Swaps involve exchanging cash flows or financial instruments between parties, often used to hedge interest rate or currency risks over a specified period. Forwards are customized contracts to buy or sell an asset at a predetermined price on a future date, primarily used for locking in prices and managing exposure to market fluctuations. Both instruments serve risk management but differ in structure, flexibility, and application within banking.

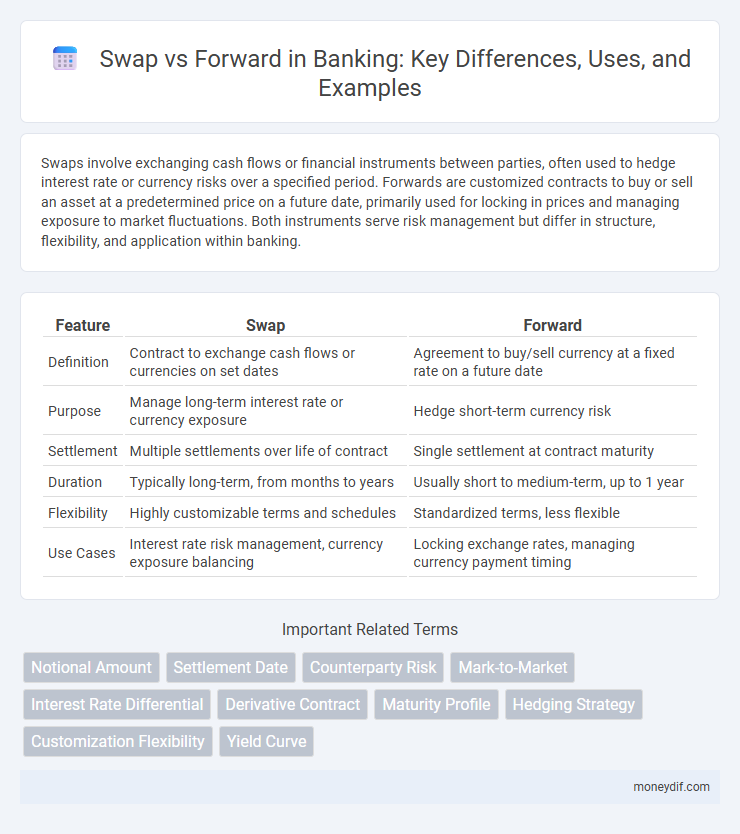

Table of Comparison

| Feature | Swap | Forward |

|---|---|---|

| Definition | Contract to exchange cash flows or currencies on set dates | Agreement to buy/sell currency at a fixed rate on a future date |

| Purpose | Manage long-term interest rate or currency exposure | Hedge short-term currency risk |

| Settlement | Multiple settlements over life of contract | Single settlement at contract maturity |

| Duration | Typically long-term, from months to years | Usually short to medium-term, up to 1 year |

| Flexibility | Highly customizable terms and schedules | Standardized terms, less flexible |

| Use Cases | Interest rate risk management, currency exposure balancing | Locking exchange rates, managing currency payment timing |

Understanding Swaps and Forwards in Banking

Swaps and forwards are essential derivatives used in banking to manage interest rate and currency risks. A swap involves exchanging cash flows or liabilities between parties, typically interest rate swaps or currency swaps, to hedge against fluctuations over an agreed period. In contrast, a forward contract locks in a specific price for an asset or currency at a future date, providing certainty for financial planning and risk mitigation.

Key Differences Between Swaps and Forwards

Swaps and forwards are both derivative contracts used in banking to manage financial risks, but swaps involve exchanging cash flows or financial instruments over multiple periods, whereas forwards are agreements to buy or sell an asset at a fixed price on a single future date. Swaps typically include interest rate swaps or currency swaps with ongoing payments, while forwards are often used for hedging currency or commodity price fluctuations with one-time settlement. Key differences also lie in their flexibility and customization: forwards are private, over-the-counter contracts tailored to specific needs, whereas swaps tend to have standardized terms and may involve clearinghouse intermediation.

Common Types of Swap Agreements

Common types of swap agreements in banking include interest rate swaps, where parties exchange fixed interest payments for floating rates to manage exposure to interest rate fluctuations. Currency swaps allow institutions to exchange principal and interest payments in different currencies, optimizing liquidity and reducing exchange rate risk. Commodity swaps enable banks to hedge against price volatility in raw materials, ensuring price stability for future transactions.

How Forward Contracts Work in Banking

Forward contracts in banking are customized agreements between two parties to buy or sell an asset at a predetermined price on a specified future date, primarily used for hedging currency risk. Banks utilize forward contracts to lock in exchange rates, ensuring predictability in cash flows and protection against adverse currency fluctuations. These contracts are settled at maturity, either by physical delivery or cash settlement, depending on the terms agreed upon.

Risk Management: Swaps vs Forwards

Swaps provide dynamic risk management by allowing parties to exchange cash flows or obligations, effectively hedging interest rate, currency, or commodity exposure over a longer term. Forwards lock in prices or rates for a specific future date, offering precise protection against price volatility but exposing parties to counterparty credit risk. Effective risk management often involves choosing swaps for ongoing exposure adjustments and forwards for fixed commitments or budget certainty.

Use Cases: When Banks Prefer Swaps or Forwards

Banks prefer currency swaps when managing long-term foreign exchange risk due to their ability to exchange principal and interest payments over multiple periods, making them ideal for financing cross-border investments or hedging interest rate exposure. Forward contracts are favored for short-term, straightforward hedging needs, such as locking in exchange rates for imminent foreign currency receipts or payments. Swaps provide more flexibility and customization, whereas forwards offer simplicity and certainty for specific transaction dates.

Pricing Mechanisms: Swap vs Forward Contracts

Swap contracts price their cash flows by discounting expected future payments using prevailing interest rates and forward exchange rates, reflecting market expectations over the contract period. Forward contracts set prices through agreement on a fixed exchange rate for a specified future date, calculated by adjusting the current spot rate for the interest rate differential between currencies. Swaps offer flexibility by integrating multiple payment dates and rate adjustments, while forwards provide a single locked-in rate, impacting hedging strategies and cost efficiency.

Regulatory Considerations for Swaps and Forwards

Regulatory considerations for swaps primarily involve adherence to Dodd-Frank Act requirements, including mandatory clearing, margining, and reporting to swap data repositories, while forwards often fall outside such stringent regulations due to their classification as non-centrally cleared OTC contracts. Banks engaging in swaps must ensure compliance with collateralization practices and counterparty credit risk limits imposed by prudential regulators such as the Federal Reserve and the Commodity Futures Trading Commission (CFTC). In contrast, forwards, being generally more customized and bilateral, require thorough risk management protocols but face fewer regulatory mandates, making swaps subject to more intensive supervisory scrutiny and capital requirements under Basel III frameworks.

Advantages and Disadvantages of Swaps and Forwards

Swaps offer flexibility in customizing terms to manage interest rate or currency exposure over long periods, with advantages including risk reduction and potential cost savings, but carry counterparty risk and complexity. Forwards provide a straightforward, binding contract to lock in prices or rates for future transactions, offering certainty and simplicity but exposing parties to liquidity risk and limited flexibility. Both instruments play crucial roles in hedging strategies, with swaps suited for ongoing exposure management and forwards ideal for single, predetermined settlement dates.

Future Trends in Swap and Forward Usage in Banking

The future trends in swap and forward usage in banking indicate a growing preference for more customizable and flexible derivative instruments, driven by increased market volatility and regulatory changes such as Basel III and IFRS 9 compliance. Banks are integrating advanced AI-driven analytics and blockchain technology to enhance transparency, risk management, and settlement efficiency in these contracts. Moreover, the rise of ESG-linked swaps and forwards is predicted to accelerate, reflecting the sector's shift towards sustainable finance initiatives.

Important Terms

Notional Amount

Notional amount in swaps represents the underlying principal value used to calculate cash flows, while in forwards it defines the contract size for asset delivery or settlement.

Settlement Date

The settlement date for a swap typically involves multiple cash flows occurring at predetermined intervals, whereas the forward contract settlement date usually entails a single exchange of the underlying asset at contract maturity.

Counterparty Risk

Counterparty risk in swaps is higher than forwards due to swaps' longer maturities and ongoing exposure, increasing the likelihood of default over the contract term.

Mark-to-Market

Mark-to-Market valuation regularly adjusts the fair value of swaps and forwards by reflecting current market prices to assess real-time gains or losses.

Interest Rate Differential

Interest rate differential significantly influences the pricing and valuation of currency swaps compared to forward contracts due to the impact of interest rate disparities on cash flow timings and exchange rates.

Derivative Contract

A derivative contract like a swap involves exchanging cash flows between parties based on underlying variables, while a forward contract is a customized agreement to buy or sell an asset at a predetermined price on a future date.

Maturity Profile

The maturity profile of swaps typically involves multiple settlement dates over the contract's life, whereas forwards have a single maturity date, impacting liquidity and risk management strategies.

Hedging Strategy

A hedging strategy using swaps offers greater flexibility and customization for interest rate or currency risk management compared to forwards, which provide fixed terms and counterparty risk exposure.

Customization Flexibility

Swap contracts offer greater customization flexibility than forwards by enabling tailored terms for notional amounts, payment schedules, and underlying rates to better hedge specific financial risks.

Yield Curve

The yield curve represents interest rate expectations that directly impact the valuation differences between interest rate swaps and forward rate agreements.

Swap vs Forward Infographic

moneydif.com

moneydif.com