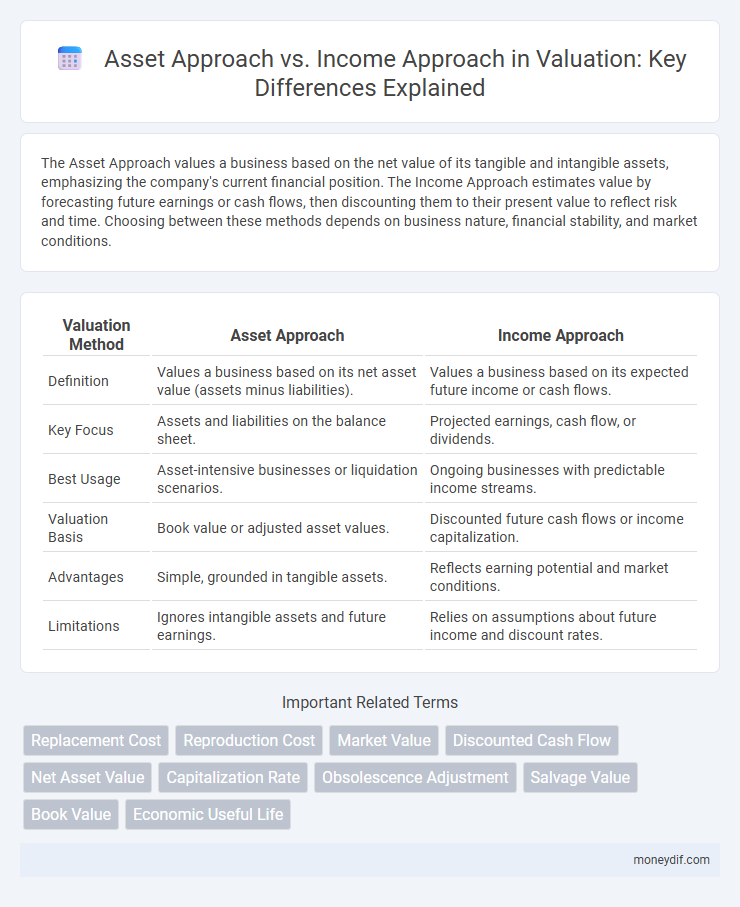

The Asset Approach values a business based on the net value of its tangible and intangible assets, emphasizing the company's current financial position. The Income Approach estimates value by forecasting future earnings or cash flows, then discounting them to their present value to reflect risk and time. Choosing between these methods depends on business nature, financial stability, and market conditions.

Table of Comparison

| Valuation Method | Asset Approach | Income Approach |

|---|---|---|

| Definition | Values a business based on its net asset value (assets minus liabilities). | Values a business based on its expected future income or cash flows. |

| Key Focus | Assets and liabilities on the balance sheet. | Projected earnings, cash flow, or dividends. |

| Best Usage | Asset-intensive businesses or liquidation scenarios. | Ongoing businesses with predictable income streams. |

| Valuation Basis | Book value or adjusted asset values. | Discounted future cash flows or income capitalization. |

| Advantages | Simple, grounded in tangible assets. | Reflects earning potential and market conditions. |

| Limitations | Ignores intangible assets and future earnings. | Relies on assumptions about future income and discount rates. |

Introduction to Valuation Approaches

The Asset Approach determines value based on the net asset value, calculating the difference between total assets and liabilities to reflect the company's underlying worth. The Income Approach estimates value by discounting projected future cash flows to their present value, emphasizing the business's ability to generate income over time. These valuation approaches provide distinct perspectives, with the Asset Approach focusing on tangible assets and the Income Approach centered on expected earnings.

Overview of the Asset Approach

The Asset Approach to valuation emphasizes determining a business's value based on the net asset value, calculated by subtracting liabilities from the total assets recorded on the balance sheet. This method is particularly effective for companies with substantial tangible assets or in liquidation scenarios where asset recovery values are critical. Unlike the Income Approach, which projects future earnings, the Asset Approach provides a snapshot of current asset worth, reflecting the company's financial position at a specific point in time.

Overview of the Income Approach

The Income Approach estimates asset value based on the present value of expected future cash flows generated by the asset, using discount rates that reflect risk and time preference. Key methods include Discounted Cash Flow (DCF) analysis and capitalization of earnings, which translate projected income into current asset value. This approach is essential for valuing income-producing properties, businesses, and intangible assets where future profitability is a primary concern.

Key Differences Between Asset and Income Approaches

The Asset Approach values a business based on the net value of its tangible and intangible assets, emphasizing balance sheet data and replacement costs. In contrast, the Income Approach estimates value by discounting expected future cash flows or earnings, focusing on profitability and risk factors. Key differences include the Asset Approach's focus on current asset values versus the Income Approach's emphasis on future income generation and market conditions.

When to Use the Asset Approach

The Asset Approach is best used when valuing companies with significant tangible assets, such as real estate or manufacturing firms, where asset values dominate overall worth. It provides accurate valuation in cases of liquidation or when earnings are unstable or negative, making income projections unreliable. This approach is also preferred for asset-intensive industries or when historical cost closely aligns with market value.

When to Use the Income Approach

The Income Approach is ideal for valuing income-producing properties where future cash flows can be reliably estimated, such as rental real estate, businesses, or investments with predictable earnings. This method emphasizes the present value of expected future economic benefits, making it suitable when historical income data and market capitalization rates are available. It is less appropriate for assets lacking consistent income streams or those with valuation heavily dependent on replacement cost or asset liquidation value.

Advantages of the Asset Approach

The Asset Approach provides a clear valuation based on the tangible and intangible assets owned by a business, making it highly reliable for companies with substantial asset bases or in liquidation scenarios. This method allows for precise identification and valuation of individual assets, offering transparency and minimizing subjectivity compared to income projections. It is particularly advantageous when future earnings are uncertain or inconsistent, ensuring a grounded assessment rooted in current asset values.

Advantages of the Income Approach

The Income Approach offers a precise valuation by directly linking an asset's value to its expected future cash flows, providing a dynamic and forward-looking assessment. This method accommodates varying risk levels and market conditions through discount rates, enhancing accuracy in diverse economic environments. It is particularly advantageous for income-producing properties or businesses, where past earnings or comparable sales data are limited or unreliable.

Limitations of Each Valuation Method

The Asset Approach often undervalues intangible assets and fails to capture future earning potential, leading to incomplete valuations for businesses with significant goodwill or intellectual property. The Income Approach relies heavily on accurate projections of future cash flows and appropriate discount rates, making it vulnerable to subjective assumptions and market volatility. Both methods may require adjustments or combined use to achieve a comprehensive and reliable valuation.

Choosing the Right Valuation Approach

Choosing the right valuation approach depends on the nature of the business and the purpose of the valuation. The Asset Approach focuses on the company's net asset value, making it ideal for asset-intensive businesses or liquidation scenarios. The Income Approach emphasizes future cash flow projections, best suited for ongoing concerns with stable earnings and growth potential.

Important Terms

Replacement Cost

Replacement cost in the Asset Approach estimates an asset's value based on current reproduction expenses, while the Income Approach derives value from the asset's expected future cash flows.

Reproduction Cost

Reproduction cost in the Asset Approach represents the current expense to duplicate an asset exactly, reflecting physical depreciation and obsolescence, while the Income Approach values an asset based on its ability to generate future economic benefits, often using discounted cash flow or capitalization methods. The Asset Approach is more relevant for tangible fixed assets requiring precise replacement valuation, whereas the Income Approach suits income-producing assets where profitability forecasts drive valuation accuracy.

Market Value

Market value often contrasts between the Asset Approach, which bases value on the net asset replacement cost, and the Income Approach, which focuses on the present value of expected future cash flows.

Discounted Cash Flow

Discounted Cash Flow (DCF) analysis integrates the Income Approach by projecting an asset's future cash flows and discounting them to present value, contrasting with the Asset Approach that values assets based on their adjusted book or replacement cost.

Net Asset Value

Net Asset Value (NAV) reflects the asset approach by calculating total assets minus liabilities, whereas the income approach values assets based on anticipated income generation.

Capitalization Rate

The Capitalization Rate in real estate valuation differs between the Asset Approach, focusing on property replacement cost minus depreciation, and the Income Approach, emphasizing net operating income relative to market value.

Obsolescence Adjustment

Obsolescence adjustment in asset approach quantifies value reduction due to physical, functional, or economic factors, while income approach incorporates obsolescence by forecasting diminished future cash flows or earnings.

Salvage Value

Salvage value in the Asset Approach represents the estimated residual value of an asset at the end of its useful life, directly impacting the asset's book value and depreciation calculations. In contrast, the Income Approach incorporates salvage value into discounted cash flow models to adjust projected income streams and terminal value estimations, influencing overall asset valuation.

Book Value

Book value represents the asset-based valuation reflecting historical cost minus depreciation, contrasting with the income approach which estimates value based on the present worth of expected future earnings.

Economic Useful Life

Economic Useful Life determines the asset's value duration in the Asset Approach, while the Income Approach estimates it based on the period generating economic benefits.

Asset Approach vs Income Approach Infographic

moneydif.com

moneydif.com