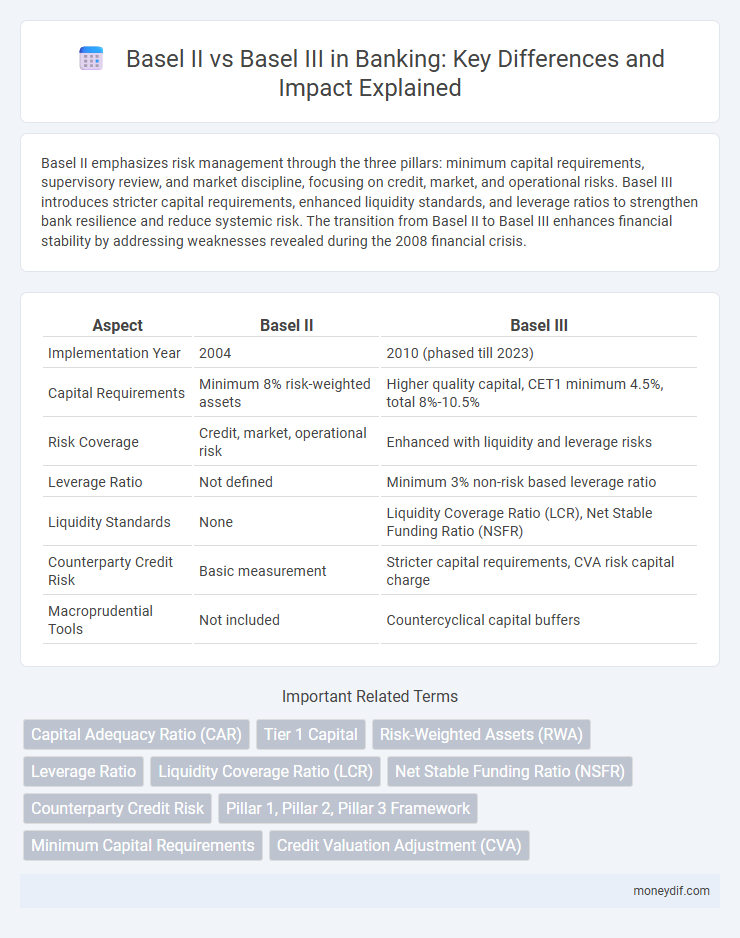

Basel II emphasizes risk management through the three pillars: minimum capital requirements, supervisory review, and market discipline, focusing on credit, market, and operational risks. Basel III introduces stricter capital requirements, enhanced liquidity standards, and leverage ratios to strengthen bank resilience and reduce systemic risk. The transition from Basel II to Basel III enhances financial stability by addressing weaknesses revealed during the 2008 financial crisis.

Table of Comparison

| Aspect | Basel II | Basel III |

|---|---|---|

| Implementation Year | 2004 | 2010 (phased till 2023) |

| Capital Requirements | Minimum 8% risk-weighted assets | Higher quality capital, CET1 minimum 4.5%, total 8%-10.5% |

| Risk Coverage | Credit, market, operational risk | Enhanced with liquidity and leverage risks |

| Leverage Ratio | Not defined | Minimum 3% non-risk based leverage ratio |

| Liquidity Standards | None | Liquidity Coverage Ratio (LCR), Net Stable Funding Ratio (NSFR) |

| Counterparty Credit Risk | Basic measurement | Stricter capital requirements, CVA risk capital charge |

| Macroprudential Tools | Not included | Countercyclical capital buffers |

Overview of Basel II and Basel III

Basel II introduced a three-pillar framework emphasizing minimum capital requirements, supervisory review, and market discipline to enhance banking stability. Basel III, developed in response to the 2008 financial crisis, strengthens capital adequacy by increasing quality and quantity of capital, introduces stricter liquidity and leverage ratios, and enhances risk coverage. Both frameworks aim to reduce systemic risk, but Basel III provides more comprehensive and stringent regulatory standards.

Key Differences Between Basel II and Basel III

Basel III introduces stricter capital requirements compared to Basel II, emphasizing higher quality capital like common equity tier 1 to improve financial stability. It enhances risk coverage by including counterparty credit risk and liquidity risks, which were less emphasized in Basel II. Basel III also implements leverage and liquidity ratios to reduce systemic risks and promote a more resilient banking system globally.

Evolution of Capital Adequacy Requirements

Basel II introduced more risk-sensitive capital requirements by incorporating credit, market, and operational risks, enhancing banks' ability to measure and manage risks effectively. Basel III evolved these standards by increasing minimum capital ratios, introducing higher-quality capital definitions like Common Equity Tier 1 (CET1), and implementing leverage and liquidity buffers to strengthen overall financial stability. This regulatory progression reflects a shift towards more comprehensive risk management frameworks and improved resilience against financial crises.

Credit Risk Management Enhancements

Basel III introduces more stringent credit risk management enhancements compared to Basel II, including higher capital requirements and improved risk sensitivity through the incorporation of credit valuation adjustment (CVA) risk capital charges. The framework emphasizes the importance of stress testing and counterparty credit risk, promoting better identification and mitigation of potential losses. Enhanced disclosure requirements under Basel III also ensure greater transparency, allowing banks to better manage credit risk exposures.

Liquidity Standards: Basel II vs Basel III

Basel II primarily emphasized capital adequacy and credit risk without detailed liquidity standards, whereas Basel III introduced stringent liquidity requirements such as the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to strengthen banks' short-term and long-term liquidity resilience. Basel III's liquidity standards aim to mitigate systemic risks by ensuring banks hold sufficient high-quality liquid assets (HQLA) to withstand financial stress scenarios. These enhanced liquidity measures under Basel III represent a significant evolution from Basel II, addressing gaps exposed during the 2008 financial crisis.

Leverage Ratios: Comparative Analysis

Basel III introduced a more stringent leverage ratio requirement at 3% of Tier 1 capital compared to Basel II, which lacked a formal leverage ratio standard, enhancing the resilience of banks against excessive borrowing. The Basel III leverage ratio acts as a non-risk-based backstop to risk-weighted capital requirements, mitigating the risk of model inaccuracies inherent in Basel II's framework. This comparative regulatory enhancement under Basel III strengthens banks' capital adequacy and reduces systemic risk by limiting leverage more effectively than Basel II.

Supervisory Review and Market Discipline

Basel II introduces the Supervisory Review Process (Pillar 2), emphasizing internal risk assessments and regulatory oversight to ensure banks maintain adequate capital beyond minimum requirements. Basel III strengthens market discipline (Pillar 3) by mandating enhanced disclosure standards that improve transparency in risk exposure, capital adequacy, and liquidity positions. These reforms collectively enhance supervisory frameworks and market-driven accountability, promoting financial stability and resilience in the banking sector.

Impact on Bank Operational Strategies

Basel II emphasized risk-sensitive capital requirements, prompting banks to enhance credit risk management and internal risk assessment models. Basel III introduced stricter capital buffers, leverage ratios, and liquidity requirements, leading banks to adopt more conservative lending practices and strengthen liquidity management frameworks. The regulatory shift from Basel II to Basel III significantly reshaped banks' operational strategies by increasing focus on resilience, capital adequacy, and stress testing capabilities.

Implementation Challenges and Timelines

Basel II implementation faced challenges such as inadequate risk sensitivity and inconsistent application across jurisdictions, resulting in uneven regulatory standards. Basel III introduces stricter capital and liquidity requirements, complicating compliance due to enhanced metrics like the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), which require significant data infrastructure upgrades. Timelines for Basel III adoption extend beyond 2023 in many regions, reflecting the complexity and resource intensity of meeting its comprehensive regulatory framework.

Future Trends in Basel Regulatory Frameworks

Future trends in Basel regulatory frameworks emphasize enhanced risk sensitivity and stronger capital requirements compared to Basel II, driven by lessons from the 2008 financial crisis. Basel III introduces advanced measures for liquidity risk, leverage ratios, and stress testing, setting the stage for Basel IV's anticipated focus on operational risk and standardizing credit risk models. Digital transformation and climate risk integration emerge as critical components shaping the evolution of Basel regulations.

Important Terms

Capital Adequacy Ratio (CAR)

The Capital Adequacy Ratio (CAR) under Basel II focused on minimum capital requirements based on credit, market, and operational risks, primarily using the 8% threshold to ensure bank solvency. Basel III enhanced CAR by introducing more stringent capital quality standards, higher minimum ratios including a conservation buffer, and additional risk coverage to improve financial stability and resilience against economic shocks.

Tier 1 Capital

Tier 1 Capital under Basel II primarily focused on core capital components like common equity and disclosed reserves, emphasizing risk weighting for credit risk assessment. Basel III strengthened Tier 1 Capital requirements by increasing minimum common equity ratios, introducing a capital conservation buffer, and enhancing the quality and quantity of capital to improve bank resilience during financial stress.

Risk-Weighted Assets (RWA)

Risk-Weighted Assets (RWA) under Basel III incorporate more stringent capital requirements and enhanced risk sensitivity compared to Basel II, reflecting an increased focus on counterparty credit risk, market risk, and operational risk. Basel III introduces higher capital buffers and leverage ratios, aiming to strengthen bank resilience and improve financial stability beyond the Basel II framework.

Leverage Ratio

The leverage ratio under Basel III introduces a non-risk-based measure to limit excessive leverage by banks, set at a minimum of 3%, whereas Basel II primarily focused on risk-weighted assets without a formal leverage ratio requirement. Basel III's leverage ratio acts as a backstop to risk-based capital requirements, enhancing the stability of the banking system by preventing the buildup of systemic risk through high leverage.

Liquidity Coverage Ratio (LCR)

Liquidity Coverage Ratio (LCR) is a key regulatory standard introduced under Basel III to ensure banks maintain an adequate level of high-quality liquid assets (HQLA) to cover net cash outflows over a 30-day stress period, a requirement that was not explicitly addressed in Basel II. Basel II primarily focused on credit, market, and operational risks without specifying liquidity risk metrics, whereas Basel III enhanced financial stability by mandating the LCR to strengthen banks' short-term resilience against liquidity disruptions.

Net Stable Funding Ratio (NSFR)

The Net Stable Funding Ratio (NSFR) is a key liquidity standard introduced under Basel III to ensure banks maintain a stable funding profile relative to their assets and off-balance-sheet activities over a one-year horizon. Unlike Basel II, which primarily focused on credit risk and capital adequacy, Basel III emphasizes both liquidity risk management and enhanced capital requirements to strengthen the resilience of the banking sector.

Counterparty Credit Risk

Counterparty Credit Risk (CCR) under Basel II is primarily managed through the Credit Valuation Adjustment (CVA) and standardized or internal models for counterparty exposures, focusing on potential future exposure and mitigants. Basel III enhances CCR frameworks by tightening capital requirements, incorporating more sensitive risk measures like stressed CVA and the introduction of the standardized approach for measuring counterparty credit risk exposures (SA-CCR), thereby improving the accuracy and resilience of risk management.

Pillar 1, Pillar 2, Pillar 3 Framework

Pillar 1 of the Basel framework sets minimum capital requirements focusing on credit, market, and operational risks, with Basel III enhancing these standards by introducing stricter capital buffers and leverage ratios. Pillar 2 addresses supervisory review processes, encouraging banks to assess internal risk management tailored to Basel III's emphasis on systemic risk, while Pillar 3 mandates improved market discipline through enhanced disclosure requirements, significantly strengthened in Basel III for greater transparency and risk assessment.

Minimum Capital Requirements

Minimum capital requirements under Basel III are more stringent than those of Basel II, increasing the quality and quantity of capital banks must hold to absorb losses; Basel III introduces a higher Common Equity Tier 1 (CET1) capital ratio of 4.5% plus a capital conservation buffer, compared to Basel II's lower minimum standards. Basel III also enhances risk coverage, adds a leverage ratio, and incorporates countercyclical capital buffers, promoting greater financial stability compared to Basel II's framework.

Credit Valuation Adjustment (CVA)

Credit Valuation Adjustment (CVA) quantifies counterparty credit risk in over-the-counter derivatives, reflecting the market value of credit risk exposure; under Basel II, CVA risk was less explicitly addressed, whereas Basel III introduced more stringent capital requirements and risk sensitivity for CVA to enhance financial stability. Basel III mandates banks to hold additional capital against CVA, incorporating standardized and advanced approaches to better capture counterparty credit risk volatility and market credit spreads.

Basel II vs Basel III Infographic

moneydif.com

moneydif.com