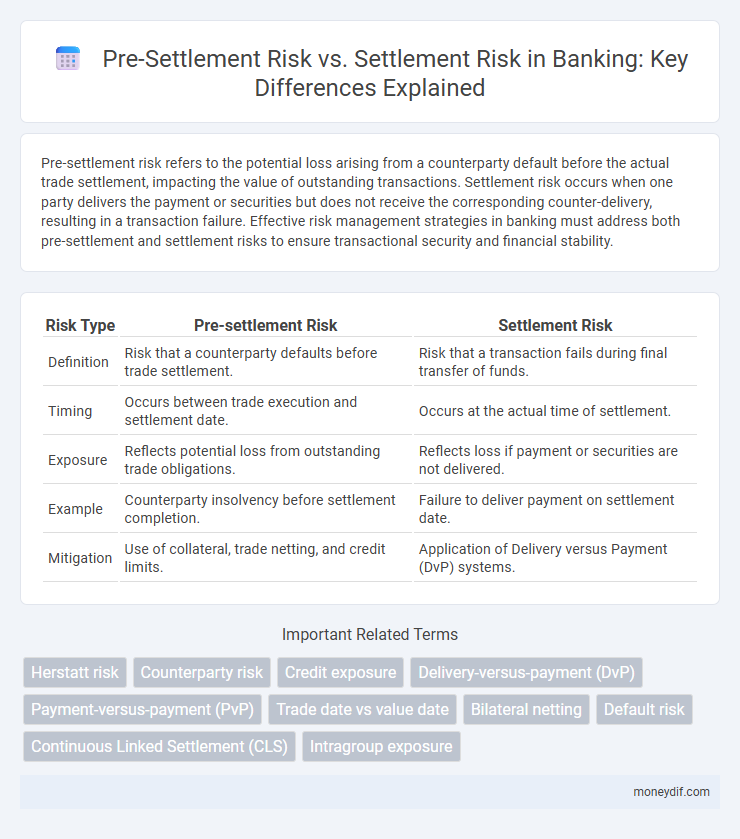

Pre-settlement risk refers to the potential loss arising from a counterparty default before the actual trade settlement, impacting the value of outstanding transactions. Settlement risk occurs when one party delivers the payment or securities but does not receive the corresponding counter-delivery, resulting in a transaction failure. Effective risk management strategies in banking must address both pre-settlement and settlement risks to ensure transactional security and financial stability.

Table of Comparison

| Risk Type | Pre-settlement Risk | Settlement Risk |

|---|---|---|

| Definition | Risk that a counterparty defaults before trade settlement. | Risk that a transaction fails during final transfer of funds. |

| Timing | Occurs between trade execution and settlement date. | Occurs at the actual time of settlement. |

| Exposure | Reflects potential loss from outstanding trade obligations. | Reflects loss if payment or securities are not delivered. |

| Example | Counterparty insolvency before settlement completion. | Failure to deliver payment on settlement date. |

| Mitigation | Use of collateral, trade netting, and credit limits. | Application of Delivery versus Payment (DvP) systems. |

Understanding Pre-Settlement Risk in Banking

Pre-settlement risk in banking refers to the potential loss faced by a party if a counterparty defaults before the actual settlement of a transaction, primarily impacting derivatives and securities trading. This risk arises from market fluctuations and the exposure accumulated during the life of the contract, making real-time risk management and collateral monitoring essential. Accurate assessment and mitigation of pre-settlement risk are critical for maintaining financial stability and ensuring compliance with regulatory frameworks such as Basel III.

Defining Settlement Risk: Key Concepts

Settlement risk arises when one party in a financial transaction delivers the payment or asset as agreed, but the counterparty fails to fulfill its side of the deal, causing potential financial loss. It primarily occurs during the settlement phase, where the exchange of funds or securities is not instantaneous, exposing parties to default risk. Effective risk management strategies in banking include real-time gross settlement (RTGS) systems and payment versus payment (PvP) mechanisms to mitigate settlement risk and enhance transaction security.

Main Differences Between Pre-Settlement and Settlement Risk

Pre-settlement risk arises from the potential default of a counterparty before the finalization of a transaction, particularly in derivatives and securities trading, whereas settlement risk occurs during the actual exchange of cash or assets at the settlement date. The main difference lies in timing: pre-settlement risk encompasses credit exposure throughout the life of the contract, while settlement risk is confined to the settlement window when payments and deliveries are executed. Mitigating pre-settlement risk involves collateral management and mark-to-market practices, whereas settlement risk reduction focuses on payment-versus-payment (PvP) mechanisms and central counterparties (CCPs).

Typical Scenarios Illustrating Pre-Settlement Risk

Pre-settlement risk commonly arises in derivatives trading, where counterparties face potential default before the transaction's final settlement, especially during margin calls or mark-to-market adjustments. It also occurs in repo agreements and securities lending when asset values fluctuate before settlement completion. These scenarios highlight the risk of loss due to counterparty insolvency or market volatility impacting the transaction value prior to settlement.

Settlement Risk: Real-World Examples

Settlement risk arises in real-world banking when one party fails to deliver the agreed-upon asset or payment at the time of settlement, notably during cross-border foreign exchange transactions such as the infamous Herstatt risk experienced in 1974 when Bankhaus Herstatt defaulted after receiving Deutsche Marks but before delivering US dollars. Another prominent example includes the 2008 financial crisis, where the collapse of Lehman Brothers triggered widespread settlement failures, highlighting the systemic impact settlement risk can have on global financial markets. In securities trading, settlement risk materializes when payment or securities fail to exchange simultaneously, necessitating robust collateral and clearing mechanisms to mitigate potential losses.

Impact of Risk Types on Financial Institutions

Pre-settlement risk exposes financial institutions to potential losses arising from counterparties defaulting before transaction settlement, significantly impacting credit risk management and capital allocation. Settlement risk arises when one party fails to deliver securities or funds at the agreed settlement time, causing liquidity shortfalls and operational disruptions. Both risks necessitate robust risk mitigation strategies to protect institution solvency and maintain market confidence.

Mitigation Strategies for Pre-Settlement Risk

Pre-settlement risk arises from the possibility that a counterparty defaults before a trade is settled, posing significant exposure during the transaction period. Key mitigation strategies include collateral management, netting agreements, and robust credit risk assessment to limit potential losses. Implementing real-time trade monitoring and using central counterparties (CCPs) further reduces pre-settlement exposure by enhancing transparency and minimizing counterparty default risk.

Managing Settlement Risk: Best Practices

Managing settlement risk requires robust controls such as real-time monitoring systems to track transaction statuses and mitigate potential failures. Implementing payment-versus-payment (PvP) mechanisms ensures simultaneous exchange of funds, minimizing counterparty exposure. Strong regulatory compliance combined with collateral management and clear netting agreements further reduce systemic vulnerabilities in settlement processes.

Regulatory Perspectives on Settlement and Pre-Settlement Risks

Regulatory frameworks such as Basel III emphasize stringent capital requirements to mitigate pre-settlement risk, which arises from counterparty credit exposure before transaction finalization. Settlement risk, involving the failure to deliver assets or payment during transaction settlement, is closely monitored by central banks and financial regulators to ensure systemic stability and reduce default impact. Enhanced supervisory guidelines and reporting standards mandate banks to implement robust risk management practices addressing both pre-settlement and settlement risks in cross-border and securities transactions.

Future Trends in Risk Management for Banks

Pre-settlement risk, arising from potential loss before a transaction's finalization, and settlement risk, linked to payment failures during settlement, remain critical concerns in banking risk management. Emerging trends emphasize the integration of advanced analytics, blockchain technology, and real-time monitoring systems to enhance risk detection and mitigation strategies. Increasing regulatory demands and the adoption of artificial intelligence-driven predictive models are reshaping how banks manage these risks in increasingly complex financial markets.

Important Terms

Herstatt risk

Herstatt risk, a type of pre-settlement risk, arises from time zone differences causing one party to fulfill its payment obligations while the counterparty fails to complete the corresponding settlement, distinguishing it from settlement risk that occurs during the final exchange of securities and funds.

Counterparty risk

Counterparty risk encompasses pre-settlement risk, the potential loss during the trade life before final settlement, and settlement risk, the risk of failure to deliver payment or securities at the intended settlement date.

Credit exposure

Credit exposure in pre-settlement risk arises from potential default before transaction finalization, whereas settlement risk involves the failure to exchange payments or securities on the settlement date.

Delivery-versus-payment (DvP)

Delivery-versus-payment (DvP) eliminates pre-settlement risk by ensuring simultaneous transfer of securities and payment, thereby significantly reducing settlement risk in financial transactions.

Payment-versus-payment (PvP)

Payment-versus-payment (PvP) mechanisms eliminate pre-settlement risk by ensuring simultaneous exchange of payments, thereby significantly reducing settlement risk in cross-border transactions.

Trade date vs value date

Trade date determines pre-settlement risk by marking contract initiation, while value date defines settlement risk by specifying when funds and securities exchange occurs.

Bilateral netting

Bilateral netting reduces pre-settlement risk by offsetting mutual obligations before settlement, thereby minimizing the potential exposure to settlement risk in financial transactions.

Default risk

Default risk in pre-settlement risk arises from counterparty insolvency before trade completion, while settlement risk occurs during the final transfer of assets or payment.

Continuous Linked Settlement (CLS)

Continuous Linked Settlement (CLS) mitigates pre-settlement risk by ensuring simultaneous foreign exchange transaction settlements, effectively eliminating settlement risk associated with time lags between payment deliveries.

Intragroup exposure

Intragroup exposure intensifies pre-settlement risk due to outstanding transaction obligations, whereas settlement risk arises from the failure to exchange final payments within the settlement timeframe.

Pre-settlement risk vs Settlement risk Infographic

moneydif.com

moneydif.com