WACC (Weighted Average Cost of Capital) represents the average rate a company is expected to pay to finance its assets, combining the costs of debt and equity weighted by their respective proportions in the capital structure. Cost of Equity specifically measures the return required by equity investors based on the risk of the investment in the company's equity. Valuation decisions often weigh WACC to assess overall capital cost, while Cost of Equity is crucial for evaluating equity returns and investment risk individually.

Table of Comparison

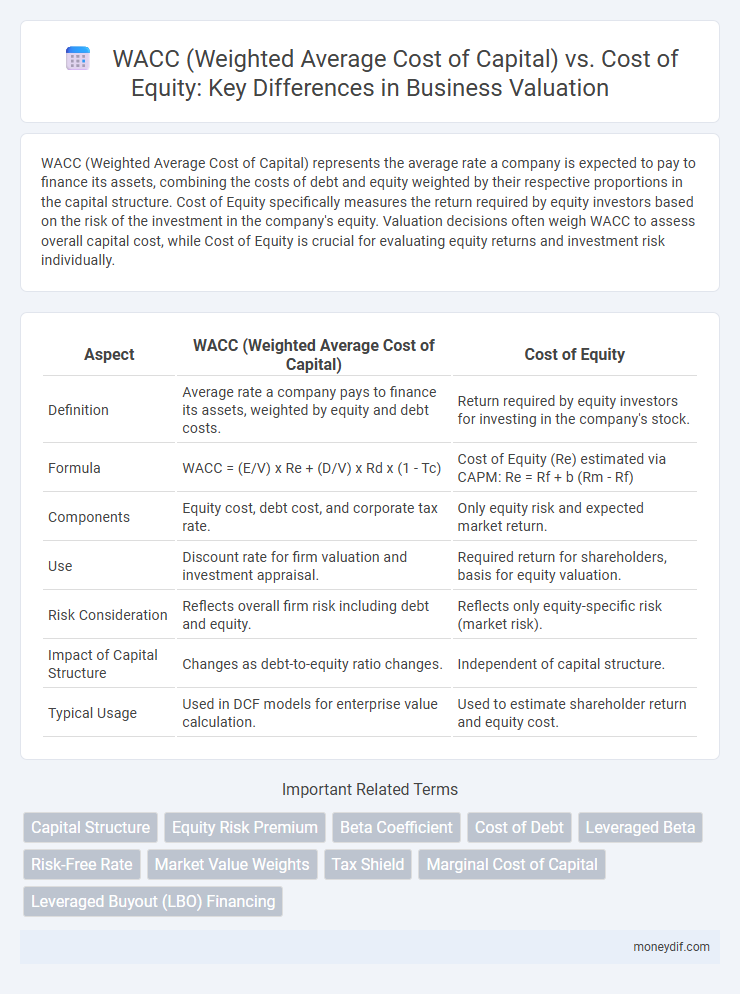

| Aspect | WACC (Weighted Average Cost of Capital) | Cost of Equity |

|---|---|---|

| Definition | Average rate a company pays to finance its assets, weighted by equity and debt costs. | Return required by equity investors for investing in the company's stock. |

| Formula | WACC = (E/V) x Re + (D/V) x Rd x (1 - Tc) | Cost of Equity (Re) estimated via CAPM: Re = Rf + b (Rm - Rf) |

| Components | Equity cost, debt cost, and corporate tax rate. | Only equity risk and expected market return. |

| Use | Discount rate for firm valuation and investment appraisal. | Required return for shareholders, basis for equity valuation. |

| Risk Consideration | Reflects overall firm risk including debt and equity. | Reflects only equity-specific risk (market risk). |

| Impact of Capital Structure | Changes as debt-to-equity ratio changes. | Independent of capital structure. |

| Typical Usage | Used in DCF models for enterprise value calculation. | Used to estimate shareholder return and equity cost. |

Introduction to Valuation: The Role of Discount Rates

Weighted Average Cost of Capital (WACC) reflects a firm's average cost to finance its assets, blending the cost of equity and debt weighted by their respective proportions in the capital structure. Cost of Equity represents the return required by equity investors, accounting for the risk of owning the company's stock without considering debt obligations. In valuation, WACC serves as the primary discount rate for cash flows to the firm, while Cost of Equity is used to discount cash flows to equity holders, highlighting their critical roles in determining present values and investment decisions.

Defining WACC: Components and Calculation

WACC (Weighted Average Cost of Capital) represents a firm's overall cost of financing, encompassing the cost of equity, cost of debt, and cost of preferred stock, each weighted by their respective proportions in the company's capital structure. The cost of equity reflects the return expected by equity investors, typically estimated using models like CAPM, while the cost of debt is derived from the after-tax interest rates on company bonds. Calculating WACC involves multiplying each component's cost by its capital weight, ensuring a comprehensive measure of the average rate the company must pay to finance its assets.

Understanding the Cost of Equity

The Cost of Equity represents the return that equity investors require on their investment in a firm, reflecting the risk associated with the company's stock. It is a critical component in valuation models and is used to discount future cash flows attributable to shareholders. Understanding the Cost of Equity helps investors assess whether a stock is fairly valued relative to its risk profile.

Key Differences Between WACC and Cost of Equity

WACC (Weighted Average Cost of Capital) represents the average rate a company is expected to pay to finance its assets, incorporating the cost of equity and the cost of debt weighted by their respective proportions in the capital structure. In contrast, the Cost of Equity reflects the return required by equity investors based solely on the company's equity risk, excluding debt financing impacts. The key difference lies in WACC accounting for both debt and equity costs for a holistic capital cost assessment, while Cost of Equity focuses exclusively on shareholder returns.

When to Use WACC in Valuation

WACC is crucial in valuation when assessing the overall cost of financing for a company with a mix of debt and equity, as it reflects the average rate that a firm is expected to pay to finance its assets. Use WACC in discounted cash flow (DCF) models to evaluate enterprise value because it accounts for the capital structure, unlike the cost of equity which only considers equity financing. WACC is most appropriate when valuing the entire firm, including debt holders and equity investors, rather than just equity shareholders.

When to Apply Cost of Equity in Valuation

Cost of Equity is applied in valuation when assessing the expected return required by equity investors, particularly in equity-financed projects or firms without significant debt. It is crucial for determining the fair value of common stock and for use in models like the Dividend Discount Model (DDM) or when calculating the equity portion of a firm's capital structure. In contrast, WACC is more appropriate when valuing the entire firm or projects funded by a mix of debt and equity, reflecting the average cost of capital from all sources.

Impact of Capital Structure on WACC and Cost of Equity

WACC reflects the overall cost of capital by combining the costs of equity and debt weighted by their proportions in the capital structure, directly influencing investment valuation and corporate finance decisions. Changes in capital structure, such as increased debt financing, generally lower WACC due to the tax deductibility of interest but raise the cost of equity as equity investors demand higher returns for increased financial risk. Understanding the dynamic interplay between debt levels and equity costs is crucial for optimizing capital structure to minimize WACC and maximize firm value.

Practical Examples: WACC vs Cost of Equity in Discounted Cash Flow (DCF)

In Discounted Cash Flow (DCF) analysis, WACC (Weighted Average Cost of Capital) represents the average rate a company is expected to pay to finance its assets, blending the cost of equity and cost of debt proportionately. For instance, a firm with 60% equity at 10% cost of equity and 40% debt at 5% cost of debt will have a WACC around 8%, which serves as the appropriate discount rate for the entire firm's cash flows. Conversely, when valuing only the equity portion, the cost of equity alone is used as the discount rate to reflect the risk borne solely by shareholders.

Common Mistakes in Applying WACC and Cost of Equity

Misapplying WACC often involves ignoring the appropriate market values for debt and equity, leading to inaccurate capital structure representation. A frequent error in estimating the cost of equity is relying solely on the Capital Asset Pricing Model (CAPM) without adjusting for company-specific risks or market anomalies. Overlooking the differential tax treatment between debt and equity financing skews WACC calculations, causing valuation biases in investment decisions.

Conclusion: Choosing the Right Discount Rate for Accurate Valuation

Selecting the appropriate discount rate hinges on the capital structure and risk profile of the investment, where WACC reflects the blended cost of all capital sources, including debt and equity, capturing overall firm risk. Cost of Equity focuses solely on equity risk, making it suitable for equity cash flows or leveraged buyouts but potentially overestimating risk for firm-wide valuation. Accurate valuation demands aligning the discount rate with the cash flow type and capital structure to ensure precision in investment appraisal and decision-making.

Important Terms

Capital Structure

Analyzing capital structure involves balancing debt and equity to minimize WACC, as an optimized WACC is typically lower than the standalone cost of equity, enhancing firm value.

Equity Risk Premium

The Equity Risk Premium directly influences the Cost of Equity, which in turn affects the Weighted Average Cost of Capital (WACC) by determining the portion of return required by equity investors above the risk-free rate.

Beta Coefficient

The beta coefficient measures a stock's volatility relative to the market and directly influences the cost of equity, which is a key component in calculating the Weighted Average Cost of Capital (WACC).

Cost of Debt

Cost of debt typically lowers the WACC due to tax deductibility of interest, making it cheaper than the cost of equity which demands higher returns for increased risk.

Leveraged Beta

Leveraged Beta reflects the increased risk of a firm's equity due to debt, influencing the Cost of Equity in the WACC calculation by adjusting for financial leverage.

Risk-Free Rate

The risk-free rate, often derived from government bond yields such as U.S. Treasury securities, serves as the baseline in calculating both the Weighted Average Cost of Capital (WACC) and the Cost of Equity, reflecting the minimum return investors expect without risk. In WACC, the risk-free rate forms a foundational component alongside market risk premiums and debt costs, whereas in Cost of Equity, it is combined with equity risk premiums to capture the expected returns demanded by equity investors.

Market Value Weights

Market Value Weights in WACC calculation reflect the proportion of each capital component based on its current market value, providing a realistic assessment of a firm's capital structure by emphasizing equity market capitalization and debt market prices. Cost of Equity represents the return required by equity investors, which, when weighted by market value, integrates with the cost of debt to accurately determine the firm's overall cost of capital for investment decision-making.

Tax Shield

Tax shield reduces WACC by lowering the effective cost of debt, making the overall capital structure more tax-efficient compared to relying solely on the cost of equity.

Marginal Cost of Capital

The Marginal Cost of Capital influences investment decisions by comparing the Weighted Average Cost of Capital (WACC), which reflects the overall cost of financing, against the Cost of Equity, representing the return required by shareholders.

Leveraged Buyout (LBO) Financing

Leveraged Buyout (LBO) financing strategically lowers the Weighted Average Cost of Capital (WACC) by increasing debt usage, which is typically cheaper than the cost of equity, thereby enhancing overall firm valuation and returns.

WACC (Weighted Average Cost of Capital) vs Cost of Equity Infographic

moneydif.com

moneydif.com