Dual control in banking requires two or more individuals to authorize critical transactions, reducing the risk of errors and fraud through shared responsibility. Segregation of duties divides tasks among different employees to prevent conflict of interest and ensure checks and balances within financial processes. Combining dual control with segregation of duties enhances internal controls and strengthens the security of banking operations.

Table of Comparison

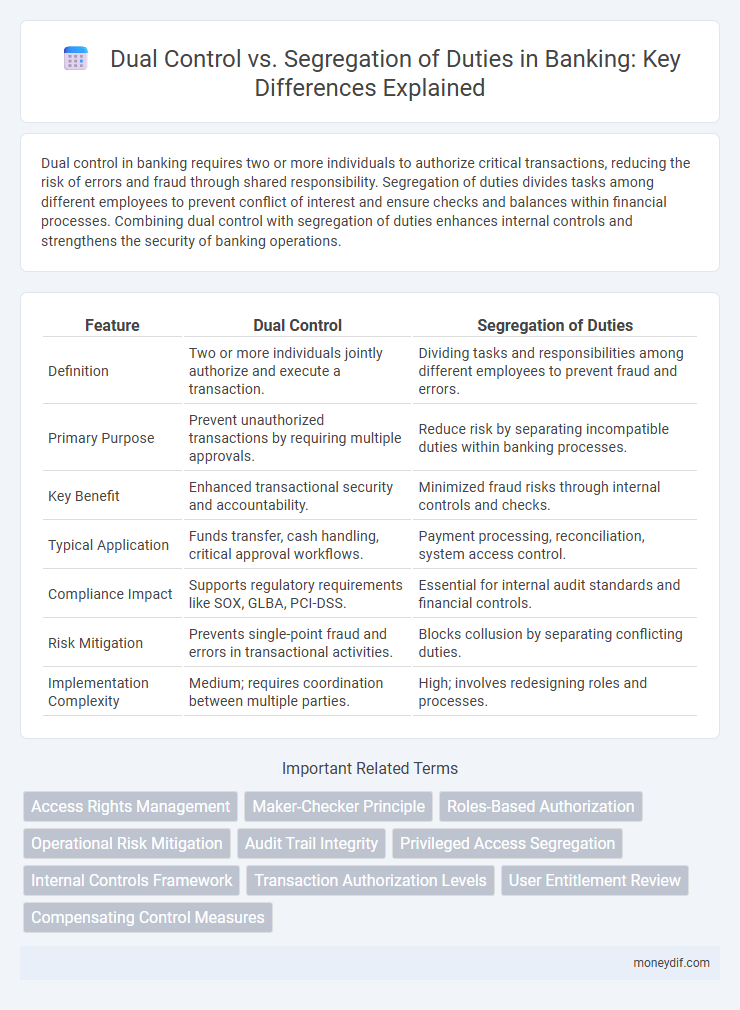

| Feature | Dual Control | Segregation of Duties |

|---|---|---|

| Definition | Two or more individuals jointly authorize and execute a transaction. | Dividing tasks and responsibilities among different employees to prevent fraud and errors. |

| Primary Purpose | Prevent unauthorized transactions by requiring multiple approvals. | Reduce risk by separating incompatible duties within banking processes. |

| Key Benefit | Enhanced transactional security and accountability. | Minimized fraud risks through internal controls and checks. |

| Typical Application | Funds transfer, cash handling, critical approval workflows. | Payment processing, reconciliation, system access control. |

| Compliance Impact | Supports regulatory requirements like SOX, GLBA, PCI-DSS. | Essential for internal audit standards and financial controls. |

| Risk Mitigation | Prevents single-point fraud and errors in transactional activities. | Blocks collusion by separating conflicting duties. |

| Implementation Complexity | Medium; requires coordination between multiple parties. | High; involves redesigning roles and processes. |

Understanding Dual Control in Banking

Dual control in banking requires two or more individuals to jointly authorize or execute high-risk transactions, ensuring enhanced security and minimizing fraud risks. It creates an environment where no single employee has unilateral access or control over critical financial processes. This system complements segregation of duties by enforcing shared responsibilities and checks within transactional workflows to maintain operational integrity.

Defining Segregation of Duties (SoD)

Segregation of Duties (SoD) is a critical internal control principle in banking that divides responsibilities among different employees to prevent fraud and errors. It ensures that no single individual has control over all aspects of a financial transaction, such as authorization, processing, and review, thus reducing operational risk. SoD enhances accountability and strengthens risk management by creating checks and balances within banking operations.

Key Differences Between Dual Control and SoD

Dual Control requires two or more individuals to jointly complete a transaction, ensuring no single person has full control, while Segregation of Duties (SoD) divides responsibilities among different individuals to minimize the risk of errors or fraud. In banking, Dual Control is often applied to secure physical or digital asset access, whereas SoD spans broader operational roles like authorization, record-keeping, and reconciliation. The primary difference lies in Dual Control's focus on collaboration for transaction execution versus SoD's focus on role separation to enforce accountability and reduce risk.

Benefits of Dual Control in Financial Institutions

Dual control enhances security in financial institutions by requiring two authorized individuals to complete sensitive transactions, reducing the risk of fraud and errors. This system ensures accountability and transparency, fostering trust among stakeholders and regulatory bodies. By splitting critical tasks, dual control minimizes the likelihood of internal collusion and strengthens overall operational integrity.

Advantages of Implementing Segregation of Duties

Segregation of Duties (SoD) enhances internal controls by distributing critical tasks among multiple employees, reducing the risk of errors and fraud in banking operations. Implementing SoD ensures transparency and accountability, as no single individual has complete control over financial transactions or access to sensitive information. This systematic approach strengthens compliance with regulatory requirements and safeguards asset integrity within financial institutions.

Common Use Cases for Dual Control in Banking

Dual control in banking is commonly applied in transaction processing, cash handling, and critical system authorization to prevent fraud and errors by requiring two or more individuals to complete a task. It ensures that no single employee has unilateral access to execute high-risk operations such as fund transfers, wire payments, and access to vaults or safety deposit boxes. This practice complements segregation of duties by adding an additional layer of oversight, especially in activities involving large-value transactions and regulatory compliance.

Risk Mitigation Through Segregation of Duties

Segregation of Duties (SoD) mitigates risks by distributing critical banking functions such as transaction authorization, record-keeping, and asset custody among multiple employees, thereby preventing errors and fraud. This risk mitigation technique ensures that no single individual has end-to-end control over financial processes, reducing potential internal threats and operational risks. Implementing SoD in banking enhances internal controls and compliance with regulatory standards like SOX and Basel III.

Regulatory Requirements: Dual Control vs SoD

Regulatory requirements in banking mandate Dual Control to ensure that critical transactions require authorization from two independent individuals, minimizing risks of fraud and errors. Segregation of Duties (SoD) complements Dual Control by distributing responsibilities among different employees to prevent conflicts of interest and unauthorized activities. Compliance frameworks such as Basel III and SOX emphasize both controls to enhance operational integrity and safeguard financial assets.

Challenges in Applying Dual Control and SoD

Challenges in applying Dual Control and Segregation of Duties (SoD) in banking include complexity in aligning controls with operational workflows and ensuring adequate separation without causing delays or bottlenecks. Maintaining effective Dual Control requires constant monitoring and coordination between authorized personnel to prevent fraud while preserving transaction efficiency. SoD dilemmas often arise in balancing risk mitigation against resource constraints, especially in smaller institutions with limited staff and overlapping roles.

Best Practices for Effective Control Mechanisms in Banks

Dual Control requires two or more individuals to complete critical banking transactions, ensuring checks and balances, while Segregation of Duties divides responsibilities to prevent conflict of interest and reduce fraud risk. Best practices include establishing clear role definitions, implementing robust approval workflows, and regular auditing to monitor compliance and detect anomalies. Employing advanced access controls and continuous employee training enhances the effectiveness of these control mechanisms in safeguarding banking operations.

Important Terms

Access Rights Management

Access Rights Management enforces Dual Control by requiring two or more individuals to approve critical actions, ensuring no single person has unilateral access, while Segregation of Duties divides responsibilities to prevent conflicts of interest and minimize risk of fraud or error. Both concepts enhance security frameworks by restricting access permissions and monitoring activities to maintain operational integrity and compliance with regulatory standards.

Maker-Checker Principle

The Maker-Checker Principle enhances internal controls by requiring dual authorization for transaction processing, ensuring accuracy and accountability, while Dual Control involves two individuals jointly managing critical tasks to prevent errors or fraud. Segregation of Duties separates responsibilities among different personnel to reduce the risk of unauthorized actions, complementing the Maker-Checker framework by enforcing checks and balances within organizational processes.

Roles-Based Authorization

Roles-Based Authorization enforces access control by assigning permissions to specific roles, facilitating Dual Control through mandatory joint approval workflows. This approach complements Segregation of Duties by ensuring that conflicting tasks are distributed among distinct roles, thereby reducing the risk of fraud and operational errors.

Operational Risk Mitigation

Operational risk mitigation involves implementing dual control and segregation of duties to prevent errors and fraud by distributing critical tasks among multiple personnel. Dual control requires two authorized individuals to complete a process, while segregation of duties separates responsibilities to ensure no single employee has control over all aspects of a transaction, enhancing internal controls and compliance.

Audit Trail Integrity

Audit trail integrity ensures accurate and tamper-proof records, which is critical when implementing Dual Control or Segregation of Duties to prevent fraud and errors. Dual Control requires two individuals to complete a task, enhancing audit trail reliability, while Segregation of Duties divides responsibilities to reduce risk and maintain stronger internal controls.

Privileged Access Segregation

Privileged Access Segregation enforces strict separation of roles by ensuring that no single user has complete control over critical systems, reducing risks of unauthorized actions through Dual Control mechanisms. Segregation of Duties complements this by distributing tasks among multiple users, preventing conflicts of interest and enhancing security governance in IT environments.

Internal Controls Framework

The Internal Controls Framework emphasizes Dual Control and Segregation of Duties as key mechanisms to prevent fraud and errors by distributing responsibilities among multiple individuals. Dual Control requires two or more persons to complete critical tasks simultaneously, while Segregation of Duties separates functions such as authorization, custody, and record-keeping to reduce risk and enhance operational integrity.

Transaction Authorization Levels

Transaction Authorization Levels define the hierarchy of approval required for financial or operational activities to ensure accountability and risk mitigation. Dual Control mandates two individuals to jointly authorize a transaction, enhancing security, while Segregation of Duties separates transaction initiation, authorization, and recording among different roles to prevent fraud and errors.

User Entitlement Review

User Entitlement Review is a critical process for enforcing Segregation of Duties (SoD) by systematically verifying that user access rights do not conflict with conflicting roles, minimizing the risk of fraud or error. Dual Control complements this by requiring two authorized individuals to approve sensitive actions, enhancing governance beyond the automated checks enabled by SoD during entitlement reviews.

Compensating Control Measures

Compensating control measures such as Dual Control and Segregation of Duties enhance security by distributing critical tasks among multiple individuals, minimizing the risk of fraud or errors. Dual Control requires two parties to perform a single action simultaneously, while Segregation of Duties assigns different parts of a process to separate individuals, ensuring checks and balances in financial and operational workflows.

Dual Control vs Segregation of Duties Infographic

moneydif.com

moneydif.com