The prime rate serves as the benchmark interest rate that banks charge their most creditworthy customers, while LIBOR represents the average rate at which major global banks lend to each other in the short term. Prime rate is influenced by the federal funds rate set by central banks, making it a domestic indicator, whereas LIBOR reflects international borrowing costs across different currencies and maturities. Understanding the differences between prime rate and LIBOR is crucial for businesses and borrowers when negotiating loan terms or managing interest rate risk.

Table of Comparison

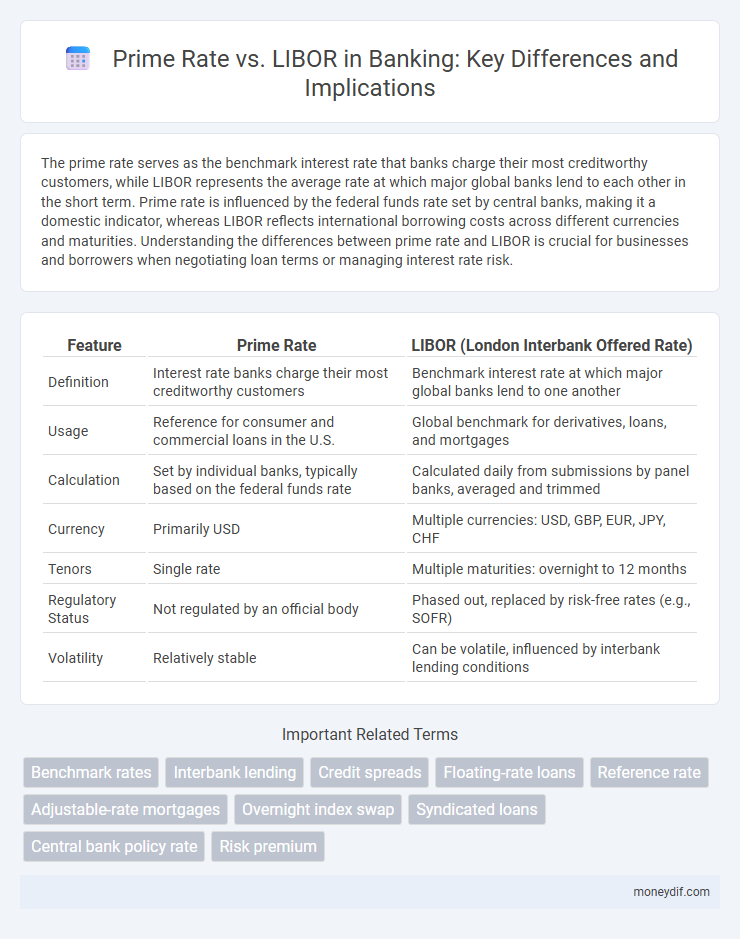

| Feature | Prime Rate | LIBOR (London Interbank Offered Rate) |

|---|---|---|

| Definition | Interest rate banks charge their most creditworthy customers | Benchmark interest rate at which major global banks lend to one another |

| Usage | Reference for consumer and commercial loans in the U.S. | Global benchmark for derivatives, loans, and mortgages |

| Calculation | Set by individual banks, typically based on the federal funds rate | Calculated daily from submissions by panel banks, averaged and trimmed |

| Currency | Primarily USD | Multiple currencies: USD, GBP, EUR, JPY, CHF |

| Tenors | Single rate | Multiple maturities: overnight to 12 months |

| Regulatory Status | Not regulated by an official body | Phased out, replaced by risk-free rates (e.g., SOFR) |

| Volatility | Relatively stable | Can be volatile, influenced by interbank lending conditions |

Understanding the Prime Rate

The Prime Rate serves as a benchmark interest rate that commercial banks charge their most creditworthy customers, often influencing lending rates on various loans such as mortgages and small business loans. Unlike LIBOR, which reflects interbank borrowing costs in the international money market for different maturities and currencies, the Prime Rate is directly set by U.S. banks based on the federal funds rate. Understanding the Prime Rate's impact on loan pricing and credit availability is essential for borrowers seeking competitive financing terms within the U.S. banking system.

What is LIBOR?

LIBOR, or the London Interbank Offered Rate, is a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans. It serves as a critical reference rate for various financial instruments including mortgages, student loans, and derivatives, influencing borrowing costs worldwide. Despite its widespread use, LIBOR is being phased out and replaced by alternative rates like SOFR due to concerns over manipulation and declining transactional data.

Historical Overview: Prime Rate and LIBOR

The Prime Rate has historically served as the benchmark interest rate that banks offer to their most creditworthy customers, typically influenced by the federal funds rate set by the U.S. Federal Reserve since its establishment in the early 20th century. LIBOR (London Interbank Offered Rate), introduced in the 1980s, became the dominant global reference rate for short-term interest rates in various currencies, reflecting the average rate at which major banks lend to one another. While the Prime Rate primarily impacts U.S. lending markets, LIBOR's historical significance lies in its widespread use across international finance before being phased out starting in 2021 due to reliability concerns.

Key Differences Between Prime Rate and LIBOR

The prime rate is the interest rate commercial banks charge their most creditworthy customers, typically large corporations, while LIBOR (London Interbank Offered Rate) represents the average rate at which major global banks lend to each other on the interbank market. Prime rate is primarily influenced by the U.S. Federal Reserve's federal funds rate, making it a benchmark for consumer and business loans in the United States, whereas LIBOR serves as a global reference rate for various financial instruments across multiple currencies. LIBOR's sensitivity to market liquidity and credit risk contrasts with the prime rate's direct linkage to domestic monetary policy, highlighting their distinct roles in the banking sector's interest rate framework.

How Prime Rate is Determined

The Prime Rate is primarily determined by the Federal Reserve's federal funds target rate and reflects the interest rate banks charge their most creditworthy customers. Banks typically set the Prime Rate at a margin above the federal funds rate, often around 3 percentage points higher, to account for operational costs and risk factors. While LIBOR is based on interbank lending rates in the London market, the Prime Rate is a domestic benchmark directly influenced by U.S. monetary policy decisions.

How LIBOR is Calculated

LIBOR is calculated based on a survey of leading global banks, which submit the interest rates at which they believe they could borrow unsecured funds in the London interbank market for various maturities. The rates are collected daily for multiple currencies and loan durations, with the highest and lowest quartiles excluded before averaging the remaining values to determine the final LIBOR rate. This process aims to reflect the true cost of unsecured borrowing between banks, influencing a wide range of financial instruments globally.

Impact on Consumer Loans and Mortgages

Prime rate directly influences consumer loan interest rates, often determining the baseline for credit cards, home equity lines of credit, and personal loans. LIBOR, historically used as a benchmark for adjustable-rate mortgages and various consumer loans, impacts the cost of borrowing but is being phased out in favor of alternative rates like SOFR. Shifts in either rate affect monthly payments and borrowing costs, thereby influencing consumer spending and housing affordability.

Prime Rate vs LIBOR in International Banking

The Prime Rate is a benchmark interest rate used primarily by U.S. banks to set lending rates for corporate and consumer loans, reflecting the federal funds rate and credit conditions. LIBOR, the London Interbank Offered Rate, serves as a global reference rate for short-term loans among major international banks, influencing diverse financial instruments worldwide. In international banking, the Prime Rate is more domestically focused, while LIBOR facilitates cross-border lending and risk assessment in multiple currencies, underpinning global financial markets.

Recent Trends and Regulatory Changes

Recent trends show a shift away from LIBOR as global regulators accelerate its phase-out, prompting banks to adopt alternative benchmarks like SOFR and the Prime rate for better transparency and stability. Regulatory changes, including guidelines from the Financial Conduct Authority (FCA) and the Federal Reserve, emphasize the cessation of LIBOR by mid-2023 and encourage the use of risk-free rates to reduce market manipulation risks. The Prime rate remains a widely used benchmark in the U.S. credit market due to its direct link to the Federal Funds Rate and resilience amid these significant regulatory adjustments.

Future Outlook: Is LIBOR Being Replaced?

The future outlook indicates LIBOR is being phased out in favor of alternative benchmarks like SOFR (Secured Overnight Financing Rate) due to regulatory reforms and concerns over manipulation risks. Major financial institutions and regulatory bodies globally are accelerating the transition to these more transparent and reliable rates by 2024. Although the Prime Rate remains stable as a benchmark tied to the Federal Funds Rate, it is less widely used internationally compared to LIBOR alternatives in derivative and loan markets.

Important Terms

Benchmark rates

Benchmark rates such as the Prime rate and LIBOR play crucial roles in determining interest rates for loans and financial products worldwide. The Prime rate is primarily influenced by the Federal Reserve's federal funds target rate and serves as a reference for consumer lending in the U.S., while LIBOR, though being phased out, historically represented the average interbank borrowing cost for major global currencies, impacting international finance and derivative contracts.

Interbank lending

Interbank lending rates influence the Prime rate, which banks set as a benchmark for consumer loans, while LIBOR (London Interbank Offered Rate) reflects the average interest rate at which major global banks offer unsecured short-term loans to one another. Fluctuations in LIBOR impact the Prime rate by altering banks' cost of capital, affecting lending rates and credit market conditions worldwide.

Credit spreads

Credit spreads reflect the difference in yield between corporate bonds and risk-free benchmarks such as the Prime rate or LIBOR, indicating the additional risk premium investors demand. The Prime rate, typically higher than LIBOR, influences lending costs for prime borrowers, while LIBOR serves as a benchmark for a broader range of credit instruments, making spreads relative to each rate crucial for assessing credit risk and market liquidity.

Floating-rate loans

Floating-rate loans often use the Prime rate or LIBOR as benchmark interest rates, with adjustments based on market conditions to determine the loan's interest payments. LIBOR, being a global reference rate, is more commonly used in international loans, while the Prime rate typically applies to U.S. domestic loans and is influenced by the Federal Reserve's policies.

Reference rate

The reference rate often serves as a benchmark for lending rates, with the Prime rate reflecting the creditworthiness of top-tier borrowers and LIBOR representing the average interbank borrowing cost in the London market. Comparing Prime rate versus LIBOR highlights differences in credit risk assessment and market conditions impacting loan interest calculations worldwide.

Adjustable-rate mortgages

Adjustable-rate mortgages (ARMs) often tie their interest rates to benchmark indexes such as the Prime rate or LIBOR, directly impacting borrowers' monthly payments based on market fluctuations. The Prime rate typically reflects the interest banks charge their most creditworthy customers, while LIBOR, formerly a dominant global reference rate, is being phased out and replaced by alternatives like SOFR, affecting ARM pricing and lender risk assessments.

Overnight index swap

Overnight Index Swaps (OIS) are interest rate derivatives based on overnight rates like the Federal Funds Rate, often used to hedge against short-term interest rate movements, contrasting with LIBOR-based swaps that depend on interbank lending rates. The Prime Rate typically tracks the federal funds rate indirectly, making OIS a more accurate reflection of overnight funding costs compared to LIBOR, which has been phased out in favor of alternative reference rates like SOFR.

Syndicated loans

Syndicated loans often reference benchmark interest rates such as the Prime Rate or LIBOR to determine borrowing costs, with LIBOR historically serving as the predominant standard for floating-rate loans before its global phase-out. The transition from LIBOR to alternative benchmarks like SOFR impacts loan agreements, pricing, and risk management in syndicated lending markets.

Central bank policy rate

The central bank policy rate directly influences the prime rate, which banks use as a benchmark for consumer and business loans, while LIBOR, historically tied to interbank lending rates in the London market, often serves as a reference rate for global financial instruments. Changes in the policy rate impact borrowing costs by shifting both the prime rate and LIBOR, affecting credit availability and interest expenses across diverse lending and investment products.

Risk premium

Risk premium reflects the additional return investors demand when choosing assets with higher default risk, often influencing the spread between prime rate and LIBOR. The prime rate, usually set by banks for preferred customers, is typically higher than LIBOR, which represents lower-risk interbank lending, and their difference incorporates credit risk and liquidity risk premiums.

Prime rate vs LIBOR Infographic

moneydif.com

moneydif.com