Nostro and Vostro accounts represent fundamental concepts in international banking, facilitating cross-border transactions between correspondent banks. A Nostro account is held by a domestic bank in a foreign currency with a foreign bank, while a Vostro account is maintained by a foreign bank in the domestic currency with the domestic bank. These accounts streamline currency exchange, improve liquidity management, and reduce transaction risks in global banking operations.

Table of Comparison

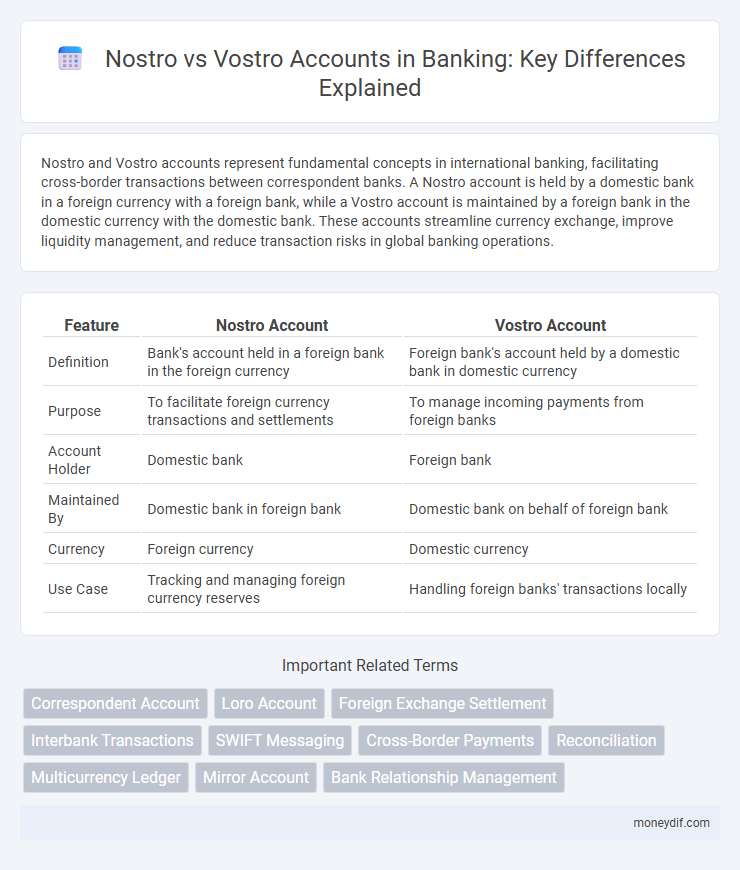

| Feature | Nostro Account | Vostro Account |

|---|---|---|

| Definition | Bank's account held in a foreign bank in the foreign currency | Foreign bank's account held by a domestic bank in domestic currency |

| Purpose | To facilitate foreign currency transactions and settlements | To manage incoming payments from foreign banks |

| Account Holder | Domestic bank | Foreign bank |

| Maintained By | Domestic bank in foreign bank | Domestic bank on behalf of foreign bank |

| Currency | Foreign currency | Domestic currency |

| Use Case | Tracking and managing foreign currency reserves | Handling foreign banks' transactions locally |

Understanding Nostro and Vostro Accounts

Nostro accounts refer to the funds a domestic bank holds in a foreign bank, typically in the foreign currency, to facilitate international transactions and currency exchange. Vostro accounts, by contrast, are accounts held by a foreign bank in the domestic bank's currency, representing the foreign bank's liabilities within the local banking system. Understanding the distinction between Nostro and Vostro accounts is crucial for efficient cross-border payments and liquidity management in global banking operations.

Key Differences Between Nostro and Vostro Accounts

Nostro accounts represent a bank's funds held in a foreign currency at another bank, while Vostro accounts are foreign banks' funds held in the domestic bank's currency. The primary difference lies in perspective: Nostro means "our account on your books," and Vostro means "your account on our books," reflecting which institution holds the funds. Nostro accounts facilitate international payments for the home bank, whereas Vostro accounts allow foreign banks to hold deposits domestically.

Importance of Nostro and Vostro in International Banking

Nostro and Vostro accounts are crucial in international banking as they facilitate cross-border transactions by enabling banks to hold and manage foreign currencies efficiently. Nostro accounts represent a bank's foreign currency holdings held in another bank, while Vostro accounts are foreign banks' holdings in the domestic bank. These accounts streamline foreign exchange operations, reduce settlement risks, and enhance liquidity management for global trade and correspondent banking relationships.

How Nostro Accounts Work

Nostro accounts are bank accounts that a domestic bank holds in a foreign currency with a correspondent bank abroad, enabling seamless international transactions. These accounts facilitate currency exchange, cross-border payments, and reconciliation by maintaining a clear record of the bank's foreign currency holdings. The efficient management of Nostro accounts helps minimize settlement risks and improves liquidity management in global banking operations.

How Vostro Accounts Function

Vostro accounts function as local currency accounts held by a foreign bank within a domestic bank, facilitating the foreign bank's ability to manage its clients' local transactions. These accounts enable efficient settlement of payments, currency exchange, and fund transfers within the host country, streamlining cross-border banking operations. By maintaining a Vostro account, foreign banks gain direct access to the domestic banking system without the need for intermediaries.

Nostro vs Vostro: Use Cases in Cross-Border Transactions

Nostro and Vostro accounts facilitate cross-border transactions by providing streamlined currency management between correspondent banks; Nostro accounts hold foreign currency funds owned by the domestic bank, while Vostro accounts reflect the domestic currency funds held by the correspondent bank. Nostro accounts enable banks to track and settle payments in foreign currencies accurately, reducing settlement risks and improving transaction transparency. Vostro accounts support efficient receipt and reconciliation of incoming foreign payments, making them essential for effective international banking operations.

Account Reconciliation: Nostro and Vostro Perspectives

Nostro and Vostro accounts play a crucial role in cross-border banking transactions, serving as internal ledgers for correspondent banks to track foreign currency holdings and liabilities respectively. Account reconciliation involves matching Nostro statements received from correspondent banks with the bank's Vostro records to identify discrepancies in transaction details, balances, and foreign exchange conversions. Efficient reconciliation ensures accurate financial reporting, reduces settlement risks, and enhances transparency in international banking operations.

Risks and Challenges of Nostro and Vostro Accounts

Nostro and Vostro accounts face distinct risks including currency fluctuations, settlement delays, and counterparty credit risk, impacting liquidity management and reconciliation processes. Operational challenges such as regulatory compliance, cross-border transaction monitoring, and technology integration increase the complexity of managing these accounts. Effective risk mitigation requires robust internal controls, real-time transaction tracking, and comprehensive due diligence on correspondent banks.

Regulatory Requirements for Nostro and Vostro Accounts

Nostro and Vostro accounts are subject to stringent regulatory requirements emphasizing transparency, anti-money laundering (AML) controls, and accurate transaction reporting to prevent financial crimes. Regulatory frameworks such as the Basel III accord and FATCA mandate thorough record-keeping and frequent audits to ensure compliance and risk management in cross-border banking operations. Banks must implement robust Know Your Customer (KYC) procedures and real-time monitoring systems to meet global standards and avoid penalties linked to non-compliance in Nostro and Vostro account management.

Future Trends: Nostro and Vostro in Digital Banking

Nostro and Vostro accounts are evolving with the rise of digital banking, driven by blockchain technology and real-time payment systems that enhance cross-border transaction efficiency. Integration of AI and machine learning in banking platforms is optimizing reconciliation of Nostro and Vostro accounts, reducing errors and increasing transparency. Future trends indicate a shift towards automated, secure, and instant settlements, transforming traditional correspondent banking relationships.

Important Terms

Correspondent Account

A correspondent account is a bank account established by one bank (the correspondent) on behalf of another bank (the respondent) to facilitate international transactions, where a Nostro account represents "our money held by you," and a Vostro account represents "your money held by us.

Loro Account

A Loro account represents a third-party bank's account held by another bank, contrasting Nostro accounts which are owned by the bank itself abroad, and Vostro accounts which are held by a foreign bank on behalf of the domestic bank.

Foreign Exchange Settlement

Foreign Exchange Settlement involves reconciling Nostro accounts, representing a bank's foreign currency held abroad, against Vostro accounts, which reflect foreign banks' funds held domestically.

Interbank Transactions

Interbank transactions involve Nostro accounts held by one bank in another bank's currency and Vostro accounts held by a correspondent bank on behalf of the first bank, facilitating cross-border payments and settlements.

SWIFT Messaging

SWIFT messaging facilitates secure communication between banks, enabling accurate reconciliation of Nostro accounts (our funds held by foreign banks) and Vostro accounts (foreign funds held by our bank) for efficient international transactions.

Cross-Border Payments

Cross-border payments rely on Nostro accounts, which a bank holds in a foreign currency at another bank, and Vostro accounts, which are held by correspondent banks locally for the foreign bank, to facilitate efficient international fund transfers.

Reconciliation

Reconciliation of Nostro and Vostro accounts ensures accurate cross-border transaction records by matching the bank's foreign currency holdings (Nostro) with corresponding records in the correspondent bank's ledger (Vostro).

Multicurrency Ledger

A Multicurrency Ledger enables accurate tracking and reconciliation of Nostro accounts, which represent a bank's foreign currency deposits held by other banks, and Vostro accounts, which represent a bank's liabilities to foreign banks, enhancing cross-border transaction transparency and financial management.

Mirror Account

A Mirror Account is a replica of a Nostro or Vostro account used by banks to internally track foreign currency transactions and reconcile cross-border payments.

Bank Relationship Management

Bank relationship management optimizes international liquidity by effectively monitoring Nostro accounts (domestic currency held in foreign banks) and Vostro accounts (foreign currency held by domestic banks), ensuring accurate transaction reconciliation and minimizing settlement risks.

Nostro vs Vostro Infographic

moneydif.com

moneydif.com