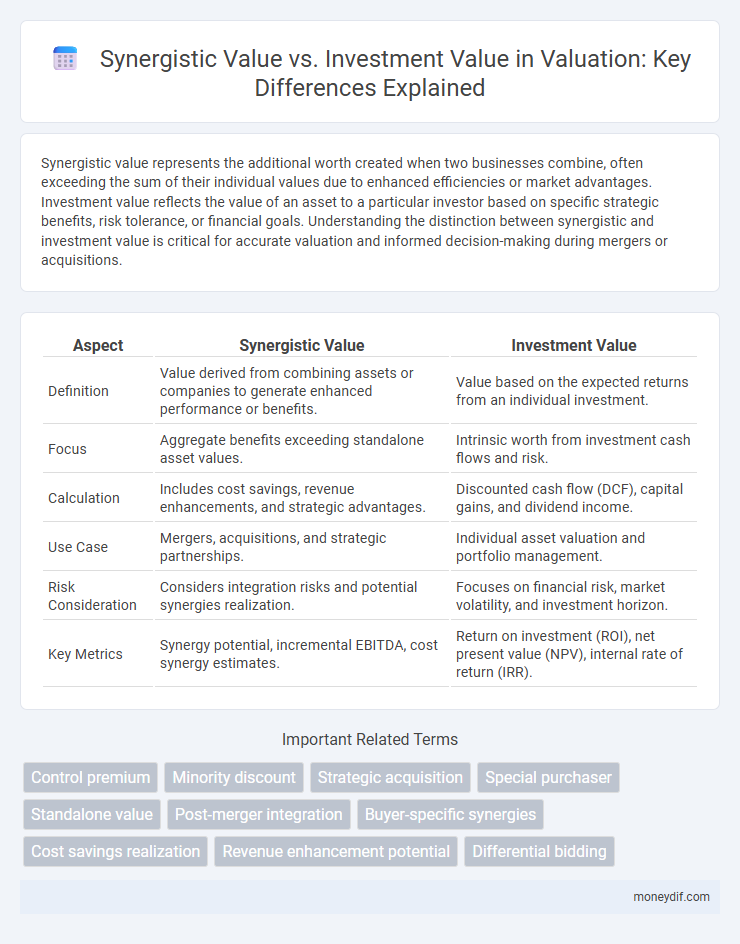

Synergistic value represents the additional worth created when two businesses combine, often exceeding the sum of their individual values due to enhanced efficiencies or market advantages. Investment value reflects the value of an asset to a particular investor based on specific strategic benefits, risk tolerance, or financial goals. Understanding the distinction between synergistic and investment value is critical for accurate valuation and informed decision-making during mergers or acquisitions.

Table of Comparison

| Aspect | Synergistic Value | Investment Value |

|---|---|---|

| Definition | Value derived from combining assets or companies to generate enhanced performance or benefits. | Value based on the expected returns from an individual investment. |

| Focus | Aggregate benefits exceeding standalone asset values. | Intrinsic worth from investment cash flows and risk. |

| Calculation | Includes cost savings, revenue enhancements, and strategic advantages. | Discounted cash flow (DCF), capital gains, and dividend income. |

| Use Case | Mergers, acquisitions, and strategic partnerships. | Individual asset valuation and portfolio management. |

| Risk Consideration | Considers integration risks and potential synergies realization. | Focuses on financial risk, market volatility, and investment horizon. |

| Key Metrics | Synergy potential, incremental EBITDA, cost synergy estimates. | Return on investment (ROI), net present value (NPV), internal rate of return (IRR). |

Introduction to Synergistic Value and Investment Value

Synergistic value arises when two companies combine resources or operations, creating additional worth beyond the sum of their individual values due to enhanced efficiencies or market power. Investment value represents the specific worth of an asset to a particular investor based on their unique investment requirements, risk tolerance, and strategic objectives. Understanding the distinction between synergistic value and investment value aids in accurate business valuation and informed decision-making.

Defining Synergistic Value in Business Valuation

Synergistic value in business valuation refers to the additional worth generated when two entities combine resources, operations, or capabilities, resulting in enhanced financial performance beyond their standalone values. This value often exceeds the individual investment values by capturing cost savings, increased market power, and operational efficiencies derived from the merger or acquisition. Recognizing synergistic value is critical for accurately assessing potential gains and guiding strategic investment decisions.

Understanding Investment Value in M&A Contexts

Investment value in M&A contexts refers to the specific worth of a target company to a particular buyer, reflecting strategic benefits, cost savings, and revenue enhancements unique to the acquiring firm. This value often exceeds market value due to synergies such as operational efficiencies, expanded market reach, or proprietary technology integration. Understanding investment value enables buyers to justify premiums and make informed decisions aligned with their strategic objectives.

Key Differences Between Synergistic and Investment Values

Synergistic value reflects the enhanced worth created when two companies merge, capturing potential cost savings, revenue growth, and strategic advantages that exceed their standalone valuations. Investment value represents the maximum price a specific buyer is willing to pay based on individual investment objectives and benefits, often influenced by unique synergies or operational decisions. Key differences include that synergistic value is theory-based on combined benefits, while investment value is buyer-specific and influenced by subjective factors and strategic intent.

Factors Influencing Synergistic Value Assessments

Synergistic value assessments are influenced by factors such as the degree of operational integration potential, complementary asset utilization, and expected cost savings from economies of scale. The strategic fit between merging entities, including market expansion opportunities and technological compatibility, significantly impacts the perceived synergy benefits. Accurate evaluation also requires considering management expertise and the stability of projected cash flows derived from combined operations.

Drivers of Investment Value in Acquisition Decisions

Drivers of investment value in acquisition decisions include anticipated cash flow enhancements, strategic alignment with existing operations, and market expansion opportunities. Synergistic value arises when combined entities generate greater performance than individual firms due to cost savings, revenue growth, or competitive advantages. Understanding the distinction helps investors focus on specific factors like integration potential, risk mitigation, and long-term financial returns to maximize acquisition outcomes.

Methods for Calculating Synergistic Value

Synergistic value is calculated by estimating the combined worth of merged entities, often using the income approach to project incremental cash flows generated from synergies. Discounted cash flow (DCF) analysis adjusts these cash flows by accounting for risks and time value of money, isolating the economic benefits exceeding standalone values. Market comparables and precedent transactions further refine synergistic value by benchmarking synergy expectations against similar mergers and acquisitions.

Practical Applications of Investment Value

Investment value reflects the specific worth of an asset to a particular investor based on unique synergies, operational benefits, or strategic goals, beyond its market value. Practical applications of investment value include merger and acquisition scenarios where buyer-specific advantages such as tax benefits, cost savings, or enhanced market access justify a premium paid over market price. Assessing investment value guides decision-making by quantifying how tailored advantages impact financial outcomes, enabling investors to optimize portfolio strategy and resource allocation.

Real-World Case Studies: Synergistic vs Investment Value

Real-world case studies highlight that synergistic value often exceeds investment value by capturing the combined benefits of merging assets, such as increased market share or cost efficiencies. For example, the acquisition of LinkedIn by Microsoft showcased synergistic value through integration synergies that boosted revenue growth beyond LinkedIn's standalone investment value. Conversely, investment value reflects the buyer-specific worth based on individual strategic objectives, as seen in private equity acquisitions where value is tied to operational improvements rather than market synergies.

Strategic Implications for Buyers and Sellers

Synergistic value reflects the enhanced worth generated when assets combine, often driving buyers to offer premiums based on anticipated operational efficiencies or market expansion. Investment value considers the individual motivations and financial goals of buyers, influencing negotiation dynamics and price expectations. Sellers must understand these distinctions to effectively position assets and leverage perceived strategic benefits in deal structuring.

Important Terms

Control premium

Control premium reflects the additional price paid over the investment value due to synergistic value expected from gaining control in a transaction.

Minority discount

Minority discounts reflect the reduced investment value of non-controlling equity stakes due to limited control and lack of synergistic value compared to controlling interests.

Strategic acquisition

Strategic acquisition maximizes synergistic value by leveraging core competencies to enhance overall business performance, whereas investment value focuses on the financial returns specific to the acquiring firm's objectives.

Special purchaser

A special purchaser often values a target company higher than its investment value due to synergistic value derived from unique strategic benefits and operational integration.

Standalone value

Standalone value measures an asset's individual worth, while synergistic value reflects the enhanced combined value realized through integration, and investment value represents the asset's value to a specific investor based on expected returns.

Post-merger integration

Post-merger integration focuses on maximizing synergistic value, which arises from combining operations to reduce costs and increase revenue beyond the sum of individual companies, often surpassing initial investment value projections. Effective integration strategies align cultural, technological, and operational aspects to unlock these synergies, ensuring that the realized benefits justify or exceed the acquisition investment.

Buyer-specific synergies

Buyer-specific synergies arise when the acquiring company leverages its unique resources, capabilities, or market position to create value beyond the standalone investment value of the target. These synergies enhance synergistic value by generating cost savings, revenue enhancements, or strategic advantages that are not realizable by other potential buyers.

Cost savings realization

Cost savings realization maximizes synergistic value by exceeding the initial investment value through enhanced operational efficiencies and integrated resource optimization.

Revenue enhancement potential

Revenue enhancement potential measures the incremental income generated by leveraging synergistic value, which arises from the combined strengths and efficiencies realized post-investment. This potential often exceeds the standalone investment value by capturing cost savings, market expansion, and cross-selling opportunities within integrated business units.

Differential bidding

Differential bidding strategically allocates investment value to maximize synergistic value by prioritizing bids that leverage complementary assets and enhance overall portfolio returns.

Synergistic value vs investment value Infographic

moneydif.com

moneydif.com