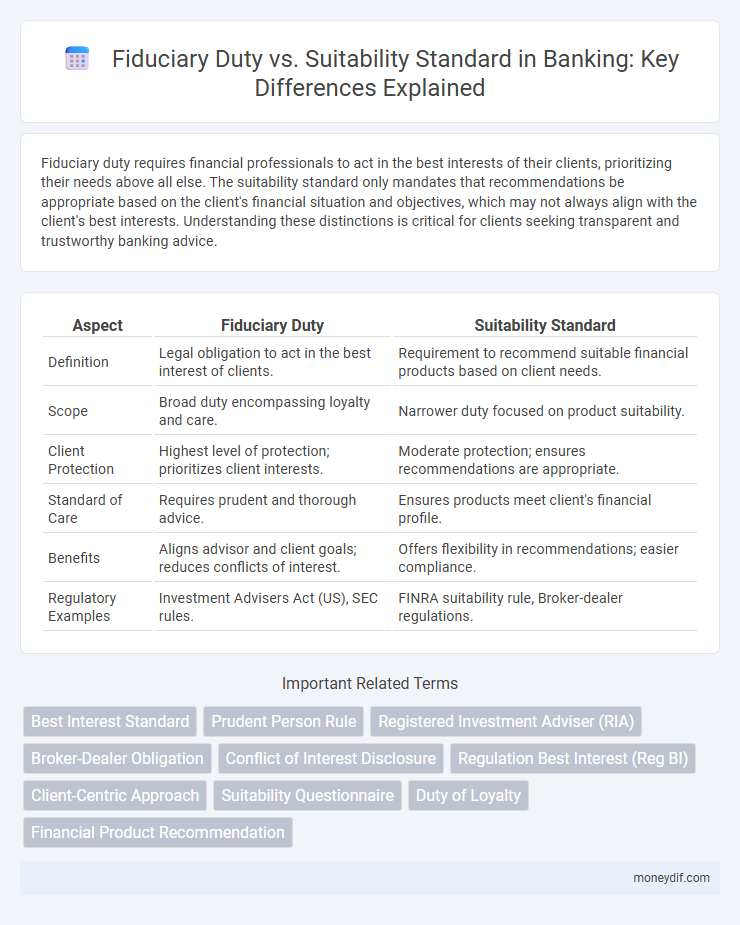

Fiduciary duty requires financial professionals to act in the best interests of their clients, prioritizing their needs above all else. The suitability standard only mandates that recommendations be appropriate based on the client's financial situation and objectives, which may not always align with the client's best interests. Understanding these distinctions is critical for clients seeking transparent and trustworthy banking advice.

Table of Comparison

| Aspect | Fiduciary Duty | Suitability Standard |

|---|---|---|

| Definition | Legal obligation to act in the best interest of clients. | Requirement to recommend suitable financial products based on client needs. |

| Scope | Broad duty encompassing loyalty and care. | Narrower duty focused on product suitability. |

| Client Protection | Highest level of protection; prioritizes client interests. | Moderate protection; ensures recommendations are appropriate. |

| Standard of Care | Requires prudent and thorough advice. | Ensures products meet client's financial profile. |

| Benefits | Aligns advisor and client goals; reduces conflicts of interest. | Offers flexibility in recommendations; easier compliance. |

| Regulatory Examples | Investment Advisers Act (US), SEC rules. | FINRA suitability rule, Broker-dealer regulations. |

Understanding Fiduciary Duty: Definition and Core Principles

Fiduciary duty in banking requires advisors to act in the best interest of their clients, prioritizing loyalty and care above personal gain. Core principles include duty of loyalty, duty of care, and full disclosure to ensure transparency and trust. This standard is legally binding, compelling financial professionals to avoid conflicts of interest and provide unbiased advice.

The Suitability Standard Explained: Key Features

The Suitability Standard requires financial advisors to recommend investment products that align with a client's financial needs, objectives, and risk tolerance at the time of the transaction. Unlike the Fiduciary Duty, which mandates acting in the client's best interest at all times, the Suitability Standard allows recommendations that are suitable but not necessarily optimal. Key features include a focus on reasonable basis suitability, customer-specific suitability, and quantitative suitability to ensure that investments meet the client's portfolio profile and investment strategy.

Fiduciary Duty vs Suitability Standard: A Direct Comparison

Fiduciary duty requires financial advisors to act in the best interests of their clients, prioritizing transparency and putting client needs above their own profit motives. The suitability standard allows advisors to recommend products that fit a client's financial situation but does not mandate the highest level of care or conflict avoidance. This direct comparison highlights fiduciary duty's stricter ethical requirements compared to the more flexible, but potentially conflicted, suitability standard in banking advisory services.

Regulatory Framework: Laws Governing Fiduciary and Suitability Duties

The regulatory framework governing fiduciary duty and suitability standards in banking is primarily established by the Investment Advisers Act of 1940 and the Financial Industry Regulatory Authority (FINRA) rules. Fiduciary duty mandates that financial advisers act in the best interest of their clients, emphasizing loyalty and care, whereas the suitability standard requires recommendations to be suitable based on the client's financial situation and objectives. The Department of Labor's fiduciary rule and the Securities and Exchange Commission (SEC) regulations further define these obligations, creating distinct legal requirements that affect compliance and client protection in investment advisory services.

Roles of Financial Advisors: Fiduciary vs Suitability Standards

Financial advisors operating under the fiduciary duty are legally obligated to act in the best interests of their clients, prioritizing transparency and full disclosure in investment decisions. Advisors adhering to the suitability standard must recommend investments that align with the client's financial profile and objectives, yet they are not required to place client interests above their own or the firm's. Understanding the distinction between fiduciary and suitability standards is critical for clients seeking tailored financial advice and optimal portfolio management.

Impact on Investors: Client Protections and Outcomes

Fiduciary duty requires financial advisors to act in the best interests of their clients, ensuring thorough disclosure and minimizing conflicts of interest, which enhances investor protection and trust. In contrast, the suitability standard only mandates recommendations that meet clients' financial needs, potentially allowing for higher-fee or less optimal products that may impact long-term outcomes. Investors under fiduciary duty arrangements typically experience better alignment with their financial goals and improved portfolio performance due to stricter regulatory oversight and client-first principles.

Conflict of Interest: How Each Standard Addresses Them

Fiduciary duty requires financial advisors to act in the best interests of their clients, prioritizing transparency and full disclosure to manage conflicts of interest effectively. The suitability standard allows advisors to recommend products that are suitable but not necessarily in the client's best interest, potentially permitting conflicts of interest when advisors prioritize their own benefits. Regulatory frameworks like the SEC's Regulation Best Interest aim to enhance conflict management under the suitability standard, but fiduciary duty remains the stricter, client-first approach.

Recent Banking Industry Trends on Fiduciary and Suitability Standards

Recent banking industry trends reflect a heightened emphasis on fiduciary duty as regulatory bodies push for greater transparency and client-first practices, distinguishing it from the less stringent suitability standard. Financial institutions increasingly adopt fiduciary standards to mitigate legal risks and enhance client trust by prioritizing investors' best interests over mere suitability. This shift aligns with evolving regulations and investor demands, driving banks to integrate comprehensive compliance frameworks and robust disclosure protocols.

Choosing an Advisor: What Clients Need to Know

Clients selecting financial advisors should understand the distinction between fiduciary duty and suitability standard to ensure their investments are managed with maximum care and loyalty. Fiduciary duty legally requires advisors to act in the client's best interest, fully disclosing conflicts and prioritizing client needs, while the suitability standard merely mandates recommendations that fit the client's financial profile, allowing conflicts of interest. Awareness of these standards helps clients make informed decisions, fostering trust and aligning investment strategies with their long-term financial goals.

The Future of Fiduciary and Suitability Standards in Banking

The future of fiduciary and suitability standards in banking is expected to see increased regulatory convergence, emphasizing heightened transparency and client-centric approaches. Emerging technologies and data analytics are driving more personalized financial advice, reinforcing fiduciary responsibilities to act in clients' best interests. Regulatory bodies like the SEC and CFPB are likely to implement stricter guidelines ensuring advisors meet both fiduciary duty and suitability standards to protect consumers in complex financial environments.

Important Terms

Best Interest Standard

The Best Interest Standard requires financial advisors to prioritize clients' welfare above personal or firm gain, ensuring fiduciary duty is upheld in all recommendations. This contrasts with the Suitability Standard, which only mandates that investment choices meet clients' needs without necessarily serving their best long-term interests.

Prudent Person Rule

The Prudent Person Rule requires fiduciaries to invest with the care, skill, and caution that a prudent person would exercise, emphasizing a duty of loyalty and prudence under fiduciary duty standards. Unlike the suitability standard, which only mandates that investments be appropriate for the investor's profile, the Prudent Person Rule imposes a higher obligation to prioritize beneficiaries' best interests and minimize risk.

Registered Investment Adviser (RIA)

Registered Investment Advisers (RIAs) are legally bound by a fiduciary duty to act in their clients' best interests, requiring full disclosure of conflicts and prioritizing client needs above their own. This standard contrasts with the suitability standard, which only obligates brokers to recommend products appropriate to a client's financial situation without the same rigorous duties of loyalty and care.

Broker-Dealer Obligation

Broker-dealer obligations in financial transactions require adherence to the suitability standard, ensuring investments align with clients' financial needs and risk tolerance, whereas fiduciary duty imposes a higher legal obligation found primarily in registered investment advisors to act in the client's best interest. The distinction impacts disclosure requirements, conflict of interest management, and the level of care exercised during investment recommendations.

Conflict of Interest Disclosure

Conflict of interest disclosure is critical in navigating fiduciary duty versus suitability standard, ensuring clients understand how advisors' financial incentives may impact investment recommendations. Fiduciary duty mandates advisors prioritize clients' best interests, while the suitability standard requires recommendations to fit clients' financial needs without necessarily minimizing conflicts, making transparent disclosure essential for informed decision-making.

Regulation Best Interest (Reg BI)

Regulation Best Interest (Reg BI) establishes a standard requiring broker-dealers to act in the best interest of retail customers when recommending securities, tightening obligations beyond the traditional suitability standard but not fully imposing a fiduciary duty like registered investment advisers have. This regulatory framework aims to enhance investor protection by mandating disclosure, care, and conflict of interest obligations while maintaining distinct roles between broker-dealers and fiduciaries.

Client-Centric Approach

A client-centric approach prioritizes the fiduciary duty, ensuring financial advisors act in the best interests of their clients with loyalty and care, as opposed to the suitability standard, which only requires recommendations to be appropriate without guaranteeing optimal client benefit. This approach enhances trust and aligns financial strategies with clients' goals, thereby elevating ethical standards and long-term client satisfaction in wealth management.

Suitability Questionnaire

A Suitability Questionnaire evaluates whether an investment recommendation aligns with the client's financial situation, objectives, and risk tolerance, reflecting the suitability standard. Fiduciary Duty imposes a higher obligation requiring advisors to act in the client's best interest, prioritizing trust and transparency beyond the minimum criteria of suitability.

Duty of Loyalty

The Duty of Loyalty requires fiduciaries to act in the best interests of their clients, avoiding conflicts of interest, a standard that exceeds the Suitability Standard which only mandates recommendations that meet a client's financial needs. Fiduciary Duty imposes stricter ethical responsibilities compared to the Suitability Standard, ensuring advisers prioritize client welfare over personal gain.

Financial Product Recommendation

Financial product recommendation must balance fiduciary duty, which legally requires acting in the client's best interest, against the suitability standard that permits recommendations aligned with the client's financial needs but not necessarily the optimal choice. Fiduciaries prioritize transparency and thorough client profiling to avoid conflicts of interest, whereas suitability standard focuses on ensuring recommendations meet basic client objectives without mandating the highest standard of care.

Fiduciary Duty vs Suitability Standard Infographic

moneydif.com

moneydif.com