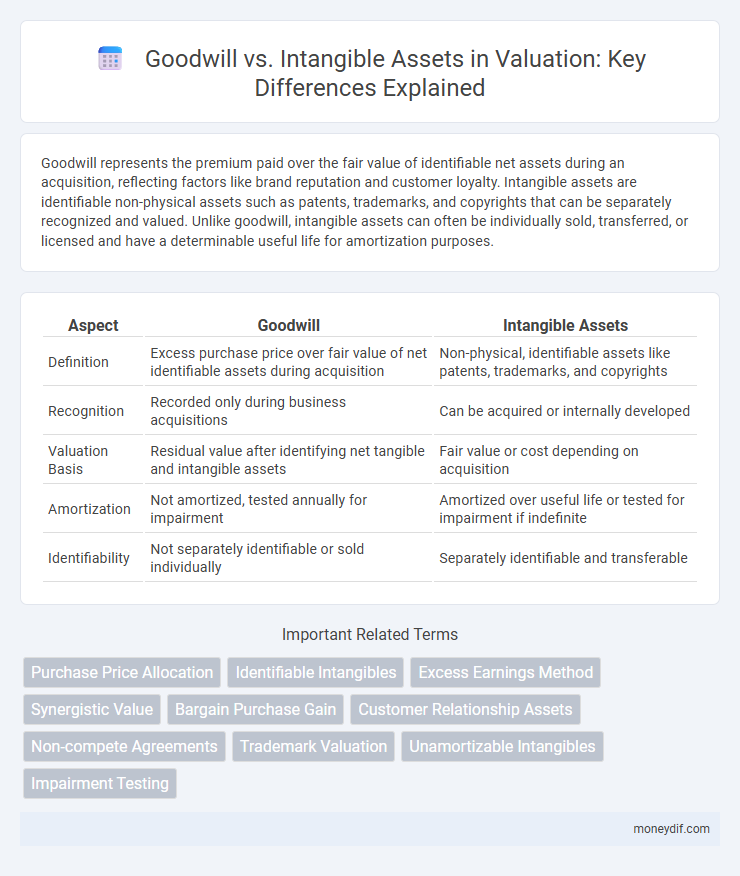

Goodwill represents the premium paid over the fair value of identifiable net assets during an acquisition, reflecting factors like brand reputation and customer loyalty. Intangible assets are identifiable non-physical assets such as patents, trademarks, and copyrights that can be separately recognized and valued. Unlike goodwill, intangible assets can often be individually sold, transferred, or licensed and have a determinable useful life for amortization purposes.

Table of Comparison

| Aspect | Goodwill | Intangible Assets |

|---|---|---|

| Definition | Excess purchase price over fair value of net identifiable assets during acquisition | Non-physical, identifiable assets like patents, trademarks, and copyrights |

| Recognition | Recorded only during business acquisitions | Can be acquired or internally developed |

| Valuation Basis | Residual value after identifying net tangible and intangible assets | Fair value or cost depending on acquisition |

| Amortization | Not amortized, tested annually for impairment | Amortized over useful life or tested for impairment if indefinite |

| Identifiability | Not separately identifiable or sold individually | Separately identifiable and transferable |

Defining Goodwill in Valuation

Goodwill in valuation represents the premium a buyer is willing to pay above the fair market value of identifiable assets and liabilities, reflecting factors such as brand reputation, customer loyalty, and employee expertise. Unlike intangible assets, which are separately identifiable and quantifiable, goodwill is an unidentifiable asset arising from business combinations and cannot be sold or transferred independently. Understanding goodwill is essential for accurately assessing a company's total value and making informed investment decisions.

What Are Intangible Assets?

Intangible assets represent non-physical resources that provide long-term value to a company, such as patents, trademarks, copyrights, and customer relationships. Unlike goodwill, which arises from acquisitions and reflects the premium paid over fair value of net identifiable assets, intangible assets are individually identifiable and can be quantified on the balance sheet. These assets contribute to competitive advantage and revenue generation without being physical or financial instruments.

Key Differences Between Goodwill and Intangible Assets

Goodwill represents the excess value paid during an acquisition above the fair market value of identifiable assets and liabilities, reflecting factors like brand reputation and customer loyalty. Intangible assets are identifiable non-physical assets such as patents, trademarks, and copyrights that can be separately recognized and valued on the balance sheet. Key differences include goodwill's inseparability from the business and its indefinite life, while intangible assets are often separable and amortized over their useful life.

How Goodwill Is Calculated

Goodwill is calculated as the excess purchase price paid during an acquisition over the fair value of the identifiable net assets acquired, including tangible assets and recognized intangible assets. This calculation reflects the premium for factors such as brand reputation, customer relationships, and anticipated synergies that are not separately identifiable. Accurate goodwill valuation requires detailed assessment of fair value adjustments to all acquired assets and liabilities at the acquisition date.

Types of Intangible Assets

Intangible assets encompass identifiable non-physical elements such as patents, trademarks, copyrights, and customer relationships, each carrying specific valuation considerations. Goodwill differs as it represents the excess purchase price over the fair value of identifiable net assets, reflecting factors like brand reputation and employee expertise rather than discrete assets. Understanding the distinction between goodwill and various types of intangible assets is critical for accurate financial reporting and valuation analysis.

Accounting Treatment of Goodwill vs Intangible Assets

Goodwill is recorded in accounting as an intangible asset representing the excess purchase price over the fair value of identifiable net assets during business acquisitions, and it is not amortized but tested annually for impairment under accounting standards such as IFRS and GAAP. In contrast, identifiable intangible assets like patents, trademarks, and copyrights are capitalized and amortized over their useful lives, reflecting systematic expense recognition. Impairment testing applies to both, but goodwill impairment can significantly affect financial statements due to its non-amortizable nature and reliance on fair value estimates.

Impact on Financial Statements

Goodwill reflects the premium paid during acquisitions beyond the fair value of identifiable tangible and intangible assets, directly affecting the balance sheet as a non-amortizable asset subject to annual impairment tests. Intangible assets, such as patents or trademarks, are capitalized separately and amortized over their useful lives, influencing both the balance sheet and income statement through systematic expense recognition. The distinction impacts financial metrics, with goodwill impairments causing sudden charges reducing net income, while intangible asset amortization leads to predictable expense flows.

Goodwill Impairment and Amortization of Intangibles

Goodwill impairment arises when the carrying value of goodwill exceeds its fair value, requiring a write-down that directly impacts a company's earnings. Unlike goodwill, intangible assets with finite lives are systematically amortized over their useful life, reflecting a consistent expense on the income statement. Proper differentiation between goodwill impairment and intangible asset amortization is critical for accurate financial reporting and valuation analysis.

Role in Mergers and Acquisitions

Goodwill represents the premium paid over the fair value of identifiable net assets during mergers and acquisitions, capturing synergies, brand reputation, and customer loyalty that are not individually recognized as intangible assets. Intangible assets, such as patents, trademarks, and proprietary technology, are separately identifiable and measurable, directly contributing to the target company's value and future revenue generation. Valuation accuracy of both goodwill and intangible assets is critical for fair deal pricing, financial reporting, and post-merger integration success.

Importance in Business Valuation

Goodwill represents the premium value of a business beyond its identifiable tangible and intangible assets, reflecting brand reputation, customer loyalty, and employee relations. Intangible assets, such as patents, trademarks, and copyrights, have specific identifiable value and legal protection, making them easier to quantify in valuation models. Accurate differentiation between goodwill and intangible assets is crucial for business valuation, as it impacts the accuracy of asset allocation, impairment testing, and overall valuation credibility.

Important Terms

Purchase Price Allocation

Purchase Price Allocation (PPA) involves distributing the acquisition cost between identifiable intangible assets and goodwill, where intangible assets are separately recognized for measurable items like patents and trademarks. Goodwill represents the residual value arising from synergies and future economic benefits that cannot be individually identified or separately recognized during the acquisition.

Identifiable Intangibles

Identifiable intangibles are distinct non-physical assets such as patents or trademarks that can be separately recognized and valued, whereas goodwill represents the residual value of a business exceeding identifiable intangibles and net assets.

Excess Earnings Method

The Excess Earnings Method calculates goodwill by isolating earnings attributable to intangible assets beyond the fair value of identifiable assets, emphasizing the value of unidentifiable intangibles. This method distinguishes goodwill from specific intangible assets by attributing residual income to goodwill after valuing tangible and separately recognized intangible assets.

Synergistic Value

Synergistic value enhances Goodwill by representing the premium paid for anticipated benefits from combining business assets beyond identifiable Intangible Assets.

Bargain Purchase Gain

Bargain Purchase Gain arises when the fair value of identifiable net assets acquired exceeds the purchase price in a business combination, contrasting with Goodwill, which represents the excess of purchase price over the fair value of net assets. Unlike Intangible Assets that have identifiable and measurable value, Bargain Purchase Gain reflects a favorable acquisition differential recognized immediately in earnings.

Customer Relationship Assets

Customer Relationship Assets represent the value derived from long-term interactions with clients and are often classified as intangible assets on the balance sheet, distinct from goodwill. Goodwill arises from business acquisitions and reflects premium paid over identifiable net assets, while customer relationship assets specifically quantify the ongoing revenue potential attributed to established client connections.

Non-compete Agreements

Non-compete agreements are often valued as intangible assets that protect a company's goodwill by restricting competitors from using proprietary knowledge or client relationships.

Trademark Valuation

Trademark valuation quantifies the economic value of a trademark as a key intangible asset, distinguishing it from general goodwill by focusing on brand-specific benefits that directly impact market competitiveness and revenue generation.

Unamortizable Intangibles

Unamortizable intangibles, including goodwill, differ from amortizable intangible assets as they are subject to annual impairment testing rather than systematic amortization under accounting standards.

Impairment Testing

Impairment testing for goodwill involves assessing the carrying amount of the reporting unit's goodwill against its fair value, while intangible assets are tested individually or as a group for recoverability by comparing their carrying amount to the sum of expected future cash flows or fair value. Goodwill impairment requires a two-step or one-step approach depending on the accounting standard, whereas intangible assets without definite lives undergo periodic impairment tests based on trigger events or annually.

Goodwill vs Intangible Assets Infographic

moneydif.com

moneydif.com