Transaction Value represents the actual price agreed upon between buyer and seller during a deal, reflecting real-market conditions and negotiation outcomes. Quoted Value refers to the estimated or listed price of an asset, often based on models or market quotations without accounting for specific transaction details. Understanding the difference between Transaction Value and Quoted Value is crucial for accurate valuation, as the former reveals true market sentiment while the latter provides a theoretical benchmark.

Table of Comparison

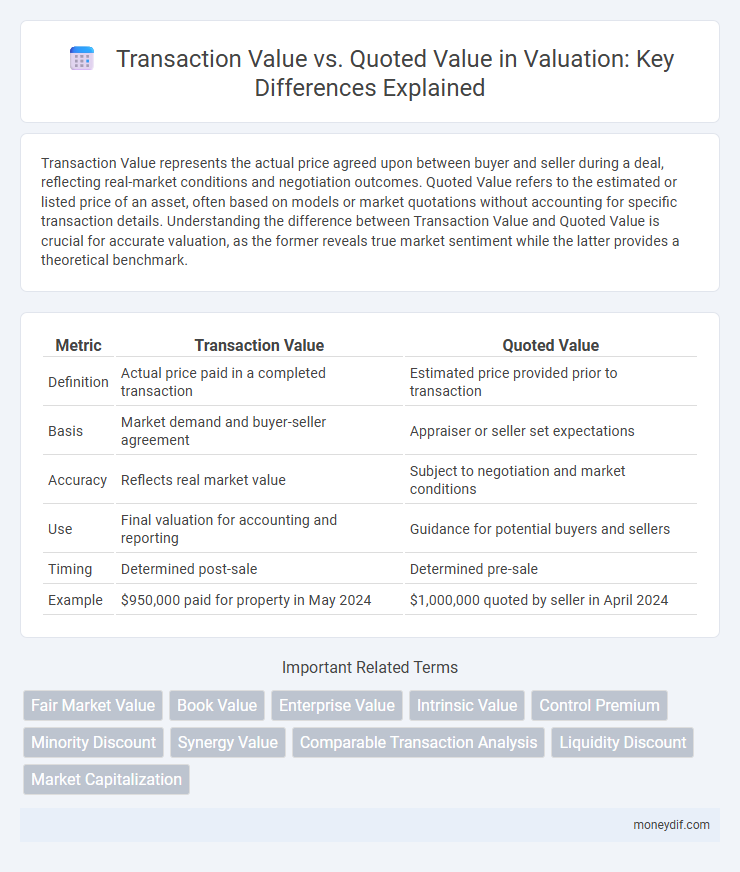

| Metric | Transaction Value | Quoted Value |

|---|---|---|

| Definition | Actual price paid in a completed transaction | Estimated price provided prior to transaction |

| Basis | Market demand and buyer-seller agreement | Appraiser or seller set expectations |

| Accuracy | Reflects real market value | Subject to negotiation and market conditions |

| Use | Final valuation for accounting and reporting | Guidance for potential buyers and sellers |

| Timing | Determined post-sale | Determined pre-sale |

| Example | $950,000 paid for property in May 2024 | $1,000,000 quoted by seller in April 2024 |

Understanding Transaction Value: Definition and Importance

Transaction value refers to the actual price paid or payable for goods or assets in a transaction, reflecting the real market conditions and buyer-seller agreement. Quoted value, by contrast, represents a listed or estimated price often used for reference or comparison purposes without reflecting final transaction terms. Understanding transaction value is crucial for accurate valuation, ensuring fair market assessment, tax compliance, and informed decision-making in financial reporting and investment analysis.

What is Quoted Value? Key Concepts Explained

Quoted value represents the officially published price of a security or asset on a public exchange, reflecting real-time market sentiment and supply-demand dynamics. It serves as a transparent benchmark for investors but may not capture transaction-specific factors like negotiation, volume discounts, or buyer-seller synergies that influence the actual transaction value. Understanding quoted value is essential for investors to gauge market liquidity and price trends, though it should be analyzed alongside transaction value to assess true asset worth comprehensively.

Fundamental Differences between Transaction Value and Quoted Value

Transaction value reflects the actual price agreed upon between buyer and seller during an asset exchange, representing real market conditions and negotiations. Quoted value, often derived from market prices or valuation models, serves as an estimated or theoretical figure that may not account for transaction-specific factors such as liquidity, timing, or unique deal terms. The fundamental difference lies in transaction value being empirical and deal-specific, while quoted value is indicative and subject to assumptions or market sentiment.

Factors Influencing Transaction Value in Real-World Deals

Transaction value in real-world deals fluctuates based on factors such as market conditions, asset liquidity, and negotiation dynamics between buyers and sellers. Quoted value often represents theoretical or listed prices, whereas transaction value reflects actual agreed prices influenced by due diligence, risk assessments, and timing. Understanding discrepancies between quoted and transaction values is crucial for accurate asset valuation and strategic investment decisions.

How Market Conditions Affect Quoted Value

Market conditions significantly influence quoted value by altering demand and supply dynamics, causing fluctuations in quoted prices independent of intrinsic transaction value. Volatility in interest rates, inflation rates, and economic indicators can lead to discrepancies between quoted and transaction values as market sentiment shifts. Quoted values often reflect real-time market perceptions and expectations rather than fundamental asset characteristics, which can result in temporary overvaluation or undervaluation.

Common Scenarios: When Transaction Value Diverges from Quoted Value

Transaction value often diverges from quoted value in scenarios involving market volatility, where fluctuations affect the final sale price compared to initial quotations. Differences arise during distress sales or forced liquidation, causing transaction values to fall below quoted values. Additionally, negotiated discounts or premium adjustments can create disparities between transaction and quoted values in private or bespoke deals.

Practical Implications for Investors and Analysts

Transaction value reflects the actual price paid in a deal, providing a concrete measure of market sentiment and demand, while quoted value represents estimated or theoretical worth based on models or market quotes. Investors and analysts rely on transaction value for accurate assessment of asset worth and to gauge real market liquidity, whereas quoted value helps in benchmarking and valuation comparisons. Understanding the divergence between these values is crucial for making informed investment decisions and identifying potential market inefficiencies.

Role of Due Diligence in Assessing Transaction Value

Due diligence plays a critical role in reconciling transaction value with quoted value by thoroughly evaluating financial statements, asset quality, and potential liabilities. This comprehensive analysis uncovers discrepancies, confirms asset valuations, and identifies hidden risks that impact the true transaction value. Accurate due diligence ensures informed decision-making and fair pricing during mergers and acquisitions, reflecting the asset's realistic market worth beyond its quoted price.

Regulatory and Reporting Considerations

Transaction value reflects the actual amount paid in a deal, capturing real market dynamics, while quoted value represents the published or indicative price, which may not account for adjustments or contingencies. Regulatory frameworks often require disclosure of transaction values to ensure transparency and prevent price manipulation, impacting financial reporting and compliance. Accurate differentiation between these values is critical for fair valuation reporting, tax assessments, and audit requirements.

Best Practices for Bridging the Gap between Transaction and Quoted Values

To bridge the gap between transaction value and quoted value effectively, analysts should integrate market conditions, negotiation terms, and timing adjustments into valuation models. Leveraging comprehensive due diligence and employing sensitivity analyses on key valuation drivers ensures a more accurate reflection of transactional premiums or discounts. Implementing standardized disclosure frameworks enhances transparency, reducing discrepancies and aligning stakeholder expectations.

Important Terms

Fair Market Value

Fair Market Value represents the estimated price a willing buyer would pay to a willing seller, often differing from the transaction value, which is the actual sale price, and the quoted value, which is the listed or suggested price.

Book Value

Book value represents a company's net asset value, serving as a baseline for comparing transaction value--the actual price paid in an acquisition--and quoted value, which is the market price of the company's shares.

Enterprise Value

Enterprise Value reflects a company's total value including debt, equity, and cash, often differing from Transaction Value which represents the actual price paid in a deal, while Quoted Value indicates the market capitalization based on current share prices.

Intrinsic Value

Intrinsic value represents the true worth of an asset based on fundamental analysis, often differing from the transaction value (actual price paid) and the quoted value (market price displayed).

Control Premium

Control premium represents the additional amount paid over the quoted value in a transaction, reflecting the buyer's advantage of acquiring controlling interest in the target company.

Minority Discount

Minority discount reflects the reduction in transaction value compared to quoted value due to limited control and marketability of minority ownership interests.

Synergy Value

Synergy Value represents the additional worth generated from a transaction beyond the Quoted Value of the individual companies involved, often reflecting cost savings, revenue enhancements, or market expansion opportunities. Transaction Value typically exceeds Quoted Value as it incorporates these expected synergies, capturing the premium paid for potential combined efficiencies and strategic benefits.

Comparable Transaction Analysis

Comparable Transaction Analysis evaluates transaction value against quoted value to determine fair market pricing by analyzing similar past transactions in the industry.

Liquidity Discount

Liquidity discount reflects the reduction in transaction value compared to quoted value due to limited marketability or difficulty in quickly converting assets to cash. This discount quantifies the gap investors apply to the quoted price to account for potential delays or costs in selling the asset.

Market Capitalization

Market capitalization represents the total market value of a company's outstanding shares, calculated by multiplying the quoted share price by the number of shares outstanding, whereas transaction value reflects the actual price at which shares are bought or sold during trading activity. Discrepancies between transaction value and quoted value arise due to bid-ask spreads, market volatility, and liquidity, impacting real-time assessments of a company's market worth.

Transaction Value vs Quoted Value Infographic

moneydif.com

moneydif.com