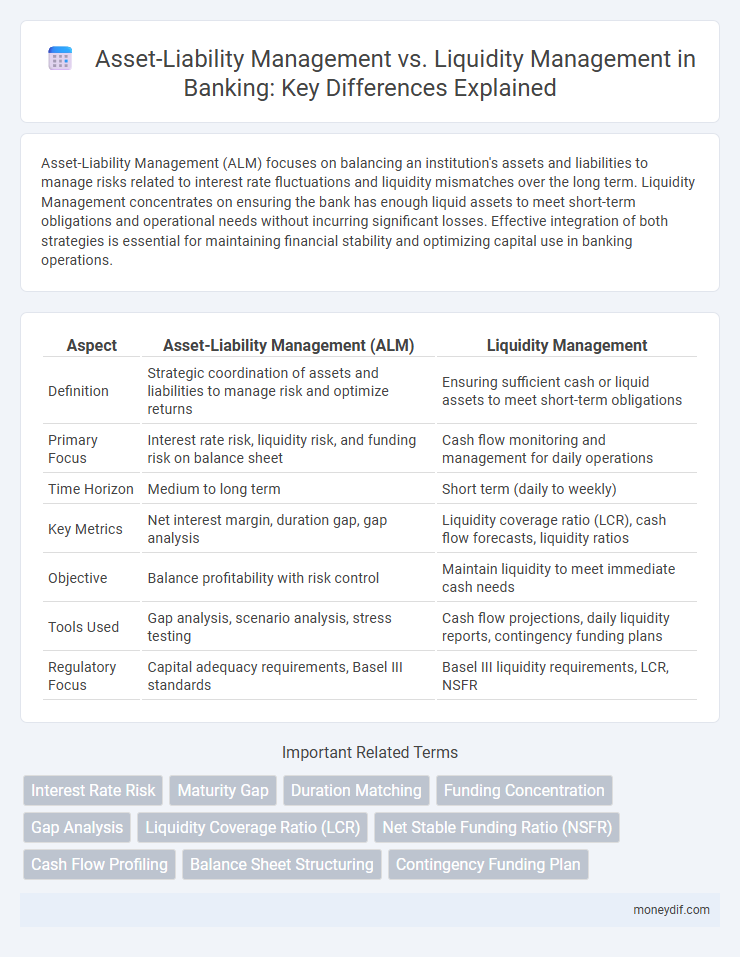

Asset-Liability Management (ALM) focuses on balancing an institution's assets and liabilities to manage risks related to interest rate fluctuations and liquidity mismatches over the long term. Liquidity Management concentrates on ensuring the bank has enough liquid assets to meet short-term obligations and operational needs without incurring significant losses. Effective integration of both strategies is essential for maintaining financial stability and optimizing capital use in banking operations.

Table of Comparison

| Aspect | Asset-Liability Management (ALM) | Liquidity Management |

|---|---|---|

| Definition | Strategic coordination of assets and liabilities to manage risk and optimize returns | Ensuring sufficient cash or liquid assets to meet short-term obligations |

| Primary Focus | Interest rate risk, liquidity risk, and funding risk on balance sheet | Cash flow monitoring and management for daily operations |

| Time Horizon | Medium to long term | Short term (daily to weekly) |

| Key Metrics | Net interest margin, duration gap, gap analysis | Liquidity coverage ratio (LCR), cash flow forecasts, liquidity ratios |

| Objective | Balance profitability with risk control | Maintain liquidity to meet immediate cash needs |

| Tools Used | Gap analysis, scenario analysis, stress testing | Cash flow projections, daily liquidity reports, contingency funding plans |

| Regulatory Focus | Capital adequacy requirements, Basel III standards | Basel III liquidity requirements, LCR, NSFR |

Introduction to Asset-Liability Management (ALM) in Banking

Asset-Liability Management (ALM) in banking involves strategically managing the risks arising from mismatches between assets and liabilities, focusing on interest rate risk, liquidity risk, and capital adequacy. ALM integrates comprehensive balance sheet analysis to optimize the bank's profitability while maintaining financial stability. Effective ALM frameworks employ gap analysis, duration analysis, and stress testing to align asset and liability profiles with the bank's risk appetite and regulatory requirements.

Understanding Liquidity Management in Financial Institutions

Liquidity management in financial institutions involves maintaining adequate cash flow to meet short-term obligations while minimizing funding costs. Effective liquidity management ensures that banks can fulfill withdrawal requests, settle debts, and comply with regulatory requirements without disrupting operations. This process requires continuous monitoring of cash positions, forecasting liquidity needs, and maintaining access to diverse funding sources to manage risks associated with liquidity shortfalls.

Core Objectives: ALM vs Liquidity Management

Asset-Liability Management (ALM) centers on balancing a bank's assets and liabilities to mitigate interest rate risk and ensure long-term financial stability. Liquidity Management focuses on maintaining sufficient cash flow and liquid assets to meet short-term obligations and regulatory requirements. Both functions are vital, with ALM addressing overall risk exposure and profitability, while liquidity management ensures operational continuity and compliance.

Key Components of Asset-Liability Management

Key components of Asset-Liability Management (ALM) include interest rate risk management, liquidity risk management, and capital adequacy. ALM involves strategic matching of asset maturities and liabilities to optimize interest margins and ensure solvency. It incorporates scenario analysis, gap analysis, and duration analysis to balance risks and returns effectively.

Essential Tools for Effective Liquidity Management

Effective liquidity management relies on essential tools such as cash flow forecasting, which predicts inflows and outflows to prevent liquidity shortages. Stress testing simulates adverse scenarios to evaluate the bank's ability to maintain adequate liquidity under pressure. Additionally, the use of liquidity coverage ratios (LCR) ensures compliance with regulatory requirements while safeguarding short-term liquidity needs.

Risk Factors: Interest Rate, Credit, and Liquidity Risks

Asset-Liability Management (ALM) and Liquidity Management are crucial frameworks in banking that address different risk factors. ALM primarily focuses on balancing interest rate risk and credit risk by managing the maturity and repricing gaps between assets and liabilities to stabilize net interest margins and maintain capital adequacy. Liquidity Management prioritizes mitigating liquidity risk by ensuring sufficient cash flow and access to liquid assets, enabling banks to meet short-term obligations without incurring significant losses.

Regulatory Frameworks Influencing ALM and Liquidity Management

Regulatory frameworks such as Basel III and the Dodd-Frank Act impose strict capital adequacy and liquidity coverage ratios, directly shaping Asset-Liability Management (ALM) and liquidity management practices within banks. These regulations require financial institutions to maintain sufficient liquid assets to cover short-term obligations and manage interest rate risk effectively while optimizing their asset and liability portfolios. Compliance with regulatory mandates ensures stability, reduces systemic risk, and promotes prudent financial management across banking operations.

Interrelationship Between ALM and Liquidity Management

Asset-Liability Management (ALM) and Liquidity Management are deeply interconnected in banking, as ALM ensures the alignment of assets and liabilities to optimize profitability while controlling risks, which directly impacts liquidity positions. Effective liquidity management requires accurate forecasting and monitoring of cash flows influenced by ALM strategies to maintain sufficient liquid reserves for meeting short-term obligations. Banks that integrate ALM with liquidity management frameworks can better mitigate interest rate risk, funding risk, and liquidity risk, enhancing overall financial stability.

Challenges and Best Practices in Managing ALM and Liquidity

Effective Asset-Liability Management (ALM) requires balancing interest rate risks and maturities, while liquidity management focuses on ensuring sufficient cash flow to meet short-term obligations without sacrificing profitability. Challenges in ALM include managing mismatched asset and liability durations amid volatile interest rates, whereas liquidity management faces unpredictable cash demands and funding market disruptions. Best practices involve conducting rigorous scenario analysis, maintaining diversified funding sources, and implementing robust stress testing frameworks to optimize capital allocation and safeguard financial stability.

Strategic Impact on Bank Performance and Stability

Asset-Liability Management (ALM) strategically optimizes the balance sheet by managing interest rate risks and maturities, directly influencing bank profitability and long-term stability. Liquidity Management ensures sufficient cash flow to meet short-term obligations, safeguarding against solvency crises and enhancing operational resilience. Together, ALM and Liquidity Management form a comprehensive risk framework critical for sustaining bank performance under varying economic conditions.

Important Terms

Interest Rate Risk

Interest rate risk in asset-liability management (ALM) involves measuring and managing the mismatch between assets and liabilities to protect net interest margins, primarily focusing on long-term stability. Liquidity management addresses short-term cash flow needs and market conditions, ensuring sufficient liquid assets to meet obligations without incurring excessive costs or losses.

Maturity Gap

The maturity gap measures the difference between the maturities of assets and liabilities, playing a crucial role in Asset-Liability Management (ALM) to manage interest rate risk and ensure financial stability. Liquidity management focuses on maintaining sufficient cash flow to meet short-term obligations, which requires closely monitoring the maturity gap to prevent liquidity shortfalls and optimize funding strategies.

Duration Matching

Duration matching in Asset-Liability Management (ALM) focuses on aligning the durations of assets and liabilities to minimize interest rate risk and ensure long-term financial stability. In contrast, Liquidity Management prioritizes maintaining sufficient cash flow and liquid assets to meet short-term obligations, emphasizing immediate financial flexibility over interest rate sensitivity.

Funding Concentration

Funding concentration poses significant risks in Asset-Liability Management by creating vulnerability to liquidity shocks when reliance on limited funding sources intensifies. Effective Liquidity Management mitigates these risks through diversification strategies and maintaining stable funding profiles to ensure continuous cash flow and financial stability.

Gap Analysis

Gap Analysis in financial contexts measures the difference between assets and liabilities over specific time periods to identify interest rate risk and liquidity mismatches. Within Asset-Liability Management (ALM), Gap Analysis evaluates timing gaps to optimize balance sheet stability, while in Liquidity Management it focuses on ensuring sufficient cash flow to meet short-term obligations.

Liquidity Coverage Ratio (LCR)

Liquidity Coverage Ratio (LCR) measures a bank's high-quality liquid assets against its net cash outflows over 30 days, serving as a critical metric in both Asset-Liability Management (ALM) and Liquidity Management. While ALM focuses on balancing assets and liabilities to optimize risk and profitability, Liquidity Management prioritizes maintaining sufficient liquid assets to meet short-term obligations and regulatory LCR requirements.

Net Stable Funding Ratio (NSFR)

Net Stable Funding Ratio (NSFR) is a key regulatory metric designed to ensure banks maintain a stable funding profile relative to their asset composition over a one-year horizon, directly linking asset-liability management practices with structural liquidity resilience. It complements liquidity management by promoting long-term funding stability, reducing reliance on short-term wholesale funding, and encouraging the alignment of funding sources with asset liquidity characteristics.

Cash Flow Profiling

Cash flow profiling is a critical technique in asset-liability management (ALM) for matching the timing and magnitude of cash inflows and outflows to mitigate interest rate risk and liquidity mismatch. In liquidity management, cash flow profiling focuses on ensuring sufficient liquid assets are available to meet short-term obligations, enhancing operational cash sufficiency and reducing funding costs.

Balance Sheet Structuring

Balance Sheet Structuring focuses on aligning asset durations and liabilities to optimize financial stability and risk control, integral to effective Asset-Liability Management (ALM). Liquidity Management ensures sufficient short-term assets to meet immediate obligations, complementing ALM by maintaining operational cash flow and mitigating solvency risks.

Contingency Funding Plan

A Contingency Funding Plan (CFP) is a critical component in Asset-Liability Management (ALM) to ensure an institution's liquidity under stress scenarios by identifying potential funding gaps and alternative liquidity sources. Unlike routine Liquidity Management, which focuses on day-to-day cash flow optimization, a CFP strategically prepares for unexpected liquidity shortfalls by integrating stress-testing and scenario analysis within the ALM framework.

Asset-Liability Management vs Liquidity Management Infographic

moneydif.com

moneydif.com