The prime rate is the interest rate that commercial banks charge their most creditworthy customers, often serving as a benchmark for various loan products. In contrast, the discount rate is the interest rate set by the central bank for lending to commercial banks, influencing overall monetary policy and liquidity. Understanding the distinction helps borrowers gauge loan costs and the central bank's approach to controlling economic growth.

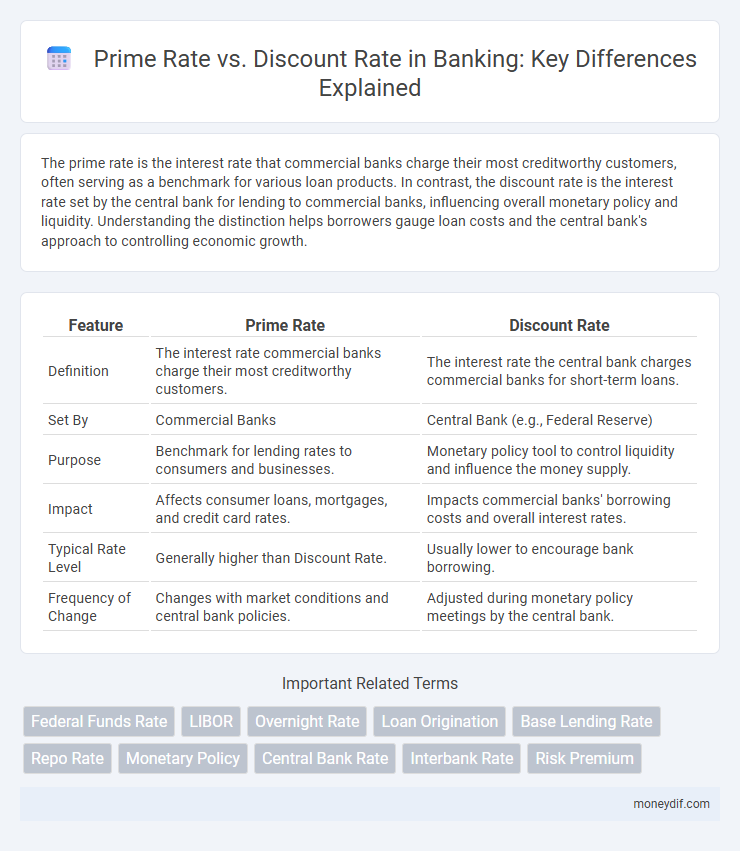

Table of Comparison

| Feature | Prime Rate | Discount Rate |

|---|---|---|

| Definition | The interest rate commercial banks charge their most creditworthy customers. | The interest rate the central bank charges commercial banks for short-term loans. |

| Set By | Commercial Banks | Central Bank (e.g., Federal Reserve) |

| Purpose | Benchmark for lending rates to consumers and businesses. | Monetary policy tool to control liquidity and influence the money supply. |

| Impact | Affects consumer loans, mortgages, and credit card rates. | Impacts commercial banks' borrowing costs and overall interest rates. |

| Typical Rate Level | Generally higher than Discount Rate. | Usually lower to encourage bank borrowing. |

| Frequency of Change | Changes with market conditions and central bank policies. | Adjusted during monetary policy meetings by the central bank. |

Understanding the Prime Rate

The Prime Rate is the interest rate commercial banks charge their most creditworthy corporate customers, serving as a benchmark for various loans, including personal and small business loans. It is influenced by the Federal Reserve's federal funds rate but typically remains about 3% higher, reflecting the risk and cost of funds. Understanding the Prime Rate helps borrowers anticipate changes in loan interest costs and manage financial planning effectively.

What Is the Discount Rate?

The discount rate is the interest rate set by central banks on loans extended to commercial banks for short-term borrowing, serving as a monetary policy tool to regulate liquidity and control inflation. It influences the cost of credit and signals the stance of monetary policy by affecting the prime rate, which is the baseline interest rate banks charge their most creditworthy customers. Understanding the discount rate is crucial for grasping how central banks manage economic stability through the banking system.

Key Differences Between Prime Rate and Discount Rate

The prime rate is the interest rate commercial banks charge their most creditworthy customers, typically large corporations, whereas the discount rate is the interest rate set by the Federal Reserve for lending to commercial banks. The prime rate directly influences consumer loan and credit card rates, while the discount rate primarily serves as a monetary policy tool affecting overall banking liquidity. Unlike the prime rate, which fluctuates based on market conditions and the federal funds rate, the discount rate is a fixed rate set by the central bank to control money supply and stabilize the economy.

How Prime Rate Impacts Borrowers

The prime rate directly influences borrowers by setting the benchmark interest rate for many types of loans, including variable-rate mortgages, credit cards, and business loans. When the prime rate increases, borrowing costs rise, leading to higher monthly payments and reduced loan affordability. Conversely, a lower prime rate decreases interest expenses, encouraging more borrowing and stimulating economic activity.

Role of the Discount Rate in Monetary Policy

The discount rate serves as the interest rate at which central banks lend short-term funds to commercial banks, playing a crucial role in monetary policy by influencing liquidity and credit availability. By adjusting the discount rate, central banks can either encourage borrowing to stimulate economic activity or tighten money supply to control inflation. This mechanism directly impacts commercial banks' lending behaviors, shaping overall economic stability.

Factors Influencing the Prime Rate

The prime rate is primarily influenced by the federal funds rate set by the Federal Reserve, reflecting the cost of borrowing reserves between banks. Economic indicators such as inflation, employment levels, and overall economic growth also drive adjustments in the prime rate to control monetary policy and credit availability. Banks consider their operating costs, risk assessments, and competitive market conditions when determining the exact prime rate offered to consumers.

How Central Banks Set the Discount Rate

Central banks set the discount rate by evaluating economic indicators such as inflation, unemployment, and overall economic growth to influence short-term lending between banks and the central institution. This rate typically remains lower than the prime rate, which commercial banks use as a benchmark for lending to their most creditworthy customers. Adjusting the discount rate enables central banks to control liquidity and steer monetary policy effectively.

Impact on Loans and Credit Products

The prime rate directly influences most consumer and business loan interest rates, setting a baseline for credit costs tied to banks' lending activities. The discount rate, set by central banks, affects the cost at which commercial banks borrow funds, indirectly shaping the prime rate and overall credit market conditions. Shifts in these rates impact the affordability of loans and credit products, affecting borrowing demand and financial market liquidity.

Prime Rate vs Discount Rate: Historical Trends

Historical trends of the Prime Rate and Discount Rate reveal that the Prime Rate typically moves in tandem with the Federal Reserve's Discount Rate adjustments, reflecting changes in monetary policy. Over decades, periods of economic expansion correlate with rising Prime Rates, while Discount Rates often precede these shifts as tools for lender regulation. Understanding these trends is crucial for banking institutions when forecasting loan interest rates and managing credit risk.

Choosing Between Prime-Based and Discount-Based Loans

Choosing between prime-based and discount-based loans depends on the borrower's risk tolerance and market outlook. Prime rate loans, linked to the benchmark rate set by commercial banks for their most creditworthy customers, usually offer stability and transparency in interest costs. Discount rate loans, influenced by the Federal Reserve's discount window rate, may provide short-term liquidity advantages but carry higher costs reflecting central bank policy shifts.

Important Terms

Federal Funds Rate

The Federal Funds Rate directly influences the Prime Rate, which banks commonly use as a benchmark for lending to consumers and businesses, while the Discount Rate is set by the Federal Reserve as the interest charged to commercial banks for borrowing from the central bank. Changes in the Federal Funds Rate typically lead to adjustments in the Prime Rate, whereas the Discount Rate serves as a monetary policy tool impacting liquidity and credit availability in the banking system.

LIBOR

LIBOR (London Interbank Offered Rate) serves as a key benchmark interest rate influencing the Prime Rate, which banks charge their most creditworthy customers, while the Discount Rate represents the interest rate set by central banks for lending to commercial banks. The interplay between LIBOR, Prime Rate, and Discount Rate reflects the cost of borrowing, liquidity conditions, and monetary policy stance in the financial markets.

Overnight Rate

The Overnight Rate influences the Prime Rate by serving as a benchmark for short-term lending among banks, while the Discount Rate is typically higher than the Overnight Rate and set by central banks as the interest rate charged to commercial banks for borrowing reserves. Changes in the Overnight Rate directly impact the cost of overnight funds, thereby affecting the Prime Rate offered to consumers and businesses, whereas the Discount Rate functions as a monetary policy tool to control liquidity.

Loan Origination

Loan origination often involves assessing the prime rate and discount rate to determine borrowing costs, where the prime rate serves as a benchmark for consumer and business loans, reflecting the creditworthiness of borrowers. The discount rate, set by central banks, influences overall liquidity and lending conditions, directly impacting the interest rates lenders offer during the loan origination process.

Base Lending Rate

The Base Lending Rate (BLR) serves as a benchmark interest rate set by banks to determine the minimum interest charge on loans, typically aligned closely with the Prime Rate, which reflects the optimal lending rate to creditworthy customers. The Discount Rate, established by central banks as the interest charged to commercial banks for short-term borrowing, influences the BLR indirectly by affecting overall liquidity and funding costs in the banking system.

Repo Rate

The repo rate is the interest rate at which central banks lend short-term funds to commercial banks, influencing the prime rate, which is the benchmark lending rate for consumers and businesses. The discount rate, set by the central bank, is typically higher than the repo rate and applies to loans taken directly from the central bank, serving as a tool to control liquidity and stabilize the economy.

Monetary Policy

The prime rate, influenced by the Federal Reserve's benchmark rates, serves as the interest rate commercial banks charge their most creditworthy customers, while the discount rate represents the interest rate the Fed charges banks for short-term loans. Changes in the discount rate often signal shifts in monetary policy that indirectly affect the prime rate, thereby influencing borrowing costs and overall economic activity.

Central Bank Rate

The Central Bank Rate, also known as the policy rate, influences the Prime Rate, which commercial banks set for their most creditworthy customers, while the Discount Rate refers to the interest rate charged by the central bank on loans to commercial banks. Changes in the Central Bank Rate directly affect the Prime Rate and Discount Rate, impacting overall lending costs and monetary policy transmission.

Interbank Rate

The interbank rate, which is the interest rate at which banks lend to each other, plays a crucial role in influencing the prime rate, the interest rate banks charge their most creditworthy customers. The discount rate, set by central banks for lending to commercial banks, indirectly impacts the interbank rate by affecting overall liquidity and monetary policy conditions.

Risk Premium

The risk premium represents the additional return investors demand above the discount rate, often reflected by the prime rate, to compensate for credit risk and market volatility. The prime rate, typically set by banks as a benchmark for loan interest, usually exceeds the discount rate, which is the Federal Reserve's rate for lending to commercial banks, thus embedding the risk premium in borrowing costs.

Prime Rate vs Discount Rate Infographic

moneydif.com

moneydif.com