SWIFT payments enable international money transfers across global banking networks, supporting multiple currencies and countries, whereas SEPA payments are designed specifically for euro-denominated transfers within the European Union and a few neighboring countries. SEPA transactions typically offer faster processing times and lower fees compared to SWIFT payments, making them more cost-effective for eurozone transfers. While SWIFT provides broader global reach, SEPA ensures standardized, efficient, and secure payments within its designated region.

Table of Comparison

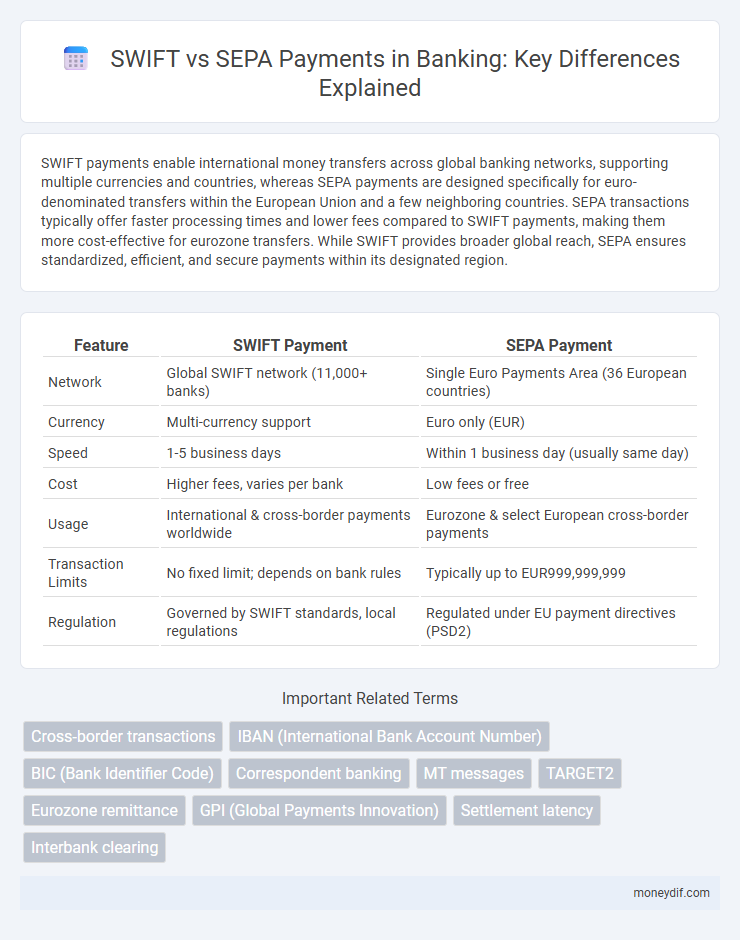

| Feature | SWIFT Payment | SEPA Payment |

|---|---|---|

| Network | Global SWIFT network (11,000+ banks) | Single Euro Payments Area (36 European countries) |

| Currency | Multi-currency support | Euro only (EUR) |

| Speed | 1-5 business days | Within 1 business day (usually same day) |

| Cost | Higher fees, varies per bank | Low fees or free |

| Usage | International & cross-border payments worldwide | Eurozone & select European cross-border payments |

| Transaction Limits | No fixed limit; depends on bank rules | Typically up to EUR999,999,999 |

| Regulation | Governed by SWIFT standards, local regulations | Regulated under EU payment directives (PSD2) |

Introduction to SWIFT and SEPA Payments

SWIFT payments use the Society for Worldwide Interbank Financial Telecommunication network to enable secure international money transfers between banks across more than 200 countries. SEPA payments operate within the Single Euro Payments Area, facilitating fast, low-cost euro transfers among 36 European countries with standardized processing. While SWIFT supports global currency transactions and diverse banking systems, SEPA is optimized exclusively for euro-denominated transactions within Europe, ensuring uniformity and efficiency.

Understanding SWIFT Payments: Global Transfers

SWIFT payments facilitate secure and standardized global money transfers between banks across more than 200 countries, enabling businesses and individuals to send funds internationally with confidence. The SWIFT network uses unique bank identifiers called BICs (Business Identifier Codes) to ensure accurate routing and settlement of cross-border transactions in various currencies. Unlike SEPA payments, which are restricted to Euro-denominated transfers within the Eurozone, SWIFT payments support diverse currencies and wider geographic reach, making them essential for global banking and international trade.

Exploring SEPA Payments: Eurozone Efficiency

SEPA payments streamline euro transactions across 36 European countries, enabling fast, secure, and low-cost transfers within the Eurozone banking framework. Unlike SWIFT payments, which facilitate global currency exchanges subject to higher fees and longer processing times, SEPA offers standardized processes and direct euro debiting between participating banks. This efficiency supports cross-border business operations and consumer payments by reducing complexity and fostering greater transparency in the European payment ecosystem.

Key Differences Between SWIFT and SEPA

SWIFT payments enable international transfers across more than 200 countries using a global network, making them suitable for cross-border transactions in multiple currencies. SEPA payments are limited to euro-denominated transfers within the 36 European countries participating in the Single Euro Payments Area, offering faster and lower-cost transactions within this zone. Key differences include geographic reach, currency support, processing time, and transaction fees, with SWIFT providing broader scope and SEPA focusing on efficiency within Europe.

Transaction Speed: SWIFT vs SEPA

SEPA payments typically settle within one business day across Eurozone countries, enabling faster euro transactions within participating banks. SWIFT payments, used globally, often take between 1 to 5 business days depending on intermediary banks and cross-border complexity. The transaction speed difference is crucial for businesses prioritizing quick euro transfers within Europe versus international payments requiring broader currency support.

Cost Comparison: Fees in SWIFT and SEPA

SWIFT payments typically incur higher fees due to correspondent bank charges and international processing costs, often ranging from $15 to $50 per transfer. SEPA payments usually have lower or no fees within the Eurozone, as the system is designed for cost-efficient Euro transfers among member countries. Banks may still apply minor charges for SEPA, but these are significantly less compared to the variable and often hidden fees associated with SWIFT payments.

Security Features of SWIFT and SEPA Payments

SWIFT payments leverage a global secure network using standardized encryption protocols and authentication methods to ensure transaction integrity and confidentiality across international borders. SEPA payments utilize robust security measures such as two-factor authentication, secure communication channels, and compliance with PSD2 regulations to protect transactions within the Eurozone. The distinct security frameworks of SWIFT and SEPA payments cater to their geographic scope, with SWIFT offering extensive international encryption and SEPA focusing on harmonized regulatory compliance for intra-European transfers.

Geographic Coverage and Accessibility

SWIFT payments provide extensive geographic coverage, enabling international money transfers to over 200 countries and territories, making them ideal for global transactions. SEPA payments are specifically designed for the Eurozone, covering 36 European countries with streamlined euro-denominated transfers and faster processing times. SEPA's accessibility is limited to participating European banks, while SWIFT's network includes thousands of financial institutions worldwide, offering broader access for cross-border payments.

Use Cases: When to Choose SWIFT or SEPA

SWIFT payments are ideal for international transactions outside the Single Euro Payments Area (SEPA), supporting multiple currencies and global bank networks. SEPA payments are best suited for euro-denominated transfers within the 36 SEPA member countries, offering faster processing times and lower fees. Selecting SWIFT is advantageous for cross-border business payments requiring diverse currency options, whereas SEPA is optimal for domestic and regional euro transfers between Eurozone banks.

Future Trends in International Payment Systems

Future trends in international payment systems emphasize increased adoption of blockchain technology and real-time payment processing to enhance SWIFT payment efficiency and reduce transaction costs. SEPA payments continue to set a standard for seamless, low-cost euro transactions within Europe, with ongoing integration of instant payment schemes and extended geographical reach. Cross-border payment innovations focus on interoperability between SWIFT and SEPA networks, leveraging APIs and distributed ledger technology to improve transparency and settlement speed.

Important Terms

Cross-border transactions

Cross-border transactions utilizing SWIFT payments enable international fund transfers across more than 200 countries with multi-currency support and standardized messaging protocols, ensuring secure and reliable global banking communication. In contrast, SEPA payments facilitate Euro-denominated transfers within the Single Euro Payments Area among 36 European countries, offering faster processing times, lower fees, and streamlined transactions within the EU market.

IBAN (International Bank Account Number)

IBAN (International Bank Account Number) standardizes bank account identification to facilitate international and cross-border payments, with SWIFT payments typically involving IBAN for global transfers outside the Single Euro Payments Area (SEPA). SEPA payments exclusively use IBAN within participating European countries to ensure seamless, low-cost euro transfers, differing from SWIFT which connects banks worldwide with unique BIC/SWIFT codes alongside IBAN.

BIC (Bank Identifier Code)

BIC (Bank Identifier Code) uniquely identifies banks in international SWIFT payments, ensuring secure and accurate cross-border transactions outside the Single Euro Payments Area (SEPA). In SEPA payments, BIC usage has been largely simplified or omitted, relying primarily on IBAN to streamline euro-denominated transfers within SEPA member countries.

Correspondent banking

Correspondent banking involves intermediary banks facilitating cross-border transactions through SWIFT payments, enabling secure, international fund transfers in multiple currencies. SEPA payments, limited to Euro transactions within the Single Euro Payments Area, bypass intermediaries for faster, cost-efficient transfers between European banks.

MT messages

MT messages, primarily used in SWIFT payments, facilitate global financial communication with standardized message types like MT103 for customer credit transfers, whereas SEPA payments rely on ISO 20022 XML formats for euro-denominated transactions within the Single Euro Payments Area. SWIFT's MT messages support cross-border, multi-currency transfers with complex remittance information, while SEPA payments emphasize simplified, low-cost euro transfers among European banks.

TARGET2

TARGET2 processes large-value euro payments in real time between European central banks through a centralized platform, ensuring immediate settlement and liquidity management for cross-border transactions. SEPA payments streamline euro transfers within the Single Euro Payments Area using standardized formats and lower costs, while SWIFT provides a global messaging network for secure interbank communication beyond Europe, supporting multi-currency transactions including target2 payments.

Eurozone remittance

Eurozone remittances often utilize SEPA payments for domestic and cross-border euro transfers within member states, benefiting from low fees and fast settlement; SWIFT payments, however, are preferred for international transfers outside the SEPA zone, offering global reach but typically involving higher costs and longer processing times. SEPA supports standardized euro transactions across 36 European countries, while SWIFT enables multi-currency payments between over 11,000 financial institutions worldwide.

GPI (Global Payments Innovation)

GPI (Global Payments Innovation) enhances SWIFT payments by enabling faster, transparent, and traceable cross-border transactions compared to traditional SWIFT transfers, which often lack real-time tracking. In contrast, SEPA payments focus on standardized euro-denominated transactions within the Single Euro Payments Area, offering low-cost and efficient domestic and cross-border Euro payments but without the extensive global reach and real-time tracking features of SWIFT GPI.

Settlement latency

Settlement latency for SWIFT payments typically spans one to five business days due to cross-border processing and multiple intermediary banks, while SEPA payments usually settle within the same business day or by the next business day for euro-denominated transactions within the Single Euro Payments Area. Enhanced processing speeds and standardized protocols in SEPA reduce settlement delays compared to SWIFT's global network, which involves complex routing and currency conversions.

Interbank clearing

Interbank clearing involves the settlement of payments between banks, where SWIFT payment systems facilitate global transactions using a standardized messaging network connecting over 11,000 financial institutions worldwide, ensuring secure international fund transfers. SEPA payment, limited to the Single Euro Payments Area, streamlines euro-denominated transactions across 36 European countries with faster processing times, lower fees, and uniform regulatory standards, optimizing cross-border euro payments within Europe.

SWIFT payment vs SEPA payment Infographic

moneydif.com

moneydif.com