LIBOR has historically served as the primary benchmark for global interest rates but faces phase-out due to manipulation risks and declining transaction volumes. SOFR, based on actual overnight Treasury repurchase agreements, offers a more transparent and reliable alternative. Transitioning from LIBOR to SOFR enhances market stability and reflects current risk-free borrowing costs more accurately.

Table of Comparison

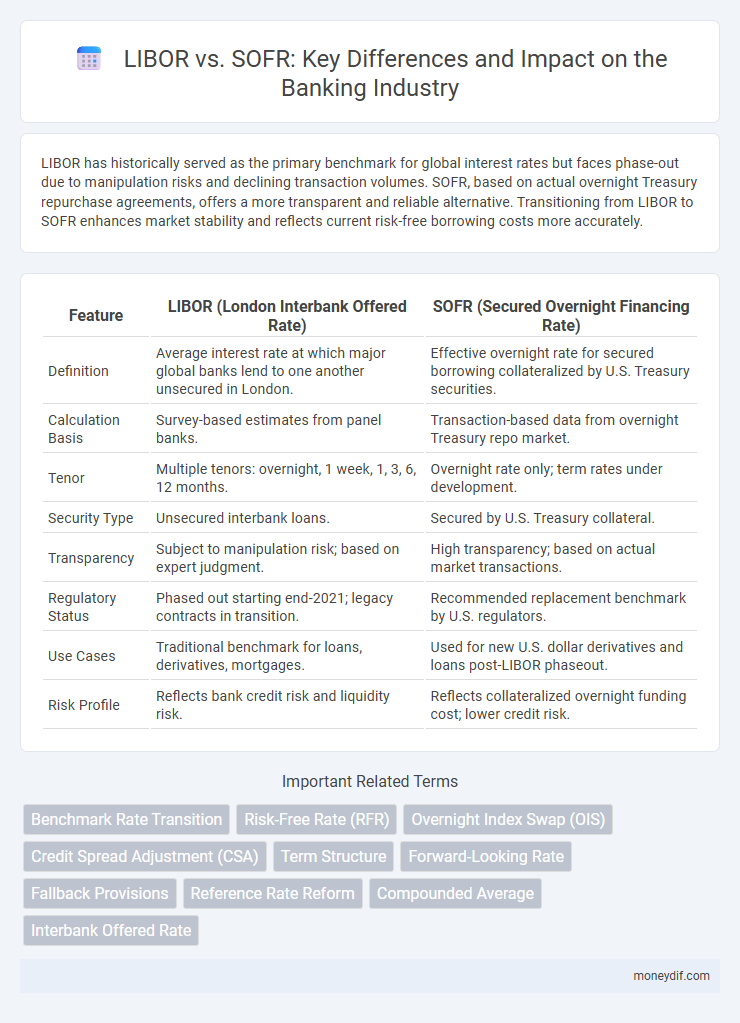

| Feature | LIBOR (London Interbank Offered Rate) | SOFR (Secured Overnight Financing Rate) |

|---|---|---|

| Definition | Average interest rate at which major global banks lend to one another unsecured in London. | Effective overnight rate for secured borrowing collateralized by U.S. Treasury securities. |

| Calculation Basis | Survey-based estimates from panel banks. | Transaction-based data from overnight Treasury repo market. |

| Tenor | Multiple tenors: overnight, 1 week, 1, 3, 6, 12 months. | Overnight rate only; term rates under development. |

| Security Type | Unsecured interbank loans. | Secured by U.S. Treasury collateral. |

| Transparency | Subject to manipulation risk; based on expert judgment. | High transparency; based on actual market transactions. |

| Regulatory Status | Phased out starting end-2021; legacy contracts in transition. | Recommended replacement benchmark by U.S. regulators. |

| Use Cases | Traditional benchmark for loans, derivatives, mortgages. | Used for new U.S. dollar derivatives and loans post-LIBOR phaseout. |

| Risk Profile | Reflects bank credit risk and liquidity risk. | Reflects collateralized overnight funding cost; lower credit risk. |

Introduction to LIBOR and SOFR

LIBOR, the London Interbank Offered Rate, has historically served as the global benchmark interest rate for short-term loans between banks, influencing trillions of dollars in financial contracts. SOFR, the Secured Overnight Financing Rate, emerged as a alternative benchmark based on actual transactions in the U.S. Treasury repurchase market, offering greater transparency and reliability. Transitioning from LIBOR to SOFR addresses manipulation risks and enhances accuracy in interest rate benchmarks for the banking industry.

Historical Background of LIBOR

Developed in the 1960s, the London Interbank Offered Rate (LIBOR) served as the primary global benchmark for short-term interest rates, underpinning trillions of dollars in financial contracts worldwide. LIBOR's rates were calculated daily based on submissions from a panel of major banks estimating their borrowing costs. Scandals involving rate manipulation and declining transaction volumes led to its phased discontinuation, prompting a transition to alternative benchmarks like the Secured Overnight Financing Rate (SOFR).

Why the Transition from LIBOR to SOFR

The transition from LIBOR to SOFR reflects regulatory efforts to adopt a more transparent and reliable benchmark, as LIBOR was susceptible to manipulation and lacked sufficient transaction volume. SOFR is based on overnight repurchase agreement transactions, offering a risk-free and robust reference rate aligned with actual market activity. This shift enhances market integrity and reduces systemic risk associated with the previous benchmark.

Key Differences Between LIBOR and SOFR

LIBOR, based on estimated borrowing rates from major global banks, reflects unsecured interbank lending risks, whereas SOFR is anchored in actual US Treasury repurchase agreement transactions, offering a secured and transaction-based benchmark. LIBOR includes multiple tenors and currencies, providing forward-looking term rates while SOFR is primarily overnight and USD-focused, emphasizing transparency and reduced manipulation risk. The transition from LIBOR to SOFR impacts loan contracts, derivatives, and risk management due to differences in credit risk representation and rate calculation methodologies.

Calculation Methodologies: LIBOR vs SOFR

LIBOR is calculated using a survey-based methodology where panel banks estimate the rates at which they can borrow unsecured funds in the interbank market, leading to potential subjectivity and manipulation risks. SOFR, in contrast, is based on actual transaction data from the U.S. Treasury repurchase (repo) market, reflecting overnight secured borrowing costs and offering greater transparency and reliability. The transition from LIBOR to SOFR emphasizes a shift from estimated, unsecured lending rates to market-driven, secured overnight rates.

Impact on Financial Products and Contracts

The transition from LIBOR to SOFR profoundly affects financial products and contracts by altering benchmark interest rates used for pricing loans, derivatives, and bonds. SOFR, based on actual Treasury repo transactions, offers greater transparency and reduces manipulation risk but introduces challenges due to its overnight and nearly risk-free nature, impacting interest rate term structures and contract valuations. Market participants must adjust fallback provisions and renegotiate terms to accommodate the different rate conventions and ensure consistent valuation and risk management.

Challenges in Adopting SOFR

Transitioning from LIBOR to SOFR presents challenges including the lack of term structure and credit sensitivity in SOFR, complicating pricing and risk management for loans and derivatives. Financial institutions face operational hurdles integrating SOFR into legacy systems and updating contract documentation to reflect the new benchmark. Market liquidity remains concentrated in certain SOFR-linked products, limiting broader adoption and increasing basis risk across financial instruments.

Implications for Borrowers and Lenders

The transition from LIBOR to SOFR significantly impacts borrowers and lenders by altering interest rate benchmarks used for loan agreements, which can affect payment calculations and interest expense predictability. SOFR, based on overnight Treasury repurchase transactions, offers a more transparent and resilient benchmark, potentially reducing manipulation risks associated with LIBOR. Borrowers may face adjustments in credit spread considerations, while lenders need to adapt risk models and contract terms to accommodate SOFR's overnight-secured rate structure.

Regulatory Guidance and Timelines

Regulatory guidance emphasizes the transition from LIBOR to SOFR to enhance market stability and reduce reliance on unsecured rate benchmarks. Key regulatory bodies, including the Federal Reserve and the SEC, have set firm timelines, targeting complete LIBOR cessation by mid-2023 and promoting SOFR adoption for new contracts. Firms are required to implement fallback language and update legacy contracts to comply with these timelines and mitigate risks.

Future Outlook of Benchmark Rates in Banking

The transition from LIBOR to SOFR marks a significant shift in benchmark rates, with SOFR's risk-free, transaction-based nature offering greater transparency and reliability for future banking contracts. Financial institutions anticipate widespread adoption of SOFR-linked products, driven by regulatory mandates and increasing market acceptance. This evolution aims to reduce systemic risk and enhance the robustness of interest rate benchmarks in global banking markets.

Important Terms

Benchmark Rate Transition

Benchmark Rate Transition involves shifting financial contracts from LIBOR to alternative reference rates like SOFR to address LIBOR's phase-out by regulators. SOFR, based on overnight Treasury repo rates, offers greater transparency and market-based reliability compared to the historically manipulated LIBOR.

Risk-Free Rate (RFR)

The Risk-Free Rate (RFR) represents the theoretical return on an investment with zero risk of financial loss, commonly estimated using benchmarks like SOFR (Secured Overnight Financing Rate) which reflects actual overnight Treasury repurchase agreement rates. LIBOR (London Interbank Offered Rate), historically used as a global benchmark, is being phased out due to its susceptibility to manipulation and lack of transaction-based data, making SOFR the preferred risk-free rate for USD-denominated financial contracts moving forward.

Overnight Index Swap (OIS)

Overnight Index Swaps (OIS) are interest rate derivatives that reference overnight rates such as SOFR (Secured Overnight Financing Rate) instead of LIBOR (London Interbank Offered Rate), which is being phased out due to reliability concerns and regulatory changes. The transition from LIBOR to SOFR in OIS contracts enhances transparency and reduces credit risk by using actual transaction-based overnight rates rather than estimated interbank lending rates.

Credit Spread Adjustment (CSA)

Credit Spread Adjustment (CSA) quantifies the risk premium difference between LIBOR and SOFR, reflecting the credit risk inherent in LIBOR's unsecured bank borrowing rates compared to SOFR's nearly risk-free overnight repurchase agreement rates. This adjustment is crucial for accurate derivative pricing and risk management as markets transition from LIBOR, which includes bank credit risk, to SOFR, a secured rate devoid of such credit risk components.

Term Structure

The term structure of interest rates reflects the relationship between LIBOR and SOFR, where LIBOR represents unsecured interbank borrowing costs with credit risk premia, while SOFR is a nearly risk-free overnight rate based on secured Treasury repo transactions. Transitioning from LIBOR to SOFR has led to the development of SOFR-based term rates derived from derivatives markets to better facilitate forward-looking loan pricing and risk management.

Forward-Looking Rate

The Forward-Looking Rate provides a projected interest benchmark based on expected future borrowing costs, crucial in the transition from LIBOR to SOFR, which is a risk-free rate rooted in actual overnight transactions. Unlike LIBOR's backward-looking and credit-sensitive nature, SOFR offers a transparent, transaction-based alternative promoting market stability and reducing manipulation risks in financial contracts.

Fallback Provisions

Fallback provisions specify the contractual terms that activate when LIBOR is unavailable, guiding the transition to alternative reference rates like SOFR. SOFR, a nearly risk-free overnight rate based on US Treasury repurchase agreements, offers greater transparency and stability compared to LIBOR's unsecured term rates, making it the preferred benchmark for fallback clauses in financial contracts.

Reference Rate Reform

Reference Rate Reform addresses the global transition from LIBOR to SOFR as the preferred benchmark for financial contracts, driven by LIBOR's declining reliability and regulatory mandates. SOFR, based on overnight U.S. Treasury repurchase agreements, offers greater transparency and resilience, improving risk management in derivatives and loan markets.

Compounded Average

Compounded Average refers to the calculation method that accumulates interest over multiple periods, commonly used in transitioning from LIBOR to SOFR benchmarks to better reflect true borrowing costs. SOFR, based on overnight repurchase agreement rates, provides a more transparent and risk-free alternative to LIBOR, which includes bank credit risk and is being phased out due to reliability concerns.

Interbank Offered Rate

Interbank Offered Rate (IBOR) serves as a benchmark for short-term interest rates, with LIBOR historically dominating global financial contracts but facing phase-out due to manipulation concerns and declining transaction volumes. SOFR, based on actual Treasury repurchase agreement rates, offers a more transparent and robust alternative increasingly adopted in US dollar-denominated derivatives and loans as part of the transition away from LIBOR.

LIBOR vs SOFR Infographic

moneydif.com

moneydif.com