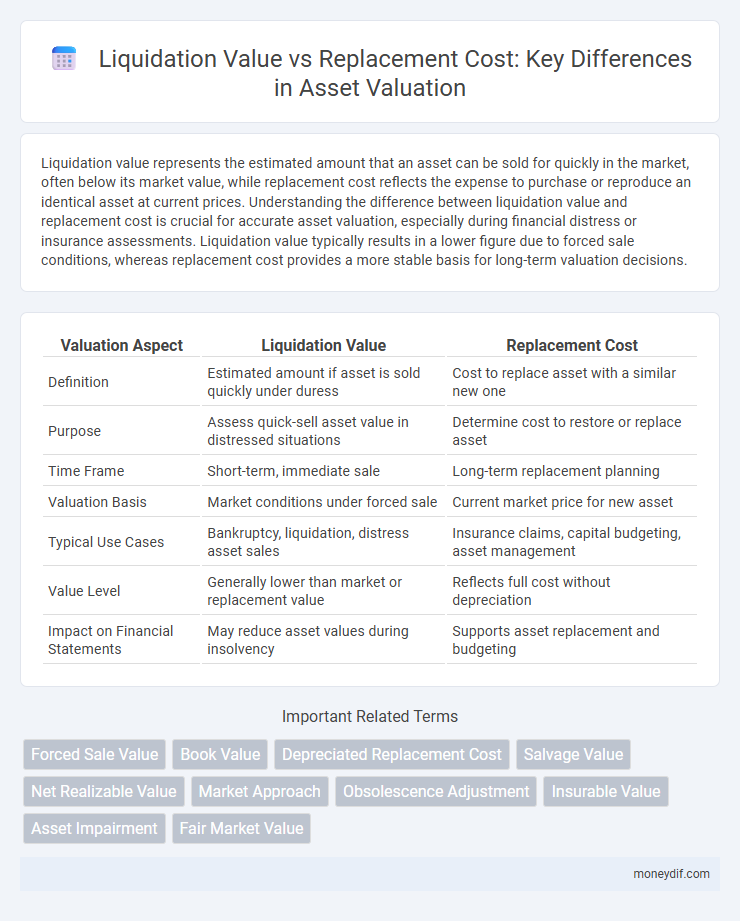

Liquidation value represents the estimated amount that an asset can be sold for quickly in the market, often below its market value, while replacement cost reflects the expense to purchase or reproduce an identical asset at current prices. Understanding the difference between liquidation value and replacement cost is crucial for accurate asset valuation, especially during financial distress or insurance assessments. Liquidation value typically results in a lower figure due to forced sale conditions, whereas replacement cost provides a more stable basis for long-term valuation decisions.

Table of Comparison

| Valuation Aspect | Liquidation Value | Replacement Cost |

|---|---|---|

| Definition | Estimated amount if asset is sold quickly under duress | Cost to replace asset with a similar new one |

| Purpose | Assess quick-sell asset value in distressed situations | Determine cost to restore or replace asset |

| Time Frame | Short-term, immediate sale | Long-term replacement planning |

| Valuation Basis | Market conditions under forced sale | Current market price for new asset |

| Typical Use Cases | Bankruptcy, liquidation, distress asset sales | Insurance claims, capital budgeting, asset management |

| Value Level | Generally lower than market or replacement value | Reflects full cost without depreciation |

| Impact on Financial Statements | May reduce asset values during insolvency | Supports asset replacement and budgeting |

Understanding Liquidation Value

Liquidation value reflects the estimated amount a property or asset would fetch if sold quickly under forced sale conditions, often below market value. It is crucial for lenders and investors assessing worst-case scenarios, as this value accounts for the urgency and market distress of the sale. Unlike replacement cost, which focuses on the expense to recreate the asset, liquidation value prioritizes immediate cash realization, influencing risk management and financial planning.

Defining Replacement Cost

Replacement cost refers to the expense required to acquire a new asset with similar utility and function, reflecting current market prices for materials, labor, and overhead. It emphasizes restoration to the asset's original condition without deducting depreciation, differing from liquidation value, which estimates the net proceeds from a quick sale. This metric guides insurance appraisals and capital budgeting by providing an accurate benchmark for asset recovery costs.

Key Differences Between Liquidation Value and Replacement Cost

Liquidation value represents the estimated amount a property or asset can be sold for quickly under distressed conditions, often below market price, while replacement cost reflects the expense to rebuild or replace the asset at current prices. Key differences include liquidation value emphasizing rapid sale under duress, resulting in lower valuations, whereas replacement cost is based on current construction or acquisition costs without market pressure considerations. Understanding these distinctions is crucial for accurate financial reporting, insurance assessments, and investment decisions.

Factors Affecting Liquidation Value

Liquidation value is influenced by factors such as market demand, asset condition, and time constraints, which typically drive a lower price compared to replacement cost. The urgency to sell during liquidation often reduces negotiation leverage, resulting in discounted asset values. Replacement cost reflects the expense to acquire similar assets at current market prices, unaffected by forced-sale conditions.

Components of Replacement Cost

Replacement cost includes direct costs such as labor, materials, and equipment needed to construct a similar asset at current market prices. Indirect costs cover fees, permits, and contractor overheads that support project completion. Contingencies and developer's profit are factored to account for unforeseen expenses and investment return expectations, making replacement cost typically higher than liquidation value.

When to Use Liquidation Value in Valuation

Liquidation value is utilized in valuation scenarios where an asset or business must be sold quickly, often under distress or financial duress, reflecting the price achievable in a forced sale. This valuation method is critical for bankruptcy proceedings, insolvency assessments, and scenarios requiring rapid asset disposition. It contrasts with replacement cost, which estimates the expense to replace an asset with a new one, making liquidation value more relevant for short-term, urgent sale decisions.

Situations Favoring Replacement Cost Assessment

Replacement cost assessment is favored in situations where the property is intended for continued use or functional utility, such as for insurance purposes or asset management. It is particularly relevant when market conditions are unstable or when liquidation value does not reflect the true economic worth due to forced sale constraints. This approach provides a more accurate measure of the resources required to replace or reproduce the asset under current market conditions, ensuring appropriate capital allocation and risk management.

Impact on Financial Reporting and Decision Making

Liquidation value reflects the estimated amount recoverable if an asset is sold quickly, often resulting in lower financial statement values that can signal potential distress to investors. Replacement cost represents the current expense to acquire an equivalent asset, supporting more accurate depreciation calculations and capital budgeting decisions. Choosing between these valuation methods significantly influences financial reporting accuracy and strategic decision-making processes, affecting asset management and investor confidence.

Industry Examples: Application of Both Methods

Liquidation value is commonly applied in distressed industries such as retail and manufacturing, where rapid asset disposal is necessary, providing a conservative estimate based on current market conditions. Replacement cost proves relevant in sectors like insurance and construction, where the focus lies in the cost to rebuild or replace assets without considering depreciation. Industries such as real estate often balance both methods, using liquidation value for risk assessment and replacement cost for long-term asset valuation.

Choosing the Right Valuation Approach

Choosing the right valuation approach depends on the purpose of the appraisal and the nature of the asset. Liquidation value is suited for distressed sales where assets must be sold quickly at below-market prices, while replacement cost estimates the expense to reproduce or replace an asset with a similar one at current prices, reflecting its utility. Understanding the asset's condition, market conditions, and intended use guides whether liquidation value or replacement cost provides a more accurate and practical valuation.

Important Terms

Forced Sale Value

Forced Sale Value typically falls below both Liquidation Value and Replacement Cost, reflecting a hurried sale scenario with reduced market exposure and diminished asset recovery potential.

Book Value

Book value represents a company's net asset value on the balance sheet and often differs from liquidation value, which estimates the proceeds from selling assets under distress, and replacement cost, which reflects the expense to acquire equivalent assets at current prices.

Depreciated Replacement Cost

Depreciated Replacement Cost calculates asset value by subtracting accumulated depreciation from Replacement Cost, offering a more realistic estimate than Liquidation Value, which reflects the immediate sale price in a distressed scenario.

Salvage Value

Salvage value represents the estimated residual worth of an asset at the end of its useful life, often compared to liquidation value, which reflects immediate sale value, and replacement cost, indicating the expense to acquire a similar new asset.

Net Realizable Value

Net Realizable Value represents the estimated selling price of an asset in the ordinary course of business minus costs of completion and disposal, typically falling between the lower Liquidation Value, which reflects quick sale under distressed conditions, and the higher Replacement Cost, which indicates the expense to acquire a similar new asset.

Market Approach

The Market Approach assesses liquidation value by analyzing recent sales of comparable assets, reflecting the price in an active market under forced sale conditions. Replacement cost estimates the expense to reproduce or replace an asset with a similar one, providing a baseline that often exceeds liquidation value due to immediate sale discounts.

Obsolescence Adjustment

Obsolescence adjustment reduces replacement cost to reflect asset depreciation, aligning liquidation value more accurately with current market conditions.

Insurable Value

Insurable value prioritizes replacement cost over liquidation value to ensure adequate coverage for rebuilding or repairing assets after loss.

Asset Impairment

Asset impairment occurs when the liquidation value of an asset falls significantly below its replacement cost, indicating that the asset's carrying amount may not be recoverable.

Fair Market Value

Fair Market Value represents the estimated price a buyer would pay under normal conditions, positioned between Liquidation Value, which reflects a forced sale price, and Replacement Cost, which calculates the expense to substitute an asset with a new equivalent.

Liquidation Value vs Replacement Cost Infographic

moneydif.com

moneydif.com