Discounted Cash Flow (DCF) valuation calculates an asset's intrinsic value by forecasting its future cash flows and discounting them to present value, emphasizing long-term profitability and risk. Relative valuation compares a company's valuation multiples, such as P/E or EV/EBITDA, against peers or industry benchmarks to determine if it is undervalued or overvalued. The choice between DCF and relative valuation depends on data availability, industry dynamics, and the need for intrinsic versus market-based valuation insights.

Table of Comparison

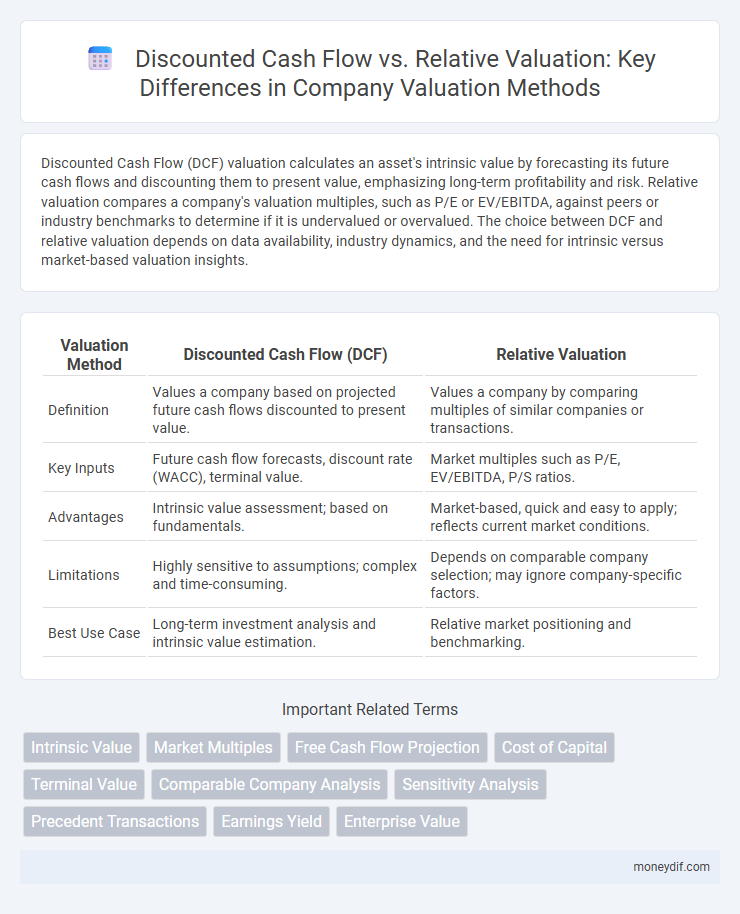

| Valuation Method | Discounted Cash Flow (DCF) | Relative Valuation |

|---|---|---|

| Definition | Values a company based on projected future cash flows discounted to present value. | Values a company by comparing multiples of similar companies or transactions. |

| Key Inputs | Future cash flow forecasts, discount rate (WACC), terminal value. | Market multiples such as P/E, EV/EBITDA, P/S ratios. |

| Advantages | Intrinsic value assessment; based on fundamentals. | Market-based, quick and easy to apply; reflects current market conditions. |

| Limitations | Highly sensitive to assumptions; complex and time-consuming. | Depends on comparable company selection; may ignore company-specific factors. |

| Best Use Case | Long-term investment analysis and intrinsic value estimation. | Relative market positioning and benchmarking. |

Introduction to Valuation Methods

Discounted Cash Flow (DCF) valuation estimates a company's intrinsic value by forecasting its future cash flows and discounting them to their present value using a suitable discount rate. Relative valuation, on the other hand, assesses a company's worth by comparing valuation multiples such as P/E or EV/EBITDA against peer companies within the same industry. Both methods provide complementary perspectives for investors seeking to determine fair value and inform investment decisions.

Understanding Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) valuation estimates the present value of a company's expected future cash flows using a discount rate reflecting the investment's risk. It requires detailed financial projections and assumptions about revenue growth, capital expenditures, and the weighted average cost of capital (WACC). DCF provides an intrinsic valuation based on fundamental performance rather than market comparisons, making it essential for long-term investment decisions.

Fundamentals of Relative Valuation

Relative valuation relies on comparing a company's financial metrics, such as price-to-earnings (P/E) and enterprise value-to-EBITDA (EV/EBITDA) ratios, to those of peer companies within the same industry. This approach assumes that similar companies should trade at similar multiples, reflecting market consensus on growth prospects, risk profiles, and profitability. Its effectiveness depends on selecting appropriate comparable firms and understanding market conditions influencing relative pricing.

Key Assumptions in DCF Analysis

Key assumptions in Discounted Cash Flow (DCF) analysis include projected free cash flows, the discount rate reflecting the weighted average cost of capital (WACC), and the terminal growth rate. Accurate forecasts of revenue growth, operating margins, and capital expenditures are critical for reliable valuation outcomes. Sensitivity to these assumptions can significantly impact the intrinsic valuation compared to relative valuation methods, which rely on market comparables and multiples.

Critical Metrics in Relative Valuation

Critical metrics in Relative Valuation include Price-to-Earnings (P/E) ratio, Enterprise Value-to-EBITDA (EV/EBITDA), and Price-to-Book (P/B) ratio, which enable direct comparison of a company's market value against peers. These metrics provide insight into market expectations, profitability, and asset efficiency without relying on future cash flow projections. Analysts prioritize these metrics to quickly assess relative undervaluation or overvaluation within industry segments.

Strengths and Weaknesses of DCF

Discounted Cash Flow (DCF) valuation excels in capturing intrinsic company value by projecting future cash flows and discounting them to present value, providing a detailed, forward-looking analysis. Its accuracy depends heavily on the quality of assumptions regarding growth rates, discount rates, and cash flow projections, making it sensitive to estimation errors and subjective inputs. Unlike Relative Valuation, DCF is less influenced by current market conditions, offering a fundamental perspective but requiring comprehensive financial data and rigorous modeling expertise.

Pros and Cons of Relative Valuation

Relative valuation offers a straightforward and market-based approach by comparing a company's valuation multiples, such as P/E or EV/EBITDA, against peer firms, making it useful for quickly assessing relative attractiveness. It is less reliant on forecasting assumptions than Discounted Cash Flow (DCF) analysis, reducing the risk of errors stemming from inaccurate cash flow or discount rate estimates. However, relative valuation can be limited by market inefficiencies, peer group selection bias, and the potential for mispricing if comparable companies differ significantly in growth prospects or risk profiles.

When to Use DCF vs Relative Valuation

Discounted Cash Flow (DCF) is ideal for valuing companies with predictable and stable cash flows, such as utilities or mature businesses, where future cash flow projections can be reliably estimated. Relative Valuation suits companies operating in competitive markets with numerous peers, enabling comparison using multiples like P/E or EV/EBITDA to assess relative market value. DCF offers intrinsic value based on fundamentals, while Relative Valuation reflects market sentiment and industry trends, making the choice dependent on data availability and company characteristics.

Common Pitfalls in Valuation Approaches

Discounted Cash Flow (DCF) valuation risks include overestimating future cash flows and selecting inappropriate discount rates, leading to inflated asset values. Relative valuation pitfalls arise from relying on comparable companies that may differ significantly in growth, risk, or capital structure, distorting multiples. Both methods require careful scrutiny of assumptions and market conditions to avoid erroneous conclusions in investment decisions.

Conclusion: Choosing the Right Valuation Method

Discounted Cash Flow (DCF) provides a detailed intrinsic valuation based on future cash flow projections, ideal for companies with predictable earnings. Relative Valuation offers a market-comparable approach using multiples like P/E or EV/EBITDA, suitable for benchmarking within industry peers. Selecting the right valuation method depends on the availability of reliable financial forecasts and market comparables relevant to the specific company and industry context.

Important Terms

Intrinsic Value

Intrinsic value represents the true worth of an asset based on its expected future cash flows, often calculated using Discounted Cash Flow (DCF) analysis that discounts projected earnings to present value. Relative valuation compares an asset's value to similar companies or assets using multiples like P/E or EV/EBITDA, which may not capture intrinsic worth as accurately as DCF's focus on fundamental cash flow generation.

Market Multiples

Market multiples provide a quick relative valuation metric by comparing a company's financial ratios to peers, while discounted cash flow analyzes intrinsic value through projected future cash flows.

Free Cash Flow Projection

Free Cash Flow Projection is crucial for Discounted Cash Flow valuation as it estimates future cash flows to determine intrinsic value, while Relative Valuation compares market multiples without directly accounting for cash flow projections.

Cost of Capital

Cost of capital directly impacts discounted cash flow valuations by determining the discount rate, while relative valuation relies on market multiples that indirectly reflect the cost of capital through investor expectations.

Terminal Value

Terminal value in discounted cash flow captures future cash flows beyond the forecast horizon, providing a comprehensive valuation often contrasted with relative valuation's market-based multiples.

Comparable Company Analysis

Comparable Company Analysis leverages relative valuation by assessing key financial multiples like EV/EBITDA or P/E ratios of similar firms to estimate a target company's market value, providing a market-driven benchmark. Discounted Cash Flow (DCF) valuation, in contrast, focuses on intrinsic value by projecting a company's future free cash flows and discounting them to present value using an appropriate weighted average cost of capital (WACC).

Sensitivity Analysis

Sensitivity analysis in discounted cash flow (DCF) models quantifies the impact of variable changes on intrinsic valuation, offering deeper insights than relative valuation, which relies primarily on market multiples and peer comparisons.

Precedent Transactions

Precedent transactions analysis derives valuation benchmarks from historical M&A deals, reflecting control premiums and market sentiment, while Discounted Cash Flow (DCF) valuation calculates intrinsic value based on projected free cash flows discounted at the weighted average cost of capital (WACC). Relative valuation compares a company's key financial multiples, such as EV/EBITDA or P/E ratios, against peer group averages to estimate value, whereas precedent transactions capture transaction-specific premiums and synergies often absent in relative metrics.

Earnings Yield

Earnings yield offers a key metric for comparing Discounted Cash Flow valuations, which focus on intrinsic value through future cash flows, against Relative Valuation methods that benchmark a company's value to its peers using market multiples.

Enterprise Value

Enterprise Value is calculated using Discounted Cash Flow by forecasting free cash flows and applying a discount rate, while Relative Valuation determines it by comparing valuation multiples of similar companies.

Discounted Cash Flow vs Relative Valuation Infographic

moneydif.com

moneydif.com