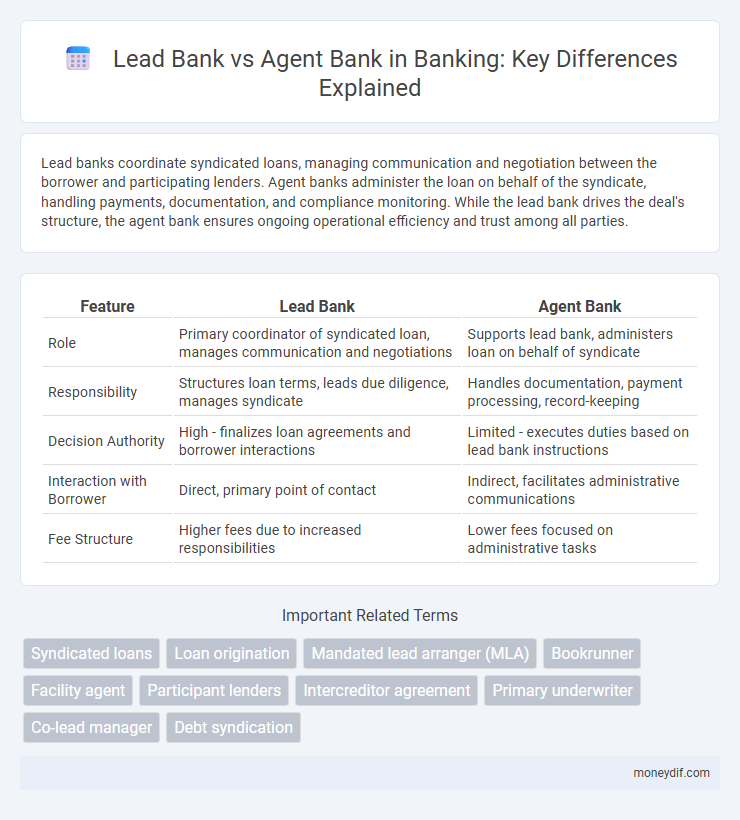

Lead banks coordinate syndicated loans, managing communication and negotiation between the borrower and participating lenders. Agent banks administer the loan on behalf of the syndicate, handling payments, documentation, and compliance monitoring. While the lead bank drives the deal's structure, the agent bank ensures ongoing operational efficiency and trust among all parties.

Table of Comparison

| Feature | Lead Bank | Agent Bank |

|---|---|---|

| Role | Primary coordinator of syndicated loan, manages communication and negotiations | Supports lead bank, administers loan on behalf of syndicate |

| Responsibility | Structures loan terms, leads due diligence, manages syndicate | Handles documentation, payment processing, record-keeping |

| Decision Authority | High - finalizes loan agreements and borrower interactions | Limited - executes duties based on lead bank instructions |

| Interaction with Borrower | Direct, primary point of contact | Indirect, facilitates administrative communications |

| Fee Structure | Higher fees due to increased responsibilities | Lower fees focused on administrative tasks |

Understanding Lead Bank and Agent Bank: Key Definitions

A lead bank is the primary financial institution responsible for structuring and coordinating a syndicated loan, managing communication between borrowers and participating lenders. An agent bank acts as the intermediary that administers the loan on behalf of the syndicate, handling tasks such as loan disbursements, repayments, and compliance monitoring. Understanding the distinct roles of lead and agent banks is crucial for effective loan syndication and risk management in complex banking transactions.

Core Functions of Lead Banks in Banking Consortia

Lead banks in banking consortia primarily coordinate syndicated loans by structuring the credit facility and managing the documentation process. They act as the main point of communication between borrower and participant banks, ensuring smooth disbursement of funds and monitoring loan performance. Lead banks also handle risk assessment and compliance oversight to safeguard the consortium's interests.

Primary Roles and Responsibilities of Agent Banks

Agent banks manage administrative tasks such as coordinating loan disbursements, processing payments, and maintaining communication between the syndicate members in syndicated loans. They ensure compliance with the loan agreement, collect and distribute interest and principal payments, and monitor borrower performance to protect the interests of all participating banks. Their role is crucial for efficient loan servicing and smooth syndicate operations within the banking sector.

Differences in Structure: Lead vs Agent Bank

A lead bank typically serves as the primary lender in a syndicated loan, managing the entire lending process, structuring the deal, and negotiating terms with the borrower. An agent bank, in contrast, acts as a facilitator and administrator, handling communication between lenders and the borrower, managing loan disbursements, collections, and maintaining records, but it does not provide the leadership in decision-making. The lead bank holds significant influence in structuring the credit facility, while the agent bank focuses on operational tasks and coordination among the syndicate members.

Process Flow: How Lead and Agent Banks Collaborate

Lead banks initiate and structure syndicated loans by coordinating with multiple financial institutions, setting terms, and managing communication with borrowers. Agent banks act as intermediaries, administering loan agreements, handling payments, and distributing funds between the lead bank and other syndicate members. This collaboration streamlines credit allocation, risk management, and borrower servicing within complex lending arrangements.

Lead Bank vs Agent Bank: Impact on Loan Syndication

In loan syndication, the lead bank plays a crucial role by structuring the deal, negotiating terms, and coordinating among participating banks, ensuring streamlined communication and efficient management. The agent bank acts as the administrative liaison, handling documentation, fund disbursements, and monitoring compliance, which reduces operational burdens on both the borrower and syndicate members. The distinction between lead and agent banks significantly influences risk allocation, decision-making authority, and overall loan servicing efficiency.

Regulatory Guidelines Governing Lead and Agent Banks

Regulatory guidelines governing lead and agent banks emphasize strict compliance with capital adequacy, anti-money laundering (AML) policies, and borrower due diligence to ensure financial stability and transparency. Lead banks must adhere to comprehensive supervisory frameworks set by central banks, including periodic reporting and risk management oversight, while agent banks operate under delegated authority but remain accountable for transaction execution and record-keeping. Both entities are subject to jurisdiction-specific regulations such as the Basel III standards and local banking acts that define their roles, responsibilities, and permissible operational scope.

Advantages and Challenges of Lead Banking

The lead bank in a syndicate loan arranges financing, coordinates communication, and manages loan documentation, providing centralized control and strong client relationships. Advantages include enhanced negotiation power and streamlined decision-making, while challenges involve higher administrative responsibilities, potential conflicts among syndicate members, and increased exposure to reputational risk. Effective lead banks balance these complexities to optimize syndicate performance and borrower satisfaction.

Benefits and Limitations of Agent Banking

Agent banking extends the reach of financial services to underserved areas, providing convenience and accessibility by leveraging local agents to facilitate transactions like deposits, withdrawals, and bill payments. This model reduces operational costs for banks and improves customer inclusion, but it also poses challenges related to agent reliability, security risks, and regulatory compliance. While agent banking enhances financial penetration, maintaining control over service quality and preventing fraud remain significant limitations.

Selecting Between Lead Bank and Agent Bank: Strategic Considerations

Selecting between a lead bank and an agent bank hinges on the scope of responsibilities and strategic goals in syndicated loans or consortium financing. A lead bank typically manages deal structuring, borrower negotiation, and syndicate coordination, making it ideal for institutions seeking influence and control over the loan process. An agent bank primarily focuses on administrative tasks and communication among lenders, suited for banks prioritizing operational efficiency without direct negotiation involvement.

Important Terms

Syndicated loans

Syndicated loans involve multiple lenders led by a lead bank responsible for structuring the loan terms and coordinating the syndication process, while the agent bank acts as the administrative intermediary managing communication, repayments, and compliance among all participating banks. The lead bank typically assumes underwriting risk and facilitates negotiations, whereas the agent bank ensures efficient loan servicing and acts on behalf of the syndicate throughout the loan lifecycle.

Loan origination

Loan origination involves the lead bank coordinating the credit assessment, documentation, and syndication process, while the agent bank manages administrative tasks such as disbursing funds, monitoring compliance, and serving as the communication link between the borrower and syndicate members. The lead bank typically underwrites the largest portion of the loan and negotiates terms, whereas the agent bank ensures operational efficiency throughout the loan lifecycle.

Mandated lead arranger (MLA)

Mandated Lead Arranger (MLA) is the financial institution designated to structure and arrange a syndicated loan, often tasked with underwriting the majority of the loan commitment. Unlike the Agent Bank, which primarily manages day-to-day administrative duties such as disbursing funds and monitoring compliance, the MLA spearheads loan negotiation and syndication efforts, positioning it as the primary coordinator in multi-lender financing deals.

Bookrunner

Bookrunner, typically the lead bank in a syndicated loan, manages the loan issuance process and coordinates among participants, whereas the agent bank primarily administers the loan post-closing, handling communications and repayments. In syndicated financing, the bookrunner's role is pivotal for structuring and marketing the deal, while the agent bank ensures efficient ongoing loan management and compliance.

Facility agent

Facility agents coordinate communication and documentation between borrowers and lenders in syndicated loans, ensuring smooth transaction management. Unlike lead banks that structure and price the loan, or agent banks that handle administrative duties, facility agents focus on ongoing loan administration and compliance monitoring.

Participant lenders

Participant lenders contribute funds to a syndicated loan but do not hold direct administrative responsibilities, which are managed by the lead bank or agent bank that coordinates the loan's origination, documentation, and ongoing management. The lead bank typically initiates the loan process and structures the deal, while the agent bank handles communication, repayments, and compliance among all participating lenders.

Intercreditor agreement

An Intercreditor Agreement defines the priority and rights among multiple lenders, typically distinguishing roles where the Lead Bank negotiates terms and the Agent Bank administers the loan on behalf of the syndicate. This agreement ensures clarity on repayment order, enforcement rights, and communication protocols, reducing conflicts between creditors.

Primary underwriter

The primary underwriter in a syndicated loan plays a critical role in structuring the credit and securing commitments, often aligned closely with the lead bank, which drives the loan negotiation and distribution process. In contrast, the agent bank primarily manages administrative tasks such as communication between lenders and coordinating payments, without assuming underwriting risk.

Co-lead manager

A Co-lead manager shares underwriting responsibilities alongside the Lead bank, collaborating to structure and distribute syndicated loans or bond issues efficiently. Unlike the Agent bank, which primarily administers the loan and acts as the liaison between borrowers and lenders, Co-lead managers focus on deal execution, marketing, and risk allocation within the syndicate.

Debt syndication

Debt syndication involves multiple lenders collaborating to provide a loan, with the lead bank underwriting and structuring the deal while the agent bank manages administrative tasks such as disbursing funds and monitoring compliance. The lead bank plays a pivotal role in negotiation and risk assessment, whereas the agent bank ensures seamless communication and coordination among syndicate members.

Lead bank vs Agent bank Infographic

moneydif.com

moneydif.com