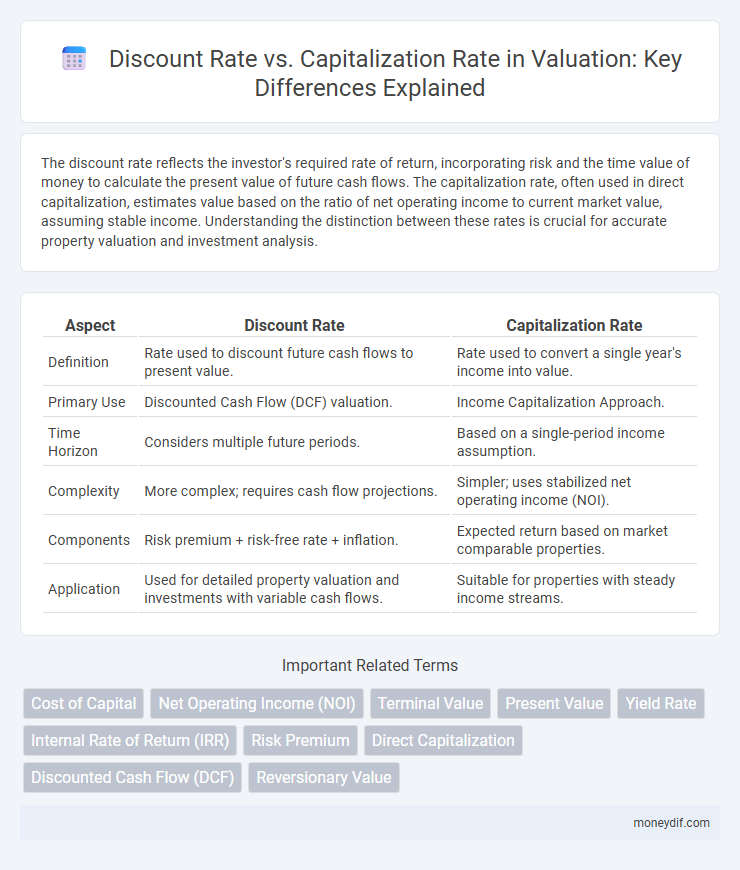

The discount rate reflects the investor's required rate of return, incorporating risk and the time value of money to calculate the present value of future cash flows. The capitalization rate, often used in direct capitalization, estimates value based on the ratio of net operating income to current market value, assuming stable income. Understanding the distinction between these rates is crucial for accurate property valuation and investment analysis.

Table of Comparison

| Aspect | Discount Rate | Capitalization Rate |

|---|---|---|

| Definition | Rate used to discount future cash flows to present value. | Rate used to convert a single year's income into value. |

| Primary Use | Discounted Cash Flow (DCF) valuation. | Income Capitalization Approach. |

| Time Horizon | Considers multiple future periods. | Based on a single-period income assumption. |

| Complexity | More complex; requires cash flow projections. | Simpler; uses stabilized net operating income (NOI). |

| Components | Risk premium + risk-free rate + inflation. | Expected return based on market comparable properties. |

| Application | Used for detailed property valuation and investments with variable cash flows. | Suitable for properties with steady income streams. |

Understanding Discount Rate and Capitalization Rate

The discount rate represents the investor's required rate of return, factoring in the time value of money and risk over a holding period, and is used to calculate the present value of future cash flows. The capitalization rate, or cap rate, is a snapshot valuation metric derived by dividing net operating income by the current market value or purchase price, reflecting the expected rate of return on an income-producing property. Understanding the distinction between these rates is critical for accurate property valuation, as the discount rate accounts for growth and risk dynamics over time, whereas the capitalization rate assumes a stable income stream with no growth.

Key Differences Between Discount Rate and Capitalization Rate

The discount rate reflects the required rate of return for an investment, considering the time value of money and risk over multiple periods, while the capitalization rate is a ratio used to convert expected annual income into an estimate of property value for a single period. Discount rate incorporates future cash flow projections and risk adjustments, whereas capitalization rate assumes steady income without explicitly accounting for growth or time. Investors use the discount rate for detailed valuation models like discounted cash flow, whereas the capitalization rate is commonly applied in direct capitalization methods for real estate valuation.

Role of Discount Rate in Valuation

The discount rate plays a critical role in valuation by reflecting the required rate of return that accounts for the time value of money and investment risk. It is used to calculate the present value of future cash flows, making it essential for discounted cash flow (DCF) analysis in asset and business valuation. Unlike the capitalization rate, which applies a single-period income method, the discount rate accommodates varying cash flows over multiple periods and adjusts for risk premiums.

Importance of Capitalization Rate in Real Estate

Capitalization rate (cap rate) is a critical metric in real estate valuation, reflecting the expected rate of return on an investment property based on its net operating income and current market value. Unlike the discount rate, which incorporates risk and time value of money over multiple periods, the cap rate provides a straightforward snapshot of property yield, essential for comparing market opportunities and assessing investment performance. Accurate cap rate analysis enhances decision-making in property acquisition, portfolio management, and market trend evaluation within the real estate sector.

How to Calculate Discount Rate

The discount rate is calculated by estimating the required rate of return based on risk factors, inflation expectations, and the opportunity cost of capital, often derived using the Capital Asset Pricing Model (CAPM) or weighted average cost of capital (WACC). This rate incorporates both the risk-free rate and a risk premium reflecting the specific investment's uncertainty. Precise calculation ensures accurate valuation by adjusting future cash flows to their present value considering time value and risk.

Methods for Determining Capitalization Rate

Methods for determining the capitalization rate include the band of investment approach, which combines the weighted costs of debt and equity capital, and the market extraction method, deriving rates from comparable property sales data. Another key approach is the build-up method, adding risk premiums to the risk-free rate to reflect property-specific and market risks. Accurately selecting the capitalization rate ensures precise property valuation by translating net operating income into market value.

Practical Applications: When to Use Each Rate

The discount rate is primarily used in discounted cash flow (DCF) analysis to account for the time value of money and risk over multiple periods, making it ideal for valuing investments with variable cash flows. The capitalization rate is commonly applied in direct capitalization methods, ideal for properties generating stable, predictable income by dividing the net operating income by the current market value. Investors typically use the discount rate for long-term, complex projects, while the capitalization rate suits quick valuations of income-producing real estate.

Impact of Market Conditions on Rates

Market conditions heavily influence both discount and capitalization rates, with rising interest rates and increased risk perception driving them higher. Discount rates often reflect broader macroeconomic factors and future cash flow uncertainty, while capitalization rates are more sensitive to current property market stability and income trends. Fluctuating market dynamics cause these rates to adjust, directly affecting property valuation and investment returns.

Common Mistakes in Applying Discount and Capitalization Rates

Common mistakes in applying discount and capitalization rates often include confusing the two, leading to inaccurate property valuations. Discount rates account for time value and risk over multiple periods, while capitalization rates reflect a single-period return, causing errors when interchangeably used. Overlooking the impact of market conditions and risk adjustments further distorts valuation outcomes, emphasizing the need for precise rate application.

Choosing the Right Rate for Accurate Valuation

Selecting the appropriate discount rate or capitalization rate is crucial for accurate property valuation, as the discount rate reflects the investor's required return considering time value and risk, while the capitalization rate represents the expected steady-state return on investment. Discount rates are preferred for valuing cash flows over multiple periods with variable growth, whereas capitalization rates are suited for properties with stable, predictable income streams. Understanding the risk profile, cash flow consistency, and market conditions helps investors and appraisers determine the most accurate rate to apply for a reliable valuation.

Important Terms

Cost of Capital

The cost of capital serves as the discount rate in present value calculations, reflecting the required return on investment to compensate for risk and opportunity cost. While the capitalization rate estimates property value by dividing net operating income by current market value, both rates fundamentally influence investment valuation but differ in application--discount rates assess cash flow timing, whereas capitalization rates provide a snapshot valuation based on income.

Net Operating Income (NOI)

Net Operating Income (NOI) is a critical metric in real estate valuation used to determine the value of income-producing properties by dividing NOI by the capitalization rate (Cap Rate). While the Cap Rate reflects expected returns based on market conditions, the discount rate incorporates additional factors such as risk and time value of money to discount future NOI streams to present value.

Terminal Value

Terminal value calculation relies on discount rate for present value assessment, while capitalization rate directly estimates terminal value by dividing expected cash flow by the rate.

Present Value

The present value decreases as the discount rate increases, while the capitalization rate directly reflects the expected return used to convert income into value.

Yield Rate

Yield rate measures investment return by incorporating the discount rate's present value adjustment and differs from the capitalization rate, which estimates property value based on net operating income without discounting future cash flows.

Internal Rate of Return (IRR)

Internal Rate of Return (IRR) represents the discount rate that equates the net present value of cash flows to zero, differentiating it from the capitalization rate, which assesses the property's income potential without accounting for the time value of money.

Risk Premium

Risk premium reflects the excess return investors demand for taking on higher uncertainty, directly impacting the discount rate used in valuation models. While the discount rate incorporates the risk premium to calculate the present value of future cash flows, the capitalization rate often simplifies this by embedding expected return and risk factors into a single rate for steady-state income valuation.

Direct Capitalization

Direct Capitalization values an income-producing property by dividing a single year's net operating income (NOI) by the Capitalization Rate (Cap Rate), which reflects the expected rate of return. The Discount Rate incorporates time value of money and risk over multiple periods, making it essential for Discounted Cash Flow (DCF) analysis compared to the simpler Cap Rate used in Direct Capitalization.

Discounted Cash Flow (DCF)

The Discounted Cash Flow (DCF) method uses the discount rate to account for risk and time value of money, while the capitalization rate directly reflects the property's expected rate of return based on income.

Reversionary Value

The reversionary value is calculated by capitalizing the net operating income using the capitalization rate or discounting the future sale proceeds using the discount rate to estimate the property's terminal value.

Discount Rate vs Capitalization Rate Infographic

moneydif.com

moneydif.com