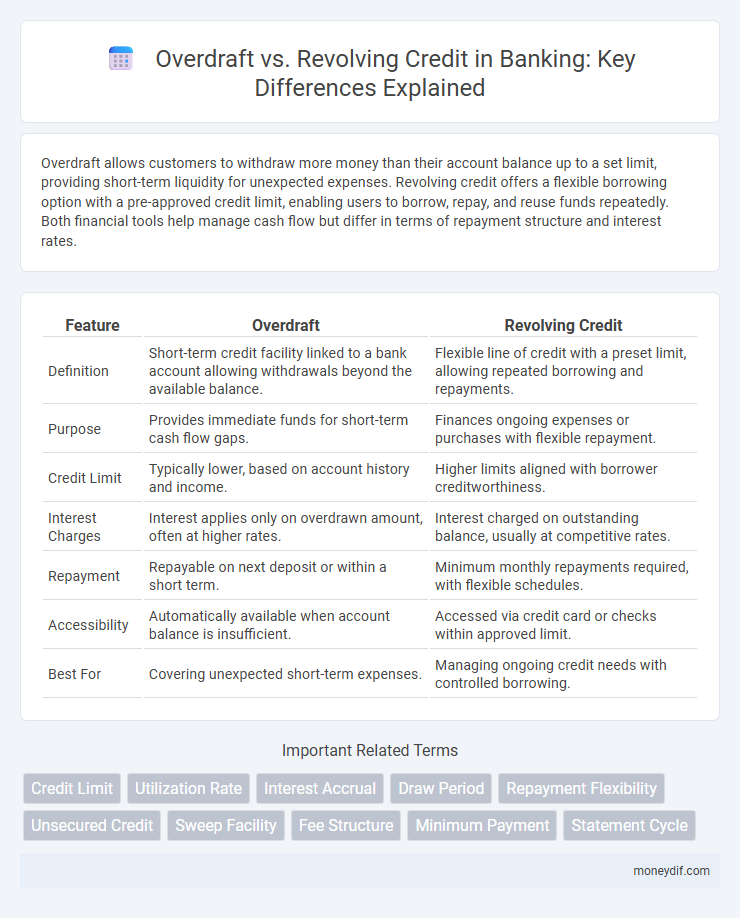

Overdraft allows customers to withdraw more money than their account balance up to a set limit, providing short-term liquidity for unexpected expenses. Revolving credit offers a flexible borrowing option with a pre-approved credit limit, enabling users to borrow, repay, and reuse funds repeatedly. Both financial tools help manage cash flow but differ in terms of repayment structure and interest rates.

Table of Comparison

| Feature | Overdraft | Revolving Credit |

|---|---|---|

| Definition | Short-term credit facility linked to a bank account allowing withdrawals beyond the available balance. | Flexible line of credit with a preset limit, allowing repeated borrowing and repayments. |

| Purpose | Provides immediate funds for short-term cash flow gaps. | Finances ongoing expenses or purchases with flexible repayment. |

| Credit Limit | Typically lower, based on account history and income. | Higher limits aligned with borrower creditworthiness. |

| Interest Charges | Interest applies only on overdrawn amount, often at higher rates. | Interest charged on outstanding balance, usually at competitive rates. |

| Repayment | Repayable on next deposit or within a short term. | Minimum monthly repayments required, with flexible schedules. |

| Accessibility | Automatically available when account balance is insufficient. | Accessed via credit card or checks within approved limit. |

| Best For | Covering unexpected short-term expenses. | Managing ongoing credit needs with controlled borrowing. |

Understanding Overdraft: Definition and Key Features

Overdraft is a banking facility that allows customers to withdraw more money than their account balance, effectively providing a short-term loan to cover unexpected expenses. Key features include a pre-approved credit limit linked to the checking account, interest charges or fees on the overdrawn amount, and the flexibility to repay the borrowed funds within a specified period. Unlike revolving credit, overdrafts typically have lower borrowing limits and are intended for immediate cash flow needs rather than ongoing credit usage.

What is Revolving Credit? An Overview

Revolving credit is a type of credit that allows borrowers to access funds up to a predetermined limit, repay the borrowed amount, and borrow again without reapplying. Common examples include credit cards and home equity lines of credit, which provide flexible borrowing options with variable interest rates and minimum monthly payments. This form of credit differs from overdrafts by offering a structured credit limit and scheduled repayment terms, facilitating ongoing access to funds for consumers and businesses.

Overdraft vs Revolving Credit: Core Differences

Overdraft and revolving credit both provide short-term financing options but differ significantly in structure and usage. Overdrafts allow account holders to withdraw beyond their available balance up to a preset limit, typically tied to checking accounts with daily interest rates on the borrowed amount. Revolving credit offers a credit line that borrowers can use, repay, and reuse continuously, often featuring flexible repayment schedules and variable interest rates based on creditworthiness.

Application Process: Overdraft vs Revolving Credit

The application process for an overdraft typically involves linking the facility to an existing checking account, with banks conducting a credit check and assessing account history to determine eligibility and limit. Revolving credit requires a more comprehensive application, including detailed financial information and creditworthiness assessment, similar to applying for a credit card or personal line of credit. While overdraft approvals are often faster due to their connection with existing accounts, revolving credit applications may take longer but offer higher credit limits and more flexible repayment options.

Eligibility Criteria for Overdrafts and Revolving Credit

Overdraft eligibility typically requires a bank account in good standing, a history of regular deposits, and a satisfactory credit score, often with minimum income verification. Revolving credit qualification generally demands a stronger credit profile, including a higher credit score, consistent and verifiable income, and lower existing debt-to-income ratios to ensure repayment capacity. Both financial products involve varying risk assessments based on creditworthiness, employment stability, and financial behavior.

Interest Rates: Overdrafts Compared to Revolving Credit

Overdrafts typically have higher interest rates than revolving credit due to their short-term, emergency nature and lack of fixed repayment schedules. Revolving credit offers lower, variable interest rates because it allows for more flexible repayment with structured minimum payments. Understanding the cost difference between overdraft fees and revolving credit interest rates is crucial for managing borrowing expenses effectively.

Repayment Structures: Flexibility and Schedules

Overdrafts provide flexible repayment options by allowing users to repay borrowed funds as deposits are made, with no fixed schedule or interest accrual after repayment. Revolving credit features structured repayment schedules with minimum monthly payments and continuous availability of credit up to a set limit, typically accruing interest on outstanding balances. The key difference lies in overdrafts offering short-term, spontaneous access to funds, whereas revolving credit supports ongoing borrowing with systematic repayment terms.

Fees and Charges: What to Expect

Overdraft fees typically include a fixed charge per transaction or a daily fee while your account remains overdrawn, often ranging from $20 to $35 per item. Revolving credit fees usually consist of interest charges based on the outstanding balance, with APRs varying between 15% and 25%, plus possible annual fees depending on the credit provider. Understanding the cost structure of each option helps consumers manage borrowing expenses effectively and avoid unexpected financial strain.

Risks and Benefits of Overdrafts and Revolving Credit

Overdrafts provide immediate access to funds beyond the account balance, offering flexibility for short-term cash flow gaps but often come with high interest rates and fees, increasing the risk of debt accumulation. Revolving credit allows borrowers to repeatedly access a credit limit while making monthly payments, which can help build credit scores if managed responsibly, yet risks include potential overspending and accumulating high-interest debt if balances are not paid off promptly. Both financial tools require careful management to avoid negative impacts on credit health and financial stability.

Choosing the Right Facility for Your Financial Needs

Overdrafts offer short-term credit linked to your current account, ideal for managing occasional cash flow gaps with immediate access up to a preset limit, while revolving credit provides a flexible borrowing option with a set credit limit that you can borrow, repay, and reuse over time, suitable for ongoing financing needs. Consider interest rates, fees, repayment terms, and the frequency of usage when selecting between overdraft and revolving credit facilities. Choosing the right option depends on your cash flow patterns, borrowing frequency, and whether you need temporary relief or continuous access to credit.

Important Terms

Credit Limit

Credit limit defines the maximum amount a borrower can access either through overdraft or revolving credit facilities, with overdraft allowing short-term negative balances on checking accounts and revolving credit offering ongoing access with variable payments. Understanding the credit limit helps manage financial flexibility while avoiding fees or interest charges associated with exceeding the approved amount.

Utilization Rate

Utilization rate measures the proportion of credit used relative to the total available credit, significantly impacting credit scores when comparing overdraft and revolving credit usage. Overdraft typically involves short-term, often smaller amounts with immediate repayment, while revolving credit allows ongoing borrowing up to a limit, influencing utilization rates differently based on borrowing patterns and repayment behavior.

Interest Accrual

Interest accrual on overdrafts typically occurs daily based on the outstanding balance and often carries higher interest rates due to its short-term and unsecured nature. Revolving credit accrues interest monthly on the average daily balance, allowing for flexible repayments and ongoing borrowing within a preset credit limit.

Draw Period

The draw period in revolving credit allows borrowers to withdraw funds repeatedly up to a credit limit, unlike overdrafts which provide a temporary deficit allowance on checking accounts. During the draw period, revolving credit requires minimum payments on outstanding balances, whereas overdrafts typically involve immediate repayment plus fees to restore positive account balance.

Repayment Flexibility

Repayment flexibility in overdraft accounts allows borrowers to repay any withdrawn amount at their convenience without fixed monthly installments, while revolving credit requires minimum monthly payments based on outstanding balances but offers continuous access to credit up to a set limit. Overdrafts typically have variable repayment schedules linked to account deposits, whereas revolving credit balances accrue interest if not fully repaid each cycle, providing structured yet adaptable financial management options.

Unsecured Credit

Unsecured credit refers to loans or credit lines granted without collateral, commonly seen in overdraft facilities and revolving credit accounts. Overdrafts provide short-term access to funds beyond a checking account balance, typically with higher interest rates, while revolving credit allows ongoing borrowing up to a set limit with flexible repayment options, often used through credit cards or personal lines of credit.

Sweep Facility

Sweep Facility automates the transfer of excess funds from a company's current account into a linked credit account to minimize overdraft usage and reduce interest costs. This mechanism optimizes liquidity by preventing overdrafts while efficiently managing revolving credit limits to maintain available borrowing capacity.

Fee Structure

Overdraft fees typically include daily interest charges plus fixed transaction fees, while revolving credit fees often encompass annual percentage rates (APR) based on outstanding balances and possible maintenance or draw fees. Understanding the cost differences between overdraft fees and revolving credit interest rates is essential for managing borrowing expenses effectively.

Minimum Payment

Minimum payment requirements on revolving credit accounts ensure the balance is reduced gradually, preventing excessive debt accumulation, while overdraft facilities typically charge fees based on the amount overdrawn without a minimum payment structure. Revolving credit offers flexible repayment options with interest on outstanding balances, contrasting with overdraft's short-term borrowing costs that depend on daily negative balances.

Statement Cycle

The statement cycle, typically ranging from 28 to 31 days, determines the period for billing and payment processing in both overdraft and revolving credit accounts, influencing how interest and fees accrue. Overdrafts apply fees immediately upon exceeding the account balance, while revolving credit calculates interest based on the balance carried over after the statement cycle ends.

Overdraft vs Revolving Credit Infographic

moneydif.com

moneydif.com