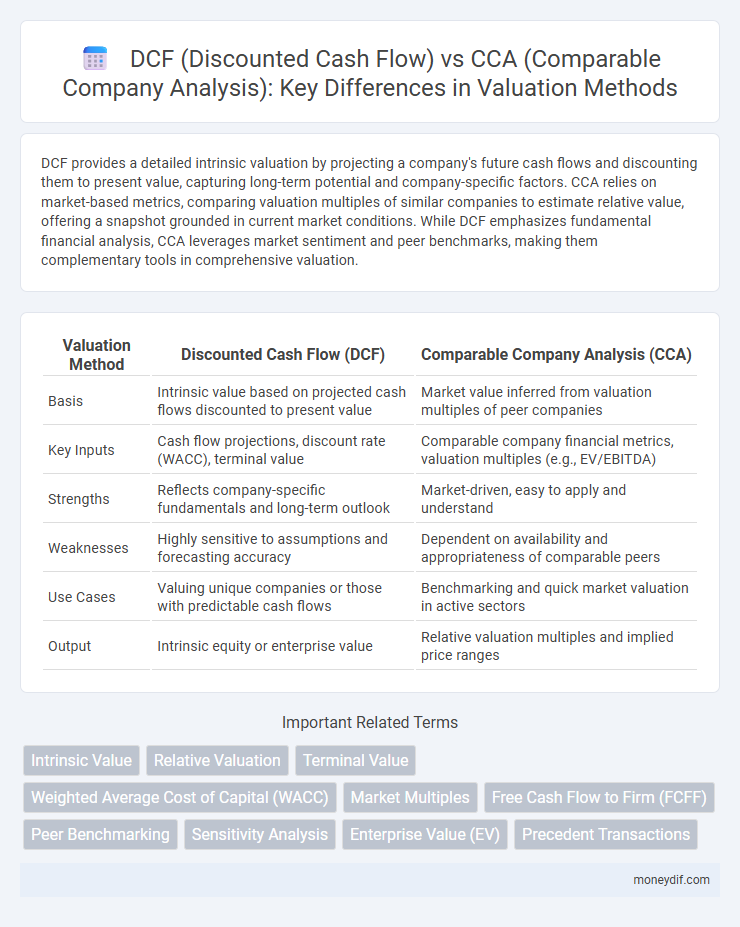

DCF provides a detailed intrinsic valuation by projecting a company's future cash flows and discounting them to present value, capturing long-term potential and company-specific factors. CCA relies on market-based metrics, comparing valuation multiples of similar companies to estimate relative value, offering a snapshot grounded in current market conditions. While DCF emphasizes fundamental financial analysis, CCA leverages market sentiment and peer benchmarks, making them complementary tools in comprehensive valuation.

Table of Comparison

| Valuation Method | Discounted Cash Flow (DCF) | Comparable Company Analysis (CCA) |

|---|---|---|

| Basis | Intrinsic value based on projected cash flows discounted to present value | Market value inferred from valuation multiples of peer companies |

| Key Inputs | Cash flow projections, discount rate (WACC), terminal value | Comparable company financial metrics, valuation multiples (e.g., EV/EBITDA) |

| Strengths | Reflects company-specific fundamentals and long-term outlook | Market-driven, easy to apply and understand |

| Weaknesses | Highly sensitive to assumptions and forecasting accuracy | Dependent on availability and appropriateness of comparable peers |

| Use Cases | Valuing unique companies or those with predictable cash flows | Benchmarking and quick market valuation in active sectors |

| Output | Intrinsic equity or enterprise value | Relative valuation multiples and implied price ranges |

Introduction to Valuation Methods

Discounted Cash Flow (DCF) valuation estimates a company's intrinsic value by projecting future cash flows and discounting them to present value using a chosen discount rate. Comparable Company Analysis (CCA) derives valuation multiples from similar firms in the industry to estimate a target company's market value. Both methods provide critical insights: DCF emphasizes a firm's fundamental financial performance, while CCA captures current market sentiment and relative valuation.

Understanding Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) valuation estimates a company's intrinsic value by projecting future free cash flows and discounting them to present value using the weighted average cost of capital (WACC). This method provides a detailed analysis based on company-specific financial performance and growth expectations, making it more insightful for long-term investment decisions compared to Comparable Company Analysis (CCA). Accurate assumptions about revenue growth, operating margins, and discount rates are crucial for reliable DCF results.

Overview of Comparable Company Analysis (CCA)

Comparable Company Analysis (CCA) evaluates a company's value by comparing financial metrics such as EV/EBITDA, P/E ratios, and revenue multiples against similar publicly traded firms within the same industry. This relative valuation approach relies on market-derived data to estimate a company's worth based on peer group performance, reflecting current market conditions and investor sentiment. CCA is favored for its simplicity and market-based perspective but may be limited by differences in operational scale, growth prospects, and accounting practices among comparables.

Key Differences Between DCF and CCA

Discounted Cash Flow (DCF) valuation projects a company's future free cash flows and discounts them to present value using the weighted average cost of capital (WACC), emphasizing intrinsic value. Comparable Company Analysis (CCA) relies on market multiples derived from similar publicly traded firms to estimate relative value based on current market sentiment. Key differences include DCF's forward-looking, fundamental approach versus CCA's market-based, relative valuation method that depends on the selection of appropriate peer companies.

Advantages of Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) valuation offers a detailed projection of a company's intrinsic value by forecasting future cash flows and discounting them to present value using a firm-specific discount rate. DCF captures the unique growth potential and risk profile of the business, unlike Comparable Company Analysis (CCA), which relies on market multiples and peer group assumptions. This method provides a more precise valuation by incorporating company-specific financial dynamics, capital structure, and long-term strategic plans.

Benefits of Comparable Company Analysis (CCA)

Comparable Company Analysis (CCA) provides a straightforward, market-driven valuation by leveraging real-time trading multiples from peer companies, enhancing relevance and transparency. CCA enables quick benchmark comparisons, facilitating the assessment of relative valuation and market sentiment without heavy reliance on future cash flow projections. This method is particularly useful in volatile markets or when reliable forecast data is limited, ensuring practical and current valuation insights.

Limitations of DCF and CCA Methods

Discounted Cash Flow (DCF) analysis relies heavily on accurate future cash flow projections and discount rates, making it susceptible to high subjectivity and estimation errors. Comparable Company Analysis (CCA) depends on selecting truly comparable firms, which can be challenging due to differences in size, growth, and market conditions, potentially leading to misleading valuation multiples. Both methods face limitations in capturing market volatility and non-financial factors that impact company value.

Appropriate Use Cases for DCF vs CCA

Discounted Cash Flow (DCF) is most appropriate for valuing companies with stable and predictable cash flows, long-term growth prospects, or unique business models where future performance can be reasonably forecasted. Comparable Company Analysis (CCA) works best for industries with readily available market data and comparable public companies, enabling valuation based on relative multiples like EV/EBITDA or P/E ratios. DCF is favored in strategic planning and intrinsic valuation, while CCA provides market benchmarks and quick valuation estimates driven by current trading multiples.

Real-World Examples: DCF vs CCA Applications

Discounted Cash Flow (DCF) valuation leverages projected free cash flows discounted at the weighted average cost of capital (WACC) to determine intrinsic company value, proving especially effective for firms with predictable cash flows like utilities. Comparable Company Analysis (CCA) uses market multiples from similar publicly traded firms to estimate value, often preferred for tech startups or companies in industries with volatile earnings. In real-world applications, DCF provided a robust valuation for a renewable energy firm with stable cash flows, while CCA helped benchmark a SaaS company's market standing against peers during its funding round.

Choosing the Right Valuation Method

Choosing the right valuation method depends on the specific context and data availability of the target company. DCF valuation captures intrinsic value by projecting future free cash flows and discounting them at the weighted average cost of capital (WACC), making it suitable for companies with stable and predictable cash flows. CCA relies on market multiples of comparable firms, providing a relative valuation benchmark that reflects current market sentiment, ideal for companies in active industries with plentiful peer data.

Important Terms

Intrinsic Value

Intrinsic value derived from DCF offers a detailed projection of a company's future cash flows discounted to present value, while CCA estimates value based on market multiples of comparable companies.

Relative Valuation

Relative valuation compares a target company's value by analyzing multiples from Comparable Company Analysis (CCA), whereas Discounted Cash Flow (DCF) valuation estimates intrinsic value based on projected cash flows discounted at the company's weighted average cost of capital (WACC).

Terminal Value

Terminal Value in DCF captures the perpetual cash flow beyond the forecast period, while CCA estimates value based on market multiples of comparable companies, emphasizing relative valuation.

Weighted Average Cost of Capital (WACC)

WACC serves as the discount rate in DCF models to value cash flows based on a company's capital structure, whereas CCA relies on market multiples and peer valuation without directly using WACC.

Market Multiples

Market multiples provide a valuation benchmark by comparing key financial ratios of a company with peers, complementing DCF's intrinsic value approach and CCA's relative market-based analysis.

Free Cash Flow to Firm (FCFF)

Free Cash Flow to Firm (FCFF) is a key input in Discounted Cash Flow (DCF) valuation models, providing intrinsic value estimates, while Comparable Company Analysis (CCA) relies on market multiples and peer comparisons rather than FCFF.

Peer Benchmarking

Peer benchmarking in financial valuation involves comparing key metrics and growth projections of similar companies to assess relative value, enhancing the accuracy of DCF (Discounted Cash Flow) models by contextualizing future cash flow assumptions. Unlike CCA (Comparable Company Analysis), which uses market multiples of peers for valuation, peer benchmarking integrates operational performance and market positioning insights to refine discount rates and terminal value estimates within the DCF framework.

Sensitivity Analysis

Sensitivity analysis in DCF models evaluates how changes in key assumptions, such as discount rates and cash flow projections, impact valuation outcomes, providing a dynamic understanding of valuation risk. In contrast, sensitivity analysis in CCA examines the effects of varying multiples and peer group selection on relative valuation, highlighting market-driven variability.

Enterprise Value (EV)

Enterprise Value (EV) derived from Discounted Cash Flow (DCF) reflects intrinsic value based on projected cash flows, while EV from Comparable Company Analysis (CCA) represents market-based valuation using peer multiples.

Precedent Transactions

Precedent Transactions provide transaction-based valuation benchmarks often yielding higher premiums than DCF, while CCA offers market-based multiples reflecting current trading valuations without control premiums.

DCF (Discounted Cash Flow) vs CCA (Comparable Company Analysis) Infographic

moneydif.com

moneydif.com