Automated Clearing House (ACH) processes batches of electronic payments, offering cost-effective and secure transfers ideal for payroll and recurring transactions, but with settlement times ranging from same-day to a few days. Real-Time Gross Settlement (RTGS) enables instant, high-value fund transfers individually settled in real time, providing immediate finality and reducing settlement risk for urgent or large transactions. Financial institutions rely on ACH for routine payments due to its efficiency, while RTGS serves critical transactions requiring immediate clearance and final settlement.

Table of Comparison

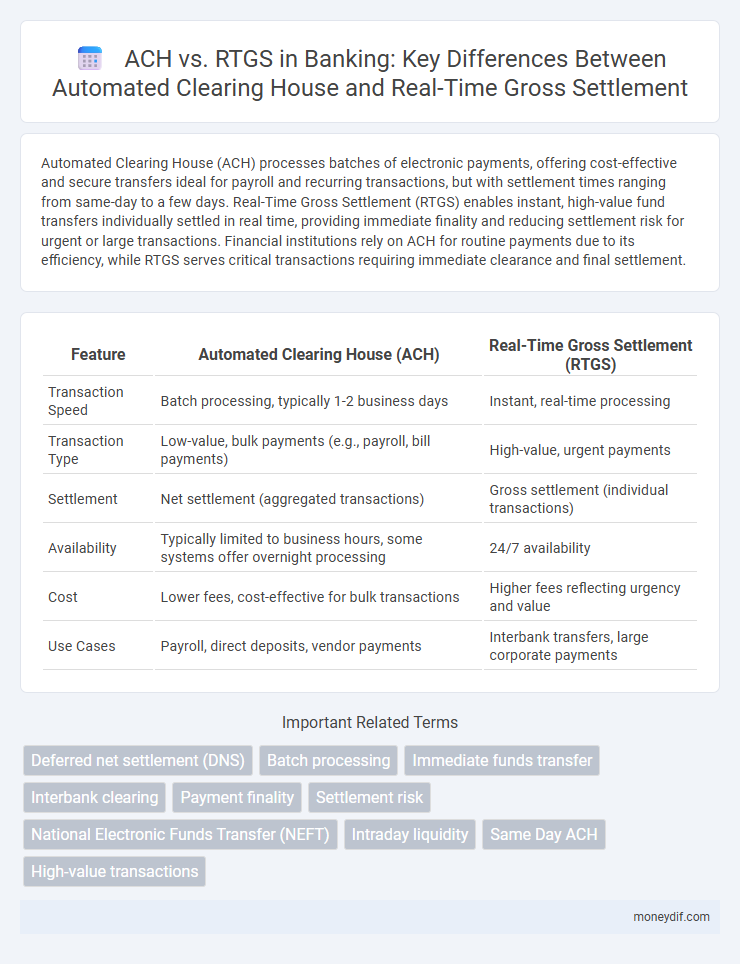

| Feature | Automated Clearing House (ACH) | Real-Time Gross Settlement (RTGS) |

|---|---|---|

| Transaction Speed | Batch processing, typically 1-2 business days | Instant, real-time processing |

| Transaction Type | Low-value, bulk payments (e.g., payroll, bill payments) | High-value, urgent payments |

| Settlement | Net settlement (aggregated transactions) | Gross settlement (individual transactions) |

| Availability | Typically limited to business hours, some systems offer overnight processing | 24/7 availability |

| Cost | Lower fees, cost-effective for bulk transactions | Higher fees reflecting urgency and value |

| Use Cases | Payroll, direct deposits, vendor payments | Interbank transfers, large corporate payments |

Introduction to ACH and RTGS

Automated Clearing House (ACH) is a batch-processing electronic network for financial transactions, enabling efficient, low-cost transfer of funds such as direct deposits and bill payments typically settled within one to two business days. Real-Time Gross Settlement (RTGS) processes individual transactions in real time and on a gross basis, providing immediate finality for high-value and urgent payments. Both systems play critical roles in the banking infrastructure by optimizing payment speed, reliability, and settlement methods tailored to different transaction needs.

Key Differences between ACH and RTGS

Automated Clearing House (ACH) processes batch transactions that settle in hours to days and is ideal for low-value, non-urgent payments like payroll and bill payments. Real-Time Gross Settlement (RTGS) provides instant, high-value funds transfer with finality, designed for urgent transactions such as interbank settlements and large corporate payments. ACH emphasizes cost efficiency and volume handling, while RTGS prioritizes immediacy and liquidity management in clearing and settlement systems.

How ACH Works in Banking

Automated Clearing House (ACH) processes large volumes of electronic payments in batches, allowing banks to settle transactions such as payroll, direct deposits, and bill payments efficiently. ACH transactions are typically cleared within one to two business days, leveraging a centralized clearing facility that nets payments between participating financial institutions. This batch processing contrasts with Real-Time Gross Settlement (RTGS), which settles transactions individually and instantaneously, making ACH ideal for low-value, non-urgent transfers.

How RTGS Operates in Financial Transactions

Real-time gross settlement (RTGS) processes high-value financial transactions instantly and individually, ensuring immediate transfer of funds without netting debits and credits. It operates on a continuous, real-time basis during business hours, providing finality and irrevocability in settlement to mitigate settlement risk. Banks use RTGS for critical interbank transfers, large-value payments, and urgent liquidity management, prioritizing speed and security in financial settlements.

Transfer Speeds: ACH vs RTGS

Automated Clearing House (ACH) transfers typically take one to two business days to process due to batch processing, making them suitable for non-urgent, low-value transactions. Real-Time Gross Settlement (RTGS) systems provide immediate transfer of funds, settling transactions individually in real-time, ideal for high-value or time-sensitive payments. Financial institutions leverage RTGS for urgent liquidity needs while ACH remains cost-effective for bulk payments with less stringent timing requirements.

Costs and Fees: ACH vs RTGS

Automated Clearing House (ACH) transactions typically incur lower costs and fees compared to Real-Time Gross Settlement (RTGS) systems, making ACH ideal for bulk, low-value payments with delayed settlement. RTGS processes high-value, time-critical payments with immediate finality but usually involves higher fees due to the real-time processing and liquidity requirements. Banks favor ACH for cost-effective batch payments, while RTGS is preferred for urgent transactions despite its elevated cost structure.

Security and Risk: ACH compared to RTGS

Automated Clearing House (ACH) transactions involve batch processing, leading to a delayed settlement and increased exposure to fraud and settlement risk compared to Real-Time Gross Settlement (RTGS) systems, which settle transactions individually and instantly, minimizing credit and liquidity risks. RTGS systems benefit from enhanced security protocols and real-time monitoring, reducing the chance of systemic risk and enabling immediate error detection. While ACH is cost-effective for low-value transactions, RTGS provides superior security and risk management for high-value and time-critical payments.

Use Cases: When to Choose ACH or RTGS

ACH is ideal for processing bulk payments such as payroll, vendor settlements, and recurring bill payments due to its cost-effectiveness and batch processing capabilities. RTGS suits high-value, time-critical transactions like interbank transfers and large corporate payments requiring immediate settlement and finality. Financial institutions select ACH for routine low-value transactions while relying on RTGS for liquidity management and real-time settlement needs.

Impact of ACH and RTGS on Businesses

Automated Clearing House (ACH) systems offer businesses cost-effective batch processing for payroll, vendor payments, and recurring transactions, enhancing cash flow management through predictable settlement times. Real-Time Gross Settlement (RTGS) provides immediate, high-value fund transfers that improve liquidity and reduce settlement risk, critical for time-sensitive transactions and large corporate payments. The integration of ACH and RTGS enables businesses to optimize transaction efficiency, balancing speed and cost depending on payment urgency.

Future Trends in Money Transfer Systems

Automated Clearing House (ACH) systems continue evolving with faster processing times and enhanced security protocols, enabling batch-based digital payments with improved efficiency for recurring transactions. Real-Time Gross Settlement (RTGS) platforms are advancing toward instant settlement capabilities, high-value transaction finality, and integration with blockchain technologies to ensure transparency and reduce settlement risk. Emerging trends emphasize the convergence of ACH and RTGS infrastructures to support seamless cross-border payments, instant liquidity access, and regulatory compliance in the evolving digital banking landscape.

Important Terms

Deferred net settlement (DNS)

Deferred net settlement (DNS) processes ACH transactions by accumulating and netting payments to settle at intervals, optimizing liquidity and reducing transaction costs. In contrast, Real-time Gross Settlement (RTGS) systems settle transactions individually and instantly, ensuring immediate finality but requiring higher liquidity reserves.

Batch processing

Batch processing in Automated Clearing House (ACH) systems enables the efficient handling of large volumes of low-value transactions by accumulating payments for settlement at scheduled intervals, optimizing cost and reducing processing time. Real-time Gross Settlement (RTGS) processes payments individually and instantly on a continuous basis, ensuring immediate finality for high-value or urgent interbank transfers but typically with higher operational costs compared to ACH batch processing.

Immediate funds transfer

Immediate funds transfer through Real-Time Gross Settlement (RTGS) enables high-value transactions to be settled individually and instantly, offering finality and reduced settlement risk compared to Automated Clearing House (ACH), which processes batched transactions with delayed clearing times. RTGS systems are critical for time-sensitive liquidity management and large-value interbank transfers, while ACH is optimized for low-value, bulk payments with lower processing costs but longer settlement cycles.

Interbank clearing

Interbank clearing systems such as Automated Clearing House (ACH) facilitate batch processing of low-value electronic payments, offering cost efficiency and delayed settlement typically within one to two business days. Real-Time Gross Settlement (RTGS) systems handle high-value, time-critical transactions individually and instantaneously, ensuring immediate finality and reducing settlement risk between banks.

Payment finality

Payment finality in Automated Clearing House (ACH) systems occurs at batch settlement, leading to delayed finalization and potential risk exposure, whereas Real-Time Gross Settlement (RTGS) systems provide immediate, irrevocable settlement on a transaction-by-transaction basis, enhancing liquidity and reducing settlement risk. The choice between ACH and RTGS impacts the speed, certainty, and risk associated with interbank fund transfers, influencing operational efficiency in payment processing.

Settlement risk

Settlement risk in Automated Clearing House (ACH) systems arises from the delayed batch processing of transactions, increasing exposure to default risk during the settlement window. Real-time Gross Settlement (RTGS) systems mitigate this risk by processing transactions individually and instantaneously, ensuring finality and reducing counterparty risk in high-value interbank transfers.

National Electronic Funds Transfer (NEFT)

National Electronic Funds Transfer (NEFT) is a batch-based electronic payment system facilitating one-to-one funds transfer between banks, similar to Automated Clearing House (ACH) which also processes transactions in batches but typically for bulk and repetitive payments; Real-Time Gross Settlement (RTGS) differs by enabling real-time, high-value transfers on a gross basis without batching. NEFT's settlement process aligns closely with ACH's delayed settlement approach, whereas RTGS provides immediate finality, making it suitable for urgent and high-value transactions.

Intraday liquidity

Intraday liquidity management is critical in Automated Clearing House (ACH) systems which typically process batch payments with delayed settlement, requiring financial institutions to monitor and allocate funds carefully throughout the day. Real-time Gross Settlement (RTGS) systems enhance intraday liquidity efficiency by enabling instantaneous, irrevocable fund transfers, reducing settlement risk and improving cash flow predictability for banks and businesses.

Same Day ACH

Same Day ACH enables faster electronic payments within the Automated Clearing House network by processing transactions in batches on the same business day, enhancing cash flow efficiency for businesses. Real-time Gross Settlement (RTGS) systems, in contrast, settle payments individually and instantly on a gross basis, offering immediate fund availability suitable for high-value and time-critical transactions.

High-value transactions

High-value transactions processed through Automated Clearing House (ACH) systems typically experience batching and delayed settlement, making them suitable for non-urgent bulk payments, whereas Real-Time Gross Settlement (RTGS) systems provide immediate, individual transaction settlement, crucial for time-sensitive interbank transfers and large-value payments. RTGS ensures finality and reduces settlement risk instantaneously, while ACH offers cost-effective processing for high-volume, lower-priority transactions.

Automated clearing house (ACH) vs Real-time gross settlement (RTGS) Infographic

moneydif.com

moneydif.com