FX swaps involve exchanging principal and interest payments in one currency for those in another currency, typically for short-term liquidity management without transferring ownership of the underlying assets. Currency swaps generally entail exchanging principal and interest payments on loans in different currencies over a longer period, often used for hedging currency risk and obtaining favorable borrowing terms. Both instruments serve distinct purposes in managing foreign exchange exposure and optimizing funding strategies within banking operations.

Table of Comparison

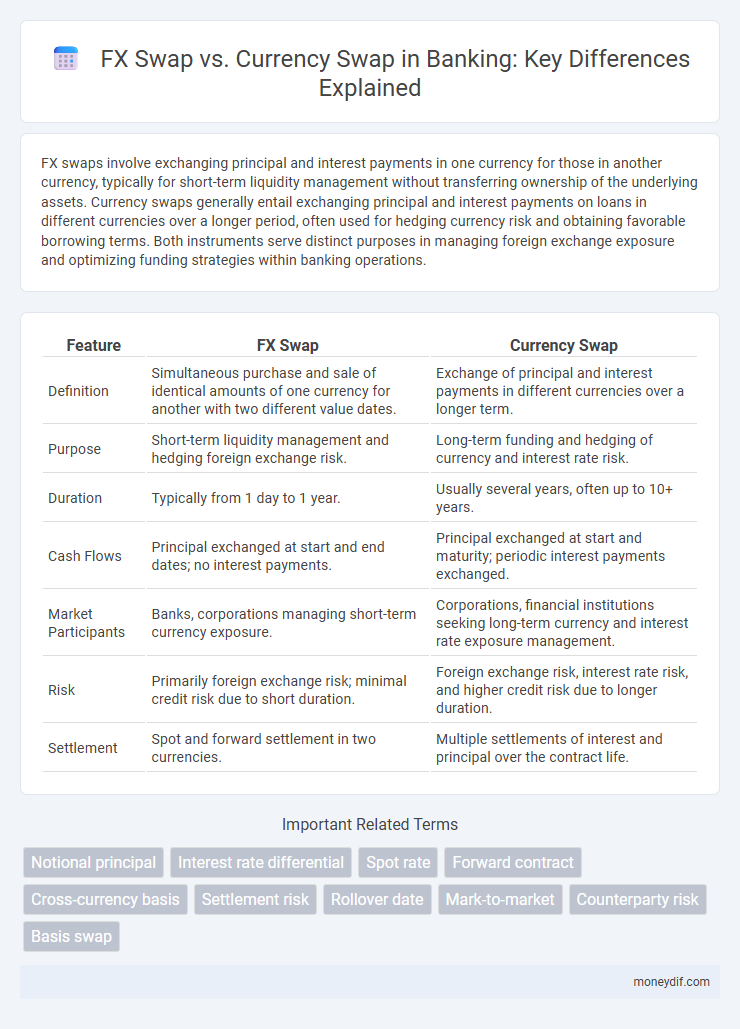

| Feature | FX Swap | Currency Swap |

|---|---|---|

| Definition | Simultaneous purchase and sale of identical amounts of one currency for another with two different value dates. | Exchange of principal and interest payments in different currencies over a longer term. |

| Purpose | Short-term liquidity management and hedging foreign exchange risk. | Long-term funding and hedging of currency and interest rate risk. |

| Duration | Typically from 1 day to 1 year. | Usually several years, often up to 10+ years. |

| Cash Flows | Principal exchanged at start and end dates; no interest payments. | Principal exchanged at start and maturity; periodic interest payments exchanged. |

| Market Participants | Banks, corporations managing short-term currency exposure. | Corporations, financial institutions seeking long-term currency and interest rate exposure management. |

| Risk | Primarily foreign exchange risk; minimal credit risk due to short duration. | Foreign exchange risk, interest rate risk, and higher credit risk due to longer duration. |

| Settlement | Spot and forward settlement in two currencies. | Multiple settlements of interest and principal over the contract life. |

Introduction to FX Swaps and Currency Swaps

FX swaps facilitate short-term foreign exchange risk management by allowing parties to exchange currencies simultaneously at spot and reverse dates, typically involving principal amounts and interest payments without exchanging principal. Currency swaps involve exchanging principal and interest payments in one currency for equivalent amounts in another currency over a longer term, often used for hedging long-term foreign currency exposure or raising capital in foreign markets. Both instruments serve distinct purposes in FX risk management, with FX swaps primarily addressing liquidity needs and currency swaps focusing on long-term funding strategies.

Definition and Core Concepts

FX swaps involve two parties exchanging principal and interest payments in different currencies with an agreement to reverse the transaction at a later date, primarily used for short-term liquidity management. Currency swaps consist of exchanging principal and interest in different currencies over a longer term, often employed to hedge long-term foreign exchange risk and secure favorable borrowing rates. Both instruments facilitate currency risk management but differ in maturity, purpose, and complexity within banking operations.

Key Differences Between FX Swaps and Currency Swaps

FX swaps involve the simultaneous buying and selling of identical amounts of one currency for another with two different value dates, primarily used for short-term liquidity management. Currency swaps exchange principal and interest payments in different currencies over a longer period, enabling hedging of long-term currency risk. Key differences include maturity length, cash flow structure, and risk management objectives, with FX swaps focused on short-term funding and currency swaps aimed at mitigating long-term exchange rate exposure.

How FX Swaps Work in Banking

FX swaps in banking involve simultaneous purchase and sale of identical amounts of one currency for another with two different value dates, primarily used for short-term liquidity management and hedging foreign exchange risk. Transactions typically include a spot transaction and a forward contract, enabling banks to access currency funding without exposure to exchange rate fluctuations between the two settlement dates. This mechanism differs from currency swaps, which exchange principal and interest payments over longer periods, serving broader financing and investment strategies.

The Structure of Currency Swaps

Currency swaps involve exchanging principal and interest payments in different currencies between two parties over a set period, typically structured with fixed or floating interest rates on each leg. Unlike FX swaps, which focus on short-term exchange of currencies with a near-immediate reversal, currency swaps facilitate longer-term hedging or funding needs by establishing initial and final principal exchanges at agreed-upon rates. This structure allows institutions to manage currency risk and diversify funding sources efficiently over extended maturities.

Use Cases in Corporate Banking

FX swaps enable corporate clients to manage short-term liquidity needs and hedge foreign exchange risk in currencies with differing maturities, typically used for funding or temporary currency exposure adjustments. Currency swaps serve longer-term strategic purposes, allowing companies to exchange principal and interest payments in different currencies to optimize debt servicing costs or access international capital markets. Both instruments enhance corporate treasury efficiency by tailored risk management aligned with duration and currency exposure.

Risk Management and Hedging Strategies

FX swaps primarily address short-term liquidity risk and currency exposure by simultaneously buying and selling identical amounts of one currency for another, enabling instant hedging of foreign exchange risk. Currency swaps involve exchanging principal and interest payments in different currencies over a longer period, effectively managing both interest rate risk and currency risk in cross-border financing. Implementing these instruments in risk management allows banks to optimize cash flow matching and reduce volatility in earnings stemming from foreign exchange fluctuations.

Advantages and Disadvantages of Each Instrument

FX swaps offer liquidity management and short-term currency risk mitigation with typically lower credit risk due to their shorter duration, but they lack flexibility in customizing interest rate exposures compared to currency swaps. Currency swaps enable long-term exchange of principal and interest payments in different currencies, providing hedging for interest rate and currency risks over extended periods, yet they can have higher counterparty risk and complexity in valuation. Both instruments serve distinct purposes in international financial management, with FX swaps better suited for temporary funding needs and currency swaps designed for strategic balance sheet and cash flow management.

Regulatory Considerations in Swap Transactions

Regulatory considerations in FX swaps and currency swaps center on compliance with Basel III capital requirements and Dodd-Frank Act regulations, which impact margin and reporting obligations. FX swaps often benefit from simplified regulatory treatment due to their short-term nature and collateralization, while currency swaps typically face stricter capital charges and documentation standards under the EMIR framework. Banks must also manage exposure limits and conduct rigorous counterparty risk assessments in both instruments to align with global regulatory mandates.

Choosing Between FX Swaps and Currency Swaps

Choosing between FX swaps and currency swaps depends on the duration and purpose of the transaction; FX swaps are typically short-term agreements used for liquidity management or hedging currency risk, while currency swaps often involve longer-term debt restructuring and interest rate management. FX swaps primarily exchange principal and interest in a single currency pair over a short period, whereas currency swaps involve exchanging principals and interest payments in different currencies, often linked to underlying loans or bonds. Banks and corporations select FX swaps for quick currency access and currency swaps to optimize capital structure and manage long-term exposure.

Important Terms

Notional principal

Notional principal in FX swaps refers to the agreed amount of currency exchanged at the start and reversed at maturity without interest, serving purely as a reference for calculating exchanged currency amounts. In contrast, currency swaps involve exchanging notional principals at inception and maturity, with periodic interest payments based on these principals, reflecting a more complex structure for hedging currency and interest rate risk.

Interest rate differential

Interest rate differential significantly influences FX swaps, where parties exchange principal and interest payments based on different currencies, typically reflecting short-term interest rate disparities; currency swaps involve exchanging principal and fixed or floating interest payments over longer maturities, thus exposing counterparties to both interest rate and currency risk. The pricing and valuation of FX swaps hinge on the interest rate differential between two currencies' overnight rates, while currency swaps incorporate longer-term interest rate spreads and credit risk premiums impacting cash flows and swap valuations.

Spot rate

The spot rate in FX swaps represents the immediate exchange price for two currencies, crucial for determining the initial principal exchange, while the forward legs reflect agreed future rates; currency swaps involve exchanging principal and interest payments at predetermined rates over a longer term, where spot rates influence the initial notional conversion but future cash flows depend on fixed or floating interest rate differentials. Understanding the spot rate's role helps differentiate the short-term exchange focus in FX swaps from the multi-currency debt and interest rate management purpose of currency swaps.

Forward contract

A forward contract locks in the exchange rate for a future currency transaction, serving as a fundamental component in FX swaps where two parties exchange currencies and reverse the transaction at a later date. In contrast, currency swaps involve exchanging principal and interest payments in different currencies over a longer term, facilitating debt servicing and hedging interest rate risk beyond the short-term nature of FX swaps.

Cross-currency basis

Cross-currency basis reflects the difference between the spot exchange rate and the implied forward rate in FX swaps, indicating the premium or discount for swapping currencies over time. Currency swaps involve exchanging principal and interest payments in different currencies, directly impacting funding costs and hedging strategies beyond the short-term liquidity management characteristic of FX swaps.

Settlement risk

Settlement risk in FX swaps arises from the potential failure of one party to deliver the currency on the agreed date, creating exposure due to the time lag between settlements in different currencies. Currency swaps generally reduce settlement risk by exchanging principal and interest payments over the contract's life, providing synchronized cash flows and lowering counterparty default exposure compared to FX swaps.

Rollover date

The rollover date in FX swaps marks the contract's settlement extension, involving a simultaneous spot and forward transaction to manage short-term currency exposure. In contrast, currency swaps have defined rollover dates for exchanging principal and interest payments at agreed intervals over longer terms, facilitating long-term hedging or financing in different currencies.

Mark-to-market

Mark-to-market accounting for FX swaps involves valuing the swap at current spot and forward rates to reflect real-time market conditions, while currency swaps require marking both the principal and interest rate components to market based on prevailing exchange and interest rates. This differentiation ensures accurate risk assessment and financial reporting by capturing the distinct valuation dynamics of short-term FX swaps versus longer-dated currency swaps.

Counterparty risk

Counterparty risk in FX swaps primarily involves the potential default of one party during the short-term exchange of principal and interest amounts, as these transactions typically settle within days or weeks. In contrast, currency swaps expose parties to longer-term counterparty risk since they entail exchanging principal and interest payments over extended periods, increasing the likelihood of credit events affecting either party.

Basis swap

Basis swaps involve exchanging floating interest rates tied to different currencies, often used to hedge currency risk and manage funding costs more efficiently than FX swaps or traditional currency swaps. FX swaps primarily exchange principal and interest in two currencies for a short duration, while currency swaps exchange principal and interest over a longer term, making basis swaps a more flexible tool for managing cross-currency interest rate exposure.

FX swap vs Currency swap Infographic

moneydif.com

moneydif.com