EBITDA multiple measures a company's enterprise value relative to earnings before interest, taxes, depreciation, and amortization, providing insight into operational profitability without non-cash expenses. EBIT multiple incorporates depreciation and amortization, reflecting the impact of capital intensity and asset aging on valuation. Selecting between EBITDA and EBIT multiples depends on industry characteristics and the significance of non-cash charges to accurately assess company value.

Table of Comparison

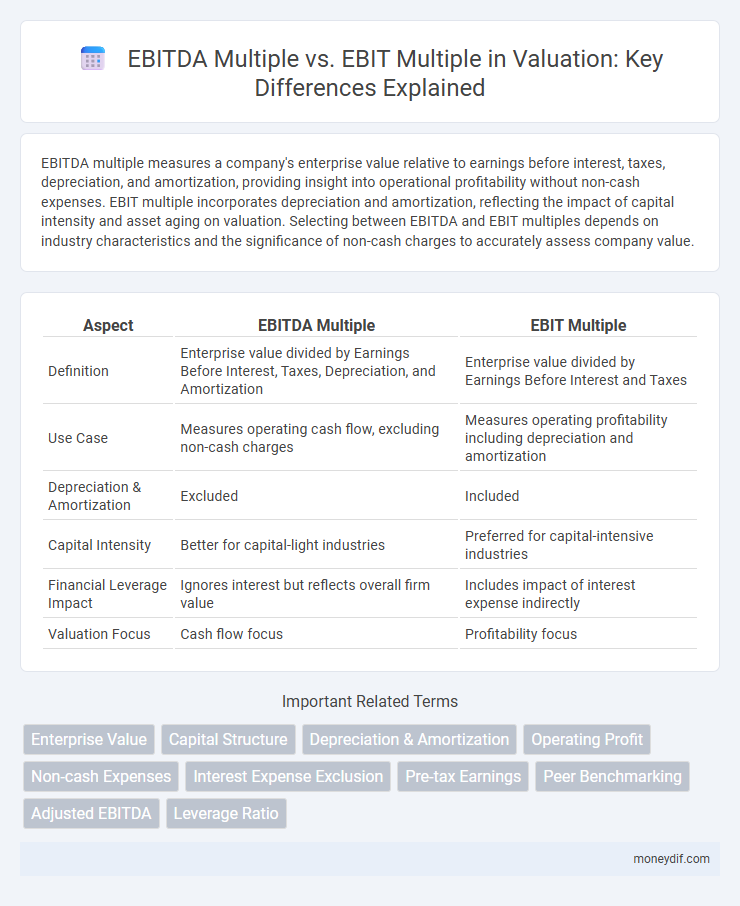

| Aspect | EBITDA Multiple | EBIT Multiple |

|---|---|---|

| Definition | Enterprise value divided by Earnings Before Interest, Taxes, Depreciation, and Amortization | Enterprise value divided by Earnings Before Interest and Taxes |

| Use Case | Measures operating cash flow, excluding non-cash charges | Measures operating profitability including depreciation and amortization |

| Depreciation & Amortization | Excluded | Included |

| Capital Intensity | Better for capital-light industries | Preferred for capital-intensive industries |

| Financial Leverage Impact | Ignores interest but reflects overall firm value | Includes impact of interest expense indirectly |

| Valuation Focus | Cash flow focus | Profitability focus |

Introduction to EBITDA and EBIT Multiples

EBITDA multiples measure a company's valuation based on earnings before interest, taxes, depreciation, and amortization, emphasizing cash flow and operational profitability. EBIT multiples, on the other hand, assess value considering earnings before interest and taxes, including depreciation and amortization effects on profitability. Investors use EBITDA multiples for businesses with significant non-cash expenses, while EBIT multiples offer insight into assets-heavy companies with substantial depreciation charges.

Understanding EBITDA Multiple

EBITDA Multiple is a widely used valuation metric that compares a company's enterprise value to its earnings before interest, taxes, depreciation, and amortization, providing a clear view of operational profitability without the effects of capital structure and non-cash expenses. This multiple is preferred for assessing businesses with significant capital expenditures or varying depreciation policies, as it highlights cash flow potential and operational efficiency. Investors use EBITDA multiples to gauge company valuation relative to industry peers, enabling more accurate cross-company comparisons in mergers and acquisitions.

Understanding EBIT Multiple

EBIT multiple evaluates a company's value by comparing enterprise value to earnings before interest and taxes, providing insight into operational profitability excluding financing and tax effects. It is especially useful for capital-intensive businesses where depreciation and amortization significantly impact EBITDA, making EBIT a more accurate reflection of operational performance. Investors use EBIT multiples to assess a firm's ability to generate earnings from core operations while controlling for differences in capital structure and tax environments.

Calculation Methods for EBITDA vs EBIT Multiples

EBITDA multiple is calculated by dividing enterprise value (EV) by earnings before interest, taxes, depreciation, and amortization (EBITDA), emphasizing operational cash flow by excluding non-cash expenses and capital structure effects. EBIT multiple is derived by dividing enterprise value by earnings before interest and taxes (EBIT), factoring in depreciation and amortization, which reflects asset wear and amortized expenses. The choice between EBITDA and EBIT multiples hinges on the visibility of capital expenditures and non-cash charges impacting profitability and valuation comparability.

Key Differences Between EBITDA and EBIT Multiples

EBITDA multiple measures a company's enterprise value relative to earnings before interest, taxes, depreciation, and amortization, capturing operating profitability without non-cash expenses. EBIT multiple compares enterprise value to earnings before interest and taxes, including depreciation and amortization, reflecting asset-heavy companies' cost structures. The key difference lies in EBITDA multiples ignoring non-cash charges, making them preferable for evaluating cash flow and operational efficiency, while EBIT multiples provide insight into profitability after accounting for capital expenditure impact.

When to Use EBITDA Multiple

EBITDA multiple is preferred when evaluating companies with significant non-cash expenses, high capital expenditures, or varying debt levels, as it reflects operating performance before depreciation, amortization, interest, and taxes. This multiple is particularly useful in capital-intensive industries such as telecommunications, manufacturing, and utilities, where asset-heavy operations can distort EBIT figures. EBITDA multiples provide a clearer comparison of operational profitability and cash flow potential across firms with different capital structures and tax environments.

When to Use EBIT Multiple

EBIT multiple is preferred over EBITDA multiple when a company has significant capital expenditures or non-cash expenses that impact profitability, providing a clearer picture of operational efficiency. It is ideal for industries with high depreciation and amortization costs, such as manufacturing or utilities, where EBIT reflects true operating earnings. Choosing EBIT multiple helps investors assess valuation by accounting for the impact of asset-heavy business models and long-term investments.

Pros and Cons of EBITDA Multiple

EBITDA multiple is widely used in valuation due to its ability to measure operating performance by excluding non-cash expenses like depreciation and amortization, providing a clearer picture of cash flow generation. Its main advantage lies in comparability across companies with different capital structures and tax environments, making it ideal for industries with heavy capital investments. However, EBITDA multiples can overstate profitability by ignoring capital expenditures, debt servicing costs, and changes in working capital, which may mislead investors about a company's true financial health.

Pros and Cons of EBIT Multiple

EBIT multiple valuation incorporates depreciation and amortization costs, providing a more comprehensive view of operating profitability, especially for capital-intensive industries. This method reflects true earning power by accounting for non-cash expenses but can be less useful for firms with varying capital structures or tax environments. Companies with high fixed assets may benefit from EBIT multiples as it avoids overvaluation common in EBITDA-based assessments.

Choosing the Right Multiple for Accurate Valuation

Choosing between EBITDA multiple and EBIT multiple depends on the capital structure and depreciation policies of the business. EBITDA multiples are preferred for businesses with high non-cash charges and varying capital expenditures, as they provide a clearer picture of operational cash flow. EBIT multiples are more suitable for companies with stable capital assets and consistent depreciation, reflecting true operating profitability after accounting for asset aging.

Important Terms

Enterprise Value

Enterprise Value is often valued using EBITDA multiples to assess overall operational profitability before depreciation and amortization, whereas EBIT multiples focus on earnings after these expenses, affecting comparability and valuation precision.

Capital Structure

Analyzing capital structure through EBITDA multiples provides a clearer valuation by including depreciation and amortization expenses, while EBIT multiples focus on operating profit excluding these non-cash charges.

Depreciation & Amortization

EBITDA multiples exclude depreciation and amortization to focus on operational cash flow, while EBIT multiples incorporate these non-cash expenses, reflecting earnings after asset depreciation.

Operating Profit

Operating profit, representing core business earnings before interest and taxes, is crucial in differentiating EBITDA multiple valuation, which includes depreciation and amortization, from EBIT multiple valuation that excludes these non-cash expenses.

Non-cash Expenses

Non-cash expenses such as depreciation and amortization impact EBIT but are excluded in EBITDA, making EBITDA multiples higher and more reflective of operational cash flow performance. Investors use EBITDA multiples to evaluate cash-generating ability, while EBIT multiples incorporate non-cash charges, providing insight into overall profitability including asset wear and financing effects.

Interest Expense Exclusion

Interest expense exclusion in EBITDA multiples provides a clearer comparison of operational profitability than EBIT multiples, which include interest costs affecting leverage-sensitive valuations.

Pre-tax Earnings

Pre-tax earnings impact valuation metrics as EBITDA multiples exclude depreciation and amortization, reflecting operational cash flow more directly, while EBIT multiples include these charges, providing a more conservative measure of profitability.

Peer Benchmarking

Peer benchmarking using EBITDA multiple versus EBIT multiple provides a precise valuation comparison by reflecting operational profitability before and after accounting for depreciation and amortization. EBITDA multiples often highlight cash flow potential and operational efficiency, while EBIT multiples offer a clearer view of earnings after fixed asset expenses, enabling more tailored investment or acquisition decisions.

Adjusted EBITDA

Adjusted EBITDA enhances valuation accuracy by excluding non-recurring items, making the EBITDA multiple generally higher and more reflective of cash flow than the EBIT multiple, which includes depreciation and amortization expenses.

Leverage Ratio

Leverage Ratio impacts valuation by influencing EBITDA Multiple and EBIT Multiple, where higher leverage typically leads to a lower EBIT Multiple compared to EBITDA Multiple due to increased interest expense reducing EBIT.

EBITDA Multiple vs EBIT Multiple Infographic

moneydif.com

moneydif.com