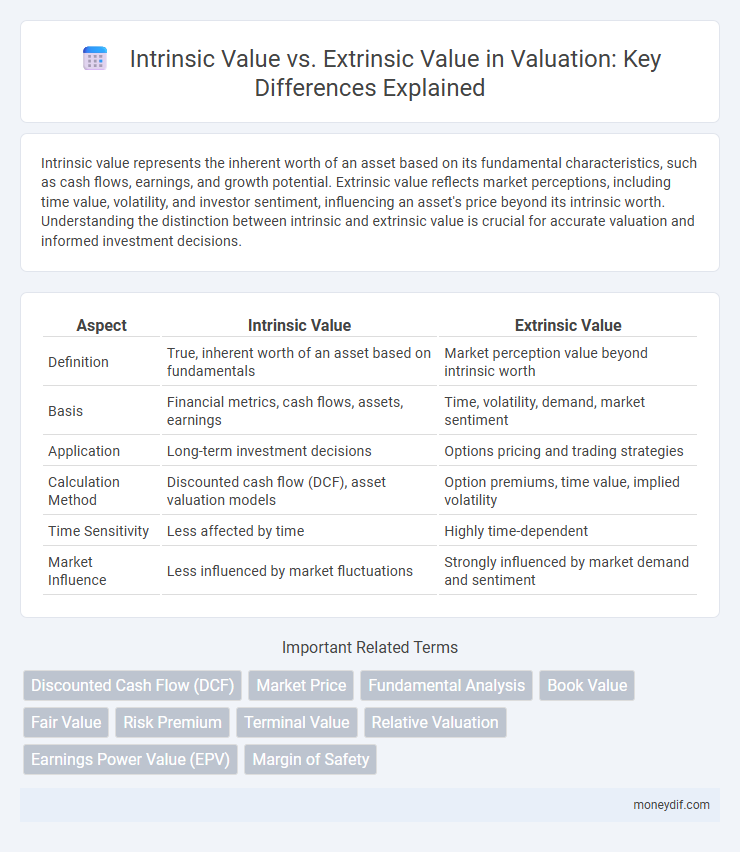

Intrinsic value represents the inherent worth of an asset based on its fundamental characteristics, such as cash flows, earnings, and growth potential. Extrinsic value reflects market perceptions, including time value, volatility, and investor sentiment, influencing an asset's price beyond its intrinsic worth. Understanding the distinction between intrinsic and extrinsic value is crucial for accurate valuation and informed investment decisions.

Table of Comparison

| Aspect | Intrinsic Value | Extrinsic Value |

|---|---|---|

| Definition | True, inherent worth of an asset based on fundamentals | Market perception value beyond intrinsic worth |

| Basis | Financial metrics, cash flows, assets, earnings | Time, volatility, demand, market sentiment |

| Application | Long-term investment decisions | Options pricing and trading strategies |

| Calculation Method | Discounted cash flow (DCF), asset valuation models | Option premiums, time value, implied volatility |

| Time Sensitivity | Less affected by time | Highly time-dependent |

| Market Influence | Less influenced by market fluctuations | Strongly influenced by market demand and sentiment |

Understanding Intrinsic Value in Valuation

Intrinsic value in valuation represents the inherent worth of an asset based on fundamental analysis, including financial performance, cash flow projections, and growth potential. It contrasts with extrinsic value, which factors in market sentiment, supply and demand, and external influences that may cause price fluctuations. Accurate intrinsic value assessment helps investors identify undervalued securities by focusing on tangible and measurable economic indicators rather than market noise.

What Is Extrinsic Value?

Extrinsic value represents the additional premium an option holds beyond its intrinsic value, driven by factors such as time until expiration, volatility, and market demand. It reflects the potential for the option to gain value before expiry, making it crucial for traders to assess risk and timing in options trading. Understanding extrinsic value helps investors gauge speculative opportunities and optimize option pricing strategies.

Key Differences Between Intrinsic and Extrinsic Value

Intrinsic value represents the inherent worth of an asset based on fundamentals such as cash flows, earnings, and growth potential, independent of market price. Extrinsic value, often associated with options pricing, reflects the premium attributed to factors like time until expiration, volatility, and market demand beyond intrinsic value. The key difference lies in intrinsic value assessing true fundamental worth, while extrinsic value captures market-driven influences and speculative elements.

Methods for Calculating Intrinsic Value

Intrinsic value in valuation is calculated using fundamental analysis methods such as discounted cash flow (DCF) models, which estimate an asset's present value based on projected future cash flows discounted at an appropriate rate. Another common method is the dividend discount model (DDM), focusing on the expected dividends and growth rates to determine the stock's intrinsic value. These approaches contrast with extrinsic value, which relies on market-based metrics and the option's time value rather than the underlying asset's fundamental characteristics.

Factors Influencing Extrinsic Value

Extrinsic value in options trading is influenced by factors such as time until expiration, market volatility, and the underlying asset's price movements. Longer time to expiration typically increases extrinsic value, while higher volatility raises the premium due to greater uncertainty. External market conditions and investor sentiment also impact the perceived extrinsic premium.

Intrinsic vs Extrinsic Value in Stock Market Analysis

Intrinsic value in stock market analysis represents the true, inherent worth of a stock based on fundamental factors such as earnings, dividends, and growth potential, independent of market price fluctuations. Extrinsic value reflects the market-driven premium or discount on a stock's price caused by external factors including investor sentiment, market volatility, and speculative demand. Understanding the distinction between intrinsic and extrinsic value aids investors in identifying underpriced or overpriced stocks by comparing fundamental worth with current market conditions.

Practical Examples: Intrinsic and Extrinsic Value Compared

Intrinsic value reflects the inherent worth of an asset based on fundamental analysis, such as a stock's discounted future cash flows or a bond's present value of payments. Extrinsic value represents the additional premium paid for potential benefits, like an option's time value exceeding its intrinsic worth due to volatility and time until expiration. For instance, a call option trading at $5 with an intrinsic value of $2 has $3 in extrinsic value driven by market expectations and time factors.

Importance of Distinguishing Between Value Types

Understanding the distinction between intrinsic value and extrinsic value is crucial for accurate asset valuation and informed investment decisions. Intrinsic value reflects the fundamental worth based on underlying financials or utility, while extrinsic value captures market perceptions, time decay, and volatility premiums. Investors leverage this differentiation to assess risk accurately, avoid overpaying for speculative premiums, and optimize portfolio performance.

Common Misconceptions About Intrinsic and Extrinsic Value

Intrinsic value represents the inherent worth of an asset based on fundamental analysis, often reflecting discounted future cash flows or tangible assets, whereas extrinsic value pertains to external factors such as market sentiment, time until expiration, and volatility. A common misconception is that intrinsic value alone determines an option's price, ignoring the significant impact of extrinsic factors like time decay and implied volatility on option premiums. Many investors also confuse intrinsic value with market value, failing to recognize that intrinsic value is a theoretical measure and may differ substantially from the current trading price due to extrinsic influences.

Choosing the Right Valuation Approach for Investors

Intrinsic value represents an asset's fundamental worth based on tangible factors such as cash flow, earnings, and growth potential, making it essential for long-term investors prioritizing underlying financial health. Extrinsic value incorporates market sentiment, volatility, and time decay, often used in options pricing and short-term trading strategies to capture potential price movements beyond intrinsic factors. Investors must align their valuation approach with their investment horizon and risk tolerance to accurately assess asset value and optimize portfolio decisions.

Important Terms

Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) analysis determines an asset's intrinsic value by calculating the present value of expected future cash flows, contrasting with extrinsic value, which reflects market perceptions and external factors such as volatility and time until expiration.

Market Price

Market price fluctuates based on the interplay between intrinsic value, representing an asset's true worth derived from fundamentals, and extrinsic value, reflecting time, volatility, and market sentiment factors in options pricing. Understanding the divergence between intrinsic and extrinsic values helps investors assess whether the market price presents overvaluation or undervaluation opportunities.

Fundamental Analysis

Fundamental analysis evaluates a stock's intrinsic value by examining financial statements and economic indicators, distinguishing it from extrinsic value which reflects market sentiment and external factors.

Book Value

Book value represents a company's net asset value recorded on the balance sheet, serving as a foundational metric for assessing intrinsic value, which reflects the true worth based on tangible and intangible assets. In contrast, extrinsic value pertains to market-driven factors such as time value and volatility, commonly observed in options pricing and not directly linked to the book value.

Fair Value

Fair value reflects an asset's market price, balancing intrinsic value, which measures inherent worth based on fundamentals, and extrinsic value, representing market-driven factors like time and volatility.

Risk Premium

Risk premium influences the intrinsic value by adjusting expected cash flows for uncertainty, while extrinsic value captures additional market factors such as volatility and time until expiration.

Terminal Value

Terminal value represents the estimated residual worth of an asset or investment at the end of a forecast period, crucial for calculating intrinsic value by projecting future cash flows beyond the explicit forecast horizon. Unlike extrinsic value, which reflects market sentiment and time premium in assets like options, terminal value focuses on fundamental, long-term profitability and growth potential.

Relative Valuation

Relative valuation compares assets by market prices, focusing on extrinsic value, while intrinsic value calculates an asset's true worth based on fundamental analysis.

Earnings Power Value (EPV)

Earnings Power Value (EPV) assesses intrinsic value by estimating sustainable profits, distinguishing it from extrinsic value driven by market sentiment or external factors.

Margin of Safety

Margin of Safety in investing quantifies the difference between an asset's intrinsic value, based on fundamental analysis, and its extrinsic value or market price, providing a buffer against valuation errors and market volatility.

Intrinsic Value vs Extrinsic Value Infographic

moneydif.com

moneydif.com