A payment gateway securely processes online transactions by transmitting card information from the customer to the bank, ensuring seamless authorization and payment approval. Payment aggregators simplify merchant onboarding by pooling multiple merchants under a single account, handling transaction settlements and reducing the need for each merchant to establish individual merchant accounts. Choosing between a payment gateway and a payment aggregator depends on business size, transaction volume, and the level of control required over payment processing.

Table of Comparison

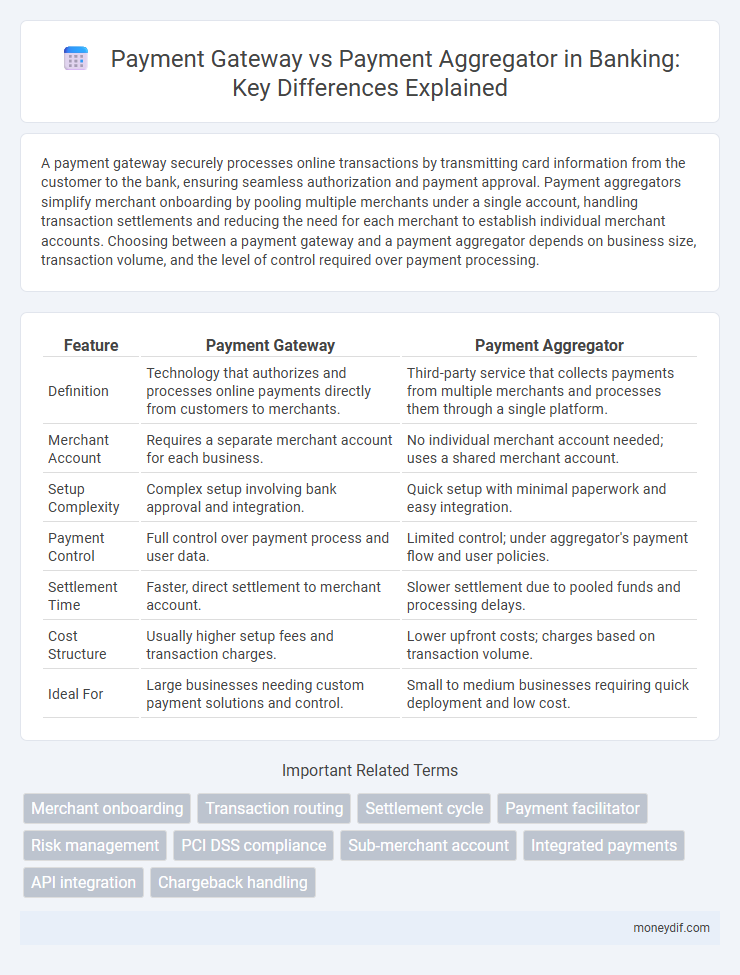

| Feature | Payment Gateway | Payment Aggregator |

|---|---|---|

| Definition | Technology that authorizes and processes online payments directly from customers to merchants. | Third-party service that collects payments from multiple merchants and processes them through a single platform. |

| Merchant Account | Requires a separate merchant account for each business. | No individual merchant account needed; uses a shared merchant account. |

| Setup Complexity | Complex setup involving bank approval and integration. | Quick setup with minimal paperwork and easy integration. |

| Payment Control | Full control over payment process and user data. | Limited control; under aggregator's payment flow and user policies. |

| Settlement Time | Faster, direct settlement to merchant account. | Slower settlement due to pooled funds and processing delays. |

| Cost Structure | Usually higher setup fees and transaction charges. | Lower upfront costs; charges based on transaction volume. |

| Ideal For | Large businesses needing custom payment solutions and control. | Small to medium businesses requiring quick deployment and low cost. |

Introduction to Payment Gateways and Payment Aggregators

Payment gateways facilitate secure authorization and processing of online transactions by connecting merchants, customers, and financial institutions. Payment aggregators serve as intermediaries allowing merchants to accept payments without maintaining individual merchant accounts by consolidating multiple merchants under a single account. Both solutions streamline digital payments but differ in integration complexity and risk management responsibilities.

Core Functions: Payment Gateway vs Payment Aggregator

Payment gateways securely transmit customer payment information from the merchant's website to the acquiring bank, authorizing transactions in real time. Payment aggregators streamline merchant onboarding by pooling multiple merchants under a single master merchant account, simplifying transaction settlement and reducing setup complexity. The core function of payment gateways centers on transaction authorization and data encryption, while payment aggregators focus on account management and consolidated payment processing for various merchants.

Technical Differences in Transaction Processing

Payment gateway processes transactions by securely transmitting payment data from the merchant to the payment processor, ensuring encryption and authorization in real time. Payment aggregators, on the other hand, consolidate multiple merchants under a single merchant account, streamlining transaction settlement but handling funds pooling and disbursement internally. Technical differences include the payment gateway's direct integration with merchant systems for individual transaction routing versus the aggregator's batch processing model that simplifies onboarding but may introduce additional settlement timing variances.

Onboarding and Integration Processes

Payment gateways require individual merchant accounts, demanding rigorous onboarding with extensive documentation and underwriting, resulting in longer setup times and complex integration through APIs. Payment aggregators streamline onboarding by pooling multiple merchants under a single master account, enabling faster approval and simplified integration via unified platforms. Banks evaluating these options prioritize payment aggregators for ease of setup and gateway services for greater control and customization in transaction processing.

Security and Compliance Considerations

Payment gateways provide direct integrations with banks and require merchants to manage PCI DSS compliance, ensuring secure transmission of payment data through encryption and tokenization. Payment aggregators handle multiple merchants under a single PCI DSS certification, reducing compliance burden but potentially increasing risk exposure due to shared infrastructure. Both solutions must adhere to strict regulatory standards like PSD2 in Europe and PCI DSS globally to prevent fraud and secure sensitive financial information.

Pricing Models and Fee Structures

Payment gateways typically charge a flat fee per transaction combined with a monthly service fee, offering direct integration with merchant accounts and control over payment processing. Payment aggregators, on the other hand, employ a consolidated pricing model with percentage-based transaction fees, often including a small per-transaction charge, with no monthly fees, simplifying onboarding for small businesses. Understanding these fee structures is crucial for merchants to evaluate cost efficiency and scalability in payment processing solutions.

Settlement Cycles and Fund Flow

Payment gateway facilitates direct transfer of funds from a customer's bank to the merchant's account, resulting in faster settlement cycles often within 24 to 48 hours. Payment aggregators pool transactions from multiple merchants into a single merchant account, causing longer settlement cycles that can range from 2 to 7 business days due to batch processing. The fund flow in payment gateways is more streamlined and transparent, while payment aggregators involve intermediary holding accounts which may delay access to funds but reduce the complexity for individual merchants.

Scalability and Business Suitability

Payment gateways offer scalable solutions suitable for businesses with high transaction volumes and require direct integration with multiple payment processors, ensuring greater control and customization. Payment aggregators provide simplified onboarding and management, ideal for small to medium enterprises seeking quick setup and lower upfront costs but may face limitations in handling large-scale transactions. Choosing between the two depends on the business's growth trajectory, transaction complexity, and the need for bespoke financial infrastructure.

Pros and Cons: Payment Gateway vs Payment Aggregator

Payment gateways offer direct integration with banks, providing faster transaction processing and greater control over payment data, but require higher setup costs and compliance with stringent PCI DSS standards. Payment aggregators simplify onboarding by pooling multiple merchants under a single account, lowering initial costs and easing compliance burdens, though they often come with higher per-transaction fees and limited customization. Choosing between a payment gateway and aggregator depends on business scale, technical resources, and the need for flexibility in payment processing.

Choosing the Right Solution for Your Banking Needs

Payment gateways provide direct transaction processing between customers and banks, offering enhanced security and control for businesses managing high volumes of payments. Payment aggregators consolidate multiple merchant transactions under a single account, streamlining onboarding but limiting customization and control over funds. Selecting the right solution depends on your banking needs, transaction volume, and desired level of control over payment processing and reconciliation.

Important Terms

Merchant onboarding

Merchant onboarding for payment gateways involves a direct contractual relationship, requiring thorough compliance checks and tailored risk assessments, while payment aggregators simplify onboarding by allowing merchants to process payments under a shared account, enabling faster setup but with aggregated risk management and typically higher transaction fees. Choosing between a payment gateway and an aggregator depends on factors like transaction volume, integration complexity, and the merchant's need for control over payment processing and settlement timelines.

Transaction routing

Transaction routing directs payment data through a payment gateway to the relevant acquiring bank, ensuring secure and fast authorization, whereas a payment aggregator consolidates multiple merchants' transactions under a single platform to simplify processing but may introduce additional routing steps. Effective transaction routing optimizes authorization success rates and reduces latency, critical factors that differentiate the operational efficiencies between payment gateways and payment aggregators.

Settlement cycle

Settlement cycle for payment gateways typically involves direct transactions between merchants and banks, ensuring faster fund transfers within 1-2 business days, whereas payment aggregators process multiple transactions collectively, which can extend settlement to 2-5 business days due to batch processing. Payment gateways offer individual merchant accounts streamlining settlements, while aggregators pool merchant transactions, affecting the speed and transparency of the settlement cycle.

Payment facilitator

A payment facilitator streamlines merchant onboarding by acting as a master merchant, differentiating from payment gateways that solely enable transaction processing and from payment aggregators that pool multiple merchants under a single account. Payment facilitators enhance transaction efficiency through direct underwriting and risk management, offering faster approvals compared to traditional payment aggregators and integrating seamlessly with payment gateways for comprehensive payment processing solutions.

Risk management

Payment gateway risk management focuses on secure transaction processing by encrypting sensitive data and preventing fraud during payment authorization, while payment aggregators manage risks by overseeing multiple merchants under a single account, monitoring batch transactions, and ensuring compliance with regulatory standards. Both entities implement advanced fraud detection systems and proactive chargeback handling to minimize financial losses and enhance payment security.

PCI DSS compliance

PCI DSS compliance for payment gateways involves direct responsibility for secure card data transmission and storage, requiring rigorous adherence to security protocols such as encryption and vulnerability management. Payment aggregators share this compliance burden by ensuring their platform handles multiple merchants' transactions securely, often leveraging the gateway's security infrastructure to streamline PCI DSS obligations.

Sub-merchant account

A sub-merchant account enables businesses to process payments under a main merchant's payment gateway, offering direct transaction settlement and greater control compared to a payment aggregator, which pools multiple merchants under a single master account but may have slower fund disbursement and less customized reporting. Payment gateways linked to sub-merchant accounts provide enhanced security features and compliance with PCI DSS standards, while payment aggregators simplify onboarding but often charge higher fees and limit merchant-specific branding.

Integrated payments

Integrated payments streamline transactions by combining payment processing directly within a business's platform, enhancing user experience and operational efficiency. Payment gateways securely authorize transactions by connecting merchants to the acquiring banks, while payment aggregators simplify merchant onboarding by pooling multiple merchants under a single account, offering faster setup but potentially higher fees.

API integration

API integration with a payment gateway enables direct connection between a merchant's website and the payment processor, ensuring secure transaction authorization and settlement, while payment aggregators offer a simplified integration by pooling multiple merchants under a single account to handle payment processing and compliance. Choosing between a payment gateway and a payment aggregator depends on factors such as transaction volume, control over customer experience, fee structures, and technical resources for managing API implementations.

Chargeback handling

Chargeback handling in payment gateways involves direct management of dispute resolution between merchants and issuing banks, providing granular control over transactions and chargeback responses. Payment aggregators, however, centralize chargeback processes across multiple merchants, streamlining dispute resolution but potentially limiting individualized control and response customization.

Payment gateway vs Payment aggregator Infographic

moneydif.com

moneydif.com