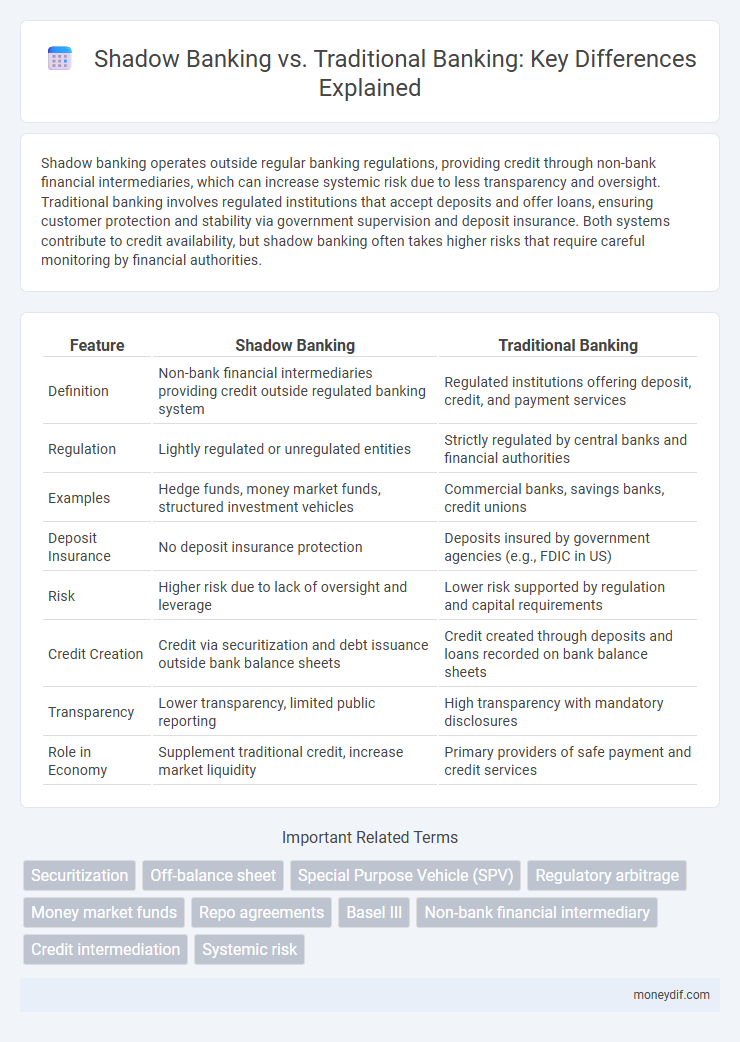

Shadow banking operates outside regular banking regulations, providing credit through non-bank financial intermediaries, which can increase systemic risk due to less transparency and oversight. Traditional banking involves regulated institutions that accept deposits and offer loans, ensuring customer protection and stability via government supervision and deposit insurance. Both systems contribute to credit availability, but shadow banking often takes higher risks that require careful monitoring by financial authorities.

Table of Comparison

| Feature | Shadow Banking | Traditional Banking |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit outside regulated banking system | Regulated institutions offering deposit, credit, and payment services |

| Regulation | Lightly regulated or unregulated entities | Strictly regulated by central banks and financial authorities |

| Examples | Hedge funds, money market funds, structured investment vehicles | Commercial banks, savings banks, credit unions |

| Deposit Insurance | No deposit insurance protection | Deposits insured by government agencies (e.g., FDIC in US) |

| Risk | Higher risk due to lack of oversight and leverage | Lower risk supported by regulation and capital requirements |

| Credit Creation | Credit via securitization and debt issuance outside bank balance sheets | Credit created through deposits and loans recorded on bank balance sheets |

| Transparency | Lower transparency, limited public reporting | High transparency with mandatory disclosures |

| Role in Economy | Supplement traditional credit, increase market liquidity | Primary providers of safe payment and credit services |

Defining Shadow Banking and Traditional Banking

Shadow banking comprises non-bank financial intermediaries that provide services similar to traditional banks but operate outside normal banking regulations, including entities such as hedge funds, money market funds, and structured investment vehicles. Traditional banking involves regulated institutions like commercial banks and savings banks that accept deposits, offer loans, and provide payment services under strict regulatory supervision to ensure financial stability and depositor protection. The key distinction lies in shadow banking's reliance on off-balance-sheet activities and less regulatory oversight compared to the heavily regulated framework governing traditional banks.

Key Differences in Regulatory Frameworks

Shadow banking operates with limited regulatory oversight compared to traditional banking, which is strictly governed by central banks and financial regulators to ensure stability and depositor protection. Traditional banks adhere to capital requirements, liquidity mandates, and comprehensive reporting standards, whereas shadow banking entities often bypass these regulations, leading to greater systemic risk. This disparity in regulatory frameworks impacts the transparency, risk management, and overall resilience of the financial system.

Core Functions and Services Offered

Shadow banking operates outside traditional regulatory frameworks, providing credit intermediation through non-bank financial institutions such as hedge funds, money market funds, and structured investment vehicles. Its core functions include securitization, repo transactions, and providing short-term funding to markets and corporations, often bypassing the deposit-taking and lending model fundamental to traditional banks. Traditional banking primarily focuses on accepting deposits, offering loans, and providing payment services, maintaining direct relationships with customers under stringent regulatory oversight to ensure financial stability and consumer protection.

Impact on Financial Stability

Shadow banking operates outside traditional regulatory frameworks, increasing systemic risk by creating interconnected liabilities that can trigger liquidity crises. Traditional banking benefits from regulatory oversight, deposit insurance, and access to central bank funding, which collectively enhance financial system resilience. The growth of shadow banking poses challenges to financial stability by amplifying leverage and reducing transparency in credit markets.

Credit Creation and Capital Flows

Shadow banking facilitates credit creation through non-bank financial intermediaries like hedge funds and money market funds, operating outside traditional regulatory frameworks, thus enabling faster capital flows with higher risk profiles. Traditional banking relies on deposit-taking and regulated lending practices, creating credit primarily through fractional reserve banking, which ensures stability but limits capital flow speed. The interplay between shadow banking and traditional banking significantly impacts overall credit availability and liquidity in financial markets, influencing economic growth and systemic risk.

Risks Associated with Shadow Banking

Shadow banking poses significant risks due to its lack of regulatory oversight, leading to increased systemic vulnerability and potential for financial instability. Unlike traditional banking, shadow banking entities engage in high-leverage activities and complex financial instruments without the safety nets like deposit insurance or access to central bank liquidity. These factors contribute to heightened credit risk, liquidity risk, and contagion effects that can amplify economic downturns.

Transparency and Disclosure Standards

Shadow banking systems operate with significantly lower transparency and disclosure standards compared to traditional banks, often leading to increased systemic risk. Traditional banks are subject to stringent regulatory frameworks requiring detailed public disclosure of financial activities, which enhances market confidence and accountability. The opaque nature of shadow banking complicates risk assessment and regulatory oversight, making it a critical area for potential regulatory reforms.

Role in Economic Crises

Shadow banking, operating outside regular banking regulations, often amplifies economic crises by increasing systemic risk through high leverage and liquidity mismatches. Traditional banking provides stability by adhering to strict regulatory frameworks, ensuring depositor protection and maintaining financial system confidence during downturns. The interconnectedness of shadow banks with traditional financial institutions can transmit shocks rapidly, exacerbating economic instability.

Growth Drivers and Market Trends

Shadow banking is experiencing rapid growth driven by demand for alternative credit sources, technological innovation, and regulatory arbitrage, capturing market segments underserved by traditional banks. Traditional banking growth is influenced by regulatory frameworks, digital transformation, and expanding retail and corporate banking services. Market trends reveal a rising preference for fintech integration, increased investment in decentralized finance (DeFi), and ongoing efforts to enhance transparency and risk management across both sectors.

Future Outlook: Integration or Separation

Shadow banking and traditional banking sectors face a pivotal future shaped by regulatory evolution and technological innovation. Integration may accelerate through fintech partnerships and blockchain adoption, enhancing liquidity and credit accessibility while managing systemic risks. Conversely, regulatory frameworks might enforce clearer separations to ensure financial stability and consumer protection, preserving distinct operational boundaries.

Important Terms

Securitization

Securitization in shadow banking involves transforming illiquid assets into marketable securities, bypassing traditional banking regulations and increasing systemic risk exposure. Traditional banking relies on deposit-based lending with stricter regulatory oversight, whereas shadow banking's securitization enables higher leverage and off-balance-sheet activities, intensifying financial market interconnectedness.

Off-balance sheet

Off-balance sheet activities in shadow banking involve non-traditional financial transactions and assets not recorded on the balance sheet, increasing systemic risk through less regulatory oversight compared to traditional banking; traditional banks primarily use on-balance sheet assets and liabilities, ensuring greater transparency and regulatory control. Shadow banking entities, such as hedge funds and special purpose vehicles, engage heavily in securitization and derivatives, contributing to financial leverage without the capital requirements imposed on regulated banks.

Special Purpose Vehicle (SPV)

Special Purpose Vehicles (SPVs) are legal entities created to isolate financial risk and facilitate complex transactions in shadow banking, enabling activities like securitization and off-balance-sheet financing that traditional banks typically cannot perform directly. Unlike traditional banks regulated by central authorities, SPVs operate with less transparency and oversight, contributing to the shadow banking system's ability to provide credit while circumventing conventional banking regulations.

Regulatory arbitrage

Regulatory arbitrage occurs when shadow banking entities exploit less stringent regulations compared to traditional banks, enabling them to engage in riskier financial activities and offer higher yields. This practice creates systemic risks by circumventing capital requirements and oversight that typically govern traditional banking institutions.

Money market funds

Money market funds play a critical role in shadow banking by providing short-term liquidity and credit alternatives outside traditional banking regulation, enabling corporations and investors to access cash-like instruments efficiently. Unlike traditional banks, which are subject to stricter capital and reserve requirements, money market funds operate with fewer regulatory constraints, contributing to systemic risk concerns due to their significant role in funding and credit intermediation within shadow banking activities.

Repo agreements

Repo agreements play a crucial role in shadow banking by providing short-term secured financing outside traditional banking regulations, often involving non-bank financial institutions such as hedge funds and money market funds. Unlike traditional banking, where deposits and loans are regulated and insured, repo markets facilitate liquidity and leverage in shadow banking through collateralized lending, increasing systemic risk due to less stringent oversight.

Basel III

Basel III regulatory framework strengthens capital and liquidity requirements to mitigate risks in both traditional banking and shadow banking sectors, addressing the latter's less transparent and less regulated activities. Enhanced oversight aims to reduce systemic risks posed by shadow banking entities that conduct credit intermediation without typical bank safeguards, thereby fostering greater financial stability alongside conventional banks.

Non-bank financial intermediary

Non-bank financial intermediaries, key players in shadow banking, provide credit and liquidity outside traditional banking regulations, often engaging in activities like securitization and repo agreements, which contrasts with traditional banks' reliance on deposit-taking and strict regulatory oversight. These entities, including hedge funds, money market funds, and finance companies, contribute to financial innovation and risk dispersion but also increase systemic vulnerability due to less transparency and regulatory safeguards.

Credit intermediation

Credit intermediation in shadow banking operates through non-bank financial intermediaries like hedge funds and money market funds, facilitating credit flow outside traditional regulatory frameworks, which enhances risk-taking and liquidity transformation. In contrast, traditional banking intermediates credit by accepting deposits and providing loans under strict regulatory oversight, focusing on stability and depositor protection.

Systemic risk

Systemic risk in shadow banking arises from its reliance on short-term funding and lack of regulatory oversight, increasing vulnerability to liquidity shocks compared to traditional banking, which benefits from stricter regulations and access to central bank support. The interconnectedness of shadow banking with traditional banks amplifies contagion effects, potentially destabilizing the entire financial system during crises.

Shadow banking vs Traditional banking Infographic

moneydif.com

moneydif.com