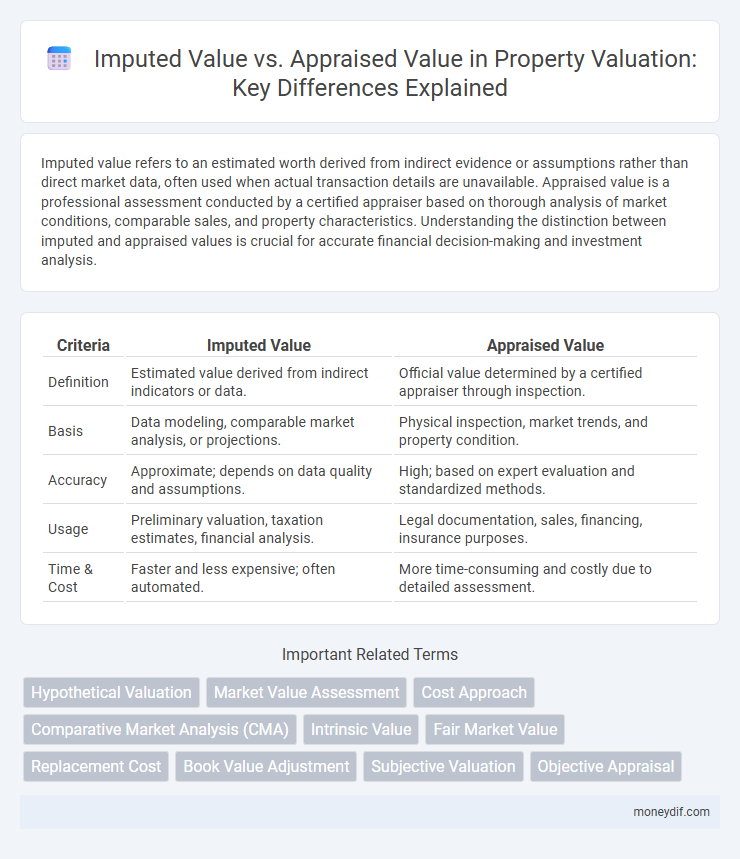

Imputed value refers to an estimated worth derived from indirect evidence or assumptions rather than direct market data, often used when actual transaction details are unavailable. Appraised value is a professional assessment conducted by a certified appraiser based on thorough analysis of market conditions, comparable sales, and property characteristics. Understanding the distinction between imputed and appraised values is crucial for accurate financial decision-making and investment analysis.

Table of Comparison

| Criteria | Imputed Value | Appraised Value |

|---|---|---|

| Definition | Estimated value derived from indirect indicators or data. | Official value determined by a certified appraiser through inspection. |

| Basis | Data modeling, comparable market analysis, or projections. | Physical inspection, market trends, and property condition. |

| Accuracy | Approximate; depends on data quality and assumptions. | High; based on expert evaluation and standardized methods. |

| Usage | Preliminary valuation, taxation estimates, financial analysis. | Legal documentation, sales, financing, insurance purposes. |

| Time & Cost | Faster and less expensive; often automated. | More time-consuming and costly due to detailed assessment. |

Understanding Imputed Value in Valuation

Imputed value in valuation represents an estimated worth derived from indirect indicators rather than direct market transactions, often used when exact appraised values are unavailable or impractical to obtain. It leverages mathematical models, cost factors, or comparable asset data to infer value, offering a pragmatic approach in financial analysis or insurance assessments. Understanding imputed value helps stakeholders gauge asset worth more flexibly, complementing traditional appraised value methods.

What is Appraised Value?

Appraised value is the professional estimate of a property's market worth determined by a licensed appraiser through detailed analysis of comparable sales, property condition, and location. It serves as an objective benchmark in real estate transactions, mortgage approvals, and tax assessments. Unlike imputed value, which is a theoretical or calculated figure, appraised value is grounded in empirical data and expert judgment.

Key Differences Between Imputed and Appraised Value

Imputed value represents an estimated worth derived from indirect data or assumptions, often used when direct market data is unavailable, whereas appraised value is determined through a formal assessment by a certified professional considering current market conditions and physical property attributes. Imputed value relies heavily on models and inference, making it more subjective and variable, while appraised value involves comprehensive analysis including property inspection, sales comparisons, and market trends for accuracy. The key difference lies in imputed value's estimation basis versus the appraised value's empirical evaluation and regulatory recognition in financial and legal contexts.

Methods for Calculating Imputed Value

Methods for calculating imputed value typically involve estimating the probable market value based on comparable asset data and projected income streams, often using cost, sales comparison, or income capitalization approaches. The cost approach assesses replacement or reproduction costs minus depreciation, while the sales comparison approach analyzes recent transactions of similar assets to determine value benchmarks. Income capitalization converts expected future earnings into present value, integrating factors like discount rates and growth projections to impute the asset's worth.

The Process of Property Appraisal

Property appraisal involves a systematic process where a licensed appraiser evaluates a property's market value based on factors such as location, condition, comparable sales, and current market trends. The imputed value, often estimated through financial analysis or income capitalization, contrasts with the appraised value that results from this hands-on inspection and market comparison. Understanding the nuances of the appraisal process ensures that stakeholders accurately interpret the appraised value rather than relying solely on imputed valuations.

Factors Influencing Imputed Value

Imputed value is influenced by factors such as market conditions, estimated cash flows, and the intrinsic characteristics of the asset, reflecting potential economic benefits rather than current market price. It often incorporates assumptions about future earnings, risk levels, and operational efficiency, which distinguish it from the appraised value based on comparable sales and physical inspections. Understanding these variables helps in assessing the imputed value's relevance for investment analysis and decision-making.

Factors Affecting Appraised Value

Appraised value is influenced by factors such as the property's location, current market trends, condition, size, and comparable sales data within the area. Economic indicators, zoning laws, and the presence of improvements or damages also significantly impact the appraised value. Unlike imputed value, which is often a theoretical estimate, appraised value reflects a comprehensive analysis by a professional appraiser based on tangible property attributes and market data.

Importance of Imputed Value in Financial Analysis

Imputed value plays a crucial role in financial analysis by providing an estimated worth of assets or liabilities when market data is unavailable or insufficient, enhancing decision-making accuracy. Unlike appraised value, which relies on professional judgment and market comparisons, imputed value incorporates intrinsic factors and projected cash flows to reflect potential economic benefits. This approach helps analysts assess the true financial position and forecast future performance more reliably, ensuring comprehensive valuation models.

Role of Appraised Value in Real Estate Transactions

Appraised value plays a critical role in real estate transactions by providing an objective estimate of a property's market worth based on recent comparable sales, property condition, and location. Unlike imputed value, which is often hypothetical or derived from theoretical models, the appraised value is determined by licensed professionals following standardized methodologies. This value influences lending decisions, sale prices, and tax assessments, ensuring all parties have a reliable benchmark for negotiation and financial planning.

Imputed Value vs Appraised Value: Which to Use and When

Imputed value estimates the worth of an asset based on related market data or inferred metrics, useful when direct appraisal information is unavailable or costly. Appraised value relies on a professional assessment considering physical inspection, condition, and comparable sales, providing a precise valuation ideal for transactions or financing. Choose imputed value for preliminary analysis or rough estimates, and appraised value when accuracy is critical for legal, tax, or sale purposes.

Important Terms

Hypothetical Valuation

Hypothetical valuation estimates an asset's worth based on imputed value assumptions rather than market-based appraised value assessments.

Market Value Assessment

Market value assessment compares imputed value, estimated through statistical models, with appraised value, determined by professional property evaluators, to ensure accurate real estate taxation and investment decisions.

Cost Approach

The Cost Approach estimates property value by calculating the Imputed Value based on reproduction or replacement costs minus depreciation, which is then compared to the Appraised Value derived from market analysis to ensure accuracy.

Comparative Market Analysis (CMA)

Comparative Market Analysis (CMA) estimates a property's imputed value by analyzing recent sales of similar homes, whereas the appraised value is determined by a licensed appraiser based on detailed property inspection and market conditions.

Intrinsic Value

Intrinsic value reflects the fundamental worth based on inherent qualities, while imputed value estimates implied worth from associated factors, and appraised value represents an expert-evaluated market price.

Fair Market Value

Fair Market Value represents the estimated price at which property would change hands between a willing buyer and seller, while Imputed Value is a theoretical estimate based on assumptions, and Appraised Value is determined by a professional appraiser's analysis.

Replacement Cost

Replacement Cost determines the expense to rebuild an asset, while Imputed Value estimates its worth based on assumptions, and Appraised Value is the market-based valuation conducted by a professional appraiser.

Book Value Adjustment

Book Value Adjustment involves modifying the recorded asset value on financial statements to reflect either the Imputed Value, which estimates an asset's worth based on hypothetical or derived data, or the Appraised Value, determined through professional evaluation and market analysis. This adjustment ensures more accurate representation of asset worth for accounting, taxation, or investment purposes.

Subjective Valuation

Subjective valuation differs from appraised value as it reflects personal perceptions and imputed value represents estimated worth based on inferred benefits rather than formal appraisal methods.

Objective Appraisal

Objective appraisal accurately determines the appraised value by factoring in the imputed value to reflect true market worth.

Imputed Value vs Appraised Value Infographic

moneydif.com

moneydif.com