Retail banking serves individual consumers by offering deposit accounts, personal loans, mortgages, and credit cards, emphasizing accessibility and convenience. Wholesale banking targets corporate clients and financial institutions, providing specialized services like large-scale loans, treasury management, and underwriting. Both segments are pivotal in the banking industry, addressing distinct customer needs with tailored financial solutions.

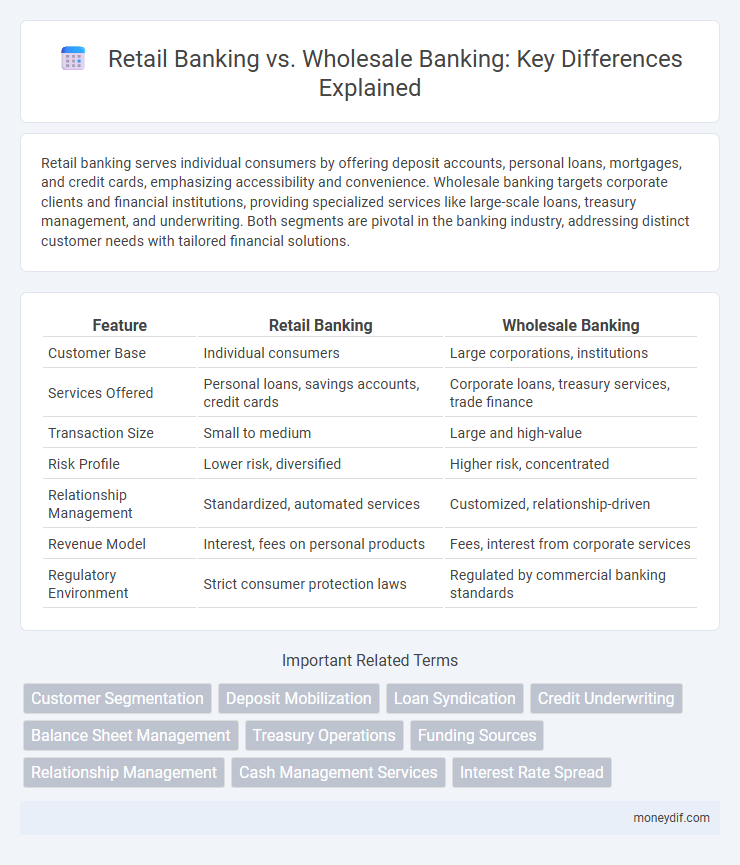

Table of Comparison

| Feature | Retail Banking | Wholesale Banking |

|---|---|---|

| Customer Base | Individual consumers | Large corporations, institutions |

| Services Offered | Personal loans, savings accounts, credit cards | Corporate loans, treasury services, trade finance |

| Transaction Size | Small to medium | Large and high-value |

| Risk Profile | Lower risk, diversified | Higher risk, concentrated |

| Relationship Management | Standardized, automated services | Customized, relationship-driven |

| Revenue Model | Interest, fees on personal products | Fees, interest from corporate services |

| Regulatory Environment | Strict consumer protection laws | Regulated by commercial banking standards |

Introduction to Retail and Wholesale Banking

Retail banking serves individual consumers with services such as savings accounts, personal loans, mortgages, and credit cards, emphasizing accessibility and personalized financial solutions. Wholesale banking targets large institutions, businesses, and government entities, offering specialized services like corporate loans, treasury management, and underwriting. Both sectors are crucial for the banking ecosystem, catering to different client needs and driving economic growth through tailored financial products.

Key Differences Between Retail and Wholesale Banking

Retail banking primarily serves individual consumers with products like savings accounts, personal loans, and mortgages, whereas wholesale banking targets large organizations, offering services such as large-scale loans, treasury management, and underwriting. Retail banking emphasizes high transaction volume with relatively low individual value, while wholesale banking handles fewer but significantly larger transactions tailored to business needs. Risk management in retail banking focuses on consumer credit risk, whereas wholesale banking deals with complex credit assessments and market risk exposure.

Customer Segments Served

Retail banking primarily serves individual consumers by providing personal financial services such as savings accounts, mortgages, and credit cards, focusing on everyday banking needs. Wholesale banking targets corporate clients, financial institutions, and government organizations, delivering specialized services including large-scale loans, treasury management, and underwriting. The distinct customer segments result in tailored product offerings that address the unique financial requirements of each group.

Products and Services Comparison

Retail banking primarily offers personal financial services such as savings and checking accounts, mortgages, personal loans, credit cards, and wealth management tailored for individual consumers. Wholesale banking targets corporate clients with products like business loans, treasury and cash management, commercial real estate financing, trade finance, and syndicate loans. The distinct focus on client segments drives the specialization in product offerings, with retail banking emphasizing accessibility and convenience, while wholesale banking concentrates on large-scale financial solutions and risk management for enterprises.

Technology Use in Retail vs. Wholesale Banking

Retail banking leverages advanced digital platforms, mobile apps, and AI-driven chatbots to enhance customer experience and streamline everyday transactions for individual clients. Wholesale banking employs sophisticated technological systems like real-time payment processing, blockchain for trade finance, and advanced risk management software to support large-scale corporate clients and interbank operations. Both sectors invest heavily in cybersecurity solutions to protect sensitive financial data, yet wholesale banking often requires more customized and complex technology infrastructures to handle high-value transactions and regulatory compliance.

Revenue Models and Profitability

Retail banking generates revenue primarily through interest income on personal loans, mortgages, credit cards, and fees from account maintenance, driving steady profitability via high customer volume. Wholesale banking earns revenue from large-scale services such as corporate loans, underwriting, treasury management, and advisory fees, typically resulting in higher profit margins per transaction despite lower client numbers. Profitability in retail banking depends on diversified product utilization and low default rates, whereas wholesale banking profits hinge on deal size, market conditions, and the complexity of financial services offered.

Risks and Challenges in Retail and Wholesale Banking

Retail banking faces higher credit risk due to the large volume of small individual loans, while wholesale banking confronts greater exposure to market and operational risks stemming from complex transactions with corporate clients. Fraud risk and regulatory compliance are significant challenges for both sectors, but wholesale banking requires more sophisticated risk management frameworks to handle large-scale financial dealings. Cybersecurity threats increasingly impact both retail and wholesale banks, necessitating continuous investment in advanced technology and staff training.

Regulatory Frameworks and Compliance

Retail banking and wholesale banking operate under distinct regulatory frameworks tailored to their client bases and transaction volumes. Retail banking is subject to stringent consumer protection laws, deposit insurance requirements, and anti-money laundering (AML) regulations designed to safeguard individual account holders. Wholesale banking faces complex compliance mandates related to large-scale corporate lending, market conduct rules, and international regulatory standards such as Basel III and Dodd-Frank, reflecting its exposure to higher financial risks and systemic implications.

Trends Shaping Retail and Wholesale Banking

Emerging digital technologies such as AI-driven customer analytics and blockchain are revolutionizing retail banking by enhancing personalized services and streamlining payment processes. Wholesale banking trends emphasize increased cybersecurity measures and advanced data management systems to support large-scale corporate clients and complex financial transactions. Both sectors experience a shift towards automation and cloud-based platforms, enabling greater operational efficiency and real-time decision-making.

Choosing the Right Banking Model for Your Needs

Retail banking focuses on individual customers and small businesses, offering services like savings accounts, personal loans, and credit cards, while wholesale banking targets large corporations and financial institutions with services such as large-scale loans, treasury management, and underwriting. Choosing the right banking model depends on the scale and complexity of financial requirements, with retail banking suited for everyday individual transactions and wholesale banking designed for high-volume, specialized financial solutions. Evaluating your specific business size, transaction frequency, and financing needs is crucial to selecting the most effective banking approach.

Important Terms

Customer Segmentation

Customer segmentation in retail banking focuses on individual consumers based on demographics and behavior, while wholesale banking targets corporate clients through industry, size, and transaction volume analysis.

Deposit Mobilization

Deposit mobilization in retail banking focuses on attracting individual customer savings through diverse account types, while wholesale banking targets large corporate clients and institutional funds to secure substantial deposits.

Loan Syndication

Loan syndication in wholesale banking involves multiple financial institutions collaborating to fund large loans, contrasting with retail banking where individual loans are offered directly to consumers.

Credit Underwriting

Credit underwriting in retail banking focuses on individual consumer creditworthiness using standardized criteria, while wholesale banking underwriting assesses complex financial risks and credit exposures of corporate clients and large institutions.

Balance Sheet Management

Balance Sheet Management in retail banking focuses on optimizing consumer deposits and personal loans to enhance liquidity and profitability, whereas in wholesale banking it prioritizes managing large-scale corporate assets, liabilities, and complex funding structures to balance risk and return.

Treasury Operations

Treasury operations in retail banking focus on managing customer deposits and liquidity, while in wholesale banking they prioritize corporate funding, risk management, and capital markets activities.

Funding Sources

Retail banking funding sources primarily include customer deposits like savings and checking accounts, while wholesale banking relies heavily on large-scale financing through corporate deposits, interbank loans, and capital market instruments.

Relationship Management

Relationship management in retail banking focuses on personalized customer service for individuals, while in wholesale banking it centers on managing complex, high-value client portfolios and corporate financial solutions.

Cash Management Services

Cash management services in retail banking focus on providing individual consumers with debit card controls and mobile payment solutions while wholesale banking offers comprehensive liquidity management and corporate treasury services for large businesses.

Interest Rate Spread

Interest rate spread in retail banking typically exceeds that in wholesale banking due to higher risk premiums and operational costs associated with consumer loans compared to large-scale, low-risk wholesale transactions.

Retail banking vs Wholesale banking Infographic

moneydif.com

moneydif.com