Levered Beta measures a company's risk including its debt, reflecting the impact of financial leverage on equity volatility, whereas Unlevered Beta isolates the business risk by removing the effects of leverage. Investors use Levered Beta to assess the sensitivity of a stock to market movements considering debt, while Unlevered Beta helps in comparing companies with different capital structures by focusing solely on operational risk. Understanding the difference between these two betas is crucial for accurate valuation, capital asset pricing, and making informed investment decisions.

Table of Comparison

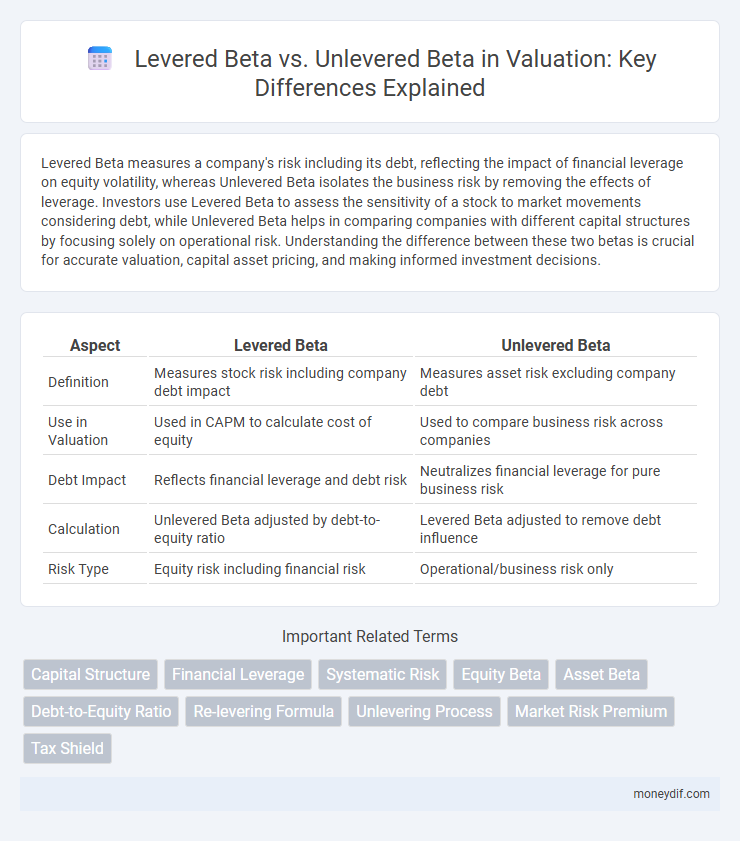

| Aspect | Levered Beta | Unlevered Beta |

|---|---|---|

| Definition | Measures stock risk including company debt impact | Measures asset risk excluding company debt |

| Use in Valuation | Used in CAPM to calculate cost of equity | Used to compare business risk across companies |

| Debt Impact | Reflects financial leverage and debt risk | Neutralizes financial leverage for pure business risk |

| Calculation | Unlevered Beta adjusted by debt-to-equity ratio | Levered Beta adjusted to remove debt influence |

| Risk Type | Equity risk including financial risk | Operational/business risk only |

Introduction to Beta in Valuation

Beta measures a stock's volatility relative to the overall market, capturing systematic risk essential in valuation models like the Capital Asset Pricing Model (CAPM). Levered beta reflects a company's capital structure by incorporating debt, showing risk exposure to equity holders, while unlevered beta isolates business risk by removing financial leverage effects. Understanding the distinction between levered and unlevered beta is crucial for accurate cost of equity estimation and firm valuation.

Understanding Levered Beta

Levered Beta measures a company's systematic risk, incorporating the impact of its capital structure, including debt, on volatility relative to the overall market. It reflects both business risk and financial risk, making it crucial for assessing equity risk in leveraged firms. Investors use Levered Beta to estimate the expected return on equity by adjusting for leverage effects in the Capital Asset Pricing Model (CAPM).

Understanding Unlevered Beta

Unlevered beta measures a company's systematic risk without the impact of debt, reflecting the inherent business risk of its assets. This metric isolates the risk attributable solely to the firm's operations by removing financial leverage, enabling clearer comparison across firms with different capital structures. Analysts use unlevered beta to assess risk for project evaluation and to calculate the cost of equity in valuation models, particularly when adjusting for changes in leverage.

Key Differences Between Levered and Unlevered Beta

Levered beta measures a stock's risk including the company's debt, reflecting the volatility of equity returns influenced by financial leverage. Unlevered beta removes the impact of debt, representing the asset's inherent business risk without financial leverage. The key difference lies in capital structure consideration: levered beta accounts for both equity and debt risk, while unlevered beta isolates market risk solely from the company's operations.

Calculating Levered Beta: Formula and Example

Levered beta is calculated using the formula Levered Beta = Unlevered Beta x [1 + (1 - Tax Rate) x (Debt/Equity)], which adjusts unlevered beta to reflect the company's debt level and financial risk. For example, a company with an unlevered beta of 0.8, a debt-to-equity ratio of 0.5, and a tax rate of 30% would have a levered beta of 0.8 x [1 + (1 - 0.3) x 0.5] = 1.08. This calculation captures the increased risk from leverage, providing a more accurate measure for equity risk and valuation models like CAPM.

Calculating Unlevered Beta: Formula and Example

Calculating unlevered beta involves removing the impact of debt from a company's levered beta to assess its risk independent of leverage. The formula is Unlevered Beta = Levered Beta / [1 + (1 - Tax Rate) x (Debt/Equity Ratio)]. For example, if a company has a levered beta of 1.2, a tax rate of 30%, and a debt-to-equity ratio of 0.5, the unlevered beta calculation is 1.2 / [1 + (1 - 0.3) x 0.5] = 0.96, indicating the firm's asset risk excluding financial leverage.

When to Use Levered Beta vs Unlevered Beta

Levered beta should be used when evaluating the risk of a company's equity, as it reflects both business risk and financial leverage, making it essential for equity valuation and cost of equity calculations. Unlevered beta is appropriate for assessing the inherent business risk of a company without the impact of debt, useful when comparing firms with different capital structures or estimating the beta for a project or asset. Choosing between levered and unlevered beta depends on whether the analysis focuses on the equity risk considering leverage effects or on the pure operational risk independent of capital structure.

Impact of Capital Structure on Beta Values

Levered Beta reflects a company's systematic risk including the impact of its capital structure by incorporating debt, whereas Unlevered Beta isolates the business risk by removing leverage effects. Changes in the debt-to-equity ratio significantly influence Levered Beta, increasing risk perception as financial leverage rises. Accurate valuation requires adjusting beta for capital structure to reflect true risk exposure in equity cost calculations.

Levered and Unlevered Beta in WACC and DCF Analysis

Levered beta reflects the risk of a company's equity that includes the impact of its capital structure, making it essential for calculating the cost of equity in WACC and DCF models. Unlevered beta removes the effects of debt, isolating the company's business risk, which is crucial for comparing firms with different leverage or when re-levering beta to a target capital structure. Accurate use of levered and unlevered beta in WACC ensures proper risk adjustment, directly influencing the discount rate and valuation outcomes in DCF analysis.

Common Mistakes and Best Practices

Confusing levered beta with unlevered beta often leads to inaccurate risk assessments, as levered beta reflects a company's capital structure including debt, while unlevered beta isolates business risk by excluding debt effects. A common mistake is using levered beta when comparing companies with different leverage levels, which distorts true operational risk comparisons. Best practices include consistently unlevering beta to assess business risk and relevering beta to a target capital structure for precise valuation adjustments.

Important Terms

Capital Structure

Levered beta measures a company's risk including debt impact, while unlevered beta reflects the firm's risk without debt, crucial for evaluating capital structure effects on equity volatility.

Financial Leverage

Financial leverage increases a company's levered beta by amplifying its exposure to market risk compared to its unlevered beta, which reflects the firm's inherent business risk without debt.

Systematic Risk

Levered Beta measures a stock's risk including debt impact, while Unlevered Beta reflects the firm's risk without debt, isolating business risk from financial leverage effects.

Equity Beta

Equity beta measures a company's stock volatility relative to the market, with levered beta reflecting both business and financial risk including debt, while unlevered beta isolates business risk by removing the impact of financial leverage.

Asset Beta

Asset Beta represents a company's risk independent of its capital structure, calculated by adjusting Levered Beta for the effects of debt to derive Unlevered Beta, which reflects the business risk without financial leverage.

Debt-to-Equity Ratio

The Debt-to-Equity Ratio directly influences Levered Beta by accounting for financial leverage, while Unlevered Beta reflects the company's asset risk excluding debt impact.

Re-levering Formula

Re-levering Formula calculates Levered Beta by adjusting Unlevered Beta for a company's debt-to-equity ratio and tax rate to reflect financial risk.

Unlevering Process

Unlevering process removes financial leverage effects from levered beta by adjusting for debt-to-equity ratio, isolating the asset risk to calculate unlevered beta.

Market Risk Premium

Market Risk Premium influences the calculation of Levered Beta by adjusting Unlevered Beta to reflect the additional financial risk from a company's capital structure.

Tax Shield

Tax shield effects increase a firm's value by reducing taxable income through debt interest, causing the levered beta to be higher than the unlevered beta by reflecting the additional financial risk from leverage.

Levered Beta vs Unlevered Beta Infographic

moneydif.com

moneydif.com