The Rule of Thumb in valuation relies on simple, industry-specific multiples derived from comparable companies, offering quick estimates with limited customization. The Guideline Public Company Method, however, involves a detailed analysis of publicly traded peers, adjusting for differences in size, growth, and risk to provide a more precise and market-reflective valuation. This method is preferred for its systematic approach and relevance in capturing current market conditions.

Table of Comparison

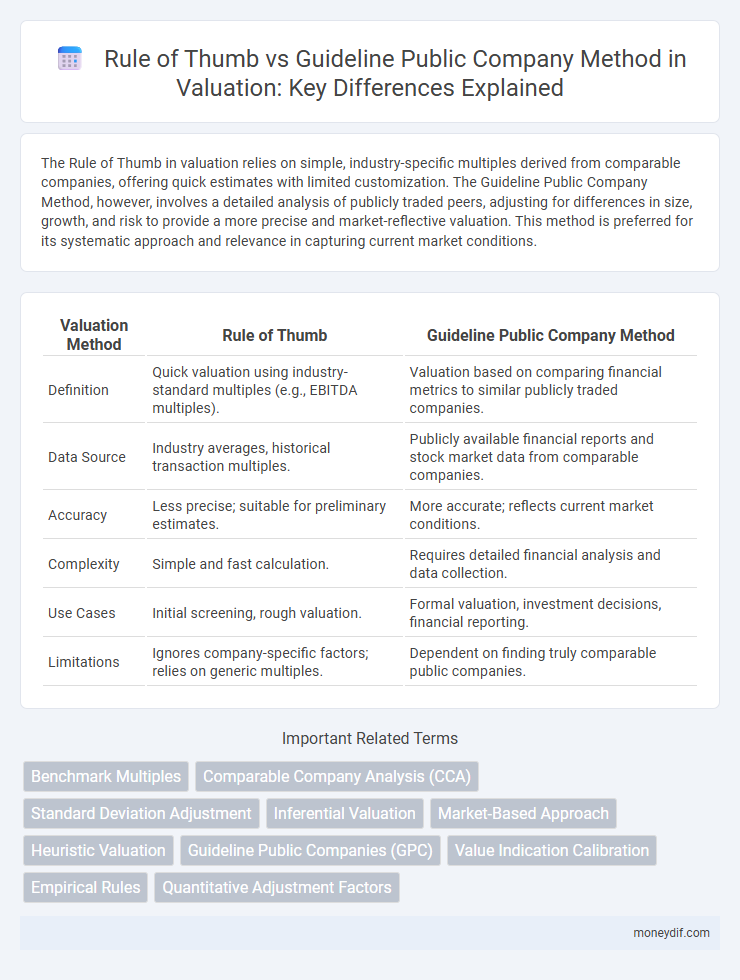

| Valuation Method | Rule of Thumb | Guideline Public Company Method |

|---|---|---|

| Definition | Quick valuation using industry-standard multiples (e.g., EBITDA multiples). | Valuation based on comparing financial metrics to similar publicly traded companies. |

| Data Source | Industry averages, historical transaction multiples. | Publicly available financial reports and stock market data from comparable companies. |

| Accuracy | Less precise; suitable for preliminary estimates. | More accurate; reflects current market conditions. |

| Complexity | Simple and fast calculation. | Requires detailed financial analysis and data collection. |

| Use Cases | Initial screening, rough valuation. | Formal valuation, investment decisions, financial reporting. |

| Limitations | Ignores company-specific factors; relies on generic multiples. | Dependent on finding truly comparable public companies. |

Introduction to Valuation Approaches

The Rule of Thumb valuation method relies on industry-specific metrics and simplified formulas, providing quick estimates based on comparable companies or historical transactions. The Guideline Public Company Method (GPCM) uses market data from publicly traded companies with similar operational and financial characteristics to derive valuation multiples such as EV/EBITDA or P/E ratios. Both approaches serve as foundational tools in introductory valuation, leveraging market comparables to estimate business value efficiently.

Defining Rule of Thumb in Valuation

Rule of thumb in valuation refers to simplified, experience-based estimates used to approximate a company's value quickly, typically expressed as a multiple of revenue, earnings, or EBITDA. This method offers a practical shortcut without extensive financial analysis, often relying on industry standards or historical averages. Unlike the guideline public company method, which uses detailed financial comparisons to publicly traded peers, the rule of thumb provides a broad, less precise valuation benchmark.

Understanding the Guideline Public Company Method

The Guideline Public Company Method values a target company by comparing it to similar publicly traded companies using key financial metrics such as price-to-earnings or enterprise value-to-EBITDA multiples. This approach relies on the assumption that market valuations of comparable companies reflect proper risk and growth expectations, providing a market-based benchmark for valuation. It offers objectivity and market-based evidence, making it preferable for valuations requiring greater accuracy than generic rule-of-thumb multiples.

Key Differences: Rule of Thumb vs Guideline Public Company

The Rule of Thumb valuation relies on industry-specific multiples derived from historical transactions or earnings, providing quick estimates but lacking customization for company-specific factors. In contrast, the Guideline Public Company Method involves analyzing publicly traded companies with similar characteristics, using market data to derive valuation multiples that reflect current investor sentiment and market conditions. Key differences include the Rule of Thumb's simplicity and generality versus the Guideline Public Company Method's data-driven precision and relevance to market fluctuations.

Data Sources: Rules of Thumb and Public Comparables

Rules of Thumb in valuation rely primarily on industry-specific multiples derived from historical transaction data and expert consensus, offering quick, approximate estimates without deep analytical rigor. The Guideline Public Company Method leverages real-time market data from actively traded comparable public companies, using standardized financial metrics to provide more precise valuation benchmarks. Each method's data sources differ in reliability and granularity, with Rules of Thumb offering broad heuristics, while Public Comparables deliver market-driven, data-rich insights critical for nuanced valuation analyses.

When to Use Rule of Thumb Valuation

Rule of Thumb valuation is most effective for small businesses in industries with well-established market multiples, offering quick, rough estimates based on common financial metrics like revenue or EBITDA. This method is suitable when time constraints or limited data prevent a full appraisal, providing a straightforward benchmark for initial pricing discussions. It is less accurate than the Guideline Public Company Method, which relies on detailed analysis of comparable public firms and is preferred for larger companies or more precise valuation needs.

Applicability of the Guideline Public Company Method

The Guideline Public Company Method (GPCM) is most applicable when valuing private companies that have similar operational, financial, and market characteristics to publicly traded firms, allowing for relevant comparative multiples. This method relies on analyzing market data from guideline companies to estimate value, making it especially useful in industries with active and transparent public markets. It is less suitable for unique or niche businesses lacking comparable public entities, where the Rule of Thumb might provide a quicker, though less precise, valuation benchmark.

Pros and Cons of Rule of Thumb Approach

The Rule of Thumb approach offers simplicity and quick valuation using industry-specific multiples derived from comparable companies, making it accessible for preliminary assessments. However, this method can lack precision due to its generalized nature and potential failure to account for unique company factors such as growth prospects, profitability variations, and market conditions. Reliance on Rule of Thumb may lead to overvaluation or undervaluation compared to the more detailed and context-sensitive Guideline Public Company Method.

Strengths and Limitations of the Guideline Public Company Method

The Guideline Public Company Method (GPCM) offers a market-based valuation by comparing the target firm to similar publicly traded companies, providing relevant benchmarks and reflecting current market conditions. Its strengths include the use of readily available financial data and the incorporation of market sentiment, enhancing valuation accuracy for firms with comparable public peers. Limitations arise from the challenge of finding truly comparable companies, potential distortions due to market volatility, and the method's reduced applicability to unique or niche businesses lacking public equivalents.

Selecting the Appropriate Method for Your Valuation

Selecting the appropriate valuation method depends on the specific characteristics and objectives of the business being valued. The Rule of Thumb method offers a simplified, industry-specific estimate useful for quick approximations, while the Guideline Public Company Method provides a more rigorous, market-based approach by comparing financial metrics to publicly traded companies. Choosing between these methods requires evaluating the availability of relevant data, the business's size, and the desired accuracy of the valuation result.

Important Terms

Benchmark Multiples

Benchmark multiples in the Rule of Thumb method rely on industry averages for quick valuation estimates, while the Guideline Public Company Method uses market-derived multiples from comparable publicly traded companies to provide more precise and context-specific business valuations.

Comparable Company Analysis (CCA)

Comparable Company Analysis (CCA) uses the Guideline Public Company Method to provide market-based valuation benchmarks, differing from Rule of Thumb approaches by relying on systematically selected peer groups and financial multiples for greater accuracy.

Standard Deviation Adjustment

Standard Deviation Adjustment refines financial benchmarks by quantifying data dispersion, enhancing accuracy beyond the Rule of Thumb's rough estimates by incorporating variability measures. The Guideline Public Company Method leverages adjusted standard deviations to compare target firms against a statistically robust set of publicly traded peers, improving valuation precision.

Inferential Valuation

Inferential valuation differentiates Rule of Thumb, a simplified heuristic based on general market multiples, from the Guideline Public Company Method, which applies detailed financial metrics from comparable publicly traded companies to estimate more precise company value.

Market-Based Approach

The Market-Based Approach evaluates asset value by comparing it to similar public companies, with the Rule of Thumb providing quick valuation estimates and the Guideline Public Company Method offering more precise, data-driven market multiples.

Heuristic Valuation

Heuristic valuation using the Rule of Thumb offers simplified, experience-based estimates for public company value, while the Guideline Public Company Method relies on systematically comparing financial multiples to similar companies for more precise valuation.

Guideline Public Companies (GPC)

The Guideline Public Company Method estimates business value by comparing financial metrics of similar public companies, offering greater accuracy than the Rule of Thumb approach, which relies on general industry heuristics.

Value Indication Calibration

Value Indication Calibration using the Public Company Method relies on guidelines for preliminary asset valuation while the Rule of Thumb provides simplified heuristics for quick estimates lacking detailed market data.

Empirical Rules

Empirical rules, such as the Rule of Thumb and Guideline Public Company Method, serve as practical valuation techniques in finance, with the Rule of Thumb relying on simplified benchmarks and the Guideline Public Company Method utilizing market data from comparable publicly traded companies to estimate value. These approaches help investors and analysts quickly approximate asset or company worth by leveraging historical trends and peer comparisons respectively.

Quantitative Adjustment Factors

Quantitative Adjustment Factors in the Guideline Public Company Method typically refine valuation accuracy by incorporating market-based multiples, while Rule of Thumb methods apply simplified, generalized multipliers often lacking precise market alignment.

Rule of Thumb vs Guideline Public Company Method Infographic

moneydif.com

moneydif.com