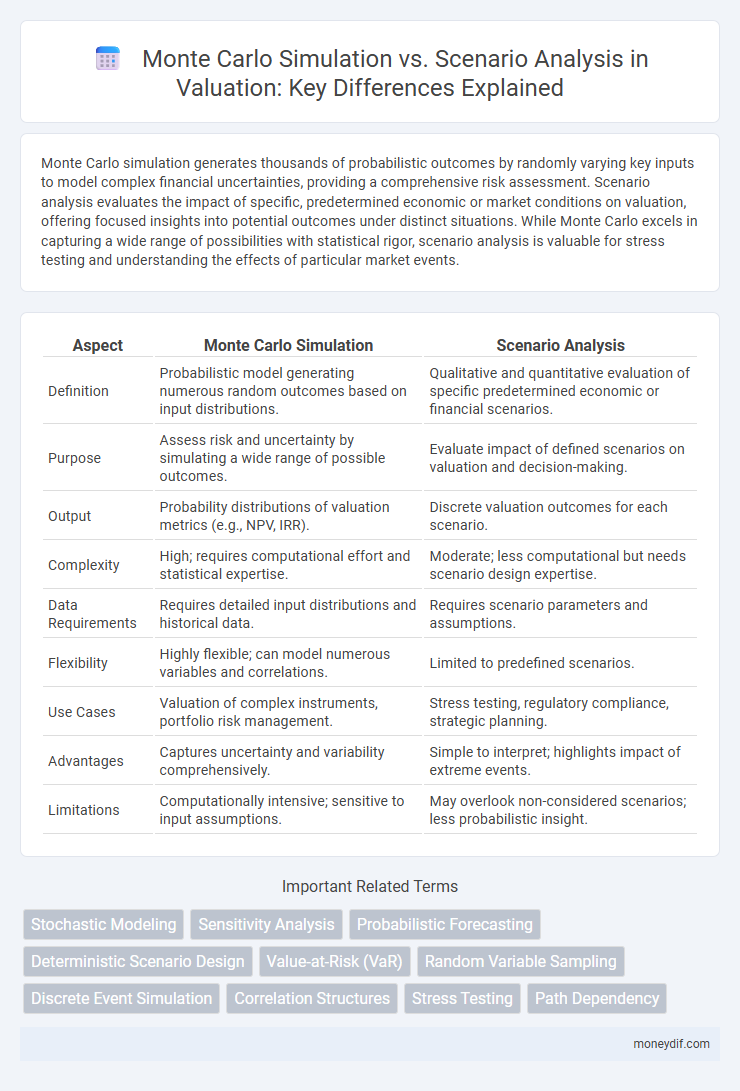

Monte Carlo simulation generates thousands of probabilistic outcomes by randomly varying key inputs to model complex financial uncertainties, providing a comprehensive risk assessment. Scenario analysis evaluates the impact of specific, predetermined economic or market conditions on valuation, offering focused insights into potential outcomes under distinct situations. While Monte Carlo excels in capturing a wide range of possibilities with statistical rigor, scenario analysis is valuable for stress testing and understanding the effects of particular market events.

Table of Comparison

| Aspect | Monte Carlo Simulation | Scenario Analysis |

|---|---|---|

| Definition | Probabilistic model generating numerous random outcomes based on input distributions. | Qualitative and quantitative evaluation of specific predetermined economic or financial scenarios. |

| Purpose | Assess risk and uncertainty by simulating a wide range of possible outcomes. | Evaluate impact of defined scenarios on valuation and decision-making. |

| Output | Probability distributions of valuation metrics (e.g., NPV, IRR). | Discrete valuation outcomes for each scenario. |

| Complexity | High; requires computational effort and statistical expertise. | Moderate; less computational but needs scenario design expertise. |

| Data Requirements | Requires detailed input distributions and historical data. | Requires scenario parameters and assumptions. |

| Flexibility | Highly flexible; can model numerous variables and correlations. | Limited to predefined scenarios. |

| Use Cases | Valuation of complex instruments, portfolio risk management. | Stress testing, regulatory compliance, strategic planning. |

| Advantages | Captures uncertainty and variability comprehensively. | Simple to interpret; highlights impact of extreme events. |

| Limitations | Computationally intensive; sensitive to input assumptions. | May overlook non-considered scenarios; less probabilistic insight. |

Introduction to Valuation Methods

Monte Carlo simulation employs stochastic modeling to estimate valuation by generating numerous random scenarios, offering a probabilistic distribution of potential outcomes. Scenario analysis evaluates valuation by assessing discrete, predefined situations reflecting different assumptions or conditions. Both methods enhance traditional valuation techniques by addressing uncertainty and variability in financial forecasts.

What is Monte Carlo Simulation?

Monte Carlo simulation is a quantitative risk analysis technique that uses repeated random sampling to model the probability distribution of possible outcomes in valuation. It generates thousands of potential scenarios by varying input variables simultaneously based on their probability distributions, providing a comprehensive view of risk and uncertainty. This method delivers a probabilistic range of valuations, enabling more informed decision-making under uncertainty.

Understanding Scenario Analysis

Scenario analysis evaluates possible future outcomes by examining discrete, predefined states of the world, offering clear insights into specific risks and opportunities. It relies on structured sets of assumptions to test the impact of changes in key variables on valuation, providing a straightforward framework for decision-making under uncertainty. This method contrasts with Monte Carlo simulation's probabilistic approach by emphasizing distinct, plausible scenarios rather than a continuous range of outcomes.

Key Differences between Monte Carlo Simulation and Scenario Analysis

Monte Carlo simulation uses probabilistic models to generate a wide range of potential outcomes by running thousands of random simulations, capturing the overall distribution of possible values. Scenario analysis evaluates specific discrete cases, focusing on predetermined conditions to assess impacts under defined assumptions. Monte Carlo provides a comprehensive risk assessment by modeling variability and uncertainty, while scenario analysis offers targeted insights into the effects of extreme or strategic events.

Advantages of Monte Carlo Simulation in Valuation

Monte Carlo simulation in valuation offers robust advantages by modeling a vast range of potential outcomes through probabilistic input variables, capturing uncertainty more comprehensively than scenario analysis. It generates detailed probability distributions for asset values, enhancing risk assessment and decision-making precision. This approach enables investors and analysts to account for complex interactions and nonlinearities in financial models, improving the accuracy and reliability of valuation results.

Benefits of Scenario Analysis for Decision Making

Scenario analysis enhances decision making by providing a clear understanding of potential outcomes under different business conditions, which helps in identifying risks and opportunities more intuitively. It allows decision-makers to model specific, plausible future states without requiring complex statistical assumptions, making results easier to communicate and interpret. By capturing qualitative insights and incorporating expert judgment, scenario analysis supports strategic planning with a focus on handling uncertainty and stress-testing key financial valuations.

Limitations of Monte Carlo Simulation

Monte Carlo simulation faces limitations such as high computational demand and sensitivity to input assumptions, which can lead to inaccurate valuation outcomes if probability distributions are poorly defined. It struggles with modeling rare events and structural breaks that scenario analysis can explicitly address. Dependency on extensive historical data also restricts its effectiveness in rapidly changing or unique market conditions.

Drawbacks of Scenario Analysis

Scenario analysis often suffers from limited scope, as it relies on a predefined set of outcomes that may not capture the full range of possible risks or market conditions. This approach can lead to biased valuation results due to its dependency on subjective judgment and expert assumptions. Unlike Monte Carlo simulation, scenario analysis lacks the ability to model continuous probability distributions and dynamic interactions among variables, restricting its usefulness in comprehensive valuation studies.

Choosing the Right Approach for Your Valuation

Monte Carlo simulation offers a robust probabilistic model that captures a wide range of potential outcomes by running thousands of randomized trials, making it ideal for valuations with complex uncertainties and non-linear risks. Scenario analysis provides a more straightforward framework by evaluating discrete, defined situations, which works best when key risk factors are limited and clearly understood. Selecting the right valuation approach hinges on the complexity of the asset, the availability of data, and the decision-maker's need for either comprehensive probabilistic insights or focused scenario-based stress tests.

Monte Carlo Simulation vs Scenario Analysis: Practical Examples

Monte Carlo simulation enhances valuation by running thousands of random variable iterations to generate probability distributions for potential outcomes, offering a granular risk assessment compared to scenario analysis's fixed-case approach. Scenario analysis evaluates discrete, predefined situations like economic downturns or regulatory changes to estimate valuation impacts under specific assumptions. For example, Monte Carlo simulation can model stock price fluctuations with variable volatility and drift, producing a comprehensive value-at-risk estimate, while scenario analysis might assess valuation solely based on a recession scenario and a growth scenario.

Important Terms

Stochastic Modeling

Stochastic modeling uses Monte Carlo simulation to generate probabilistic outcomes by random sampling, while scenario analysis evaluates predefined, distinct possibilities to assess impacts under specific conditions.

Sensitivity Analysis

Sensitivity analysis using Monte Carlo simulation quantifies output variability by probabilistically varying multiple input parameters simultaneously, while scenario analysis evaluates outcomes under defined, discrete sets of input assumptions to assess specific risk scenarios.

Probabilistic Forecasting

Probabilistic forecasting leverages Monte Carlo simulation to generate a wide range of outcomes based on random sampling, offering detailed probability distributions, while scenario analysis examines a limited set of predefined conditions to assess potential impacts under specific assumptions.

Deterministic Scenario Design

Deterministic Scenario Design involves creating fixed, predefined scenarios to analyze system behavior without random variation, contrasting with Monte Carlo simulation which relies on probabilistic sampling to model uncertainty. Scenario analysis uses these deterministic scenarios to evaluate potential outcomes, focusing on specific, plausible events rather than the broad statistical distributions generated by Monte Carlo methods.

Value-at-Risk (VaR)

Monte Carlo simulation provides probabilistic Value-at-Risk (VaR) estimates by generating numerous random market scenarios, while scenario analysis offers VaR insights based on specific, predefined economic conditions.

Random Variable Sampling

Random variable sampling in Monte Carlo simulation generates probabilistic outcomes by repeatedly sampling input distributions, whereas scenario analysis evaluates specific predefined cases without probabilistic variation.

Discrete Event Simulation

Discrete Event Simulation models dynamic systems by simulating individual events over time, while Monte Carlo simulation uses probabilistic sampling for risk assessment, and scenario analysis evaluates distinct, predefined future states to support strategic decision-making.

Correlation Structures

Monte Carlo simulation leverages random sampling to model correlation structures dynamically, while scenario analysis uses static, predefined correlation matrices to assess potential outcomes.

Stress Testing

Monte Carlo simulation provides probabilistic risk assessment through random sampling, while scenario analysis evaluates specific hypothetical events to analyze stress testing outcomes.

Path Dependency

Path dependency significantly influences Monte Carlo simulation outcomes by capturing sequential event dependencies, whereas scenario analysis evaluates discrete, predefined future states without accounting for historical event trajectories.

Monte Carlo simulation vs scenario analysis Infographic

moneydif.com

moneydif.com