Green bonds are debt instruments specifically earmarked to finance environmentally friendly projects such as renewable energy or pollution reduction. Sustainability-linked bonds, in contrast, tie their financial or structural characteristics to the issuer's achievement of broader sustainability performance targets, offering flexibility in use of proceeds. Investors seeking direct impact usually prefer green bonds, while those aiming to encourage overall corporate sustainability improvements favor sustainability-linked bonds.

Table of Comparison

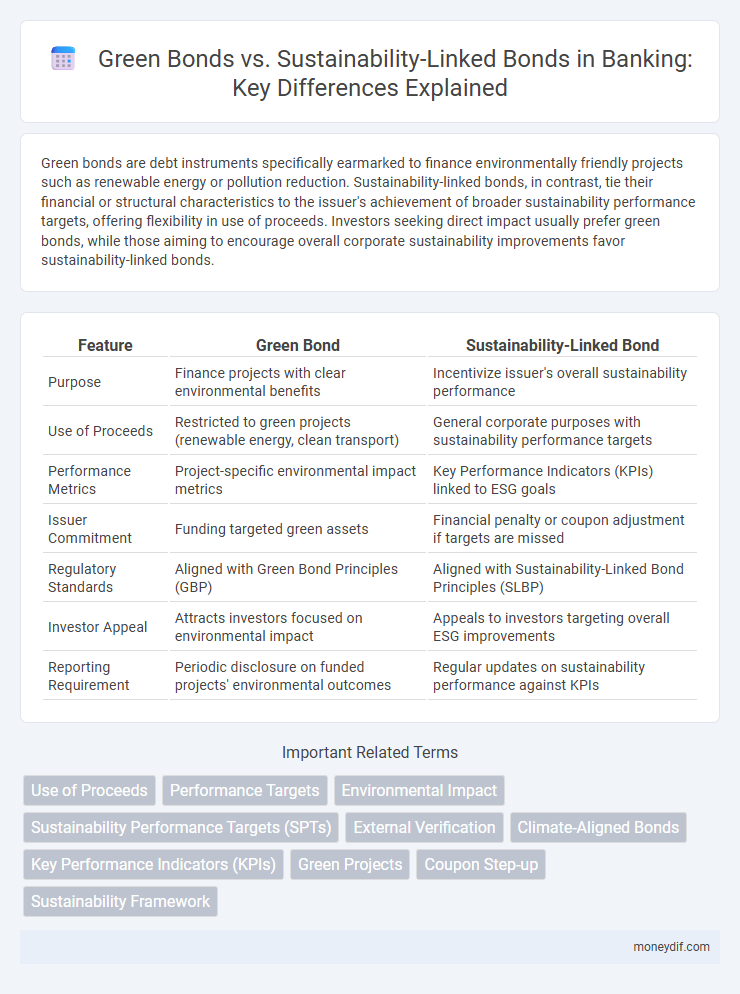

| Feature | Green Bond | Sustainability-Linked Bond |

|---|---|---|

| Purpose | Finance projects with clear environmental benefits | Incentivize issuer's overall sustainability performance |

| Use of Proceeds | Restricted to green projects (renewable energy, clean transport) | General corporate purposes with sustainability performance targets |

| Performance Metrics | Project-specific environmental impact metrics | Key Performance Indicators (KPIs) linked to ESG goals |

| Issuer Commitment | Funding targeted green assets | Financial penalty or coupon adjustment if targets are missed |

| Regulatory Standards | Aligned with Green Bond Principles (GBP) | Aligned with Sustainability-Linked Bond Principles (SLBP) |

| Investor Appeal | Attracts investors focused on environmental impact | Appeals to investors targeting overall ESG improvements |

| Reporting Requirement | Periodic disclosure on funded projects' environmental outcomes | Regular updates on sustainability performance against KPIs |

Introduction to Green Bonds and Sustainability-Linked Bonds

Green bonds are fixed-income financial instruments designed to raise capital specifically for projects with environmental benefits, such as renewable energy or energy efficiency initiatives. Sustainability-linked bonds, in contrast, tie the bond's financial characteristics, like interest rates, to the issuer's achievement of predefined sustainability performance targets across environmental, social, or governance (ESG) criteria. Both instruments support sustainable finance but differ in structure; green bonds allocate proceeds exclusively for green projects, while sustainability-linked bonds focus on the issuer's overall ESG performance improvement.

Defining Green Bonds in the Banking Sector

Green bonds in the banking sector are debt instruments specifically designated to finance projects with clear environmental benefits, such as renewable energy, clean transportation, and sustainable water management. These bonds require issuers to allocate capital exclusively to green projects, adhering to standards like the Climate Bonds Initiative or the Green Bond Principles to ensure transparency and accountability. Unlike sustainability-linked bonds that tie financial terms to broader ESG targets, green bonds focus on raising funds dedicated to specific environmental outcomes within the banking industry.

Understanding Sustainability-Linked Bonds: Concepts and Features

Sustainability-linked bonds (SLBs) are debt instruments where the issuer commits to achieving predefined sustainability performance targets (SPTs) linked to environmental, social, or governance (ESG) criteria, distinguishing them from green bonds that finance specific projects. SLBs offer flexibility as funds are not restricted to particular green projects but tied to overall corporate sustainability performance improvements, incentivizing issuers through potential financial penalties or benefits based on achieving SPTs. Key features include measurable ESG targets, externally verified performance, and transparent reporting requirements, making SLBs a dynamic tool for sustainable finance and corporate accountability.

Key Differences Between Green Bonds and Sustainability-Linked Bonds

Green bonds finance projects with direct environmental benefits such as renewable energy or pollution control, whereas sustainability-linked bonds tie financial performance to broader sustainability targets without restricting the use of proceeds. Green bonds typically require detailed reporting on the allocation and impact of funds, while sustainability-linked bonds focus on achieving predetermined environmental, social, or governance (ESG) key performance indicators (KPIs). Issuers of sustainability-linked bonds face financial penalties or increased coupon rates if sustainability targets are not met, in contrast to green bonds, which emphasize transparency and accountability in project implementation.

Market Trends and Growth in Green and Sustainability-Linked Bonds

Green bonds have experienced robust market growth, reaching over $300 billion issuances globally in 2023, driven by investor demand for transparent environmental impact projects. Sustainability-linked bonds (SLBs), with flexible use-of-proceeds structures, are rapidly gaining traction, growing at a compound annual growth rate (CAGR) of approximately 40% since 2020. The evolving regulatory frameworks and increased corporate ESG commitments are accelerating adoption of both green and sustainability-linked bonds as key instruments in sustainable finance.

Regulatory Frameworks Governing Green and Sustainability-Linked Bonds

Regulatory frameworks governing green bonds typically require issuers to allocate proceeds exclusively to environmentally beneficial projects, with strict reporting and third-party verification to ensure transparency and accountability. Sustainability-linked bonds differ by tying financial characteristics, such as interest rates, to the issuer's achievement of pre-defined sustainability performance targets, governed by less prescriptive but evolving disclosure standards. Both instruments adhere to international guidelines like the Green Bond Principles and Sustainability-Linked Bond Principles issued by ICMA, which provide frameworks to enhance market integrity and investor confidence.

Risk Assessment and Impact Measurement in Both Bond Types

Green bonds specify the use of proceeds for environmentally beneficial projects, allowing investors to directly assess environmental impact and associated risks tied to project performance. Sustainability-linked bonds tie financial terms to issuer-wide sustainability performance targets, requiring rigorous impact measurement across multiple ESG metrics to evaluate issuer risk comprehensively. Risk assessment in green bonds centers on project execution and regulatory compliance, whereas sustainability-linked bonds involve broader corporate strategy risks linked to achieving sustainability targets.

Role of Banks in Issuing and Investing in Green vs Sustainability-Linked Bonds

Banks play a critical role in issuing green bonds by facilitating capital flow to projects with clear environmental benefits, ensuring compliance with strict use-of-proceeds criteria, and providing transparency for investors. In contrast, banks issuing sustainability-linked bonds focus on linking financing costs to the issuer's achievement of predefined ESG performance targets, thereby promoting broader sustainability outcomes beyond specific projects. As investors, banks assess the environmental impact and financial viability of green bonds, while for sustainability-linked bonds they emphasize the credibility of sustainability KPIs and target-setting frameworks to manage ESG-related risks and opportunities.

Challenges and Opportunities in Green and Sustainability-Linked Bond Markets

Green bonds face challenges such as stringent eligibility criteria, limited project types, and high verification costs, which can hinder market expansion but offer opportunities for financing environmentally impactful projects with investor confidence. Sustainability-linked bonds provide flexibility by tying financing terms to broader ESG performance targets, yet measuring and verifying these targets remains complex and may affect issuer credibility. Both markets present growth potential driven by increasing regulatory support and investor demand for transparent, impact-oriented investment vehicles.

Future Outlook: The Evolution of Sustainable Finance Instruments

Green bonds and sustainability-linked bonds are set to play pivotal roles in the future of sustainable finance, with green bonds funding specific environmental projects while sustainability-linked bonds tie financing costs to broader ESG performance targets. The evolution toward integrating more dynamic and outcome-based criteria reflects growing investor demand for accountability and measurable impact in climate-related investments. Market forecasts suggest a substantial increase in issuance volumes driven by regulatory support, corporate commitments to net-zero goals, and expanded frameworks for ESG disclosures.

Important Terms

Use of Proceeds

Use of proceeds in green bonds is strictly allocated to environmentally beneficial projects such as renewable energy and pollution reduction, ensuring clear impact from the investment. Sustainability-linked bonds focus on achieving predefined sustainability performance targets, allowing broader use of proceeds while incentivizing issuer commitment to ESG goals.

Performance Targets

Performance targets for green bonds focus on achieving specific environmental projects such as renewable energy capacity or carbon emission reductions, ensuring proceeds finance green initiatives. Sustainability-linked bonds tie financial terms like coupon rates to broader, measurable ESG performance targets, incentivizing overall corporate sustainability progress beyond project-level outcomes.

Environmental Impact

Green bonds directly finance projects with measurable environmental benefits, such as renewable energy or pollution reduction initiatives, ensuring clear impact reporting and accountability. Sustainability-linked bonds incentivize issuers to meet broader ESG targets, linking financial terms to performance metrics that drive improvements across environmental, social, and governance dimensions.

Sustainability Performance Targets (SPTs)

Sustainability Performance Targets (SPTs) in sustainability-linked bonds are predefined metrics focused on improving environmental, social, or governance (ESG) outcomes, directly influencing the bond's financial terms based on achievement. Green bonds, contrastingly, commit proceeds exclusively to environmentally beneficial projects without linking financial terms to performance against specific SPTs.

External Verification

External verification for green bonds typically involves third-party certification to confirm that proceeds fund eligible environmental projects, ensuring compliance with standards like the Climate Bonds Initiative. Sustainability-linked bonds rely on independent assurance of key performance indicators tied to sustainability targets, verifying issuer commitments without restricting fund use, thus enhancing transparency and accountability.

Climate-Aligned Bonds

Climate-aligned bonds specifically fund projects that target measurable reductions in carbon emissions and climate impact, distinguishing them from green bonds which exclusively finance environmentally beneficial projects such as renewable energy or conservation. Sustainability-linked bonds tie their financial terms to broader corporate sustainability performance targets, encompassing social and governance factors beyond the narrowly defined environmental focus of climate-aligned and green bonds.

Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) for green bonds typically focus on environmental impact metrics such as carbon emissions reduction, energy efficiency improvements, and renewable energy capacity added. In contrast, KPIs for sustainability-linked bonds are broader, encompassing social, governance, and environmental targets like diversity benchmarks, water usage reduction, and corporate governance enhancements.

Green Projects

Green bonds finance projects with clear environmental benefits, such as renewable energy or pollution reduction initiatives, ensuring proceeds are allocated exclusively to green projects. Sustainability-linked bonds, however, tie financial terms to issuer-wide sustainability performance targets, promoting broader ESG improvements beyond specific green project funding.

Coupon Step-up

Coupon step-up mechanisms in green bonds typically activate when predefined environmental targets are not met, increasing the interest rate to incentivize improved performance, while sustainability-linked bonds incorporate coupon step-ups tied to broader ESG (environmental, social, governance) key performance indicators (KPIs), enhancing financial accountability beyond just environmental outcomes. These structures align investor returns with the issuer's sustainability commitments, reinforcing the financial risk-reward dynamics based on compliance with specific green or sustainability goals.

Sustainability Framework

A Sustainability Framework outlines criteria to ensure bonds finance projects with measurable environmental benefits, differentiating Green Bonds, which fund specific eco-friendly projects, from Sustainability-Linked Bonds that tie financial terms to achieving broader sustainability performance targets. This framework enhances transparency, accountability, and impact measurement in sustainable finance markets.

Green bond vs Sustainability-linked bond Infographic

moneydif.com

moneydif.com