Libor and Euribor are crucial benchmark interest rates used in the banking sector to determine lending costs and financial instruments' pricing. Libor, calculated based on rates submitted by major global banks, primarily reflects the US dollar and other currencies, whereas Euribor is based on Eurozone banks' lending rates for euro-denominated transactions. Understanding the differences between Libor and Euribor is vital for risk management and contract accuracy in international finance.

Table of Comparison

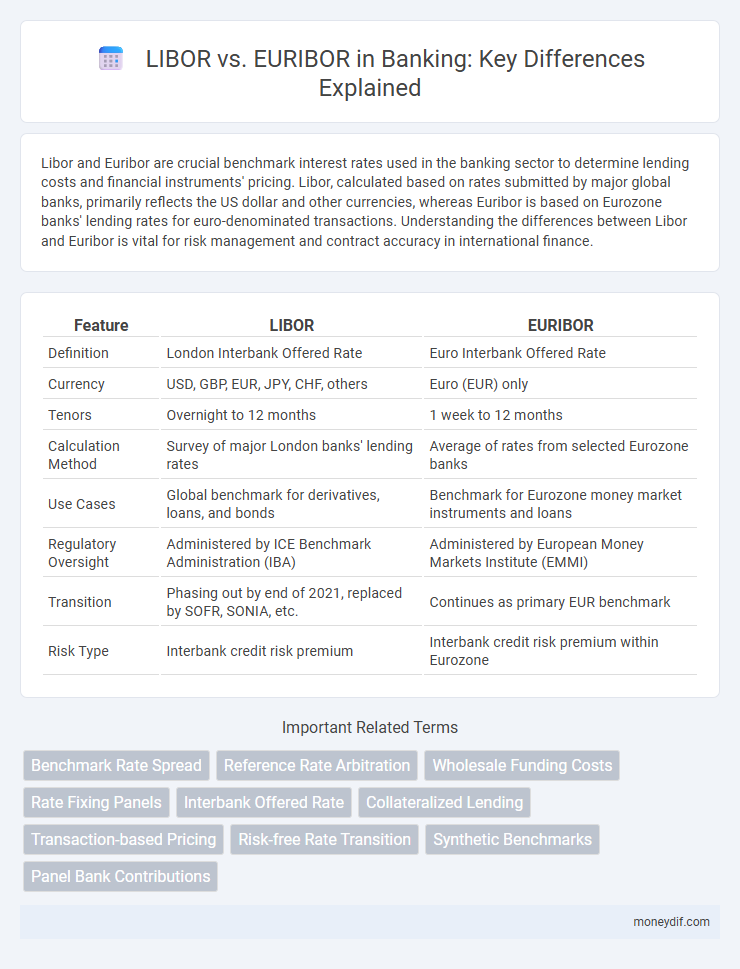

| Feature | LIBOR | EURIBOR |

|---|---|---|

| Definition | London Interbank Offered Rate | Euro Interbank Offered Rate |

| Currency | USD, GBP, EUR, JPY, CHF, others | Euro (EUR) only |

| Tenors | Overnight to 12 months | 1 week to 12 months |

| Calculation Method | Survey of major London banks' lending rates | Average of rates from selected Eurozone banks |

| Use Cases | Global benchmark for derivatives, loans, and bonds | Benchmark for Eurozone money market instruments and loans |

| Regulatory Oversight | Administered by ICE Benchmark Administration (IBA) | Administered by European Money Markets Institute (EMMI) |

| Transition | Phasing out by end of 2021, replaced by SOFR, SONIA, etc. | Continues as primary EUR benchmark |

| Risk Type | Interbank credit risk premium | Interbank credit risk premium within Eurozone |

Introduction to LIBOR and EURIBOR

LIBOR (London Interbank Offered Rate) represents the average interest rate at which major global banks borrow unsecured funds from one another in the London interbank market, serving as a critical benchmark for short-term interest rates worldwide. EURIBOR (Euro Interbank Offered Rate) reflects the average interest rate at which European banks lend to one another within the eurozone, playing a key role in European financial markets and loan pricing. Both indexes influence interest rate derivatives, loans, and mortgages, with LIBOR primarily used in markets dominated by the US dollar and other global currencies, while EURIBOR applies mainly within the euro-denominated financial sector.

Historical Background of LIBOR and EURIBOR

The London Interbank Offered Rate (LIBOR) was established in the 1980s as a benchmark interest rate at which major global banks lend to one another in the London interbank market, becoming widely used for various financial instruments globally. The Euro Interbank Offered Rate (EURIBOR) was introduced in 1999 as the primary reference rate for eurozone interbank lending, reflecting the average rates at which European banks offer unsecured short-term loans to each other. Both LIBOR and EURIBOR have served as critical rates for pricing loans, derivatives, and other financial products, with LIBOR historically dominating USD markets and EURIBOR playing a crucial role within the euro area.

Key Differences Between LIBOR and EURIBOR

LIBOR (London Interbank Offered Rate) and EURIBOR (Euro Interbank Offered Rate) differ primarily in their geographical focus and currency basis, with LIBOR representing rates for multiple currencies in London and EURIBOR specifically for euro-denominated deposits in the Eurozone. The calculation methodologies also vary; LIBOR is based on estimates from a panel of banks for unsecured interbank lending rates across several tenors, while EURIBOR is computed from actual transaction data within the Eurozone banking sector. Additionally, LIBOR's significance has diminished post-2021 due to regulatory reforms, leading to the adoption of alternative reference rates, whereas EURIBOR remains a key benchmark for euro-based financial products.

Calculation Methodologies for LIBOR and EURIBOR

LIBOR is calculated based on submissions from a panel of global banks estimating their unsecured borrowing costs for various currencies and maturities, with daily trimmed means used to exclude outliers, ensuring market-representative rates. EURIBOR derives from aggregated quotes from a panel of European banks reflecting the average interest rates at which they offer unsecured funds to one another in the euro interbank market, calculated as a truncated mean after removing highest and lowest contributions. Both benchmarks are daily published, but EURIBOR pertains to eurozone interbank lending, while LIBOR covers multiple currencies, affecting their respective methodological nuances and market applications.

Currencies and Market Coverage

Libor primarily serves as a benchmark for the US dollar and several other major currencies including the British pound, Japanese yen, and Swiss franc, covering a broad range of interbank lending markets globally. Euribor, on the other hand, is exclusively tied to the Euro and reflects the average interest rates at which eurozone banks are willing to lend unsecured funds to each other. While Libor encompasses a diverse set of currencies and international financial markets, Euribor's market coverage is concentrated solely within the euro area banking sector.

Importance in Global Financial Markets

Libor and Euribor serve as critical benchmark interest rates in global financial markets, influencing trillions of dollars in loans, derivatives, and mortgages. While Libor reflects borrowing costs among major banks in London, Euribor represents the average interest rate for eurozone interbank lending, directly impacting European financial products. The transition from Libor to alternative rates like SOFR underscores the importance of these benchmarks in ensuring transparency, stability, and investor confidence worldwide.

Transition Away from LIBOR: Implications and Timelines

The transition away from LIBOR, mandated by global regulators, is crucial due to LIBOR's discontinuation planned by the end of 2023, impacting trillions in financial contracts worldwide. EURIBOR remains a key benchmark for euro-denominated loans and derivatives, with enhancements ensuring continuity and reliability post-LIBOR. Financial institutions must update contracts and risk management systems to align with new reference rates like EURSTR, adhering to regulatory timelines and minimizing market disruption.

Impact on Loans, Mortgages, and Derivatives

LIBOR and EURIBOR benchmarks significantly influence loan and mortgage interest rates, directly affecting borrower repayment amounts and financial institution risk management. Transitioning from LIBOR to alternative rates like SOFR impacts derivative pricing and valuation, requiring adjustments in contracts to mitigate basis risk. EURIBOR's continued use in the eurozone maintains stability in mortgage products but requires close monitoring of regulatory changes affecting its calculation methodology.

Regulatory Framework and Oversight

The regulatory framework for LIBOR and EURIBOR differs significantly due to their geographic jurisdictions, with LIBOR overseen primarily by the UK Financial Conduct Authority (FCA) and EURIBOR regulated by the European Money Markets Institute (EMMI) under European Union guidelines. Both benchmark rates are subject to strict compliance standards set by the International Organization of Securities Commissions (IOSCO) Principles for Financial Benchmarks, ensuring transparency and integrity. Enhanced oversight mechanisms include robust contributor supervision, audit trails, and regular validations to mitigate manipulation risks in the global banking sector.

Future Outlook: Benchmark Alternatives and Market Adjustments

The future outlook for Libor and Euribor centers on the transition to alternative benchmark rates such as SOFR for USD and EURSTR for EUR to enhance market transparency and reduce reliance on potentially unreliable interbank lending rates. Financial institutions are adapting to regulatory reforms that mandate these replacements, leading to widespread contract renegotiations and system upgrades. Market participants expect increased adoption of risk-free rates to stabilize interest rate benchmarks and improve long-term financial product pricing.

Important Terms

Benchmark Rate Spread

Benchmark Rate Spread between LIBOR and EURIBOR reflects the interest rate differential used by financial institutions to price cross-currency loans and derivatives in international markets.

Reference Rate Arbitration

Reference rate arbitration resolves disputes by comparing LIBOR and EURIBOR benchmarks to ensure fair interest rate determination in financial contracts.

Wholesale Funding Costs

Wholesale funding costs are influenced by LIBOR and EURIBOR benchmarks, with LIBOR typically reflecting USD-based funding rates and EURIBOR representing Eurozone money market rates, driving differential pricing in cross-currency funding strategies.

Rate Fixing Panels

Rate fixing panels determine daily benchmark rates where LIBOR reflects London market data and EURIBOR represents Eurozone interbank rates, influencing global financial contracts.

Interbank Offered Rate

Interbank Offered Rate (IBOR) benchmarks such as LIBOR, determined by average borrowing costs among major London banks, and EURIBOR, based on eurozone banks' lending rates, are critical reference rates influencing global financial contracts and interest rate derivatives.

Collateralized Lending

Collateralized lending rates often adjust based on benchmarks like Euribor, increasingly preferred over Libor due to Libor's phase-out and regulatory concerns.

Transaction-based Pricing

Transaction-based pricing models adjust interest rates by referencing benchmark rates such as LIBOR or EURIBOR, reflecting real-time market transaction data to enhance pricing accuracy and risk assessment.

Risk-free Rate Transition

The risk-free rate transition involves replacing LIBOR with alternative benchmark rates like EURIBOR, reflecting more reliable, transaction-based data to enhance market stability and reduce credit risk exposure.

Synthetic Benchmarks

Synthetic benchmarks simulate interest rate scenarios to compare the pricing and risk profiles of Libor-based versus Euribor-based financial instruments.

Panel Bank Contributions

Panel bank contributions to LIBOR and EURIBOR differ in geographic representation and benchmark calculation methodologies, reflecting distinct regional borrowing costs and credit conditions.

Libor vs Euribor Infographic

moneydif.com

moneydif.com