Asset securitization involves pooling various financial assets and issuing securities backed by those assets, allowing banks to transfer risk and improve liquidity. Asset-backed lending, in contrast, refers to loans extended based on the collateral value of specific assets without converting them into tradeable securities. Both methods optimize capital management, but securitization enhances market access while asset-backed lending prioritizes direct collateralized borrowing.

Table of Comparison

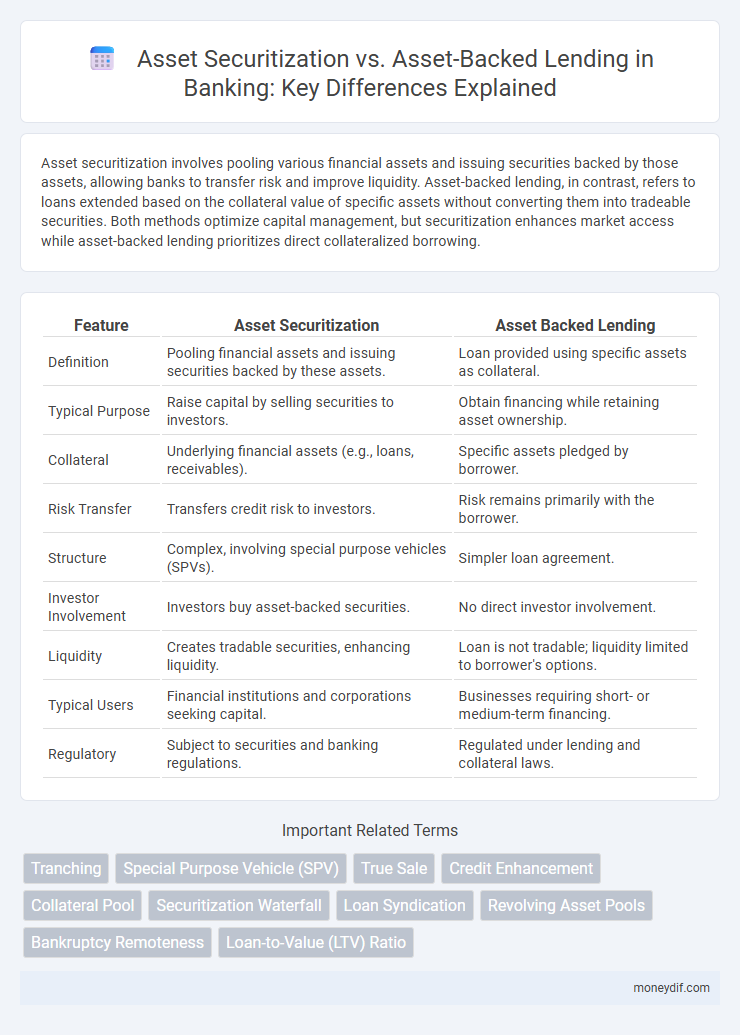

| Feature | Asset Securitization | Asset Backed Lending |

|---|---|---|

| Definition | Pooling financial assets and issuing securities backed by these assets. | Loan provided using specific assets as collateral. |

| Typical Purpose | Raise capital by selling securities to investors. | Obtain financing while retaining asset ownership. |

| Collateral | Underlying financial assets (e.g., loans, receivables). | Specific assets pledged by borrower. |

| Risk Transfer | Transfers credit risk to investors. | Risk remains primarily with the borrower. |

| Structure | Complex, involving special purpose vehicles (SPVs). | Simpler loan agreement. |

| Investor Involvement | Investors buy asset-backed securities. | No direct investor involvement. |

| Liquidity | Creates tradable securities, enhancing liquidity. | Loan is not tradable; liquidity limited to borrower's options. |

| Typical Users | Financial institutions and corporations seeking capital. | Businesses requiring short- or medium-term financing. |

| Regulatory | Subject to securities and banking regulations. | Regulated under lending and collateral laws. |

Understanding Asset Securitization in Banking

Asset securitization in banking transforms illiquid assets into tradable securities by pooling diverse financial assets like loans, mortgages, or receivables and issuing asset-backed securities (ABS) to investors. This process enhances liquidity, reduces credit risk exposure, and provides banks with immediate capital to support further lending activities. Through asset securitization, banks optimize balance sheet management and access broader funding sources compared to traditional asset-backed lending, which involves direct loans secured by specific assets.

What is Asset Backed Lending?

Asset Backed Lending (ABL) is a financing method where loans are secured by a company's assets, such as accounts receivable, inventory, or equipment, providing lenders with collateral to reduce risk. This type of credit facility offers businesses flexible access to capital based on asset value rather than solely on cash flow or credit history. ABL is commonly used by firms needing working capital or growth funding while preserving operational control over their assets.

Key Differences Between Asset Securitization and Asset Backed Lending

Asset securitization involves pooling various financial assets and issuing securities backed by these assets to investors, thereby transferring risk and improving liquidity. Asset-backed lending, on the other hand, refers to loans extended to borrowers secured directly by underlying assets without creating tradable securities. The key differences lie in securitization's use of asset pools and capital markets versus asset-backed lending's reliance on conventional loan structures secured by specific collateral.

Benefits of Asset Securitization for Banks

Asset securitization enhances liquidity by converting illiquid assets into tradable securities, enabling banks to free up capital and improve balance sheet management. It diversifies funding sources and reduces reliance on traditional deposits, lowering funding costs and enhancing financial stability. Furthermore, securitization allows risk transfer to investors, optimizing credit risk exposure and supporting regulatory capital relief.

Advantages and Risks of Asset Backed Lending

Asset Backed Lending (ABL) offers lenders the advantage of secured loans tied to specific assets, improving credit risk management and providing borrowers with flexible financing options based on asset value. The primary benefits include enhanced liquidity, favorable interest rates due to reduced lender risk, and easier access to capital without diluting ownership. However, ABL carries risks such as asset value depreciation, complex valuation processes, and potential liquidity constraints if underlying assets become illiquid or decline unexpectedly.

Eligibility Criteria for Asset Securitization and Asset Backed Lending

Eligibility criteria for asset securitization include a pool of homogeneous, high-quality financial assets such as loans, receivables, or mortgages with predictable cash flows and legal isolation from the originator. Asset-backed lending requires the borrower to provide specific tangible assets as collateral, with strong creditworthiness, clear ownership, and sufficient asset valuation to support loan repayment. While securitization focuses on aggregating and pooling assets for capital market issuance, asset-backed lending depends on direct asset collateralization and borrower financial stability.

Regulatory Framework Governing Both Practices

The regulatory framework governing asset securitization and asset-backed lending involves strict compliance with capital reserve requirements, disclosure obligations, and risk retention rules set by financial authorities such as the SEC and Basel Committee. Asset securitization is subject to securitization-specific regulations like the Dodd-Frank Act and the EU Securitization Regulation, focusing on transparency and investor protection. Asset-backed lending is regulated under broader lending laws involving credit risk assessment, borrower eligibility, and collateral management standards defined by federal and international banking regulators.

Impact on Bank Balance Sheets

Asset securitization transfers loans or receivables from bank balance sheets to special purpose vehicles, improving liquidity and risk diversification while reducing capital requirements. Asset-backed lending maintains assets on the bank's balance sheet, increasing leverage and risk exposure but providing steady interest income and greater control. This difference directly affects regulatory capital ratios and the bank's ability to manage credit risk and funding flexibility.

Asset Securitization vs Asset Backed Lending: Use Cases

Asset securitization is commonly used by financial institutions to transform illiquid assets like mortgage loans or receivables into tradable securities, enhancing liquidity and risk diversification. Asset-backed lending primarily serves businesses seeking direct financing against specific assets such as inventory or accounts receivable, offering a flexible credit solution without selling the underlying assets. While securitization is essential for capital market funding and risk transfer, asset-backed lending focuses on short-term borrowing needs and balance sheet management for corporate clients.

Choosing the Right Financing Solution for Banks

Asset securitization enables banks to transform illiquid assets into marketable securities, optimizing balance sheets and transferring risk to investors. Asset-backed lending offers direct financing secured by specific assets, ensuring liquidity without offloading asset ownership. Selecting between securitization and lending depends on the bank's capital requirements, risk tolerance, and liquidity objectives.

Important Terms

Tranching

Tranching in asset securitization involves structuring pooled assets into multiple classes with varying risk and return profiles, enhancing capital efficiency and investor appeal. In asset-backed lending, while credit risk is managed, tranching is less complex, focusing on secured financing rather than segmented investor layers typical of securitized products.

Special Purpose Vehicle (SPV)

Special Purpose Vehicles (SPVs) in asset securitization serve as bankruptcy-remote entities that isolate financial risk by pooling and converting assets into tradable securities, enhancing liquidity and creditworthiness. In contrast, asset-backed lending involves direct loan financing secured by specific assets without transferring ownership to an SPV, maintaining the lender's risk exposure.

True Sale

True sale in asset securitization legally transfers underlying assets off the originator's balance sheet, ensuring investors have clear rights independent of the originator's credit risk. In contrast, asset-backed lending maintains the assets as collateral on the lender's books, keeping the risk tied to the borrower's creditworthiness without full asset transfer.

Credit Enhancement

Credit enhancement in asset securitization improves the creditworthiness of issued securities through mechanisms like overcollateralization, reserve accounts, and third-party guarantees, reducing risk for investors. In contrast, asset-backed lending relies more on borrower credit and collateral quality, with limited structural credit support, making credit enhancement less prominent than in securitization.

Collateral Pool

Collateral Pool in asset securitization consists of diversified financial assets pooled to support the issuance of asset-backed securities, enhancing credit quality and liquidity. In asset-backed lending, the Collateral Pool typically involves specific, fewer assets pledged directly to secure a loan, focusing on borrower credit risk mitigation rather than broad risk distribution.

Securitization Waterfall

Securitization Waterfall structures the priority of payments in asset securitization by allocating cash flows from underlying assets to various tranches of securities, ensuring senior tranches receive payments before subordinate ones. In contrast to asset-backed lending, where repayments depend primarily on borrower obligations, securitization waterfalls provide a predefined hierarchy that mitigates credit risk through tranche prioritization.

Loan Syndication

Loan syndication involves multiple lenders sharing portions of a large loan, distributing risk, while asset securitization converts pools of loans or receivables into marketable securities backed by those assets. Unlike asset-backed lending, which provides credit directly secured by specific assets, asset securitization facilitates liquidity by transforming those assets into tradable financial instruments, enhancing risk management and capital efficiency.

Revolving Asset Pools

Revolving asset pools in asset securitization refer to a dynamic collection of financial assets, such as receivables, that are continuously replenished to support ongoing cash flow, contrasting with static pools used in traditional asset-backed lending where loan assets remain fixed. This structure allows securitization transactions to maintain liquidity and credit quality by replacing paid-off or matured assets, optimizing risk distribution and enhancing funding flexibility for issuers.

Bankruptcy Remoteness

Bankruptcy remoteness in asset securitization ensures that the special purpose vehicle (SPV) holding the securitized assets is insulated from the originator's financial distress, minimizing risk to investors. In contrast, asset-backed lending typically involves direct loans secured by assets without creating an SPV, which means the lender has less protection from the borrower's bankruptcy risk.

Loan-to-Value (LTV) Ratio

Loan-to-Value (LTV) ratio serves as a critical metric in both asset securitization and asset-backed lending, indicating the proportion of a loan compared to the value of collateral assets. Asset securitization typically maintains lower LTV ratios to enhance creditworthiness for investors, whereas asset-backed lending may allow higher LTV ratios reflecting lender risk tolerance and collateral liquidity.

Asset Securitization vs Asset Backed Lending Infographic

moneydif.com

moneydif.com