A blanket lien grants a lender comprehensive security interest over all of a borrower's assets, ensuring repayment through any available collateral, while a specific lien targets only particular assets or properties designated in the loan agreement. Blanket liens offer broader protection for creditors but may complicate the borrower's ability to obtain additional financing. Specific liens provide clearer asset prioritization, allowing borrowers to secure multiple loans using different collateral without cross-collateralization.

Table of Comparison

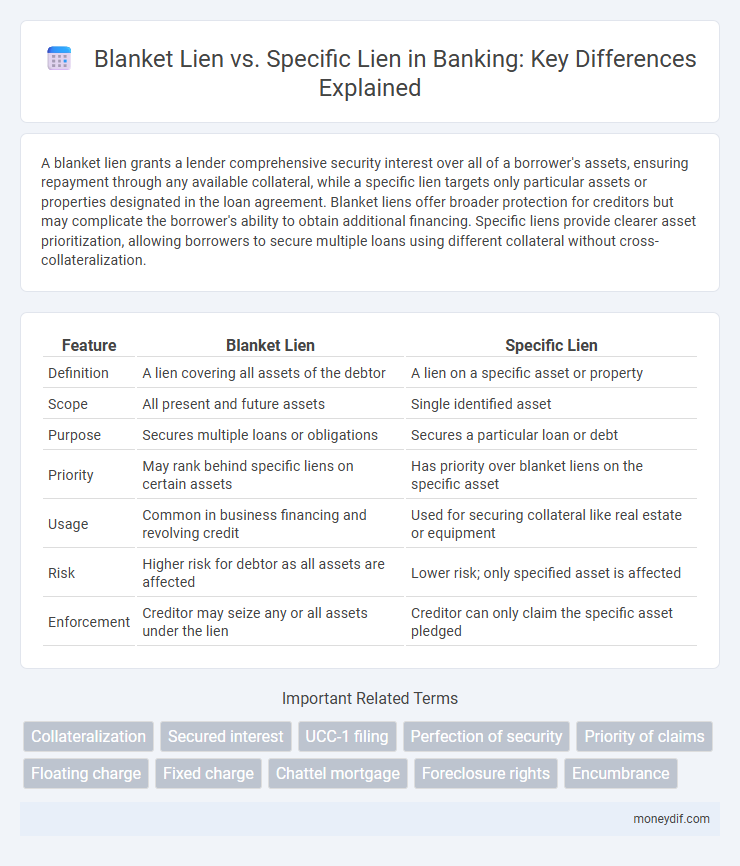

| Feature | Blanket Lien | Specific Lien |

|---|---|---|

| Definition | A lien covering all assets of the debtor | A lien on a specific asset or property |

| Scope | All present and future assets | Single identified asset |

| Purpose | Secures multiple loans or obligations | Secures a particular loan or debt |

| Priority | May rank behind specific liens on certain assets | Has priority over blanket liens on the specific asset |

| Usage | Common in business financing and revolving credit | Used for securing collateral like real estate or equipment |

| Risk | Higher risk for debtor as all assets are affected | Lower risk; only specified asset is affected |

| Enforcement | Creditor may seize any or all assets under the lien | Creditor can only claim the specific asset pledged |

Introduction to Liens in Banking

In banking, a lien represents a legal claim or hold on a debtor's assets to secure repayment of a loan or obligation. A blanket lien covers all assets of the borrower, granting the lender broad security interests, while a specific lien targets particular assets as collateral. Understanding the differences between blanket and specific liens is crucial for managing risk and ensuring proper asset protection in lending agreements.

Defining Blanket Liens

A blanket lien grants a lender a security interest over all assets of a borrower, ensuring comprehensive collateral coverage for a loan or credit facility. This type of lien allows the creditor to claim any or all assets in case of default, providing broader protection compared to specific liens, which attach only to specified assets. Blanket liens are commonly used in business loans to secure obligations across diverse asset categories such as inventory, equipment, and accounts receivable.

Understanding Specific Liens

Specific liens are legal claims on particular property or assets used as collateral for a debt, ensuring the lender's right to seize only that designated asset if the borrower defaults. Unlike blanket liens that cover all assets of the borrower, specific liens limit the lender's security interest to agreed-upon items such as real estate, vehicles, or equipment. Understanding specific liens helps businesses and lenders clearly define collateral boundaries, reducing risks by targeting precise assets for debt recovery in banking transactions.

Key Differences: Blanket Lien vs Specific Lien

A blanket lien offers a creditor security interest over all current and future assets of a debtor, whereas a specific lien targets a particular asset as collateral. Blanket liens provide broader creditor protection but may complicate asset liquidation, while specific liens limit creditor claims to the designated asset, allowing clearer prioritization. Understanding the distinction in scope and collateral specificity is crucial for risk management and loan structuring in banking.

Benefits of Blanket Liens for Lenders

Blanket liens offer lenders comprehensive security by covering all current and future assets of a borrower, enhancing the likelihood of debt recovery in case of default. This broad collateral base reduces monitoring costs and increases flexibility in lending decisions, allowing lenders to extend larger credit lines confidently. Such liens simplify the collateral management process and improve the lender's position in bankruptcy proceedings by securing priority over multiple assets.

Advantages of Specific Liens for Borrowers

Specific liens offer borrowers targeted protection by securing only particular assets as collateral, which allows them to retain greater control over their other property. This focused approach minimizes risk exposure and can facilitate easier refinancing or asset liquidation without encumbering unrelated assets. Borrowers benefit from clearer terms and potentially lower borrowing costs due to the reduced collateral scope compared to blanket liens.

Risks and Drawbacks: Blanket vs Specific Liens

Blanket liens pose risks by granting lenders claims on all borrower assets, increasing the chance of losing unrelated property during default, which complicates asset management for businesses. Specific liens limit risk exposure by attaching to particular assets, but they can restrict flexibility in collateral use and may complicate financing if those assets depreciate or become encumbered. Prioritizing lien types requires careful assessment of asset valuation volatility and potential impact on future borrowing capacity.

Legal Implications in Banking Transactions

Blanket liens grant banks a security interest over all assets of a borrower, providing extensive legal control in case of default and often simplifying enforcement and asset recovery processes. Specific liens attach only to particular assets, limiting the scope of collateral but offering precise legal protection and clarity regarding the encumbered property. Understanding these distinctions is crucial for banks when drafting loan agreements to ensure enforceability and minimize litigation risks during debt recovery.

Practical Examples in Lending Agreements

In lending agreements, a blanket lien secures all current and future assets of the borrower, such as when a bank grants a loan secured by all inventory and receivables across multiple locations, providing extensive collateral coverage. A specific lien targets a particular asset, exemplified by a loan backed only by a single piece of machinery or real estate, limiting the lender's claim to that item. Practical application of blanket liens offers lenders broader security in dynamic asset environments, while specific liens cater to transactions focusing on individual, high-value assets.

Choosing the Right Lien for Your Banking Needs

Selecting the appropriate lien type is crucial in banking to secure loans effectively and protect both lender and borrower interests. A blanket lien covers all assets of the borrower, providing broader collateral protection, while a specific lien targets particular assets, offering more precise security. Assessing the borrower's asset structure and risk profile ensures the optimal lien choice aligns with the loan's purpose and repayment terms.

Important Terms

Collateralization

Collateralization involves securing a loan by pledging assets, where a blanket lien grants creditors a claim over all assets of the borrower, while a specific lien targets only particular assets as collateral. Blanket liens provide broader security for lenders, whereas specific liens limit the claim to defined property, impacting the borrower's asset flexibility and risk exposure.

Secured interest

A secured interest grants a lender a legal claim on collateral to ensure debt repayment, with a blanket lien covering all assets of the borrower, while a specific lien targets particular property or assets. Blanket liens provide broader security but may complicate asset liquidation, whereas specific liens offer focused protection on designated items, balancing risk and creditor priority.

UCC-1 filing

UCC-1 filing establishes a blanket lien giving the secured party a security interest in all current and future assets of the debtor, while a specific lien targets particular collateral itemized in the financing statement. Blanket liens offer broader creditor protection and priority over various assets, whereas specific liens provide security limited to designated property, impacting enforcement and recovery strategies.

Perfection of security

Perfection of security interests ensures enforceability against third parties by properly filing or possessing collateral, with blanket liens covering all assets of a debtor and specific liens attaching to designated collateral only. Blanket liens offer broader protection but may face priority challenges, while specific liens provide clearer priority on particular assets, influencing creditor risk and recovery outcomes.

Priority of claims

Priority of claims typically places specific liens above blanket liens because specific liens attach to particular assets, granting creditors stronger and more direct security interest. Blanket liens cover all assets of a debtor, but their priority ranking is generally subordinate to specific liens unless expressly agreed upon or perfected earlier.

Floating charge

A floating charge provides security over a changing pool of assets, allowing a company to use and dispose of those assets in the ordinary course of business until a specific event crystallizes the charge. Unlike a blanket lien, which grants a general claim over all property without consent, or a specific lien that attaches to particular property as security, the floating charge offers flexible security that converts into a fixed charge upon default or insolvency.

Fixed charge

A fixed charge is a form of security interest tied to specific assets, restricting their disposal without lender consent, commonly associated with specific liens which target particular property or assets. Blanket liens provide broader security by covering all or most assets of a borrower, allowing lenders more extensive claims but potentially complicating asset sales compared to fixed charge-specific lien arrangements.

Chattel mortgage

Chattel mortgage grants a security interest over movable personal property, typically classified as a specific lien since it applies to individual assets rather than all assets of the debtor. In contrast, a blanket lien covers multiple or all assets of a borrower, providing broader collateral security beyond the scope of a chattel mortgage's targeted protection.

Foreclosure rights

Foreclosure rights differ significantly between blanket liens and specific liens, as a blanket lien covers multiple properties under one loan, allowing the lender to foreclose on all properties if the borrower defaults, whereas a specific lien targets a single property securing a particular debt. Understanding the distinction is crucial for property owners and lenders to assess risk exposure and legal strategies during foreclosure proceedings.

Encumbrance

Encumbrance refers to a legal claim or liability on a property that may affect its transfer or value, with a blanket lien covering multiple assets as collateral for a debt, while a specific lien targets a particular asset or property. Understanding the distinction between blanket liens and specific liens is crucial for evaluating the scope and risk of encumbrances in asset management or financing.

Blanket lien vs Specific lien Infographic

moneydif.com

moneydif.com