Economic Value Added (EVA) measures a company's financial performance by calculating the value created beyond the required return of its shareholders, emphasizing operational efficiency and capital cost. Market Value Added (MVA) represents the difference between the market value of a company and the capital invested by shareholders, reflecting investor perceptions and growth potential. While EVA focuses on internal value generation, MVA captures the external market assessment of the company's overall worth.

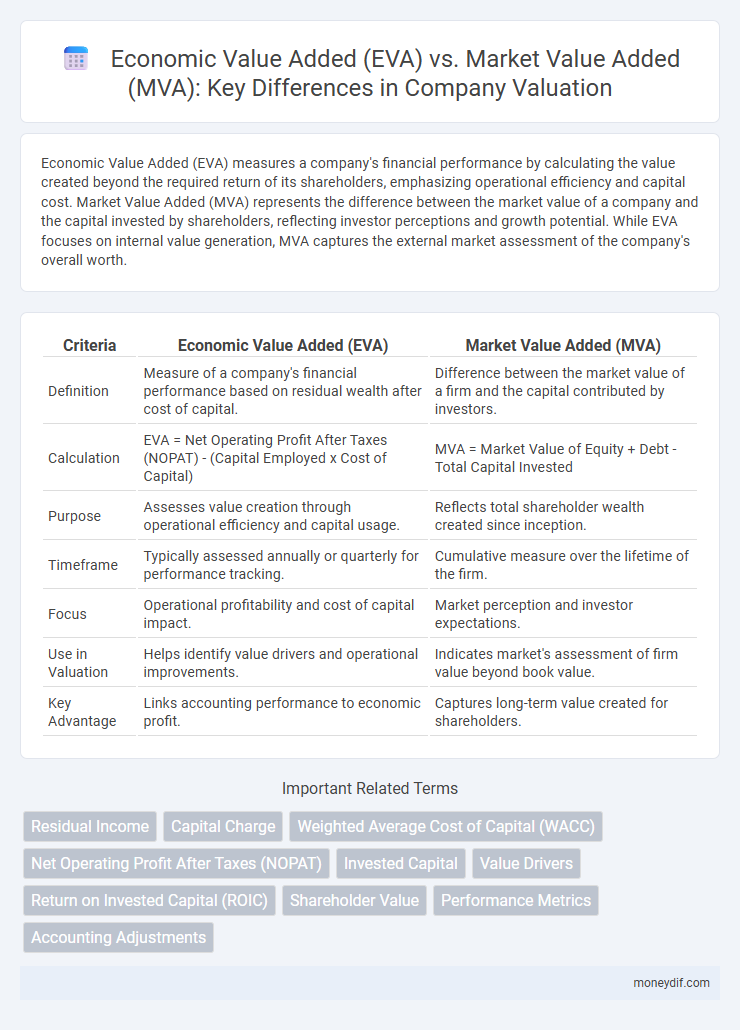

Table of Comparison

| Criteria | Economic Value Added (EVA) | Market Value Added (MVA) |

|---|---|---|

| Definition | Measure of a company's financial performance based on residual wealth after cost of capital. | Difference between the market value of a firm and the capital contributed by investors. |

| Calculation | EVA = Net Operating Profit After Taxes (NOPAT) - (Capital Employed x Cost of Capital) | MVA = Market Value of Equity + Debt - Total Capital Invested |

| Purpose | Assesses value creation through operational efficiency and capital usage. | Reflects total shareholder wealth created since inception. |

| Timeframe | Typically assessed annually or quarterly for performance tracking. | Cumulative measure over the lifetime of the firm. |

| Focus | Operational profitability and cost of capital impact. | Market perception and investor expectations. |

| Use in Valuation | Helps identify value drivers and operational improvements. | Indicates market's assessment of firm value beyond book value. |

| Key Advantage | Links accounting performance to economic profit. | Captures long-term value created for shareholders. |

Introduction to Economic Value Added (EVA) and Market Value Added (MVA)

Economic Value Added (EVA) measures a company's financial performance by calculating the value created beyond the required return on its capital, highlighting true economic profit. Market Value Added (MVA) represents the difference between the company's market value and the capital invested by shareholders, reflecting overall value creation for investors. Both EVA and MVA are critical valuation metrics used to assess management effectiveness and long-term shareholder wealth.

Defining Economic Value Added: Key Concepts

Economic Value Added (EVA) measures a company's financial performance by calculating the residual profit after deducting the cost of capital from net operating profit after taxes (NOPAT). It reflects the true economic profit, indicating whether the firm generates value beyond its capital costs. Unlike Market Value Added (MVA), which represents the difference between the market value of a company and the capital invested by shareholders, EVA provides a direct assessment of operational efficiency and value creation.

Understanding Market Value Added: Core Principles

Market Value Added (MVA) measures the difference between a company's market value and the capital invested by shareholders and debt holders, reflecting the wealth created beyond the invested capital. It focuses on market perceptions and expectations, capturing the present value of future economic profits rather than accounting earnings. This metric complements Economic Value Added (EVA) by highlighting investor confidence and market-generated value over time.

Calculation Methods: EVA vs MVA

Economic Value Added (EVA) calculates value by subtracting the company's cost of capital from its net operating profit after taxes (NOPAT), emphasizing operational efficiency and capital costs. Market Value Added (MVA) measures the difference between the company's market capitalization and total capital invested, reflecting investor perception and market performance. EVA uses accounting data to assess internal profitability, while MVA relies on market data to evaluate overall shareholder wealth creation.

Interpretation of EVA in Corporate Performance

Economic Value Added (EVA) measures a company's true economic profit by calculating net operating profit after taxes minus a charge for capital employed, providing insight into value creation beyond accounting profits. Unlike Market Value Added (MVA), which reflects the market's assessment of a company's total value over invested capital, EVA focuses on operational efficiency and capital costs, highlighting how effectively management generates returns above required thresholds. Interpreting EVA in corporate performance allows stakeholders to assess whether management's decisions are generating sustainable shareholder value and improving operational effectiveness.

MVA as a Measure of Shareholder Wealth Creation

Market Value Added (MVA) measures the difference between a company's market value and the capital invested by shareholders, reflecting the wealth created above the invested capital. It serves as a key indicator of shareholder value creation by capturing the market's assessment of the firm's cumulative profitability and growth potential. Unlike Economic Value Added (EVA), which focuses on current operational performance, MVA provides a long-term perspective on how effectively management has increased investor wealth.

EVA vs MVA: Comparative Analysis

Economic Value Added (EVA) measures a company's true economic profit by subtracting the cost of capital from net operating profit after taxes, emphasizing value creation from operational efficiency. Market Value Added (MVA) reflects the difference between the market value of a firm and the capital invested by shareholders, capturing investor expectations and market perception of future growth. EVA provides insight into internal performance and capital cost management, while MVA offers a broader perspective on market valuation and shareholder wealth generation.

Real-world Applications of EVA and MVA

Economic Value Added (EVA) is extensively used in corporate finance to measure a company's true economic profit by deducting the cost of capital from net operating profit after taxes, guiding management decisions on performance improvement and resource allocation. Market Value Added (MVA) reflects the market's perception of a firm's value creation, calculated as the difference between the market value of a company and the capital invested by shareholders, serving as a key indicator for investors evaluating long-term growth potential. Real-world application of EVA and MVA is evident in performance-based compensation schemes, strategic investment decisions, and shareholder communication, enhancing transparency and aligning management objectives with shareholder value creation.

Limitations and Challenges of EVA and MVA

Economic Value Added (EVA) faces limitations in accurately capturing a company's true economic profit due to reliance on subjective adjustments to accounting data, which can distort the cost of capital and capital charges. Market Value Added (MVA) challenges include its sensitivity to market fluctuations and investor sentiment, making it less reliable as an indicator of long-term value creation. Both EVA and MVA require careful interpretation since EVA may overlook intangible assets, while MVA's dependence on market conditions can result in valuation volatility.

Choosing Between EVA and MVA: Strategic Implications

Choosing between Economic Value Added (EVA) and Market Value Added (MVA) hinges on a firm's strategic focus; EVA provides a precise measure of internal financial performance by accounting for the cost of capital, aiding operational improvements and value creation. MVA reflects the market's perception of a company's long-term value, integrating external expectations and investor sentiment, thus guiding strategic decisions related to market positioning and growth potential. Firms prioritizing short-term performance management lean toward EVA, while those aiming to enhance shareholder wealth and market valuation emphasize MVA.

Important Terms

Residual Income

Residual Income measures the net operating profit after deducting the cost of capital, serving as the basis for Economic Value Added (EVA), which quantifies value created beyond required returns. Market Value Added (MVA) represents the difference between a firm's market value and invested capital, reflecting shareholder wealth generated through sustained positive residual income and EVA performance.

Capital Charge

Capital charge represents the dollar amount of capital cost required to fund a business's operations, serving as a benchmark in Economic Value Added (EVA) calculations by subtracting this charge from net operating profit after taxes (NOPAT) to determine value creation. Market Value Added (MVA) differs by measuring the difference between the company's market value and the total capital invested, reflecting the cumulative value generated above the capital charge over time.

Weighted Average Cost of Capital (WACC)

Weighted Average Cost of Capital (WACC) serves as a critical benchmark in calculating Economic Value Added (EVA), which measures a company's true economic profit, while Market Value Added (MVA) reflects the market's valuation of a firm's cumulative EVA relative to invested capital.

Net Operating Profit After Taxes (NOPAT)

Net Operating Profit After Taxes (NOPAT) measures a company's operating efficiency and is fundamental in calculating Economic Value Added (EVA), which represents value created above the firm's cost of capital, while Market Value Added (MVA) reflects the difference between the company's market value and invested capital, indicating overall market perception of value creation.

Invested Capital

Invested Capital represents the total funds deployed in a business to generate Economic Value Added (EVA), which measures the firm's true economic profit, while Market Value Added (MVA) reflects the market's assessment of a company's value creation above the invested capital.

Value Drivers

Value Drivers such as Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) directly impact Economic Value Added (EVA) by measuring the company's efficiency in generating profit above its cost of capital, while Market Value Added (MVA) reflects investors' perception of value created beyond the book value of invested capital. Focusing on improving EVA through operational performance and capital efficiency ultimately drives MVA growth by enhancing shareholder wealth and market valuation.

Return on Invested Capital (ROIC)

Return on Invested Capital (ROIC) measures a company's efficiency at generating profits from its invested capital, directly influencing Economic Value Added (EVA) by quantifying the net value created above the cost of capital. Market Value Added (MVA) reflects the difference between the company's market value and the capital invested by shareholders, with sustained ROIC exceeding the weighted average cost of capital (WACC) driving positive EVA and increasing MVA.

Shareholder Value

Shareholder Value is enhanced when Economic Value Added (EVA) surpasses the cost of capital, indicating that a company generates returns above its capital expenses. Market Value Added (MVA) reflects the difference between a firm's market value and the invested capital, capturing investor perceptions of future EVA growth and overall corporate performance.

Performance Metrics

Performance metrics such as Economic Value Added (EVA) focus on measuring a company's true economic profit by deducting the cost of capital from net operating profit after taxes, while Market Value Added (MVA) represents the difference between the firm's market value and the invested capital, reflecting shareholder wealth creation. EVA provides a clear indication of operational efficiency and value generation, whereas MVA captures the market's overall perception of a company's financial performance and long-term growth prospects.

Accounting Adjustments

Accounting adjustments reconcile reported financial data to accurately measure Economic Value Added as the net operating profit after taxes minus capital charges, which contrasts with Market Value Added that reflects the difference between a company's market capitalization and the book value of invested capital.

Economic Value Added vs Market Value Added Infographic

moneydif.com

moneydif.com