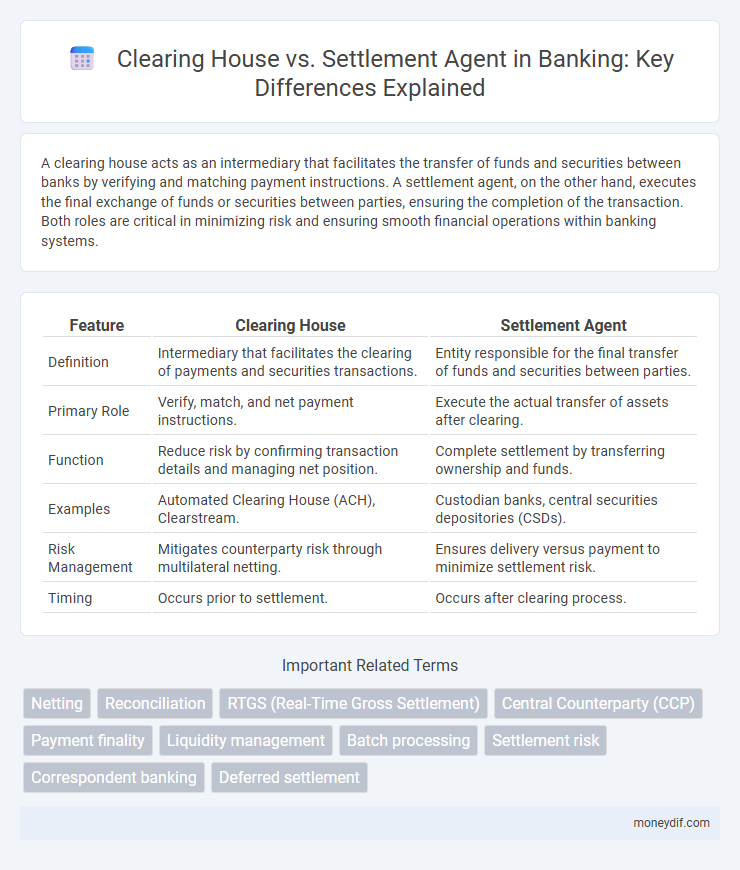

A clearing house acts as an intermediary that facilitates the transfer of funds and securities between banks by verifying and matching payment instructions. A settlement agent, on the other hand, executes the final exchange of funds or securities between parties, ensuring the completion of the transaction. Both roles are critical in minimizing risk and ensuring smooth financial operations within banking systems.

Table of Comparison

| Feature | Clearing House | Settlement Agent |

|---|---|---|

| Definition | Intermediary that facilitates the clearing of payments and securities transactions. | Entity responsible for the final transfer of funds and securities between parties. |

| Primary Role | Verify, match, and net payment instructions. | Execute the actual transfer of assets after clearing. |

| Function | Reduce risk by confirming transaction details and managing net position. | Complete settlement by transferring ownership and funds. |

| Examples | Automated Clearing House (ACH), Clearstream. | Custodian banks, central securities depositories (CSDs). |

| Risk Management | Mitigates counterparty risk through multilateral netting. | Ensures delivery versus payment to minimize settlement risk. |

| Timing | Occurs prior to settlement. | Occurs after clearing process. |

Introduction to Clearing Houses and Settlement Agents

Clearing houses act as intermediaries that facilitate the processing and reconciliation of financial transactions between banks, ensuring accurate and efficient trade validation. Settlement agents manage the final transfer of funds and securities, guaranteeing that both parties fulfill their transaction obligations. Both entities are crucial in maintaining liquidity and reducing settlement risks within the banking infrastructure.

Key Roles in Financial Transactions

Clearing houses ensure accurate verification and matching of payment orders between financial institutions, reducing risks and facilitating smooth transaction flows. Settlement agents handle the final transfer of funds or securities, completing the transaction by ensuring delivery and receipt according to agreed terms. Both entities play crucial roles in maintaining the integrity and efficiency of banking payment systems.

Operational Differences: Clearing Houses vs Settlement Agents

Clearing houses primarily manage the verification, netting, and confirmation of trade obligations between financial institutions to ensure accurate transaction matching and reduce counterparty risk. Settlement agents facilitate the actual transfer of funds and securities after clearing has been completed, coordinating the final exchange to settle obligations efficiently. Operationally, clearing houses focus on risk management and transaction validation, while settlement agents emphasize the secure and timely delivery of assets to conclude the transfer process.

Risk Management in Clearing and Settlement

In banking, clearing houses manage the risk of transaction processing by acting as intermediaries that guarantee payments between parties, reducing counterparty risk through netting and collateral requirements. Settlement agents facilitate the final transfer of funds and securities, focusing on ensuring accurate and timely delivery while minimizing settlement risk associated with payment failures or delays. Effective risk management in clearing and settlement involves robust monitoring systems, credit risk assessment, and adherence to regulatory standards to prevent systemic failures.

Regulatory Frameworks Governing Each Entity

Clearing houses operate under stringent regulatory frameworks established by financial authorities such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), ensuring transparent risk management and compliance with capital requirements. Settlement agents are regulated by banking regulators including the Federal Deposit Insurance Corporation (FDIC) and state banking authorities, emphasizing fiduciary responsibilities and secure handling of client funds. Both entities must adhere to anti-money laundering (AML) laws and data protection regulations to safeguard transactional integrity within the banking sector.

Impact on Transaction Speed and Efficiency

Clearing houses expedite transaction speed by centralizing and validating payment instructions, reducing the risk of errors and delays during the clearing process. Settlement agents primarily focus on the transfer of funds and ownership after clearing, often resulting in a slightly slower but more secure final settlement. The efficiency gained from a clearing house lies in streamlining multiple transactions simultaneously, whereas settlement agents ensure accuracy and legal compliance in individual transactions.

Costs and Fee Structures Compared

Clearing houses typically charge standardized fees based on transaction volume and value, offering cost efficiencies through bulk processing and reduced counterparty risk. Settlement agents often impose variable fees reflecting service complexity, including transaction-specific costs and administrative expenses, which can lead to higher charges for bespoke settlements. Comparing these fee structures reveals that clearing houses generally provide more predictable and lower overall costs for high-frequency banking transactions, while settlement agents may incur higher fees tied to individualized settlement requirements.

Technological Innovations in Clearing and Settlement

Technological innovations in clearing and settlement have transformed clearing houses by enabling real-time processing and blockchain integration, enhancing transparency and reducing settlement risks. Settlement agents leverage automated systems and artificial intelligence to streamline transaction verification and ensure accurate fund transfers across financial institutions. The adoption of distributed ledger technology and interoperable platforms accelerates efficiency, minimizes errors, and fortifies security in cross-border payment settlements.

Case Studies: Clearing Houses and Settlement Agents in Action

Clearing houses, such as the Clearing House Interbank Payments System (CHIPS), facilitate the efficient netting and reconciliation of interbank payments, reducing settlement risk in large-value transactions. Settlement agents, exemplified by the Depository Trust Company (DTC), handle the actual transfer of securities and funds between parties, ensuring accurate and timely final settlement. Case studies reveal how coordinated operations between clearing houses and settlement agents mitigate systemic risk and enhance liquidity management in global financial markets.

Choosing the Right Solution for Banking Institutions

Choosing the right solution between a clearing house and a settlement agent depends on the banking institution's transaction volume, risk tolerance, and operational complexity. Clearing houses provide efficient batch processing and risk management for interbank transfers, enhancing liquidity and reducing counterparty risk. Settlement agents offer tailored, real-time settlement services ideal for cross-border payments and bespoke financial transactions requiring immediate fund transfer and confirmation.

Important Terms

Netting

Netting reduces the total number of payment obligations between counterparties by consolidating multiple transactions into a single net payment, maximizing efficiency in clearing houses. Unlike settlement agents who focus on the final transfer of assets to complete trades, clearing houses utilize netting processes to minimize settlement risk and streamline transaction flows.

Reconciliation

Reconciliation in financial transactions involves verifying and matching records between Clearing Houses and Settlement Agents to ensure accuracy and prevent discrepancies in trade processing. Clearing Houses manage the netting and risk mitigation of transactions, while Settlement Agents confirm the final transfer of securities and funds, making their coordination crucial for seamless reconciliation.

RTGS (Real-Time Gross Settlement)

RTGS (Real-Time Gross Settlement) processes high-value interbank payments immediately on a transaction-by-transaction basis, ensuring final and irrevocable settlement without netting delays. Clearing Houses primarily manage the validation and netting of payment instructions, while Settlement Agents execute the actual fund transfers within the RTGS system to finalize settlement in real time.

Central Counterparty (CCP)

Central Counterparties (CCPs) act as intermediaries in financial markets, reducing counterparty risk by becoming the buyer to every seller and the seller to every buyer during trade clearing. Unlike Settlement Agents who primarily facilitate the transfer of securities and funds, CCPs ensure trade novation and guarantee completion of transactions, thus enhancing market stability and liquidity.

Payment finality

Payment finality ensures that transactions processed through clearing houses are irrevocably confirmed once settled, providing legal certainty to participants. Settlement agents execute the transfer of funds or securities post-clearing, finalizing the payment and reducing systemic risk in financial markets.

Liquidity management

Liquidity management in financial transactions requires precise coordination between the Clearing House, which guarantees the matching and netting of trades, and the Settlement Agent, responsible for the actual transfer of funds and securities. Optimizing liquidity flows involves ensuring the Clearing House efficiently aggregates payment obligations while the Settlement Agent executes timely settlements to minimize settlement risk and funding costs.

Batch processing

Batch processing enables Clearing Houses to aggregate multiple payment transactions into a single group for efficient validation and risk management before funds are released. Settlement Agents execute the final transfer of funds between financial institutions based on these processed batches, ensuring accurate and timely settlement of obligations.

Settlement risk

Settlement risk arises when a Clearing House guarantees the completion of securities transactions but may face delays or defaults in transferring funds or securities during settlement. A Settlement Agent facilitates the actual exchange of assets between parties, mitigating settlement risk by ensuring timely and accurate delivery within the clearing system's framework.

Correspondent banking

Correspondent banking involves financial institutions providing services to each other, enabling cross-border transactions through intermediaries such as clearing houses and settlement agents, which facilitate the transfer of funds and securities. Clearing houses act as centralized intermediaries that guarantee trade completion and mitigate counterparty risk, while settlement agents execute the final exchange of assets, ensuring accurate and timely transaction fulfillment.

Deferred settlement

Deferred settlement allows clearing houses to temporarily postpone the final exchange of securities and funds, facilitating liquidity management and risk reduction in financial markets. Settlement agents execute the actual transfer of ownership and payment on the agreed settlement date, ensuring the completion of transactions initiated and matched by the clearing house.

Clearing House vs Settlement Agent Infographic

moneydif.com

moneydif.com