Core banking systems provide a centralized platform that handles essential banking functions such as account management, transactions, and customer data processing, ensuring consistent and efficient operations across all branches. Modular banking offers a flexible approach by allowing financial institutions to integrate specific components or services, enabling customization and scalability tailored to evolving market demands. Choosing between core and modular banking depends on a bank's need for comprehensive system integration versus adaptable, targeted solutions for rapid innovation.

Table of Comparison

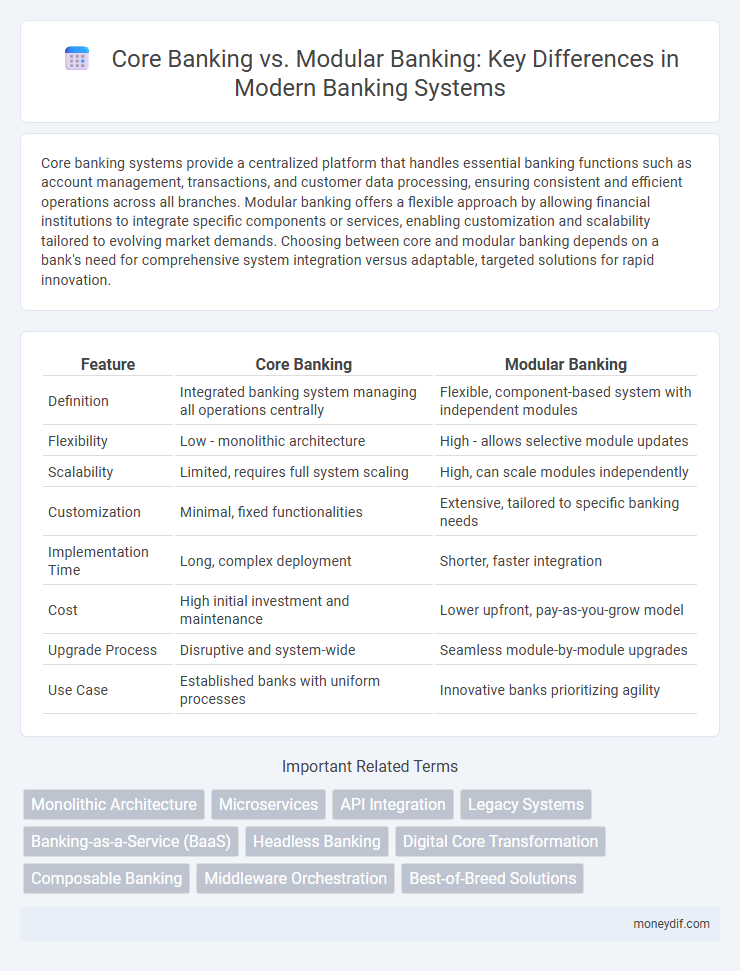

| Feature | Core Banking | Modular Banking |

|---|---|---|

| Definition | Integrated banking system managing all operations centrally | Flexible, component-based system with independent modules |

| Flexibility | Low - monolithic architecture | High - allows selective module updates |

| Scalability | Limited, requires full system scaling | High, can scale modules independently |

| Customization | Minimal, fixed functionalities | Extensive, tailored to specific banking needs |

| Implementation Time | Long, complex deployment | Shorter, faster integration |

| Cost | High initial investment and maintenance | Lower upfront, pay-as-you-grow model |

| Upgrade Process | Disruptive and system-wide | Seamless module-by-module upgrades |

| Use Case | Established banks with uniform processes | Innovative banks prioritizing agility |

Understanding Core Banking Systems

Core banking systems centralize financial services by linking branches, ATMs, online channels, and mobile platforms into a unified database, enabling real-time transaction processing and comprehensive customer data management. Modular banking architecture decomposes these systems into distinct, interoperable components, allowing banks to customize, upgrade, and scale specific functions independently for enhanced agility and innovation. Understanding core banking involves recognizing its role as the foundational infrastructure that supports critical banking operations, customer relationship management, and regulatory compliance across all delivery channels.

What is Modular Banking?

Modular banking is a flexible financial technology approach that allows banks to integrate distinct modules or components, such as payments, loans, and compliance, independently within their existing systems. This architecture enables rapid innovation, seamless customization, and faster deployment of banking services compared to traditional monolithic core banking platforms. By leveraging APIs and microservices, modular banking supports scalability, reduces operational risks, and enhances customer experience through targeted functionality.

Key Differences Between Core and Modular Banking

Core banking systems provide a centralized platform that handles comprehensive banking operations such as account management, transaction processing, and compliance, ensuring uniformity and efficiency across branches. Modular banking offers a flexible architecture composed of independent, interoperable components that allow banks to customize and scale specific functions like payments, lending, or risk management according to their needs. Key differences include the core system's monolithic design supporting end-to-end services versus modular banking's agile, API-driven structure enabling faster innovation and integration with third-party fintech solutions.

Advantages of Core Banking Platforms

Core banking platforms offer centralized data management that enhances real-time transaction processing and improves customer service efficiency. These systems provide robust security features and ensure regulatory compliance, reducing operational risks for financial institutions. Seamless integration with multiple banking channels enables consistent customer experiences and supports scalable growth strategies.

Benefits of Modular Banking Architectures

Modular banking architectures offer enhanced flexibility by enabling financial institutions to integrate and customize individual components based on specific business needs, significantly reducing implementation time and costs. This approach supports scalability and faster innovation, allowing banks to quickly adopt new technologies and respond to market changes without overhauling entire systems. By leveraging APIs and interoperable modules, modular banking improves operational efficiency and facilitates seamless integration with third-party services, enhancing customer experience and competitive advantage.

Challenges in Migrating From Core to Modular Banking

Migrating from core banking to modular banking presents challenges including data integrity risks during system integration and complex migration of legacy data to microservices-based architectures. Banks often face operational disruptions and extended downtime due to incompatible interfaces and lack of standardized APIs between legacy core systems and modular platforms. Ensuring regulatory compliance and robust security measures throughout the transition adds layers of complexity, requiring significant investment in technology and skilled personnel.

Security Considerations: Core vs Modular Banking

Core banking systems centralize data, enabling consistent security protocols and robust access controls across all transactions, minimizing vulnerabilities. Modular banking introduces decentralized components that may require individualized security measures, increasing complexity but allowing tailored protection for specific functions. Ensuring comprehensive encryption, multi-factor authentication, and regular vulnerability assessments is critical in both core and modular architectures to mitigate cyber threats effectively.

Impact on Customer Experience

Core banking systems offer centralized, uniform services that ensure consistent customer experiences across branches, enhancing reliability and speed for routine transactions. Modular banking allows for tailored solutions and faster innovation, enabling banks to integrate specialized services that meet diverse customer needs and improve personalized interactions. The choice between core and modular systems directly influences customer satisfaction by balancing standardized efficiency with flexible, customized offerings.

Cost Implications: Core vs Modular Approaches

Core banking systems involve significant upfront capital expenditures due to comprehensive infrastructure and integration requirements, leading to higher initial costs but lower long-term operational expenses through unified processes. Modular banking solutions offer scalable deployment with reduced initial investment by implementing individual components as needed, which can result in higher cumulative costs from multiple vendor contracts and integration efforts. Evaluating total cost of ownership necessitates analyzing development, maintenance, licensing, and upgrade expenses specific to each approach within the banking institution's strategic framework.

Future Trends in Banking Technology

Core banking systems provide a unified platform for managing customer accounts, transactions, and back-office operations, enabling consistent service delivery across branches. Modular banking introduces flexibility by allowing banks to integrate specialized, scalable components or microservices tailored to emerging customer needs and regulatory changes. Future trends emphasize AI-driven automation, API-enabled open banking, and cloud-native architectures that support seamless innovation and rapid adaptation in both core and modular banking frameworks.

Important Terms

Monolithic Architecture

Monolithic architecture in core banking systems centralizes all banking functions into a single, interconnected platform, which can lead to scalability challenges and slower innovation cycles. In contrast, modular banking architecture breaks down core functionalities into independent, interoperable modules, enabling more agile updates and tailored customer experiences.

Microservices

Microservices architecture enables core banking systems to be decomposed into independent, scalable services, enhancing flexibility and reducing deployment times compared to traditional monolithic core banking platforms. Modular banking leverages microservices to create customizable, interoperable components that allow financial institutions to rapidly innovate and integrate new functionalities while maintaining robust security and compliance.

API Integration

API integration in core banking systems enables seamless communication between centralized financial services and external applications, enhancing real-time transaction processing and data synchronization. In modular banking, APIs facilitate flexible, scalable integration of specialized modules, allowing banks to deploy new functionalities rapidly while maintaining interoperability across diverse platforms.

Legacy Systems

Legacy systems in core banking often involve monolithic architectures that limit flexibility and slow down innovation, whereas modular banking uses microservices and APIs to enable rapid development and seamless integration with third-party solutions. Transitioning from legacy core banking systems to modular platforms enhances scalability, reduces operational risks, and improves customer experience by supporting real-time processing and personalized services.

Banking-as-a-Service (BaaS)

Banking-as-a-Service (BaaS) integrates with core banking systems to offer comprehensive financial services, while modular banking allows flexible, customizable components that can be independently updated or scaled. Core banking supports centralized transaction processing, whereas modular banking emphasizes agility and innovation by enabling seamless integration of third-party services within the BaaS ecosystem.

Headless Banking

Headless banking decouples the front-end user interface from the back-end core banking system, allowing seamless integration and customization through APIs. Compared to traditional core banking, modular banking offers greater flexibility by enabling financial institutions to select and deploy specific services independently, enhancing innovation and agility in digital banking solutions.

Digital Core Transformation

Digital Core Transformation revolutionizes financial institutions by shifting from traditional Core Banking Systems, characterized by monolithic architectures, to Modular Banking platforms that enable agile, scalable, and customizable services. This shift enhances operational efficiency, accelerates product innovation, and supports seamless integration with emerging fintech technologies, driving competitive advantage in the evolving digital economy.

Composable Banking

Composable banking enables financial institutions to customize their technology stack by integrating modular banking components, offering greater flexibility and faster innovation compared to traditional core banking systems that rely on monolithic architectures. This approach reduces time-to-market and enhances scalability by allowing banks to select and combine best-of-breed modules tailored to specific business needs.

Middleware Orchestration

Middleware orchestration enhances core banking systems by enabling seamless integration and communication between legacy applications and new modules, facilitating real-time data processing and reducing operational silos. In modular banking, middleware orchestration supports agile service composition and API management, allowing financial institutions to rapidly deploy and scale independent, customer-centric banking services.

Best-of-Breed Solutions

Best-of-Breed solutions in banking emphasize selecting specialized, high-performing software modules tailored for specific functions, contrasting with Core banking systems that offer integrated, all-in-one platforms. Modular banking leverages these best-of-breed components to enhance flexibility, scalability, and innovation while maintaining interoperability within the core infrastructure.

Core banking vs Modular banking Infographic

moneydif.com

moneydif.com