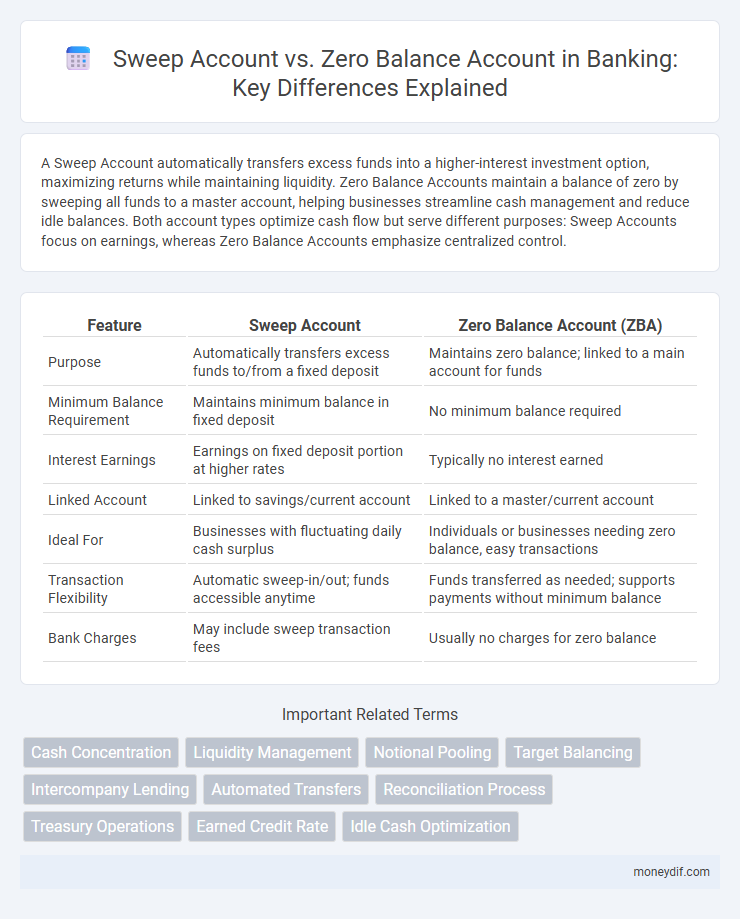

A Sweep Account automatically transfers excess funds into a higher-interest investment option, maximizing returns while maintaining liquidity. Zero Balance Accounts maintain a balance of zero by sweeping all funds to a master account, helping businesses streamline cash management and reduce idle balances. Both account types optimize cash flow but serve different purposes: Sweep Accounts focus on earnings, whereas Zero Balance Accounts emphasize centralized control.

Table of Comparison

| Feature | Sweep Account | Zero Balance Account (ZBA) |

|---|---|---|

| Purpose | Automatically transfers excess funds to/from a fixed deposit | Maintains zero balance; linked to a main account for funds |

| Minimum Balance Requirement | Maintains minimum balance in fixed deposit | No minimum balance required |

| Interest Earnings | Earnings on fixed deposit portion at higher rates | Typically no interest earned |

| Linked Account | Linked to savings/current account | Linked to a master/current account |

| Ideal For | Businesses with fluctuating daily cash surplus | Individuals or businesses needing zero balance, easy transactions |

| Transaction Flexibility | Automatic sweep-in/out; funds accessible anytime | Funds transferred as needed; supports payments without minimum balance |

| Bank Charges | May include sweep transaction fees | Usually no charges for zero balance |

Introduction to Sweep Accounts and Zero Balance Accounts

Sweep accounts automatically transfer surplus funds from a primary current or savings account to a higher-interest earning investment or loan account, optimizing liquidity and returns for businesses. Zero Balance Accounts (ZBA) maintain a zero balance by pooling funds from a master account to cover transactions, simplifying cash management and enhancing control over multiple sub-accounts. Both account types are essential tools in corporate treasury management, enabling efficient cash flow optimization and financial discipline.

Key Features of Sweep Accounts

Sweep accounts automatically transfer excess funds from a zero balance account to a higher interest-bearing account, optimizing liquidity management for businesses. These accounts help maintain minimum balances, reduce idle cash, and maximize interest earnings by sweeping surplus funds into investment instruments. Real-time fund transfers and customizable thresholds ensure efficient cash flow control and operational flexibility.

Key Features of Zero Balance Accounts

Zero Balance Accounts (ZBA) require no minimum balance, allowing businesses to maintain a zero balance while facilitating automatic fund transfers to cover payments. These accounts streamline cash management by linking to a master account, ensuring seamless liquidity without manual intervention. ZBAs reduce the risk of overdrafts and improve fund utilization, making them ideal for payroll and vendor payments.

How Sweep Accounts Work in Banking

Sweep accounts in banking automatically transfer excess funds from a primary account to a higher interest-earning investment or savings account, optimizing liquidity and returns. When the balance in the primary account dips below a predetermined threshold, the swept funds are transferred back to maintain the minimum required balance. This dynamic balance management helps businesses maintain operational cash flow while maximizing interest income.

How Zero Balance Accounts Operate

Zero Balance Accounts (ZBAs) function by maintaining a null balance at all times, with funds automatically transferred from a master or linked account to cover transactions as needed. This system minimizes idle cash by consolidating funds centrally while allowing subsidiaries or branches to operate seamlessly. ZBAs enhance cash management efficiency by reducing overdraft risks and improving liquidity monitoring within corporate banking structures.

Major Differences Between Sweep and Zero Balance Accounts

Sweep accounts automatically transfer surplus funds from a current account to a fixed deposit or savings account, optimizing interest earnings while maintaining liquidity. Zero Balance Accounts (ZBA) maintain a nil balance by transferring aggregate fund requirements to a master account, simplifying fund management for multiple branches or departments. Unlike sweep accounts that focus on maximizing interest, ZBAs emphasize centralized control over disbursements and cash flow without maintaining minimum balances.

Advantages of Sweep Accounts for Businesses

Sweep accounts offer businesses enhanced cash management by automatically transferring excess funds into higher-interest accounts, maximizing liquidity and returns. These accounts reduce idle balances, improve working capital efficiency, and minimize the need for manual fund transfers. The automated nature of sweep accounts supports better control over cash flow, ensuring funds are optimally allocated without disrupting daily operations.

Benefits of Zero Balance Accounts for Cash Management

Zero Balance Accounts (ZBAs) optimize cash management by automatically consolidating funds from multiple sub-accounts into a master account, ensuring efficient use of capital without idle balances. These accounts reduce the need for manual transfers, lowering administrative costs and simplifying cash flow monitoring. Businesses benefit from improved liquidity control and enhanced fund utilization, making ZBAs ideal for managing operational expenses seamlessly.

Choosing Between Sweep and Zero Balance Accounts

Choosing between a Sweep Account and a Zero Balance Account depends on cash management needs and operational efficiency. Sweep Accounts automatically transfer excess funds to higher interest-earning investments, maximizing returns while maintaining liquidity for daily transactions. Zero Balance Accounts streamline payments by consolidating funds into a master account, minimizing idle balances and simplifying reconciliation across multiple branches or departments.

Which Account Suits Your Banking Needs?

Sweep accounts automatically transfer excess funds from a current account to a fixed deposit, maximizing interest earnings while maintaining liquidity, making them ideal for businesses with fluctuating cash flows. Zero Balance Accounts (ZBA) maintain a balance of zero by sweeping funds to and from a master account, perfect for companies needing centralized control of multiple sub-accounts without earning interest on idle funds. Choosing between sweep accounts and zero balance accounts depends on the need for interest optimization versus streamlined fund management across various accounts.

Important Terms

Cash Concentration

Cash concentration optimizes liquidity management by consolidating funds from multiple accounts into a central account, while sweep accounts automate transferring excess cash to investment or repayment accounts daily; zero balance accounts (ZBAs) maintain a zero balance by drawing funds from a master account as needed, ensuring precise fund allocation without idle balances. Both sweep accounts and ZBAs enhance cash flow efficiency but differ in operational mechanics and balance control--sweep accounts focus on surplus fund investment, whereas ZBAs prioritize minimizing idle cash in sub-accounts through centralized replenishment.

Liquidity Management

Liquidity management enhances cash flow efficiency by using sweep accounts, which automatically transfer excess funds into interest-bearing accounts to maximize returns, while zero balance accounts centralize cash by maintaining a zero balance and funding transactions from a master account. Businesses optimize working capital and reduce idle cash by choosing sweep accounts for interest optimization or zero balance accounts for centralized control and reduced overdraft risk.

Notional Pooling

Notional pooling consolidates the credit and debit balances of multiple accounts without physically transferring funds, optimizing interest benefits and liquidity management. Sweep accounts automatically transfer surplus funds to earning accounts, whereas zero balance accounts maintain zero balance by sweeping funds daily to a master account, both facilitating cash concentration but differing in operational mechanisms.

Target Balancing

Target Balancing optimizes cash management by allocating funds to maintain desired balances, reducing idle cash and overdraft risks within Sweep Accounts and Zero Balance Accounts (ZBAs). Sweep Accounts automatically transfer excess funds to interest-bearing accounts, while ZBAs centralize disbursements and receipts, enabling precise control of subsidiary accounts through target balance settings.

Intercompany Lending

Intercompany lending streamlines cash management by utilizing sweep accounts to automatically transfer excess funds between subsidiaries, optimizing liquidity and reducing external borrowing costs. Zero balance accounts complement this process by maintaining subsidiary accounts at a zero balance, ensuring all cash is centralized without manual intervention, enhancing control and efficiency in intercompany cash flows.

Automated Transfers

Automated transfers in sweep accounts enable the seamless movement of excess funds into higher-interest investments, optimizing liquidity without manual intervention. Zero balance accounts maintain a daily balance of zero by automatically transferring funds to or from a master account, ensuring precise cash management and minimizing idle balances.

Reconciliation Process

The reconciliation process for sweep accounts involves automatically transferring excess funds to a linked zero balance account (ZBA) to maintain a target balance, simplifying cash management and reducing the need for manual transfers. Zero balance accounts are designed for daily expense payments, with all transactions consolidated back to the master sweep account to ensure accurate tracking and streamlined reconciliation.

Treasury Operations

Treasury operations leverage Sweep Accounts to automatically transfer excess funds to higher-yield accounts, optimizing liquidity and interest earnings, while Zero Balance Accounts (ZBAs) maintain a zero balance by concentrating funds in a master account, simplifying cash management and ensuring funds availability. Both tools enhance cash flow efficiency, with Sweep Accounts maximizing returns and ZBAs centralizing control over disbursements.

Earned Credit Rate

The Earned Credit Rate (ECR) quantifies the interest cost savings or revenue generated from sweep accounts by offsetting deposit balances against loan balances, enhancing liquidity management efficiency. Zero Balance Accounts (ZBAs) consolidate funds daily to a master account, minimizing idle balances but typically do not directly influence ECR, unlike sweep accounts that actively optimize credit usage and reduce interest expenses.

Idle Cash Optimization

Idle Cash Optimization enhances liquidity management by minimizing idle funds through strategic use of Sweep Accounts, which automatically transfer excess balances to higher-yield investment accounts, compared to Zero Balance Accounts that maintain a zero dollar balance by pulling funds from a master account as needed. Sweep Accounts optimize returns on surplus cash, while Zero Balance Accounts streamline fund allocation and reduce overdraft risk within an enterprise's cash management system.

Sweep Account vs Zero Balance Account Infographic

moneydif.com

moneydif.com